What Are Bumiputera Business Loans and Why Should You Consider Them?

Bumiputera business loans are specialised financing options in Malaysia designed to support entrepreneurs from the Bumiputera community, including Malays, Orang Asli, and other indigenous groups.

These loans often come with benefits such as lower interest rates, flexible repayment terms, and access to government-backed programs aimed at fostering business growth.

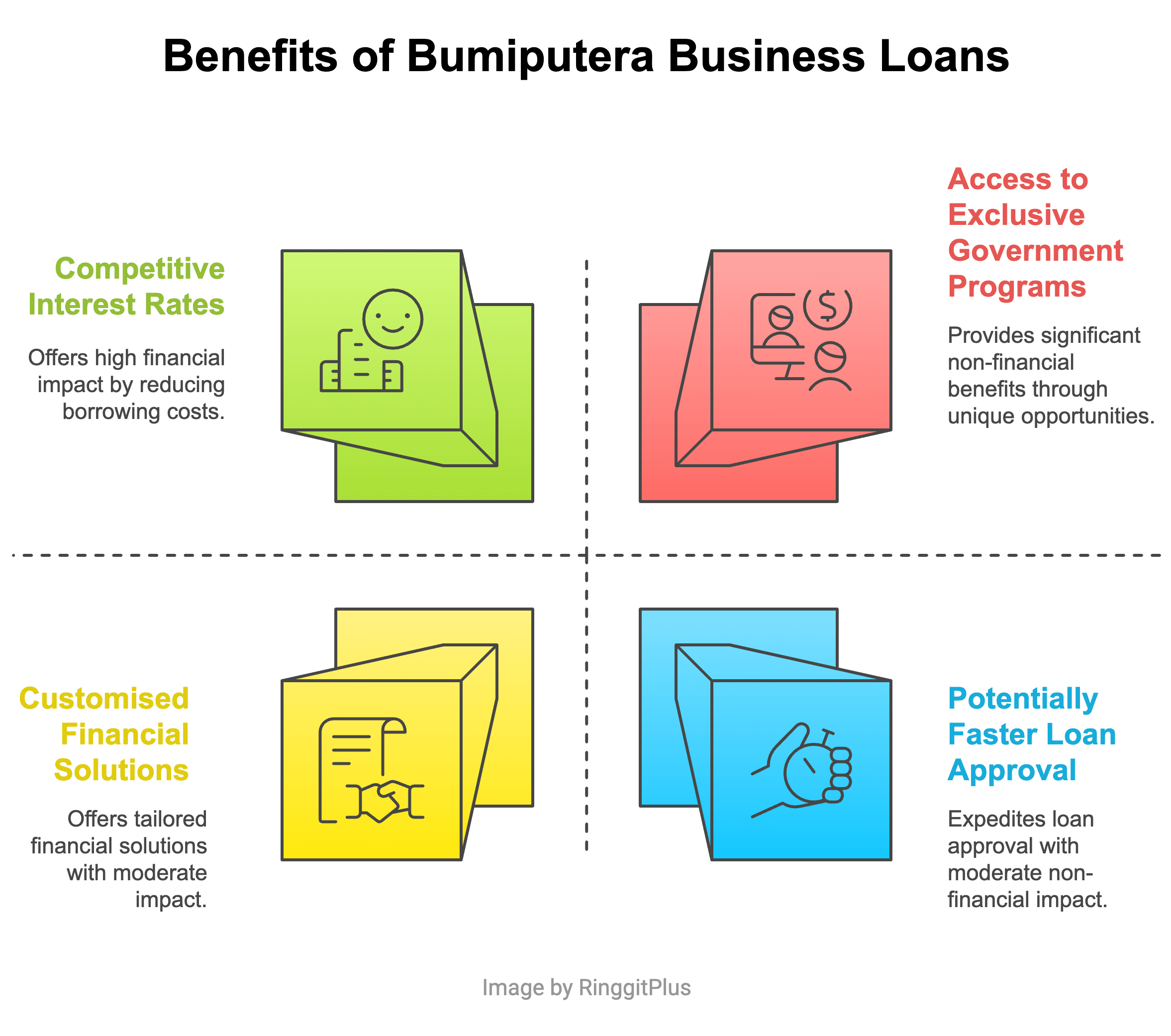

What Are the Benefits of Bumiputera Business Loans?

