What You Need To Know About Comprehensive Car Insurance

What does a Myvi and a Mercedes have in common? Answer: both vehicles need a valid car insurance to be allowed on the road.

New or secondhand, local or imported, if you own a car you need to have a valid car insurance to be able to drive it on the road; it's as simple as that.

Anyone telling you any different is either ill-informed or simply has no regard for his or her own welfare – as well as those around him or her.

Besides, if you don’t have a valid car insurance and road tax (these two come hand in hand, you can’t buy or renew one without the other) you might have to fork out extra money towards paying traffic summons if you get flagged down by the police or stopped at a roadblock.

Why should I get car insurance?

According to the Road Transport Act 1987, it is compulsory for all car owners in Malaysia to have a valid car insurance and road tax, both of which need to be renewed on a yearly basis.

But, legal requirements aside, it’s also important to have sufficient car insurance coverage for your vehicle so that if anything bad happens to it (be it a collision, natural disaster, or even theft), you can count on your insurance policy to cover the costs of the repairs – or replacement.

Based on the research done by the Malaysian Institute of Road Safety Research, there were over 400,000 road accidents recorded in 2020 alone, almost 5,000 of which were fatal.

This is reason enough to buy a suitable - and ample - insurance policy to cover you and your vehicle when you’re on the road.

What are the types of car insurance available in Malaysia?

