Gavin Pereira

6th March 2018 - 8 min read

Every year represents a new beginning to achieve new goals, explore different avenues, and a general sense of change. The thing is, it takes a little bit of planning in order to end the year with a bang. You will need to focus on more than just the 2018 Malaysian public holidays. This time around, you should be looking into the full 2018 calendar to anticipate expenses, and not just the public holidays you would like to exploit.

Many people make holiday plans, weight loss aspirations, financial targets and other goal-oriented achievements without considering the different points in the calendar year that leave them broke and eventually derails their entire plan.

Start by taking baby steps and start planning the coming weeks, months, quarters and eventually, the year-end objective with the help of the quarterly indicators below. You may note that we included Chinese New Year and Valentine’s Day too but no worries, we have placed this here so that you know what to look out for in the year ahead as well.

JANUARY

| Su | Mo | Tu | We | Th | Fr | Sa |

|---|---|---|---|---|---|---|

| — | 1 | 2 | 3 | 4 | 5 | 6 |

| 7 | 8 | 9 | 10 | 11 | 12 | 13 |

| 14 | 15 | 16 | 17 | 18 | 19 | 20 |

| 21 | 22 | 23 | 24 | 25 | 26 | 27 |

| 28 | 29 | 30 | 31 | — | — | — |

FEBRUARY

| Su | Mo | Tu | We | Th | Fr | Sa |

|---|---|---|---|---|---|---|

| — | — | — | — | 1 | 2 | 3 |

| 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 11 | 12 | 13 | 14 | 15 | 16 | 17 |

| 18 | 19 | 20 | 21 | 22 | 23 | 24 |

| 25 | 26 | 27 | 28 | — | — | — |

MARCH

| Su | Mo | Tu | We | Th | Fr | Sa |

|---|---|---|---|---|---|---|

| — | — | — | — | 1 | 2 | 3 |

| 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 11 | 12 | 13 | 14 | 15 | 16 | 17 |

| 18 | 19 | 20 | 21 | 22 | 23 | 24 |

| 25 | 26 | 27 | 28 | 29 | 30 | 31 |

February

Valentine’s Day (14 February)

With a relatively easy-going start to the year, the first financial hump to lookout for is the romantic, Valentine’s Day. With the hyper-inflated prices of gifts and dining options, try purchasing your gifts online, or way before Valentine’s season. Even better, you can start buying some of the gifts now (provided that it’s non-perishable) and save it up for next year. Fret not, we will give you a few hacks along the way to keep you on solid ground.

Chinese New Year (16 & 17 February)

For those who are celebrating Chinese New Year, there isn’t much of a financial breather between Valentine’s day and Chinese New Year. Let’s hope some of you have the luxury of recuperating a little cost with Ang Pows. If not, you are going to be dishing out a little more, to your unmarried friends and family members. Despite the high expenses, this is a time to take advantage of the festive sale prices. Look out for bargains on clothes, grocery items, and possibly even gifts.

APRIL

| Su | Mo | Tu | We | Th | Fr | Sa |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

| 29 | 30 | — | — | — | — | — |

<a href=”https://ringgitplus.com/en/credit-card/?utm_source=ringgitplus&utm_medium=banner&utm_campaign=my-rpint-crcd-gen&utm_content=blogcta_crcd_bestcreditcardinmalaysia_ringgitplus_mid”title=”Compare credit card”>

MAY

| Su | Mo | Tu | We | Th | Fr | Sa |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

| 29 | 30 | — | — | — | — | — |

JUNE

| Su | Mo | Tu | We | Th | Fr | Sa |

|---|---|---|---|---|---|---|

| — | — | — | — | — | 1 | 2 |

| 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| 10 | 11 | 12 | 13 | 14 | 15 | 16 |

| 17 | 18 | 19 | 20 | 21 | 22 | 23 |

| 24 | 25 | 26 | 27 | 28 | 29 | 30 |

April

Tax Returns Filing without Business Income (30 April)

Throughout March and April, it is a relatively open field to save up until the end of April. For those who do not have a business income to file, the deadline to submit one’s taxes is at the end of April.

If you have your taxes deducted every month, then you will be safe from any further deductions. In fact, you could even look forward to certain rebates that RinggitPlus will highlight, closer into the tax season.

