What Is Buy Now Pay Later?

Buy Now Pay Later (BNPL) is a type of financing that provides consumers with the choice to pay for products either without interest or with a certain percentage of interest over a specified period of time.

It is often set up as a money-lending facility or an instalment plan that involves a customer, a lender, and the businesses from which the purchases are made.

Due to its low entry barriers, simplicity, as well as flexible repayment choices, BNPL plans have grown in popularity in Malaysia as a substitute for providing customers with instant access to credit.

According to the Consumer Credit Oversight Board (CCOB) Task Force, in the second half of 2024, there were 83.8 million BNPL transactions. This number jumped to 102.6 million transactions in the first half of 2025. The number of active accounts also rose from 5.1 million at the end of 2024 to 6.5 million by June 2025.

Why do people love to use BNPL?

Based on an online survey conducted by Consumer Credit Oversight Board Task Force (CCOBTF) involving 21,070 BNPL active users between August and September 2024, 69% of users rely entirely on this financial tool as their sole source of financial support.

Not only that, 56% of them use the service from Financial Service Provider (FSP) to purchase essential items for daily living and only 12% use it to buy non-essential items. The study found that BNPL is favoured because 98% of BNPL users believe that the service is easy to manage while 95% express satisfaction with the product.

As a result, a lot of businesses including banks have started to accept this payment option. In Malaysia, among some of the leading BNPL players are Atome, FavePay Later, Grab PayLater and SPaylater.

And because these BNPL can be accessed easily, the BNPL market in Malaysia is expected to grow at a compound annual growth rate (CAGR) of 15.1%, reaching a transaction volume of RM10.67 billion in 2025.

BNPL spending is expected to grow and could reach RM17.9 billion by 2030 with an expected increase of approximately 10.9% annually, according to the “Malaysia Buy Now Pay Later Business Report 2025” by Research and Markets.

How does Buy Now Pay Later work?

The concept is simple: you make purchases at a participating merchant or store, and choose BNPL at the checkout to delay payment until a later date. If accepted, most of the BNPL apps require you to pay off the first instalment as a down payment out of the total purchase price.

For example, say your item costs RM800 and you choose to pay for it over a 3-month BNPL plan, you will need to pay about RM267 as the first payment, and then the other two remaining payments will be paid off in the next two months, in a series of 0% interest payments. You can also choose to pay your instalments as auto deductions from either your debit or credit card.

As BNPL typically features a fixed repayment plan so most providers often suggest consumers to use auto deduction from either their debit or credit card to pay for their instalments. It is the safest and simplest way to ensure you won’t get penalised and accumulate more debt by missing your payments. The auto deduction feature may also be opted out if you wish to, subject to the BNPL provider’s discretion.

What is a credit limit in Buy Now Pay Later plans?

In the context of BNPL plans, a credit limit is the maximum amount of credit that you are approved to borrow from the provider. When you apply for a BNPL plan, the provider will typically review your creditworthiness and other factors to determine your credit limit.

For example, if you’re approved for a BNPL plan with a credit limit of RM1,000, you can use the plan to make purchases up to RM1,000. Once the credit limit is reached, you will not be able to make further purchases through the BNPL plan until you have paid off some or all the outstanding balance.

How can i increase my credit limit?

Generally, BNPL providers in Malaysia offer credit limits that range from a few hundred ringgit to several thousand ringgit. The credit limit may also be adjusted over time based on your payment history and other factors. Some providers may also offer higher credit limits to consumers who have established a positive credit history with them.