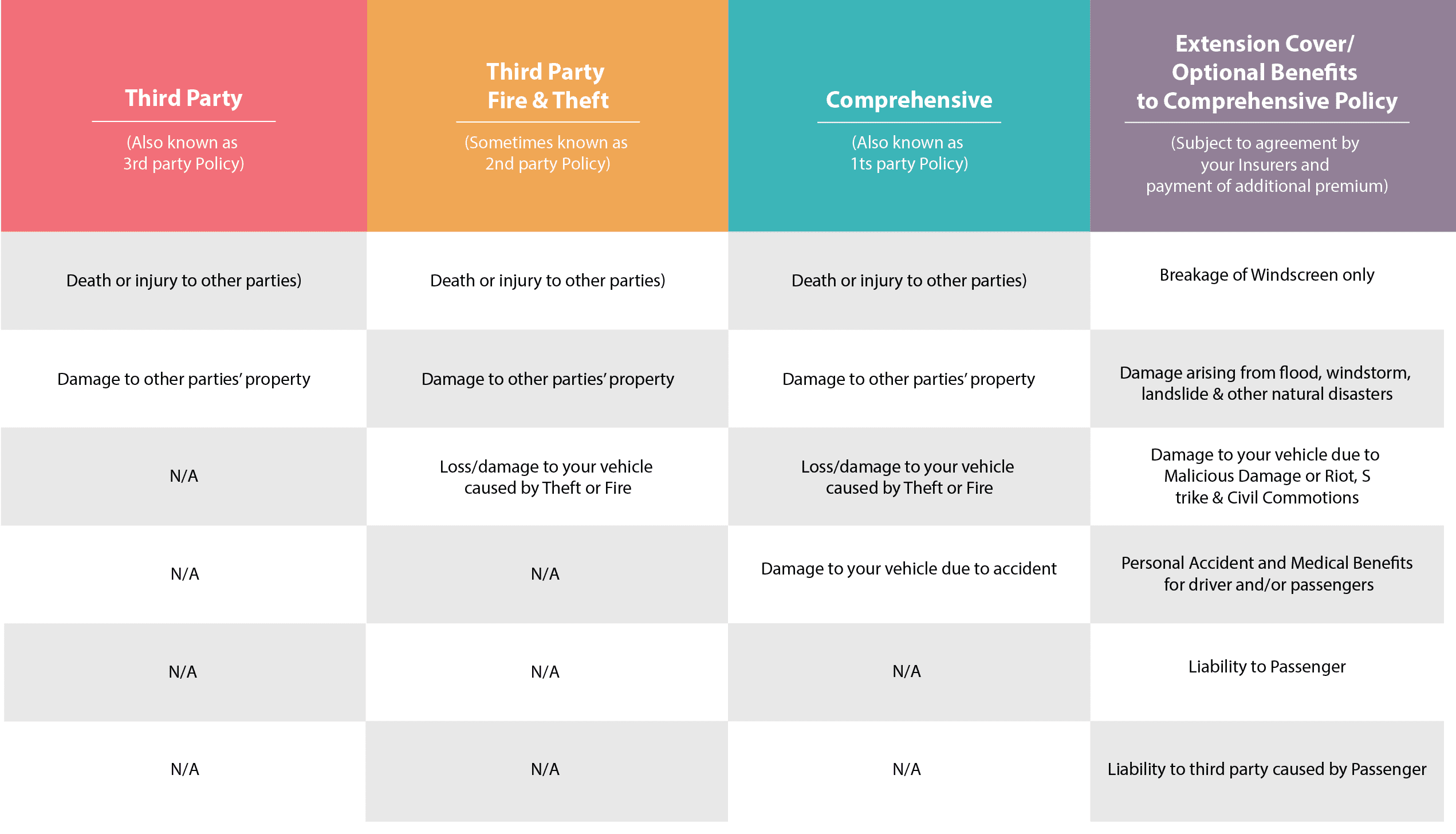

There are three types of motor insurance available in the Malaysian market, each unique in its purpose to cover you and/or your vehicle.

Third Party Cover

A third-party cover is usually the cheapest among the three offered car insurance covers, and the most basic form of car insurance you can have in Malaysia.

However, this policy doesn’t cover you for any damages to your own person or vehicle.

Imagine this: it was a rainy night, and you’re driving home after a late night at work. The road was slick and all of a sudden, your car skids at a junction and you collide into another motorist. By luck, you escaped unscathed - but the same can’t be said for the person you collided with.

To avoid forking out an exorbitant amount of money to pay for his or her hospital bills – not to mention vehicle repairs – you’ll need at least a third-party car insurance.

Just as its name suggests, a third-party cover insurance policy covers claims made against you for bodily injuries or even deaths caused to others (third parties). It also includes any loss or damage to their vehicle or property.

Third-Party Fire and Theft Cover

For the most part, third-party fire and theft cover work just like a third-party cover, except this policy allows you to make a claim if your car suffers a fire damage or gets stolen.

Please be aware that this cover type addresses loss/damage due to accidental fire and theft, but not loss/damage due to accident itself.

This means that you can only make a claim for events such as:

– Your car gets stolen

– Damages as a result of an attempted theft such as damaged door locks and broken windows

– Damages due to fire

Comprehensive Cover

This car insurance policy offers a wider range of coverage than the two car insurance covers mentioned previously.

In addition to providing cover for all that was mentioned above, it also covers damages done to your OWN car!

Comprehensive car insurance is advisable if you cannot afford to replace your car just like that, for example by using your savings to buy a new car or using a second car.

The moment you rely on your car to commute to work for example, and those before-mentioned scenarios don’t apply, you better have a comprehensive cover which will provide the cash equivalent to the replacement value (current market value) of your car, so at least you can go and buy another car.

Here's a table to help you understand the differences between each car insurance policy:

What is the ideal sum insured for my car?

Deciding on the right amount of car insurance is not rocket science. Insurers aim to make your life easy and determine the optimal sum insured, based on market value of your car.

With detarification in force since July 2017, additional factors are relevant to determine your premium. However, the ideal sum insured really goes back to the market value of your car only.

The age of your car is a key factor to calculate the best sum insured.

Simply put, insurers can pull the technical details of your car from a database, such as manufacturing year, engine size, model type, horsepower, etc., so they know the original price of your car versus the current market value of your car, given the actual mileage.

It’s straight-forward, if you purchase a new car worth RM100,000 then your sum insured should ideally equal the same amount.

As the original price comes down over the years and your car gets older, the sum insured can also be reduced every year, in line with the lower value and market price of your car.

In theory, you could decide to purchase a lower sum insured than the market value of your car. For example, if the market value of your car is RM22,000 after a couple of years, you decide to purchase a sum insured worth RM20,000 only.

You might be able to save a few bucks, but eventually, you might decide to still go for the full sum of RM22,000 because the difference in premium might only be a comparatively small amount and you would be penalized for the under-insurance.

What your car insurance will not (normally) cover?

While it is tempting to dive straight into the hunt for the best car insurance deals straightaway, you may want to read the terms and conditions of all three policies carefully and be aware of things included and excluded from your coverage.