May

Mother’s Day (13 May)

Among the more important dates of the Malaysian 2018 calendar, is the day to show your mother how much you appreciate her. Although it shouldn’t be narrowed down to one day a year, you may still want to loosen the purse strings and do a little something for the person who gave birth to you.

Awal Ramadhan (15 May)

Awal Ramadhan is the beginning point of the fasting month. While it is not a national public holiday in Malaysia, the fasting month is a time frame to consider traveling. Traditionally, this period is a low season for air travel, and opens up lots of opportunities for cheap airfares.

Of course, there are exceptions to this rule. You should avoid traveling toward Indonesia as those working overseas would be rushing back home for Hari Raya, causing a massive price hike. You should also avoid flying domestically during the final week before Hari Raya, when prices are at its peak.

June

Hari Aidilifitri (15 & 16 June)

To our Muslim brothers and sisters, this is a joyous occasion that also drains the bank account. Duit raya, kuih raya, attire, travel expenses, and all the miscellaneous expenses can may be the wrong time to plan any quarterly commitments.

Father’s Day (17 June)

To top it all off, father’s day will be on the third day of Hari Raya. What a perfect way to keep the celebrations going, by giving the man of the family an additional honour. Even those who aren’t celebrating Hari Raya should be looking to make Father’s day a memorable one with a little gift or something meaningful.

Tax Returns Filing for Individuals with Business Income (30 June)

If you are accruing a business income, the end of June is when you are going to have to pay the piper. Especially with Raya and Father’s day expenses that could be piling on to your monthly expense, you are going to need to make additional adjustments to the months prior to ensure you aren’t impacted too heavily. Should you need some short-term cash flow, you could always consider a personal loan or payday loan. At this point in time, you should be able to see how one’s finances can dip dramatically during certain quarters through the 2018 calendar year.

JULY

| Su | Mo | Tu | We | Th | Fr | Sa |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

| 29 | 30 | 31 | — | — | — | — |

AUGUST

| Su | Mo | Tu | We | Th | Fr | Sa |

|---|---|---|---|---|---|---|

| — | — | — | 1 | 2 | 3 | 4 |

| 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| 12 | 13 | 14 | 15 | 16 | 17 | 18 |

| 19 | 20 | 21 | 22 | 23 | 24 | 25 |

| 26 | 27 | 28 | 29 | 30 | 31 | — |

SEPTEMBER

| Su | Mo | Tu | We | Th | Fr | Sa |

|---|---|---|---|---|---|---|

| — | — | — | — | — | — | 1 |

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | 29 |

| 30 | — | — | — | — | — | — |

August

Merdeka Day (31 August)

During this quarter, we will enjoy the privilege of two long weekends. Merdeka Day falls on a Friday, giving even the states with the shifted weekend, the Sunday off. Since it is only a three day long weekend, travel to the shorter destination and save the further destinations for the longer upcoming holidays.

September

Yang Dipertuan Agong’s Birthday (9 September)

Awal Muharram (11 September)

The public holiday on the 9th, falls on a Sunday, making the 10th an automatic public holiday for states that do not have the shifted Friday and Saturday weekend. Combining the Awal Muharram public holiday on the 11th, those on a conventional weekend will be looking at a nice long break from Saturday to Tuesday. An ideal time to travel to destinations that are a little costlier and further out, given the general low financial commitment season.

OCTOBER

| Su | Mo | Tu | We | Th | Fr | Sa |

|---|---|---|---|---|---|---|

| — | 1 | 2 | 3 | 4 | 5 | 6 |

| 7 | 8 | 9 | 10 | 11 | 12 | 13 |

| 14 | 15 | 16 | 17 | 18 | 19 | 20 |

| 21 | 22 | 23 | 24 | 25 | 26 | 27 |

| 28 | 29 | 30 | 31 | — | — | — |

NOVEMBER

| Su | Mo | Tu | We | Th | Fr | Sa |

|---|---|---|---|---|---|---|

| — | — | — | — | 1 | 2 | 3 |

| 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 11 | 12 | 13 | 14 | 15 | 16 | 17 |

| 18 | 19 | 20 | 21 | 22 | 23 | 24 |

| 25 | 26 | 27 | 28 | 29 | 30 | — |

DECEMBER

| Su | Mo | Tu | We | Th | Fr | Sa |

|---|---|---|---|---|---|---|

| — | — | — | — | — | — | 1 |

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | 29 |

| 30 | 31 | — | — | — | — | — |

October

Budget Announcement

Typically, the budget announcement for the following year happens at the end of October. This is when you should be looking out attentively for rebates or benefits that could assist you in the following year.