1. Access to Exclusive Government Programs:

Gain entry to unique government initiatives like capacity-building workshops, business development programs, and mentorship opportunities tailored for Bumiputera entrepreneurs.

2. Customised Financial Solutions:

These loans are designed with the specific needs of Bumiputera businesses in mind, offering flexible terms and adaptable repayment options.

3. Potentially Faster Loan Approval:

Government dedication to facilitating access to funds can lead to expedited approval processes for Bumiputera business loans.

4. Competitive Interest Rates:

Often featuring attractive interest or profit rates, these loans can make borrowing more affordable for your business

Who Is Eligible for a Bumiputera Business Loan in Malaysia?

-

Bumiputera Status:

You must be a Malaysian citizen belonging to the Bumiputera community, which includes Malays, Orang Asli, and other indigenous ethnicities officially recognised by the Malaysian government.

-

Bumiputera Ownership & Management:

Your business must be owned and actively managed by Bumiputera individuals. For many schemes, this means at least 51% or even 100% Bumiputera equity.

-

Ownership and Management:

Your company must be legally registered and operating in Malaysia. This includes holding a valid business license, being registered with the Companies Commission of Malaysia (SSM), and adhering to all relevant local regulations.

-

Legal Business Operations:

Lenders require proof of your business's financial health. Be prepared to provide consistent revenue streams and up-to-date financial statements (e.g., profit & loss, balance sheets).

-

Credit History:

A good credit score and a proven track record of timely loan repayments are crucial. This demonstrates your reliability as a borrower.

-

Collateral Requirements:

Some loans may require valuable assets as security. If assets are limited, explore options like leveraging business assets, accounts receivable, or a co-signer.

-

Comprehensive Business Plan:

Present a detailed business plan outlining your objectives, strategies, market analysis, financial projections, and how the loan funds will be specifically utilised for growth or operations.

-

Regulatory Compliance:

Ensure your business adheres to all relevant government regulations, industry standards, and obtains necessary permits.

-

Age Restrictions:

Certain loan programmes might have age-related criteria, especially those targeted at young entrepreneurs or specific demographics.

-

Other Specific Criteria:

Depending on the scheme (e.g., for manufacturing, agriculture, or specific industries), there might be additional requirements related to business type, location, or target market.

What Tips Can Help You Secure a Bumiputera Business Loan?

Applying for a Bumiputera business loan can be smooth with proper preparation. Here's how to tackle potential challenges:

-

Addressing Collateral Gaps

If you’re struggling to provide the usual security for a loan, you still have options. You can use your business assets (like equipment or stock), unpaid customer invoices, or even get someone to co-sign your loan. You can also check out government guarantee schemes from Syarikat Jaminan Pembiayaan Perniagaan (SJPP) and CGC as they can help cover part of the risk so you don’t need to come up with as much collateral.

-

Rigorous Financial Planning

Before taking a loan, make sure you really understand your business numbers. Estimate how much income you can realistically expect, keep track of your cash flow, and plan how you’ll repay the loan without putting pressure on your day-to-day operations. This helps you stay in control and avoid unnecessary financial stress.

-

Thorough Understanding of Loan Terms

Carefully review all loan agreements, focusing on interest/profit rates, fees, and repayment schedules. Don't hesitate to seek clarification on any unclear clauses and explore negotiation possibilities where appropriate.

-

Mitigating Market Risks

Diversify your business operations, explore new markets, and adapt your offerings to minimize exposure to market fluctuations. Investing in innovation is also key to long-term resilience.

-

Building Emergency Fund

An emergency fund gives you breathing room during tough times whether it’s slow sales, rising costs, or sudden challenges. It’s better to be prepared than caught off guard.

-

Proactive Document Preparation

Gather all required documents well in advance. Seeking professional advice can ensure your application is complete and meets all eligibility criteria, significantly boosting your approval chances.

-

Focus on Long-Term Success

Beyond securing the loan, prioritise a sustainable growth strategy, prudent debt management, and ensure the financing aligns with your overall business objectives.

-

Seek Expert Guidance

Leverage the experience of mentors, business advisors, or financial consultants specialising in Bumiputera SME loans. Their insights can simplify the loan application process and strategic planning.

