Katrina Balan Quiroz

16th November 2020 - 7 min read

2020 has been a year of reflection. Given the current global situation and circumstances, most of us were called to reflect on our personal finances to gain a better understanding of where we stand financially and rethink our spending habits.

Personal finance involves various money-related activities such as budgeting, investing, and saving for emergencies which require a great deal of time and meticulous effort. It is an important aspect to pay attention to as it relates to our everyday lives from what we eat, where we live, and more. However, the maths and confusing financial terms that come with it may not be everyone’s cup of tea. These are the reasons why some may struggle to manage their personal finances.

In this article, we’ll be discussing 3 common money struggles that most of us have, and how to overcome these struggles to better manage our personal finances.

Struggle #1: Trying To “Save” Yourself From Money Troubles

Saving money is one of the key foundations of financial stability. According to the 50/30/20 rule, the rule of thumb is to save 10 – 20% of your current income and to build an emergency fund of at least 3 to 6 months worth of expenses. Unfortunately, according to the RinggitPlus Survey 2019, only 27.52% of Malaysians can survive up to 6 months on their savings alone.

Saving money requires self discipline and determination but for some of us, most of our monthly income goes into paying the necessities such as bills and debts – which leaves us with just enough to get by until the end of the month.

Another reason as to why we struggle to save is the lack of motivation and specific financial goals. Saving for the sake of saving will feel like a chore and likely lead to impulse purchases thus bringing you back to square one.

Struggle #2: “Where Did My Money Go?”

Ask yourself this: Do you know how much money you spent last month?

Tracking your expenses no matter how small or big helps you to plan your monthly budget. By noting down how much you spend for food, utilities, transportation, entertainment, and shopping, you can identify negative spending habits, avoid overspending, and improve your monthly cash flow.

Unfortunately, tracking your expenses can get quite tedious and sometimes, we may just forget to do so. When it happens often, it can put us off our expense-tracking all together.

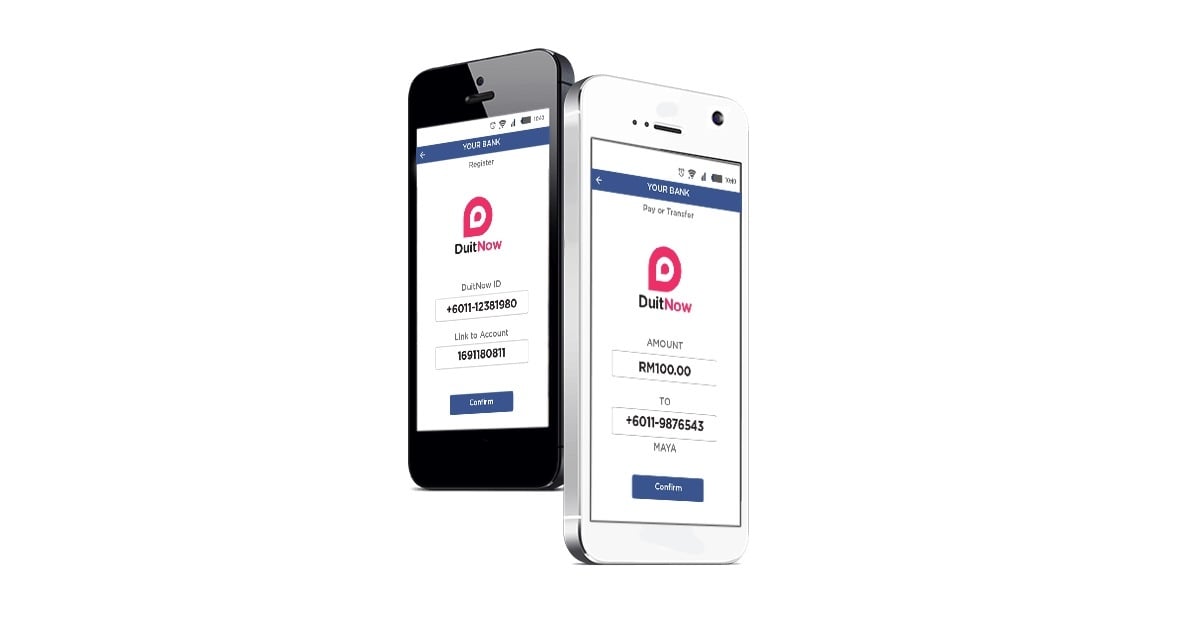

Struggle #3: Overloaded Banking Worries

From keeping track of how much is in your savings and current accounts to keeping up with monthly payments for loans and credit cards, banking can be a hassle when not organised.