If you were intending to purchase a house, the new policies, rebates or schemes for the following year could help you make strategic decisions at the point of purchase.

NOVEMBER

Deepavali (6 November)

Deepavali, the festival of lights comes around just before the year end school holidays. Typically a high spending season for those celebrating and entering the year end peak season. On the other hand, it is a great opportunity for those who are not celebrating to travel before the year end peak season kicks off.

DECEMBER

Christmas (25 December)

Overlapping with the travel peak season, beginning of the school term and Christmas itself can be costly. But if you planned out the 2018 calendar well, and have had the discipline to manage your finances, the triple threat will be just another season to sail through.

Last financial tips and Tools for Thought

Last but not least, highlight areas such as insurance renewal, annual check-ups, car service, birthdays and other events that will cost you money during the 2018 calendar year. By doing so, you can look out for time segments that are overly expensive to your personal finances and plan your goals around them.

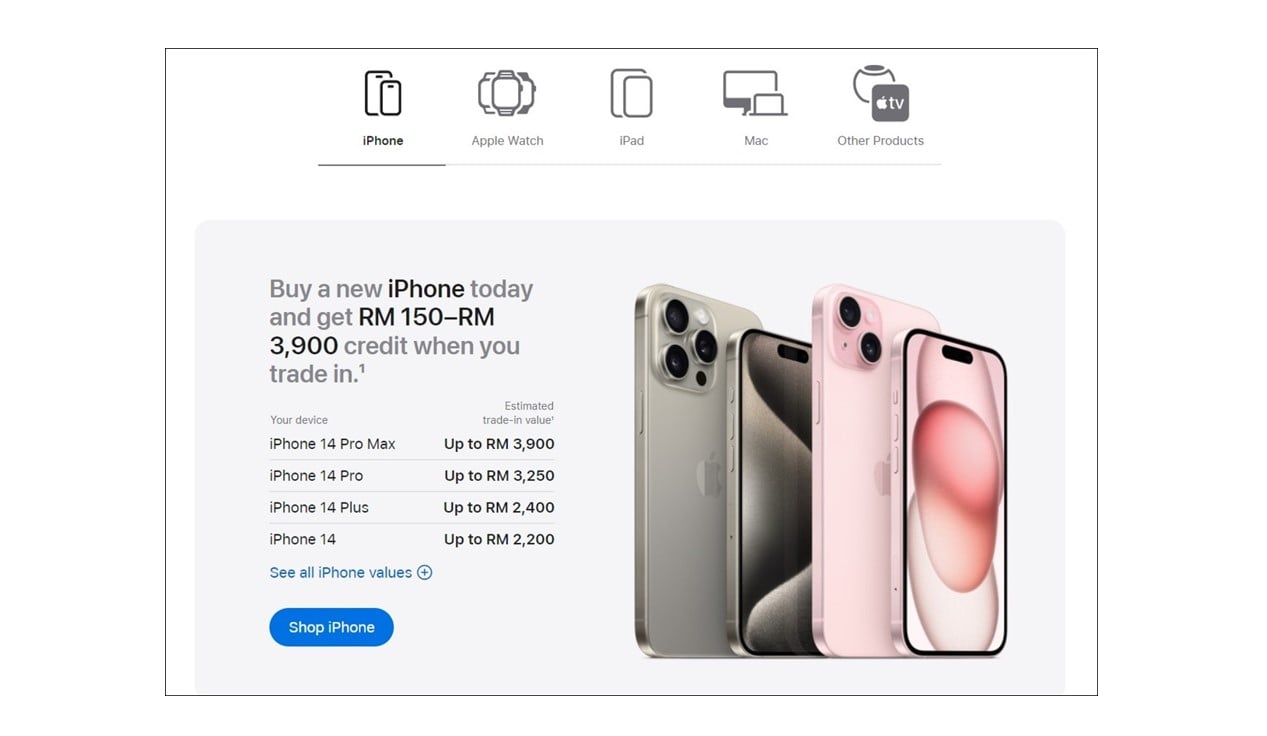

It would also be a smart idea to have a credit card that allows you to monitor your monthly budgets and gives you some great cashback or travel rewards when you need to stretch your ringgit. Check out our credit card comparison tool and strategise your financials for 2018.

Comments (0)