Balkish Rosly

3rd October 2014 - 6 min read

Oh no, you’ve out-swiped yourself! Now, the sight of your credit card statement sends chills through your bones. Never mind the haunted doll “Annabelle“; you’ve got a more terrifying problems to scream about! But good news, big spenders! We’ve got the solution to shoo those demonic debts away. Instead of grudgingly paying the minimum amount for a couple of years, you could easily cut your debt in half by applying for a balance transfer credit card.

Gasp! Another credit card?!

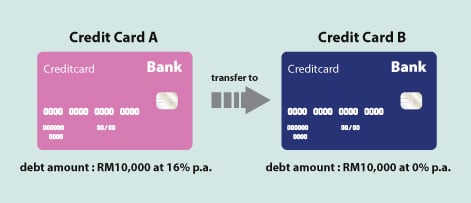

Applying for another credit card to cut down your debt may sound a little loco (re: crazy if you lack street cred), but a balance transfer card allows you to transfer all of your high interest credit card debt (usually at 15% p.a. – 18% p.a.) onto another credit card at a lower interest rate (or even none at all) for a limited time to help you pay off your balance faster. Here’s how balance transfer card works:

Yep, instead of paying off your debt at a whopping 15% to 18% p.a., you can now enjoy a lower interest rate. Even better, some banks in Malaysia actually offer a 0% balance transfer promotion – which makes paying down your debt move a lot faster. In case you were wondering “why are the banks offering me this super generous gift?”, it is essentially because they want to promote their products to attract new consumers, and what better way than to offer a 0% interest rate on your credit card balance? Whilst it may seem like the bank is only doing it for themselves – that doesn’t mean you can’t benefit from the situation. Who doesn’t want an interest free period on any credit product?

3 Things You Need to Know About Balance Transfers

We know the zero percent deal sounds awesome but wait up! Before applying for a transfer, here are three things you absolutely must know about the programme.

1. Balance Transfer Interest Rates and Payment Scheme Differ with Every Bank

There are gazillions (maybe we exaggerate but there’s at least 300+) of credit cards here in Malaysia, and most, if not all, do offer balance transfer programmes. However, only a handful of banks offer to transfer at 0%. If your heart is set on applying a 0% balance transfer credit card (and why shouldn’t you!), it’s best to go with the bank that gives you the longest 0% period. In Malaysia, you can expect to get up to 12-months of interest free debt payment. But why grab the longest period? Here’s why:

- If you don’t repay your debt in the given period, the credit card’s interest rate will revert to the bank’s prevailing rates (that’s 15% to 18% p.a. for most banks), bringing you back to square one. However, If you have the bucks and can afford to pay off your debt in 6 months or less, then go for it!

- Banks usually have two payment options; easy and fixed payment. With easy payment, banks usually require RM50 or 5% of the outstanding balance every month. So if your balance transfer amount is RM10,000, you can choose to pay RM100 for 11 months and RM8,900 on the last month. On the contrary, fixed payment means that you’re stuck with RM833.33 per month for the whole 12 months – which will make it harder if you can’t afford that amount every month.

2. Some Have an Upfront Fee

Banks sometimes do charge a 3% to 4% upfront fee; this is basically the fee for transferring your outstanding balance to your brand new credit card. Not all banks have this transfer fee, so feel free to breathe a sigh of relief. Also, like any old loan, some banks can and will slap you with a fee of up to RM100 when you decide to settle your balance transfer earlier than expected (quite common with fixed payment balance transfer cards). It might be a good idea to start reading your terms and conditions / grill the bank officer for every little detail.

3. There is a minimum and maximum transfer amount for Balance Transfer

The minimum transfer amount for balance transfer is usually RM1,000, and the maximum transfer amount is normally at 90% of your credit limit. If you are a credit card hoarder, here is a piece of good news for ya’ll! You can consolidate your debts from more than one credit card from different banks into your balance transfer credit card. For example, the Maybank Balance Transfer programme allows you to transfer balances from up to three banks at one time. Note, that this is subject to if you’re credit limit will allow for a consolidation such as this.

Should you apply for a balance transfer credit card?

If you can manage your debt well, then the answer is yes! But then again, don’t fall into a false sense of security and keep these tips in mind:

DON’T SWIPE IT! The whole point of taking up a new card with the 0% balance transfer promotion is to settle off – NOT accumulate – more pesky debt. Once you’ve been approved for a balance transfer programme, best to keep your balance transfer card locked away in a drawer – or even better – cut it up.

Don’t forget about your debt. Now that your 18% p.a. interest rate is gone, you can finally stop choking. It feels great to finally be free of interest rates, but do keep in mind that your debt is still there, and the 0% interest will only be available for 12 months or less – so you better get those payments going!

Keep two cards? Maybe not! Once you paid off your debt, should you keep the card? This is a tough one, but it all depends on your current situation. If you can’t even handle one card, it might be best to keep only the top card in your wallet and get rid of the other one.

Who knew that applying for a brand new credit card could help you reduce your debt? Balance transfers can no doubt be used to your advantage, as long as you don’t let the bank win the battle by accumulating more debt!

Comments (0)