Not all incidents are covered by a car insurance policy, even though you think they might just be, because as your car insurance plan is slightly higher – or the highest – one of the best plans you can buy, compared to the other plans.

Here is a list of conditions that may not be covered under your car insurance policy:

Your own death or bodily injury due to a car accident

If you think a standard car insurance could cover the costs of your medical bills – or even funeral – in the event you get into a car accident, think again.

Even a comprehensive car insurance policy only covers the damages done to your vehicle (and the person’s which you may have collided into) vehicle.

However, you can add Personal Accident insurance cover to your car insurance as a rider to help cover your medical costs.

Alternatively, you can also get a separate stand-alone medical or personal accident insurance policy to help with the medical bills. – just be sure to check if the policy covers injuries that are caused by car accidents.

Your liability for claims from your passengers

A passenger who gets hurt because of a car accident will usually have an easier case compared to the person behind the wheel - if the accident involves two vehicles, one of the drivers will most likely be found negligent and is liable for the physical injuries done to the passenger.

To avoid paying for these claims from your own pockets, you can add Passenger Liability Extension Cover to your car insurance policy.

Damaged or stolen custom car accessories

Pimping your brand-new car with custom rims, leather seats, and expensive sound systems might earn you brownie points with your friends (even dates).

But, these luxurious upgrades may attract thieves to your car like bees to honey.

Most standard car insurance policies don’t cover the costs of repairs or replacements for these custom accessories, although you can check with your car insurance provider if you can extend the coverage to your accessories as well.

Consequential loss, depreciation, wear and tear, mechanical, technical breakdown failures, or breakages

Like everything else - cars aren't built to last forever.

As vehicle parts wear out with time (excluding parts made from glass e.g. windshield), the value of your car depreciates along with them.

You'll probably lose up to 40% of its initial value 5 years down the road - literally!

If you're planning to insure a car that is pushing 15 years of age, it may be hard to get a comprehensive car insurance policy for it, but you can opt for a third-party cover instead.

Vehicle damage due to acts of nature e.g. flood, landslide, typhoon

These unfortunate events, along with earthquakes and hurricanes are commonly referred to as natural disasters or acts of God and are not usually not covered in standard car insurance policies.

On the other hand, you can choose to boost your policy with additional cover against natural disasters.

Of course, this will result in a higher premium, but if you live in an area that is prone to floods and/or landslides, it’s worth paying the extra money than spending your entire savings on the repairs costs – which no doubt will be extremely expensive.

What are the add-on covers available for car insurance?

The car policy allows for policyholders to extend coverage to include extra benefits and additional cover apart from the standard coverage. Do communicate with your insurers to request for these additional covers.

1. Flood, windstorm, rainstorm, typhoon, hurricane, volcanic eruption, earthquake, landslide/landslip, subsidence or sinking of the soil/earth or other convulsions of nature