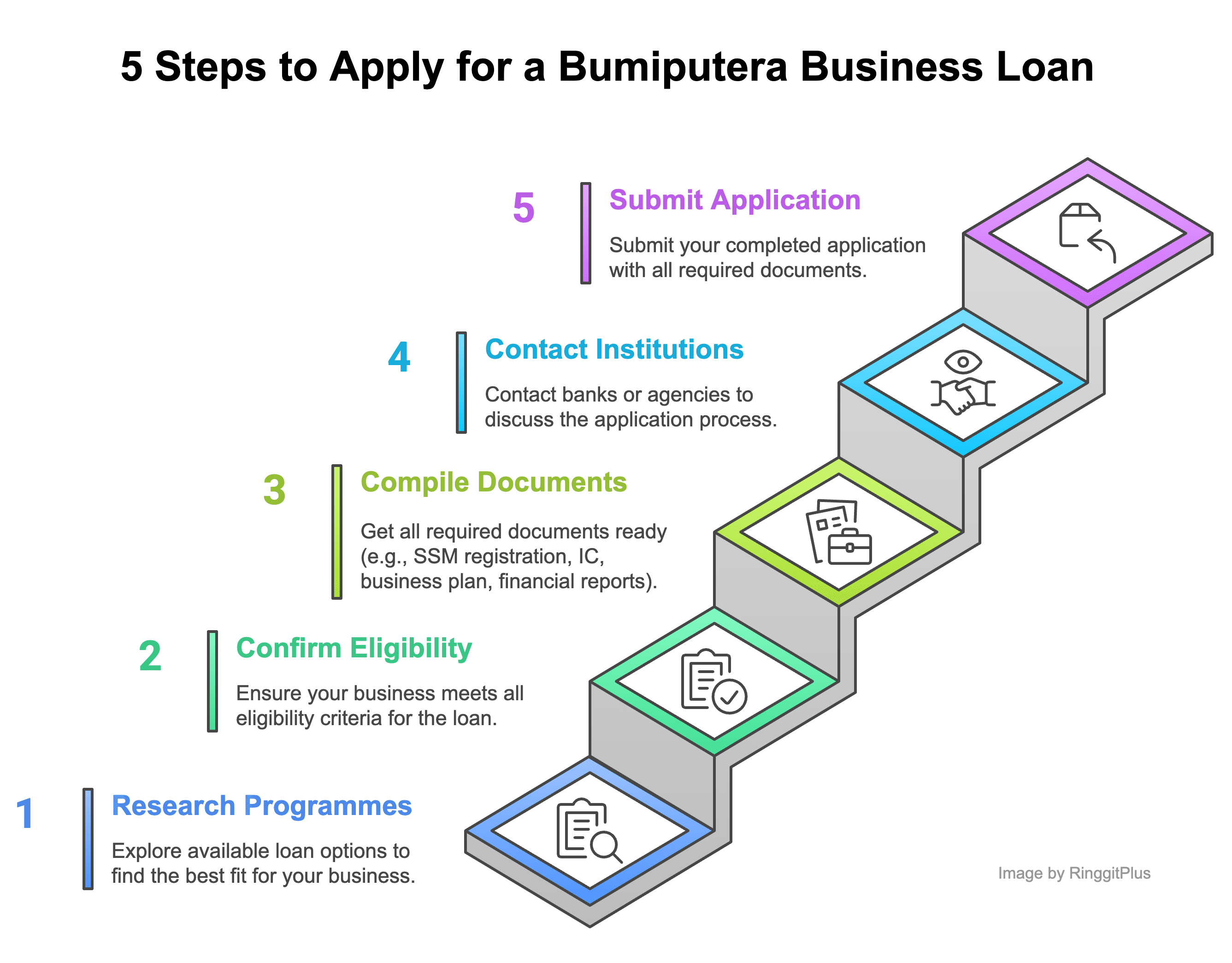

How Can You Apply for a Bumiputera Business Loan?

Ready to apply for your SME Bumiputera loan? Follow these steps:

- Research Available Programmes: Start by exploring the various Bumiputera business loan programmes offered by banks and government agencies. Identify those best suited to your business needs, noting specific requirements, terms, and benefits.

- Confirm Eligibility Criteria: Rigorously cross-check your business's eligibility for your chosen loan. This includes Bumiputera status, years in operation, and annual revenue.

