Alex Cheong Pui Yin

28th January 2022 - 3 min read

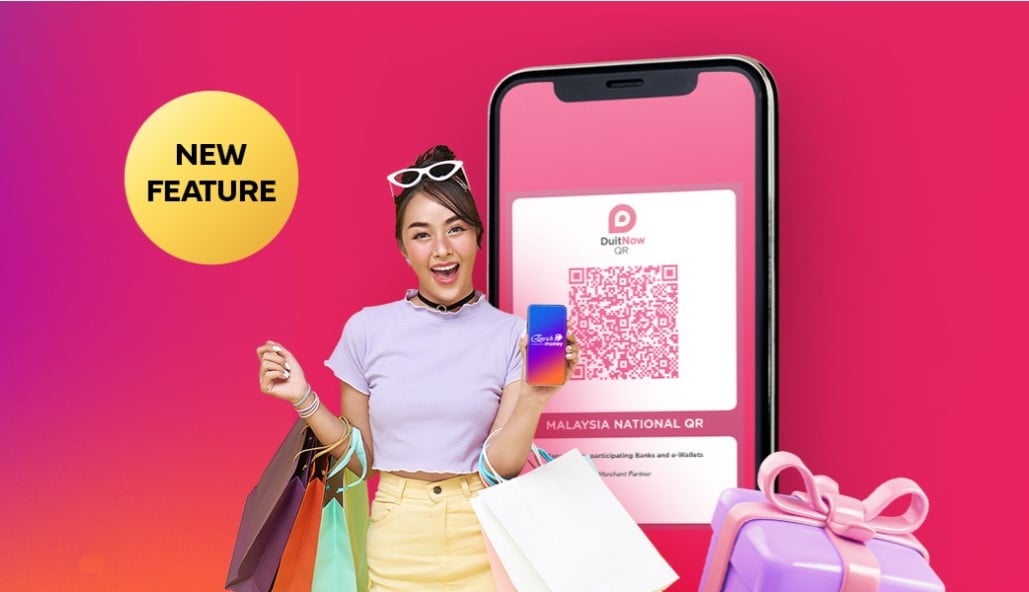

Bank Negara Malaysia (BNM) has announced the launch of a cross-border QR payment linkage with Bank Indonesia (BI), which will enable citizens in both countries to perform instant and secure cross-border payments when making purchases.

With this latest update, consumers in Malaysia and Indonesia will be able to conveniently and safely pay for their purchases at online and offline merchants by scanning the DuitNow or QRIS (Quick Response Code Indonesian Standard) QR codes. The service, which is part of the pilot phase that has already begun, will eventually lead to a full commercial launch in the third quarter of 2022. There are also plans for the linkage to be expanded to support cross-border remittances.

“The cross-border QR payment linkage between Malaysia and Indonesia marks a key milestone in the long history of collaboration between both countries. Phase 2 of the QR payment linkage between Malaysia and Thailand has also gone live this week,” said the deputy governor of BNM, Jessica Chew Cheng Lian, adding that these developments will bring the nations closer to the vision of creating an Asean network of fast and efficient retail payment systems.

Malaysia’s cross-border payment linkage with Thailand has been established since June 2021, with the first phase allowing users in Thailand to make payments to Malaysian merchants by scanning DuitNow QR codes. The second phase, meanwhile, allows Malaysians to perform similar transactions with merchants in Thailand. Aside from Thailand, Malaysia has also formed payment linkages with Singapore and the euro area.

Meanwhile, the deputy governor of BI, Doni P Joewono said this initiative marks another milestone of the Indonesia Payment System Blueprint. “This will give more options for users in the cross-border payment space and serve as a key to improve transaction efficiency, support the digitalisation of trade and investment, and maintain macroeconomic stability by promoting a more extensive use of the Local Currency Settlement (LCS) Framework,” he said.

BNM and BI further commented that this linkage will not only strengthen the economic tie between Malaysia and Indonesia, but also give a big boost to the tourism sector of both countries. During pre-Covid days, an average of 5.6 million travellers travelled between the two countries per year. Additionally, both countries are also key remittance corridors for their nationals working abroad, who stand to benefit from faster, cheaper, and more transparent cross-border remittances via this initiative.

(Sources: Bank Negara Malaysia, The Edge Markets)

Comments (0)