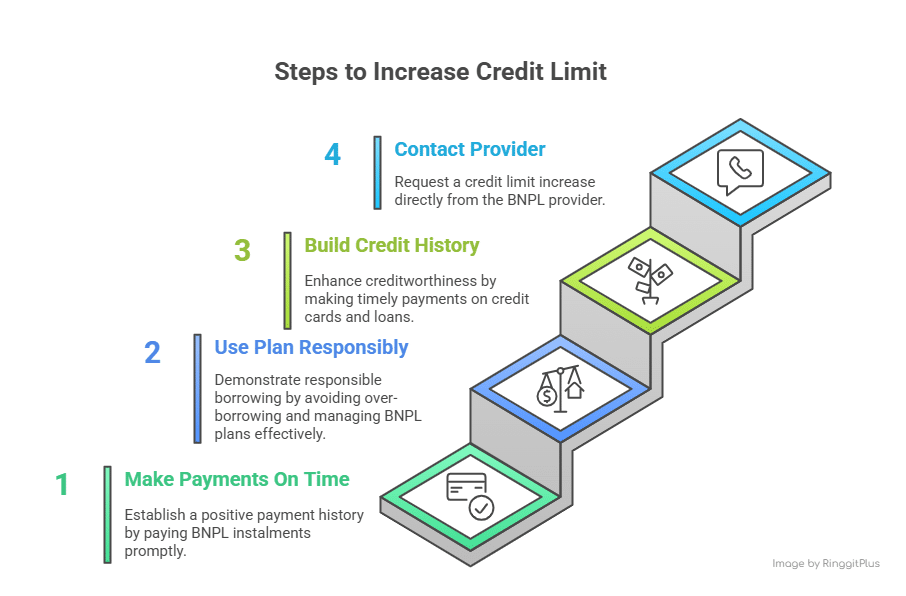

If you're looking to increase your credit limit for BNPL plans in Malaysia, here are a few things you can try:

- Make payments on time

Paying your BNPL plan instalments on time can help establish a positive payment history with the provider, which can increase the likelihood of being approved for a higher credit limit.

- Use the plan responsibly

Using BNPL plans responsibly and avoiding over-borrowing can help demonstrate to the provider that you are a responsible borrower, which can increase your chances of being approved for a higher credit limit.

- Build a positive credit history

Building a positive credit history with other lenders and creditors can also help increase your chances of being approved for a higher credit limit with BNPL providers. This can include making payments on time for credit cards, loans, and other types of credit.

- Contact the provider

If you have a good payment history with a BNPL provider and would like to request a higher credit limit, you may be able to contact the provider directly to request an increase. Some providers may allow you to request a credit limit increase online or through their customer service channels.

It's important to remember that not all BNPL providers may allow for credit limit increases and that each provider may have their policies and criteria for determining credit limits. Additionally, borrowing more than you can comfortably afford to repay can have negative consequences for your credit score and financial health.

As with any type of credit, it's important to use BNPL plans responsibly and make payments on time to avoid negative impacts on your credit score and financial health.

Advantages of Buy Now Pay Later

As mentioned, the BNPL has taken off in popularity in recent years, especially after the Covid-19 pandemic and it’s not exactly a puzzle as to why it’s becoming more favoured by the local consumers. From payment flexibility to interest-free options (depending on the provider), let’s dive into detail on some of the advantages of using a BNPL.

- Flexibility in payment

Make purchases and delay payment until a later date. Rather than having to pay for a purchase all at once, you can spread the cost out over a longer period. This can be particularly useful for expensive purchases such as electronics, appliances, or furniture, which can be expensive and difficult to pay for upfront.

- Manage cash flow

You can spread the cost out over a longer time, making it easier to budget expenses and manage cash flow.

- Build credit scores

Using BNPL responsibly can help you build a positive credit history, especially since the new Consumer Credit Bill 2025 — expected to be approved by the end of this year will require providers in Malaysia to report borrowing data to credit bureaus, according to The Edge Malaysia in May 2025. This is great for younger consumers who are starting to establish their credit.

- Availability of financing options

There are several BNPL providers to choose from and the popular ones in Malaysia include GrabPay, Boost, and Atome which offer a range of interest-free plans and longer-term financing options.

For example, Atome offers instalment plans of up to 6 months (and sometimes 12 months for selected merchants), and GrabPay offers 12x instalments. Meanwhile, Boost gives a repayment plan of up to 24 months, subject to selected merchants.

- Reward programs

Some BNPL providers offer rewards programs and other perks to encourage customers to use their services. For example, Atome Malaysia offer their users a rewards program called Atome+ where it is designed to enhance shopping experience by earning points with every purchase. Similarly, SPayLater also offers their users with a lot of exclusive perks that can be seen as Shopee coins, vouchers and cash deals — helping shoppers to save more!

What are the risks of using BNPL?

BNPL isn't always a better option for your financing just because it makes spending simpler. If you don’t use BNPL wisely, you may expose yourself to substantial financial risks which in the end, may not be ultimately worth the convenience. Here are some of the things you should consider before you use a BNPL service:

- Interest and fees

You may end up paying more in interest or fees if you don't pay off your balances on time as scheduled. In Malaysia, each BNPL provider has their own late payment penalty and if it accumulates over time, your balances may add up quickly which can be hard to pay off later on.

As an example, Atome charges an admin fee of RM30 for each late payment. That’s RM60 maximum penalty if you’ve chosen the 3 monthly instalment plan (the first payment is already completed during the initial checkout but you miss the other two payments).

- Overspending

BNPL can encourage you to spend more money than you otherwise would, as the option to pay later can make purchases seem more affordable than they actually are. So before you use a BNPL, it is better for you to have a budget in mind. This way, you can ensure that your payments are both affordable and timely.