2. Breakage of glass in windscreen or windows

3. Strike, riot and civil commotion

4. Tuition and testing purposes

5. Additional named driver

6. All drivers’ extension for private car policies issued to a company of businesses only

7. Passenger liability

8. Liability of passengers for acts of negligence

9. Additional business use

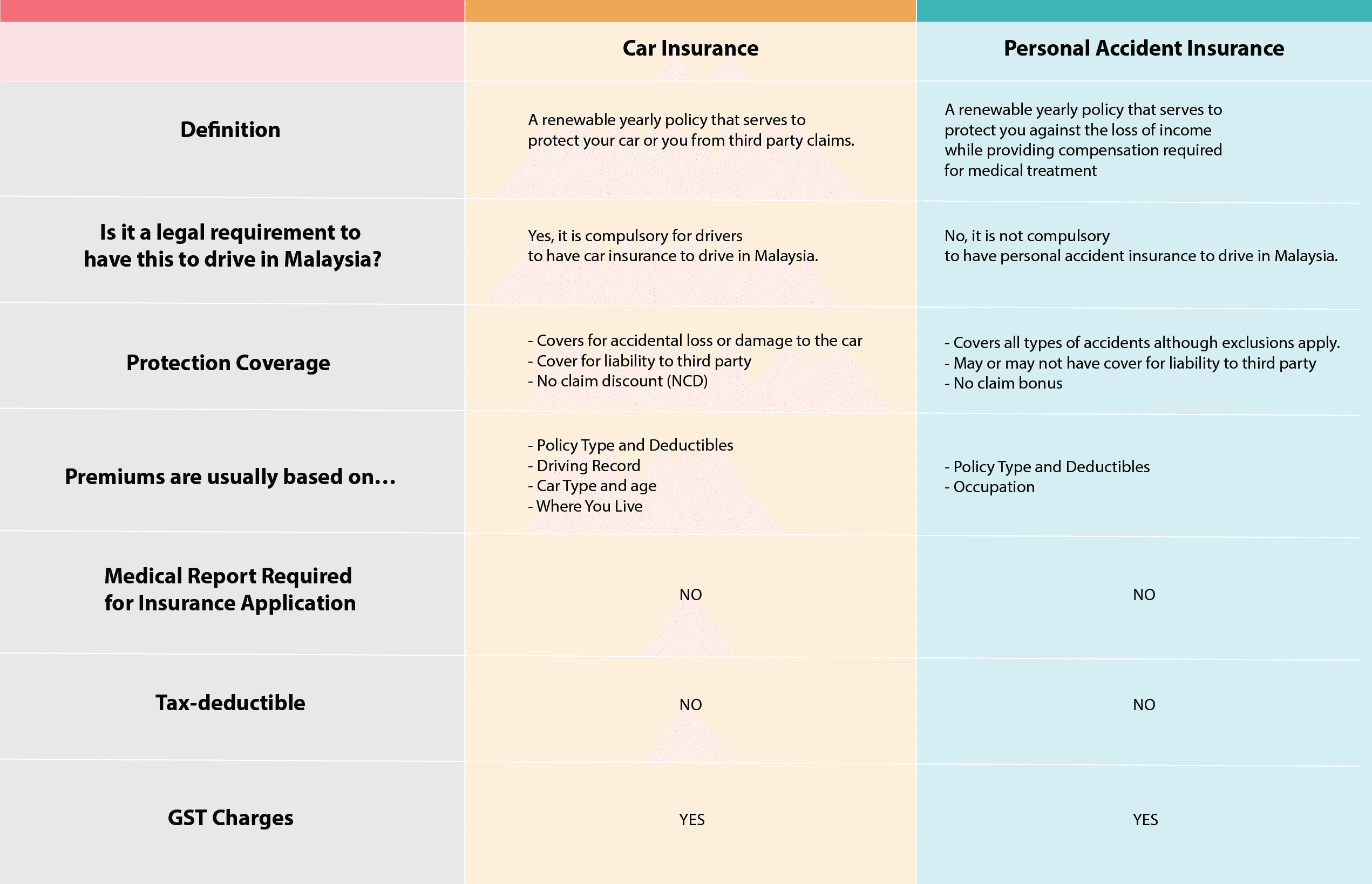

What is the difference between a Car Insurance and Personal Accident Insurance?

You must be thinking, why do I need a personal accident insurance on top of a car insurance? Well, we have prepared a comparison table to answer that question:

With effect from 1 June 2018, the Goods and Service Tax (GST) will be set to zero.

How do insurers calculate car insurance premium rates in Malaysia (Post de-tariffication)?

Before July 2017, the premium rates for car insurance in Malaysia were pretty much the same (based on the value of your vehicle and its engine capacity) across all insurance providers.

This was because the premium rates were tariffed by Bank Negara Malaysia (BNM).

Insurer based their premium calculation mainly on the technical details and age, therefore the market value of your car.

However, since the implementation of de-tariffication in July 2017, insurance companies now look into various additional other factors to determine your car insurance premium.

This risk-based assessment is put into play to give drivers an incentive to actively reduce their risk and therefore enjoy lower premiums. The key driver-related risk factors are:

Age – If you are a ‘P’ license holder, you may need to pay a higher premium. As per the motor de-tariffication, your risk profile indicates a higher risk due to a lack of driving experience.

Gender – Although it is said that male drivers are more likely to engage in aggressive driving behaviour, we are very much aware of the existence of viral videos featuring not-so-friendly female drivers as well so… all’s fair when you are on the road?

Occupation – If your job requires you to be on the road frequently, then it’s sad to say that chances are your premium is most likely higher too. For instance, the insurance premium for a bus driver is higher because of their job nature which involves transporting passengers from one location to another, as compared to a desk-bound office worker who may be leading a sedentary lifestyle.

