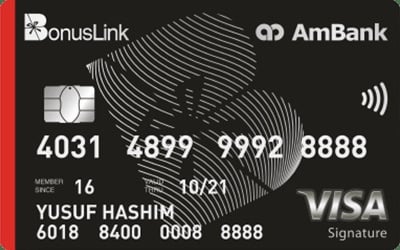

Gateway to more rewards

It pays to be loyal to the AmBank BonusLink Visa Signature because you are getting a card that gives you the power and benefits for spending. You will receive 2 sets of BonusLink Points (BLP): one from AmBank and another from BonusLink Partners.

For every RM1 spent on retail purchases locally and overseas, you will earn BonusLink Points.

- Shell Petrol and Parkson: Get 5x BLP for every RM1

- Local dining, grocery, shopping (including Parkson) and overseas spending: Earn unlimited 2x BLP for every RM1 spent

- Other spending (including Shell): 1x BLP for every RM5 spent, with no limit on how many points you can earn

If that's not enough BonusLink Points for you, this AmBank BonusLink Visa Signature Credit Card is giving 45,000 extra BonusLink Points as a welcome gift for new AmBank BonusLink Visa Signature cardholders!

The BonusLink Points you have collected will have a 3-year expiration from the date of your card approval, so don't wait for too long to redeem for gift vouchers or Shell and Parkson products, among others.

Or, you can redeem the BonusLink Points for cash at a conversion rate of 5,700 BonusLink Points to RM50 cash credit. The redemption can be made in multiples of RM50.

Complimentary Shell Gold Tier Membership

When you sign up for this card, you are automatically upgraded to the Shell Power Up programme for one year

You will earn 2x BonusLink Points for every litre of Shell FuelSave 95, Shell V-Power 97, or Shell FuelSave Diesel

Exclusive travel privileges

Looking for comfort and privacy at a busy airport for three hours?

Enter the world of exclusivity with AmBank BonusLink Visa Signature, as it promises you 6x access to participating Plaza Premium Lounges in over 50 countries locally and internationally every year, in addition to more discounts for walking in.

However, there is a catch! To enjoy the access privilege, you must spend a minimum of RM1,000 within a calendar month before each lounge visit.

Find out more details about the airport lounge benefit in the terms and conditions.

Dining and room privileges at Marriott Hotels

On top of the travel privileges, cardholders who spend a minimum amount of RM30,000 in a year are eligible for Club Marriott Malaysia Annual Membership to enjoy up to 50% off dining, buffet and complimentary birthday cake at Marriott Hotels.

Need a stay to clear your mind and unwind? Worry not, you will get 20% off for the Best Available Rate on all room categories.

Check out the full details of this privilege.

Flexible and affordable easy payment plans

You have two choices for easy payment plans: (1) 0% Easy Payment Plan, which gives you options of repayment up to 36 months at a 0% rate or (2) AmFlexi-Pay, which extends the repayment horizon up to 24 months at a low management fee.

Either way, a minimum of RM500 spent on a single receipt is required for both plans.

Free of charge

For the first two years with the AmBank BonusLink Visa Signature, the annual fees for principal and supplementary cards will be waived.

You still can continue to enjoy the annual fee waiver every year when you swipe your AmBank BonusLink credit card 12 times in a year from the third year onward.

Travel benefits

Travel benefits