- Compile Required Documents: This phase is critical. Don't hesitate to contact lenders for clarification. Typically, you'll need:

- Business registration documents (SSM)

- Identity documents (IC/passport) of all owners/directors

- A detailed business plan with financial projections

- Recent financial statements (balance sheet, income statement, cash flow)

- Proof of Bumiputera status (if required)

- Collateral documentation (if applicable)

- Engage Financial Institutions: Contact the banks or agencies offering your chosen programmes. Discuss their specific application process and any additional information needed.

- Submit Your Application: Once all documentation is meticulously prepared, submit your application.

Need a clearer picture? Just check out the image we have provided below for easy reference.

Bumiputera Business Loan Comparison: Leading Options in Malaysia 2025

These are some of the leading Bumiputera financing options offered by major institutions in Malaysia:

| Financial Institution | Loan Programs | Details | Loan Amount | Interest Rates |

| Maybank | New Entrepreneur Fund (NEF) | Supports the growth of Bumiputera-owned SMEs and entrepreneurs | Up to RM5 million | 5.0% p.a. (subject to change by Bank Negara) |

| Mara and SME Corporation Malaysia | Galakan Eksport Bumiputera Programme (GEB) | Assists SMEs and SMIs in export and domestic sectors. | RM50,000 -RM3 million | 5.0% p.a. (subject to change by Bank Negara) |

| BSN | Kasih-Bumiputera | Perfect for securing working capital, capital expenditure and renovation | RM5,000 - RM50,000 | 4.0% p.a. |

| Agrobank | Masyarakat Perdagangan & Perindustrian Bumiputera (MPPB-HUB) | To assist Bumiputera SMEs in obtaining working capital and capital expenditure in the agricultural sector | Up to RM200,000 | 3.75% p.a. |

| Bank Islam | Working Capital Guarantee Scheme - Bumi | To assist Bumiputera SME companies in all sectors to gain access to financing for working capital and capital expenditure | RM100,000 - RM3 million | - |

| Public Bank | Working Capital Guarantee Scheme - Bumiputera | A scheme set up to assist Bumiputera SMEs in all sectors to gain access to financing for working capital and capital expenditure. | Up to RM3 million | - |

What Government Support Is Available for Bumiputera Entrepreneurs?

The Malaysian government's commitment to empowering Bumiputera entrepreneurs goes far beyond just providing direct loans. In fact, various dedicated agencies are actively working to offer a wealth of integrated support, helping Bumiputera businesses not only get started but truly thrive and innovate in Malaysia's dynamic market.

-

Bumiputera Entrepreneurship Fund

One key player in this ecosystem is TEKUN Nasional, an agency under the Ministry of Entrepreneur Development & Cooperatives (KUSKOP). TEKUN is well-known for providing efficient and quick micro-credit financing, making it accessible for Bumiputeras to either kickstart a new venture or expand an existing one.

Their support isn't limited to just capital; it also includes crucial training and advisory services to help entrepreneurs sharpen their business skills.

-

Initiatives from SME Corporation Malaysia (SME Corp. Malaysia)

Another vital institution is SME Corporation Malaysia (SME Corp. Malaysia), which acts as the central coordinating agency under KUSKOP for all SME development programmes. SME Corp. offers several impactful initiatives specifically tailored for Bumiputera businesses.

For instance, their Bumiputera Enterprise Enhancement Programme (BEEP) provides comprehensive support to strengthen core business activities, build capacity, boost productivity, and streamline access to broader financing.

For younger entrepreneurs, the Tunas Usahawan Belia Bumiputera Programme (TUBE) specifically targets Bumiputera youth aged 18-30 who are eager to venture into entrepreneurship, offering them direct support to launch their ideas.

They also have the Galakan Eksport Bumiputera Programme (GEB), which provides valuable financial assistance, often in the form of matching grants, to help Bumiputera SMEs break into international markets and grow their exports.

-

Bumiputera Agenda Steering Unit (TERAJU) Facilitation Fund

The Bumiputera Agenda Steering Unit (TERAJU) also plays a significant role with its Facilitation Fund, actively supporting Bumiputera businesses in strategic sectors.

