Ahmad Mudhakkir

2nd November 2017 - 5 min read

Retirement planning is something Malaysians aren’t very good at apparently. According to a recent report by The Star newspaper, current EPF savings for most Malaysians are barely enough for a decent life after retirement.

With an average savings of RM194,000, assuming one lives until 75 with no major medical expenses or outstanding debt, that amounts to about RM810 per month, which is RM25 a week. While this rough calculation does not take into account other factors like inheritance, investments, and so forth, the numbers still look bleak.

The remedy to this problem is to simply allocate a portion of our monthly earnings specifically for retirement. But how much should go in there, exactly? There are quite a few variables to think about: inflation rate, life expectancy, and projected expenses, among others.

Thankfully, we’ve found a quick and easy way to figure out if you’re saving enough for the retirement you want. It’s Nerdwallet’s retirement calculator.

There are quite a few retirement calculators floating around online but many of them are either too involved, or too simplified. This calculator on the hand is simple enough to be understood easily, yet doesn’t skimp out on important variables necessary for a healthy estimate of how much savings is really needed.

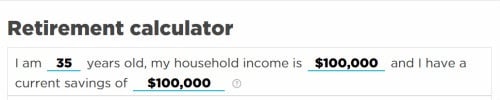

The interface is simple enough, first enter your current age, household income, then your current savings.

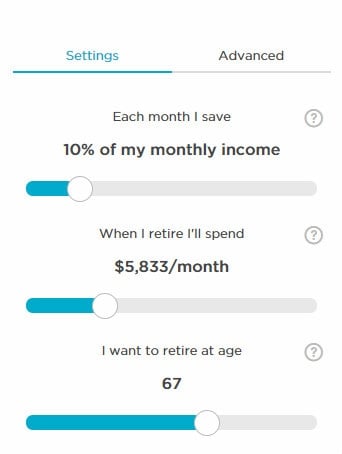

The left sidebar is where things get interesting. You input the percentage of your income that you currently put towards retirement. If you only rely on EPF contributions you can put in your 8% or 11%. You can also exclude your EPF contributions and just key in how much of your net earnings you save for retirement. Doing it this way means you will arrive at a safer (as in, larger) estimate.

Next, you have to input your projected monthly expenditure. This one can be tricky to figure out, since we can’t quite predict the kind of expenses we might need in future. But a quick way to come up with this figure is to just use your current monthly expenses.

The third figure here is your retirement age. In Malaysia, the minimum age of retirement is 60 years old. You can plan for this, or if you want to save more aggressively, place your retirement age even younger than that.

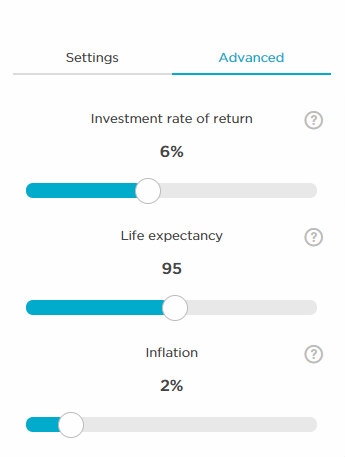

Once this is done, click the “Advanced” tab above the sidebar. The topmost figure is the rate of return for your investments. If you only have EPF, you can put down 2.5%, since legally, that’s the amount they’re obligated to provide. You can do a more precise estimation of the rate of returns by looking through past year records as well, (which would bring that percentage up to about 5%) but keep in mind that past performance is not indicative of future outcome. If you’re more on top of your investments than most, you can put down the rate of returns you actually have whether that be from fixed deposits, ASB accounts, unit trusts, or other investment vehicles.

The rate of inflation can be kept at 2% since that has been the average for Malaysia for the past half a decade. Alternatively, you can increase it to 3 or 4% for a safer estimate. Your life expectancy as a Malaysian citizen is about 75 years according to the world bank, so that should be the final figure you key in.

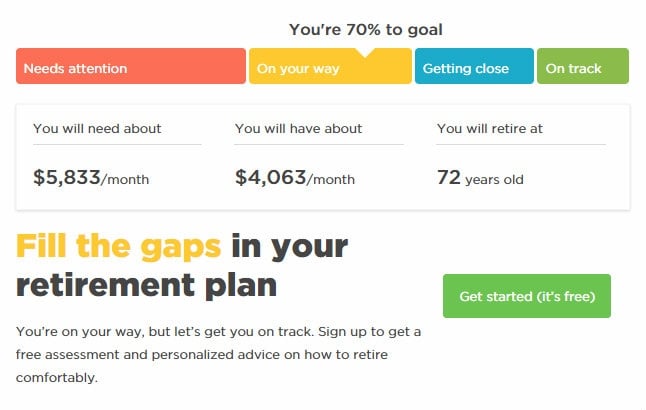

Now that you’ve done all this, you can check out the tabulated results in the calculator. It will tell you the level of readiness you are for retirement, how far along you still have to save, and crucially, how much you need to increase your savings by if you’re still far off.

How Do You Catch Up if You’re Way Behind?

Let’s say that after inputting all your figures, the calculator tells you that you need to save up RM230 more every month. Before you do anything else, you can consider whether or not the kind of retirement you want may be different than the one you keyed in.

Perhaps you don’t mind retiring a bit later, or maybe your current expenses include some heavy debts that you expect to pay off well before retirement, which means your projected monthly expenses would go way down. Use the sliders to adjust these values and see whether or not you’re still well-prepared for retirement.

If the calculator still shows that you’re not quite on track for retirement, then there are three major areas you can focus on. Those would be savings, investments, and earnings.

To max out your savings, we recommend eliminating your debts first to free up the cash for your savings, then using your skills and free time to look for side income, after which you can start thinking about investing some of your cash to put your money to work. An easy and simple way to get started with investments is to head over to our fixed deposits comparison page where you can find the best accounts with high returns that can work for you. We’ve written more detailed articles elsewhere on our blog on how to do these three things and we recommend you check those out.

Try the calculator out for yourself over at Nerdwallet so you can quickly figure out where you stand as far as your retirement plan goes. How well did you do? Do you have your own retirement plan set up yet? Let us know in the comments section down below!

Comments (0)