Alex Cheong Pui Yin

22nd March 2023 - 2 min read

Standard Chartered Bank has informed customers that it will be shifting away from SMS one-time passwords (OTP) as a verification method for all online banking transaction-related matters starting from April 2023. Instead, it will adopt its own virtual security token, SC Mobile Key, in order to provide an enhanced banking experience.

Standard Chartered explained that the SC Mobile Key will allow you to approve your logins to the bank’s online banking website, and to verify banking transactions solely via the SC Mobile app – which is installed in your phone (a registered device). This essentially creates a closed ecosystem without a chance for scammers to intrude or take advantage of any part of the authentication process, thereby making it more secure and convenient.

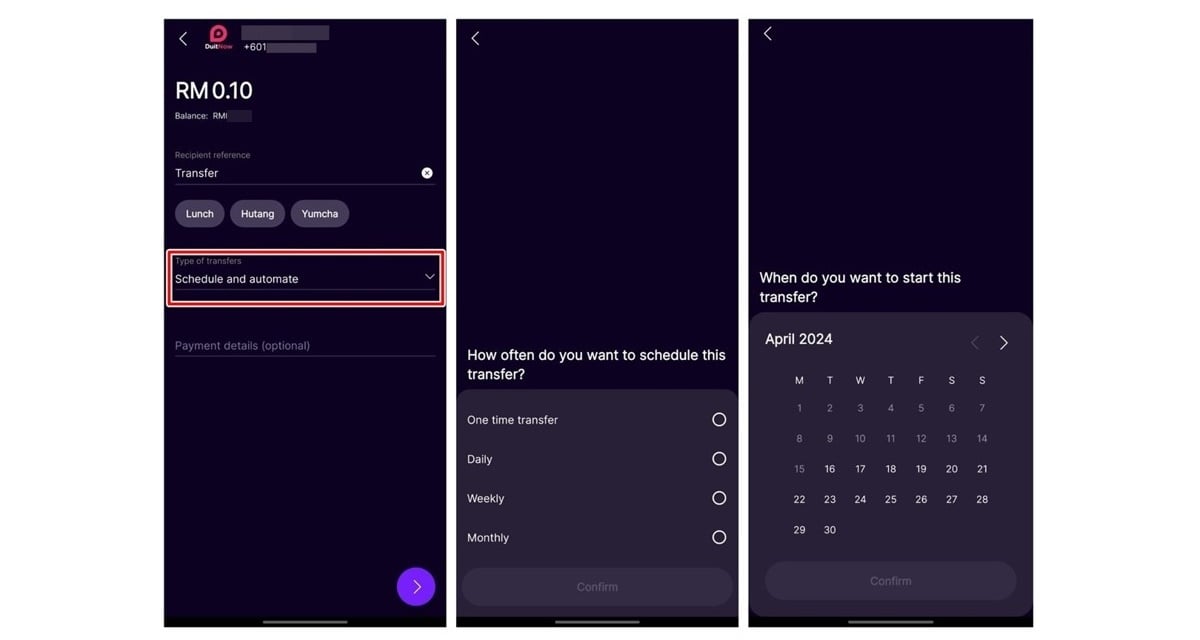

Here’s a quick visual guide from Standard Chartered on how the SC Mobile Key works when you log in to the bank’s online banking website through your computer or other devices (considered as non-registered devices because it is not your phone), and when you perform online transactions.

To activate and register for the SC Mobile Key, download the Standard Chartered Mobile app onto your phone (minimum operating system of Android 9 & iOS 13) and fire it up. You’ll immediately be prompted to register your phone as a security token (registered device). Once you tap on “Register Now”, an SMS with an OTP will be sent to you; key it in. After that, enter and re-enter your new 6-digit SC Mobile Key PIN – and you’re done! You can now use your new 6-digit PIN with your registered mobile device to approve all future logins from other non-registered devices, along with online banking transactions!

To note, Standard Chartered had actually launched the SC Mobile Key much earlier, back in 2019, but was utilised only when performing selected sensitive online and mobile banking activities. These included transferring funds or making payments above a pre-defined threshold (set at RM10,000 for third party bank/interbank fund transfers, and RM5,000 for bill payments).

The bank’s latest decision to enforce the mandatory use of the SC Mobile Key is also in line with the five additional safeguard measures that were listed by Bank Negara Malaysia (BNM) in a bid to combat financial scams.

(Source: Standard Chartered)

Comments (2)

What to do if I have an old smartphone or used pc browser to do online banking. Need to buy new phone?? Now i am obsolete!!! Creating ‘super app’ available to limited customers only. DUMBEST IDEA!!!!

I registered SC Mobile Key on my old Huawei phone but then now changed to new Oppo phone and I registered again. But I cannot get the PIN to successfully register. How do I go about it?