TERAJU has made a substantial impact, contributing significantly to value creation for Bumiputeras, attracting considerable private investment, and boosting the market capitalisation of Bumiputera companies listed on Bursa Malaysia.

A great example of their collaborative efforts is the Bumiputera Supply Chain Programme (BSC). This initiative works alongside various financial institutions like SME Bank, RHB Islamic, Bank Muamalat, and EXIM Bank, offering specialised financing solutions aimed at integrating Bumiputera businesses more deeply into key supply chains.

If you're curious about how your business can benefit, a simple search for "TERAJU Facilitation Fund eligibility" will give you more details.

-

Perbadanan Usahawan Nasional Berhad (PUNB)

Finally, Perbadanan Usahawan Nasional Berhad (PUNB) is known for its holistic approach to empowering Bumiputera entrepreneurs. PUNB provides a mix of financing and services across a wide array of economic sectors, including retail, distributive trades, manufacturing, and various service industries.

Among their prominent programmes is Pembiayaan PROSPER, an integrated financing package that not only provides capital but also includes valuable advisory support, business monitoring, and continuous entrepreneurial training.

PUNB also offers more specialised schemes like PROSPER Profesional, catering to working capital, renovations, or equipment needs in fields such as healthcare; PROSPER Didik, specifically designed for businesses entering early childhood education; and PROSPER Stesen Minyak, which aims to increase Bumiputera involvement in the petroleum retail sector.

To find specific details on "PUNB financing for retail businesses" or other sectors, heading to their website is your best bet.

Frequently Asked Questions About Bumiputera Business Loans

Got more questions? We've got answers! Here are some common queries about Bumiputera business loans in Malaysia:

1. What is "Bumiputera status" for a business loan?

For a business loan, "Bumiputera status" means your business must be predominantly owned and managed by individuals from the Bumiputera community, which includes Malays, Orang Asli, and other indigenous groups recognised by the Malaysian government. Many schemes require at least 51% or even 100% Bumiputera ownership, depending on the specific programme.

2. Can first-time entrepreneurs apply for a Bumiputera business loan?

Yes, absolutely! Many programmes, especially those from agencies like TEKUN Nasional and PUNB, are designed to support new Bumiputera entrepreneurs. Having a solid business plan is crucial to show your vision and repayment capability.

3. What if I don't have enough collateral for a Bumiputera loan?

Don't worry! While some loans require collateral, many Bumiputera-focused schemes offer more flexibility. Options include using business assets, accounts receivable, or even finding a co-signer. Government agencies like CGC (Credit Guarantee Corporation) also provide guarantee schemes to help SMEs secure financing without full collateral.

4. How long does it usually take to get a Bumiputera business loan approved?

Approval times vary depending on the specific loan program and the completeness of your application. Some micro-financing schemes might offer quicker approvals, while larger loans from commercial banks can take longer. Always ensure all your documents are complete to speed up the process.

5. Are interest rates for Bumiputera loans lower than conventional loans?

While not guaranteed, Bumiputera business loans often offer competitive or more favourable interest rates compared to regular commercial loans. This is part of the government's effort to provide affordable financing to support Bumiputera entrepreneurs. Always compare the profit rates (for Islamic financing) or interest rates across different providers.

6. Can a Bumiputera business loan be used for any business type?

Most Bumiputera business loans are open to various economic sectors like trading, services, manufacturing. However, some programmes are sector-specific, like Agrobank's MPPB-HUB for agriculture or PUNB's PROSPER Stesen Minyak for petroleum retail. Always check the programme details to ensure your business type is eligible.

7. What other support is available beyond Bumiputera loans?

A lot! Beyond loans, the government offers a wide range of support, including:

- Training & Mentorship: Programmes to enhance business skills.

- Business Development: Initiatives to help your business grow and become more competitive.

- Grants: Matching grants for specific activities like export enhancement.

- Networking Opportunities: Platforms to connect with other entrepreneurs and industry experts.

- Advisory Services: Guidance on business planning, operations, and market access.

8. Where can I get more information or apply?

You can contact the financial institutions (Maybank, BSN, Agrobank, Bank Islam, Public Bank) directly for their specific loan products. For government agency programmes, reach out to TEKUN Nasional, SME Corp. Malaysia, TERAJU, PUNB, or visit their official websites. It's always best to speak to their representatives for the latest information and application procedures.