ringgitplus

30th September 2019 - 2 min read

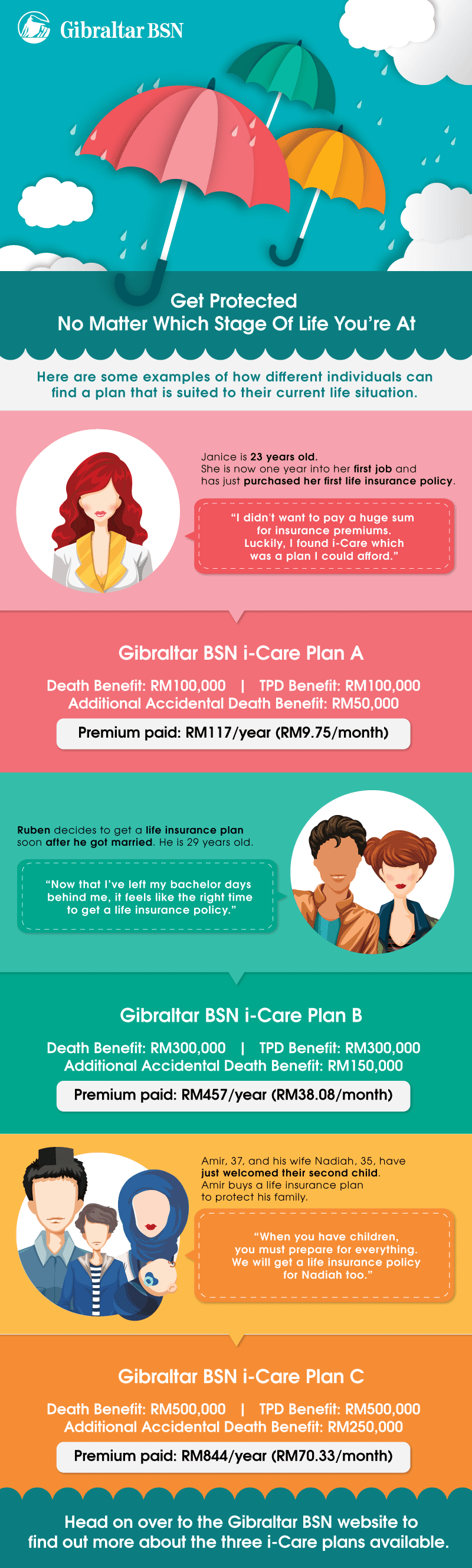

Everyone stands to benefit from getting a life insurance policy, regardless of where they are in life. It doesn’t matter if you’ve just entered the working world, or if you’ve already advanced in your career and are married with kids. Whether it’s the affordability of the premiums or the level of coverage that is your concern, you should be able to find a life insurance plan that caters to your needs.

A life insurance policy can have different tiers or plans. Usually, you pay higher premiums for a higher benefit – which basically means a larger payout amount. Therefore, if your focus is affordability, you can look for a life insurance plan with low premium prices. Or if you really want a higher coverage to suit your circumstances, choose a plan with a bigger benefit payout.

Gibraltar BSN’s i-Care life insurance is a non-participating renewable term policy that protects you against death, accidental death, and total and permanent disability (TPD). You pay an annual premium based on your age and the plan that you are on, and the policy automatically renews every year. There are three plans as below:

| Plan A | Plan B | Plan C | |

| Death Benefit | RM100,000 | RM300,000 | RM500,000 |

| Total And Permanent Disability Benefit | RM100,000 | RM300,000 | RM500,000 |

| Additional Accidental Death Benefit | RM50,000 | RM150,000 | RM250,000 |

So, don’t just assume that life insurance policies are for a specific group of people and wouldn’t be suitable for you. With premiums as low as RM9.75 a month, you definitely can’t say that life insurance is unaffordable. Find out more about Gibraltar BSN’s i-Care life insurance policies here.

Comments (0)