Residence – You are more likely to pay a higher premium for your car insurance if your home is in Petaling Jaya as opposed to someone who is staying in Subang Jaya. Why? Because different areas have different crime rates and therefore, higher or lower chances of your car getting stolen or damaged.

Claim history – This goes without saying. If you had a lot of claims in the past, insurers will take note of this and increase your premium as your risk profile is high.

Use of car – The more you drive in a year, the higher your risk.

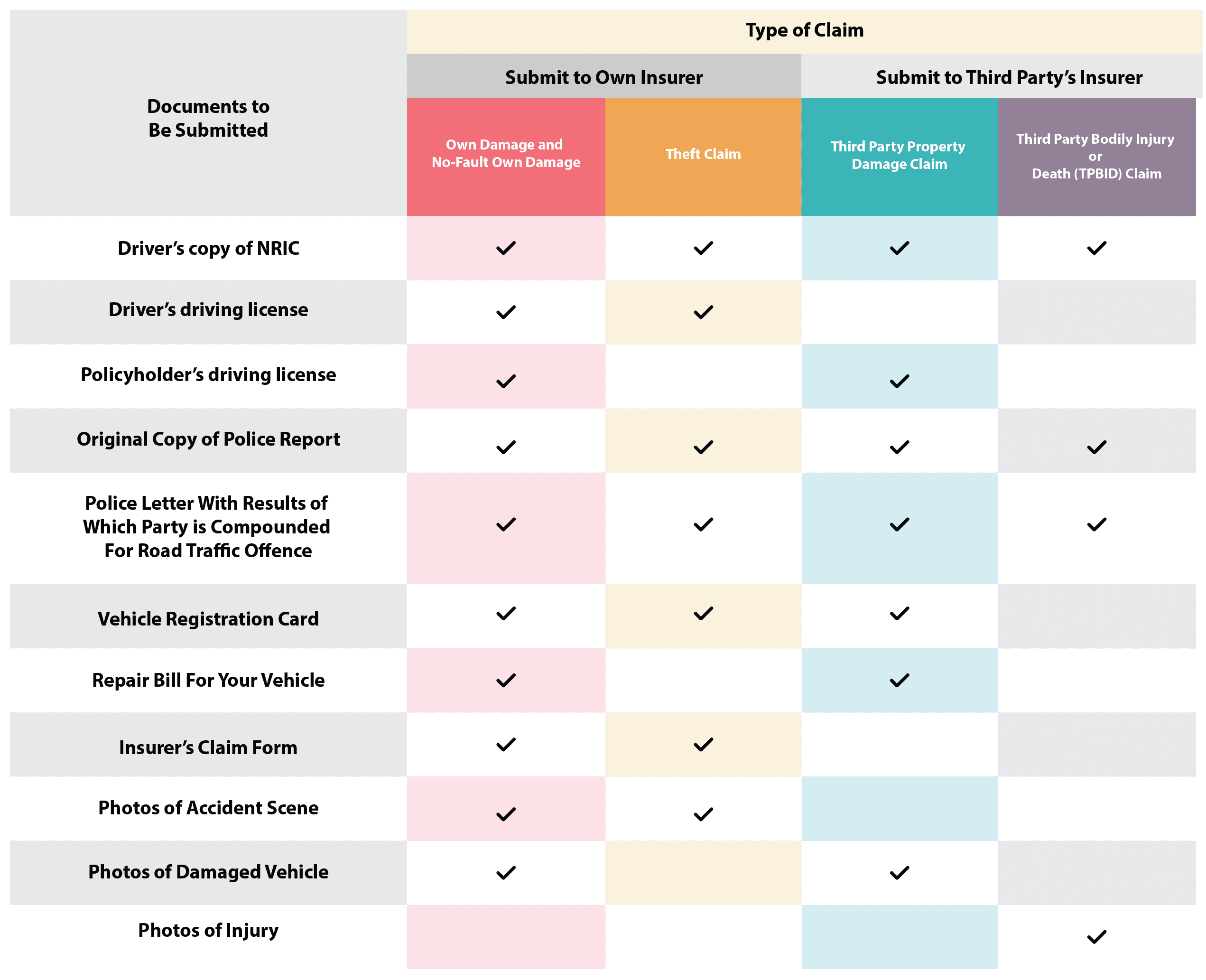

How do I submit a car insurance claim?