- Risk of debt

Did you know that the overall percentage of BNPL consumers who had past-due payments in the fourth quarter of 2022 was 17%? This is as reported in the Financial Stability Review by BNM (conducted during the second half of the year 2022). Undeniably, frequent and irresponsible use of BNPL can lead you to accumulate more debt which can be difficult to manage and may have long-term consequences.

- Collection Practices

If you miss payments, the BNPL provider may pursue the debt through its own team or appoint an external collection agency. This means a debt collector may contact you. If they do, ask for the agency's name and a written notice showing the outstanding amount.

Additionally, a private debt collector has no special legal power or authority to enter your home or remove your belongings without a court order. That said, they cannot seize property unless they have a court judgment and orders (like a Writ of Seizure and Sale).

Should the creditor sue you and win a final decision/ judgment, the enforcement action against your property is handled only by the courts.

Common ways the court can collect the debt include using a Writ of Seizure and Sale to take and sell your property or they can use garnishee proceedings to take money directly from your bank accounts.

- Legal Enforcement and Bankruptcy Rules

A creditor may also choose to start a bankruptcy case against you. This is a separate legal process with its own rules. Following the amendments to the Insolvency Act, you must owe at least RM100,000 for a creditor to petition for your bankruptcy.

For most simple debts, a creditor must start legal action within six years from the date the payment was due. If you are contacted about a very old debt, this is important to know. However, this six-year limit can be reset if you make a part-payment or acknowledge the debt.

If you need help, you can approach Agensi Kaunseling dan Pengurusan Kredit (AKPK) for free counselling.

- Impact on credit scores

Late or missed payments on BNPL plans can negatively impact credit scores, which can make it harder for you to access credit in the future.

What would happen if I failed to make repayments for my BNPL plan?

Failing to repay your BNPL payments can lead to penalties and account restrictions—here are the actions that may be taken by the FSP if you continue missing payments each month:

1. Late Payment Charges (LPC):

If you miss a payment, the FSP will apply a late payment charge as stated in the agreement.

2. Payment Reminder:

You will receive a payment reminder at least 3 days before the due date. The reminder will include:

- The amount you owe to FSP

- The late fee that will be charged if you don't pay on time

3. Account Suspension After Missed Payments:

If you miss up to 3 payments:

- Your BNPL account will be paused

- You won't be able to use it for new purchases until all missed payments are cleared

4. Early Suspension Option:

Even before 3 missed payments, the provider may choose to suspend your BNPL account based on their internal risk policy.

Am I allowed to use BNPL if I’m declared bankrupt?

No, individuals who have been declared bankrupt are not permitted to use BNPL services. This restriction is outlined in Bank Negara Malaysia’s (BNM) Personal Financing, updated on 15 December 2023.

However, individuals who have been discharged from bankruptcy are not subject to this restriction.

How to get started with Buy Now Pay Later?

In summary, BNPL providers may require you to meet certain requirements before signing up for one, such as:

- Age

Most BNPL age requirements are typically 18 to 21 years old in Malaysia.

- Identification

You’ll need to provide identification documents such as an IC or passport to verify your identity.

- Creditworthiness

Providers may evaluate your creditworthiness before approving you for a BNPL plan. This can include factors such as credit score or income. It also means you’ll need to have a bank account with a debit or credit card.

- Residency

You’ll need to be a resident of Malaysia to be eligible for BNPL.

It's important to note that each BNPL provider may have their own eligibility criteria and should carefully review the terms and conditions before applying for a BNPL plan. Additionally, even if you’re eligible for a BNPL plan, it is advised to consider your financial situation and ability to make payments on time.

Buy Now Pay Later comparison in Malaysia

| Provider | Tenure | Interest/Profit Rates | Late Payment Fees |

| GrabPay | 4, 8 or 12 months | 0% interest rate | RM10 admin fee or 1.5% processing fee per instalment for 8 and 12-month plan |

| Boost | 3, 6, 9, 12 months | 2.5% profit rate of transaction amount per month | RM5 or 1% of outstanding balance, whichever is higher |

| Atome | 3, 6 or 12 months | 0% interest but 1.5% instalment rate of the order amount per month | RM23 for each missed payment with additional RM7 penalty may apply |

| Shopee Pay | 1, 3, 6, 12, 18 or 24 months | 0% interest rate but processing fee of 1.5% for 6, 12, 18, and 24 months instalments. | RM10 or the principal bill amount, whichever is lower |

Overall, BNPL can be a useful payment option if you’re looking for flexibility and convenience. However, it's important to use these services responsibly and to understand the potential risks and costs involved.