Moreover, disorganised banking could cause you to miss an important monthly payment or overdraft your account unintentionally. This could bring down your credit score thus affecting your approval chances when applying for a new credit card or loans in the future.

And if you’re a deal-seeker and looking to save while you spend, poor banking management will make it difficult for you to keep up with banking promotions for your favourite shops and restaurants.

Overcome Your Money Struggles With MAE by Maybank2u

Maybank has recently unveiled a fresh, next-generation way to help us Malaysians take charge of our personal finances. MAE by Maybank2u is an all new and upgraded version of the Maybank2u application that comes with an e-wallet, the MAE e-wallet, and a debit card, the MAE Card as well as all your favourite Maybank2u banking features.

As a “pocketable digital bank” , MAE by Maybank2u can be used by both Maybank and non-Maybank users, to perform regular banking needs such as paying bills, transferring funds and checking your banking details for Maybank users. You can also look out for new restaurants or decide where to eat with exclusive deals with the Makan Mana Wheel!

Although, it is not to be confused with the existing mobile app, Maybank2u, which will be eventually phased out in the future.

And the good news is, MAE by Maybank2u could just be what you need to overcome the above mentioned struggles. Here’s how:

Paying Yourself First with Tabung

The importance of saving is emphasised with Tabung, designed to encourage users to save consistently and regularly to achieve their financial goals. It comes with individual Tabung and group Tabung, where you get to save together with your family and friends towards a specific goal such as a family vacation or a big purchase.

Whether you’re saving by yourself or with a group, you can set an amount to be automatically deducted from your account to your Tabung on a weekly or monthly basis. To add some fun, there are also 3 Boosters features that can help you accelerate the saving process.

The Spare Change feature rounds up your expenses and transfers the “spare change” into your Tabung. For example, if your new t-shirt is RM19.50, then the amount to be paid will be rounded up to RM20 with the extra RM0.50 automatically transferred into your Tabung.

Next, the Scan & Save feature directly transfers the savings you’re entitled for from promotions that were purchased in QR transactions into your MAE by Maybank2u account, while the Guilty Pleasure feature penalises you by transferring an amount from your e-wallet balance into your Tabung when you exceed your daily spending limit that you set for a specific category.

Track Your Spending Effortlessly with Expenses

MAE by Maybank2u also comes with a tool to help you manage your spending called Expenses which provides you with a simple and comprehensive view of all your spending through your Maybank accounts, cards, and Scan & Pay (formerly known as Maybank QRPay) transactions.

Your expenses will be conveniently categorised to give you a good look at where exactly your money is going, whether it’s leaning towards Food, Utilities, Shopping, or more. This tool also helps to identify your spending habits and how to improve them. To fully utilise the tool, you can also manually include your cash transactions with just a few taps.

Not forgetting, MAE by Maybank2u also includes the latest deals and promotions all in one place for you to save more while you spend. Enjoy cashback from your favourite restaurants or discounts on essentials and more when you purchase with MAE by Maybank2u.

It Also Comes With a MAE Card, In A New Signature Yellow!

Fresh, vibrant, and energetic – complementing MAE by Maybank2u with its bright yellow hue, is the MAE Card that comes with Visa payWave contactless payment.

The debit card offers competitive foreign exchange rates and can be used locally, and internationally, with the option to freeze and unfreeze the card anytime through MAE by Maybank2u.

Not only that, you also get to enjoy exclusive cashback and rewards when you spend with the MAE Card. Perfect for the shopping season coming up this November! Moreover, what’s special about this brand-new MAE Card is that all your expenses made with the card are also automatically tracked in the app as well.

If you’re interested, you can apply for a MAE Card through MAE by Maybank2u and have it delivered to their doorstep within seven working days.

Here’s how you can apply for a MAE Card:

Exciting Cash Rewards of Up To RM1 Million Up For Grabs!

By signing up now for MAE Card, you can get your RM8 cashback when you spend a minimum of RM30 in a single receipt with the MAE Card. You’ve also got a chance to win RM88 cashback too! With up to RM1 million cash rewards up for grabs, there’s no need to wait in line to experience a revolutionary online and offline banking experience with MAE by Maybank2u. Download the app today from Google Play Store and Apple AppStore. Or you can download it straight via a QR Code on Maybank’s website.

Comments (0)