It can be challenging if you to submit a car insurance claim without researching what is it that’s required.

For a hassle-free car insurance claim, always keep in mind that the type of claim you wish to take will determine the documents needed to process your claim.

For your convenience, we have a prepared a table to assist you in the preparation of the required documents prior to submitting a claim.

Own Damage Claim

Let’s say that your car is involved in a hit and run and since you do not know who is the person that has knocked into your vehicle, you will need to submit a claim on your own car insurance policy.

This is referred to as own damage claim. Do note that this only applies if you have a comprehensive policy and the result is that your NCD entitlement will be forfeited.

When you notify your insurer regarding the accident, they will provide you with the names of approved workshops/panel workshops that you can your vehicle for repair.

Here are the documents required for car insurance claim in Malaysia:

- Copy of your MyKad

- Copy of your most recent driver's license

- Original copy of the police report

- The Keputusan report issued by the police department

- Car registration card

- Claims adjuster report including bill of repair cost for your car or any damaged property

- If required, photos of the damaged car or property

Ensure that all these documents are prepared beforehand as the workshop will only repair your vehicle after receiving your insurance company’s approval.

Once the repairs have completed, you will receive a notification by the workshop asking you to collect your vehicle.

Own Damage Knock-for-Knock Claim

Just like the own damage claim above, the own damage knock for knock claim applies when it is clear that the fault lies on the third party and the official police report results have determined the third party as the ones who will be compounded for the offense.

This report will serve as a form of evidence which can be used to submit for your ‘Own Damage Knock-for-Knock’ claim. Also, it won’t affect your NCD as well.

How do I pay my car insurance premium?

As you may well know, there are several ways to pay your annual car insurance premiums, such as auto-debit, online payments, as well as the traditional payment options like cheques and cash.

But you also have the option to pay it in installments. Some credit cards allow you to convert your car insurance premium payment to 0% Easy Payment Plan (EPP).

The tenure varies from one credit card provider to another, but this can significantly help to lighten your financial burdens and make room for other things – such as putting more money towards your savings.

If my car breaks down, will my car insurance pay for a rental car?

This is a very insurance carrier specific question as every insurance company handles rental car coverage differently.

Some give a small amount of coverage as a default feature on their policy and others do not.

However, you want to check if the extra expense is worth the coverage especially in households with multiple vehicles, as many car repair shops offer a free rental car while work is being done.

Does my car insurance cover me when I rent a car?

Normally, your car insurance only covers your own car and the insured drivers for that car.

You better check with the car rental company what to do in case of an accident. The rental car is insured by the car rental company.

Does my car insurance pay if someone else is driving my car?

Insurance companies require that policy holders declare all drivers that are covered.

This could be individual persons and/or everyone in your household.

Technically, there is no insurance coverage for someone driving your car, who is not listed and therefore covered - very dangerous and very expensive!

Can I cancel my car insurance policy anytime?

You can cancel your car insurance at any time. However, there might be a penalty, if you cancel within the one-year period, as the standard coverage runs for one year.

Best approach would be to swap insurers towards the end of the one-year contract and simply not renew, but change to a new insurer.

Car Insurance Glossary

Add-Ons – As car insurance policies offer a basic form of coverage for your vehicle, you may want to consider add-on covers/extensions for extra protection and peace of mind. According to PIAM, here are some of the add-ons which can be included in your car insurance policy :

1. Flood, windstorm, rainstorm, typhoon, hurricane, volcanic eruption, earthquake, landslide/landslip, subsidence or sinking of the soil/earth or other convulsion of nature

2. Windscreen protection

3. Strike, riot and civil commotion

4. Tuition and testing purposes

5. Additional named driver

6. All drivers’ extension for private car policies issued to a company of businesses only

7. Passenger liability

8. Liability of passengers for acts of negligence

9. Additional business use

Accident - An event or occurrence that is unforeseen and unintended.

Adjuster - One who settles insurance claims; may be a salaried employee or an independent operator.

Average Clause - In the event of a partial loss, your claim will be adjusted in accordance to the portion that your vehicle is insured for. For instance, if you have insured your car up to 60% of the market value, you will only receive up to 60% of the total repair cost by the insurer.

Car Liability Insurance - A form of liability insurance that is specifically designed to indemnify for loss incurred through legal liability for bodily injury and damage to property of others caused by accident arising out of ownership or operation of a car.

Excess – Also known as a deductible, it is the amount that you will need to bear before your insurance company pays for the balance of your vehicle damage claim. Excess can be divided into 2 types which is compulsory excess and other excess.

Compulsory Excess – This is non-negotiable and is usually set by the insurer in the situation that your vehicle is driven by : - a person who is not named in your policy - a person who is named in your policy but under the age of 21 - a provisional (P) driving license holder - a full driving license holder with less than two years driving experience

Other Excess – This is negotiable and applicable at discretion of the insurer. Insurers are sometimes willing to implement no excess on a case to case basis.

Consequential Loss – Damages which are caused by a certain action committed by the policyholder or a third party and not an outcome that is unexpected.

Claims Adjuster – an individual who investigates insurance claims to determine the extent of the insurer’s liability.

Release Letter/Release of Liability – This refers to the legal document between 2 parties. Typically, it involves the Releasor (person promising not to sue) and the Releasee (person or company who may or may not be liable). By signing this form, the Releasor acknowledges that he or she understands the risks and claims involved and agrees to not sue the Releasee for past or future injuries or damages.

Daily Cash Allowance – an amount of money that is paid daily to the policyholder in the situation that the vehicle insured is undergoing repairs

Loading - This refers to the extra charge that is added by insurers when they consider the potential policyholder as a risk-prone individual. For example, if you are a new driver, your car insurance policy may be higher as insurers will deem that you are more likely to end up in an accident due to your lack of driving experience.

Other factors which may lead you to a car insurance with a high loading would be the age of your vehicle. So yes, even it may seem like a good idea to buy an imported 8-year-old second-hand luxury car with a low mileage at a fraction of it’s price, some insurers may consider it as a risk when they bring you onboard as a policyholder of their car insurance as the perception that an older car is more likely to encounter problems due to daily wear and tear remains.

Compensation for Assessed Repair Time (CART) – A form of third party benefit, it is compensation provided by the insurance of the person who have hit your vehicle and the amount is decided by the number of days it takes for your vehicle’s repair.

A claims adjuster will perform the assessment and specify the amount of repair time required for the car repair. The purpose of CART is to provide you with funds which can be utilised for a rental car, allowing you to continue with your daily life as the workshop repairs your car within the specified duration.

Bear in mind that CART does not equate to the amount of time your car will be spending at the workshop and that it is only available for accident victims.

Loss of Use - In the event that you are involved in an accident, you may be provided a vehicle or a sum of money which you can use to rent a vehicle.

Market Value – The sum of the insured amount based on the current market value of the vehicle

Agreed Value – The sum of the insured amount based on the vehicle’s age and model

Insured Value/Sum Insured – For new vehicles, the insured value refers to the purchase price. For other vehicles that do not fall under this category, the insured value is equivalent to the market value of the vehicle when a policy is bought.

Betterment – When your damaged vehicle is sent for repair, it is normal that some wrecked parts are replaced with new franchise parts. Your insurer will only bear a portion of the costs. You will have to pay the difference according to the standard scale of betterment which can range from 0% to 40%.

Roadside Assistance – A service provided by insurers to policyholders who may be suffering from a vehicle breakdown/accident

No Claim Bonus/Discount – Available in the form of a refund in premiums, either in full or partial. It can also be a discount on your premiums if you decide to renew your car insurance policy as a loyalty benefit

Disclosure – Letting the insurers know of information that may be vital in influencing the premium of the car insurance.

Actual Value Cost – Amount required to repair or replace your vehicle plus depreciation.

Replacement Cost – Actual amount required to repair or replace your vehicle minus depreciation.

Theft - The unlawful taking of property of another: the term includes such crimes as burglary, larceny, and robbery.

Under-Insurance - A condition in which not enough insurance is purchased to cover the total cash or market value of the insured asset.

NCD (No-Claim-Discount) - The premium payable may be reduced if you have no-claim-discount (NCD) entitlement. NCD is a ‘reward’ scheme for you if no claim was made on your insurance policy on an annual basis. Different NCD rates are applicable for different classes of vehicles. For a private car, the scale of NCD ranges from 25% to 55% as provided in the policy.