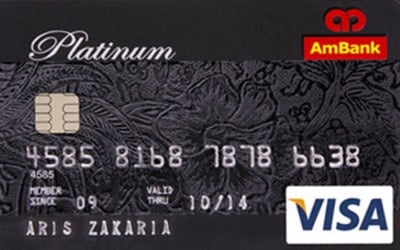

Who could ever imagine a piece of plastic can bring you all the shopping convenience you dreamed of? AmBank Visa Platinum Card gives you more than just convenience, it also makes your shopping experience a whole lot more satisfying and rewarding!

Easy points, easy redemption

While spending with your credit card overseas saves you from the trouble and danger of carrying a bulk of cash, you'll also get to earn 2 AmBonus Points for every RM1 spent outside of Malaysia. Conversely, every RM1 charged to your card locally gives you 1 AmBonus Point.

Exchange your accumulated points for smart home appliances ranging from air sterilisers to air fryers, trending luggage bags or even perfume that you could use as a gift.

There's more you can do with your AmBonus Points, look out for AmBonus Points Xchange signage when you're out shopping as they're the AmBank participating merchants that allow you to redeem their products with your points.

Every 200 points are equivalent to RM1 and to redeem an item, you must have at least a balance of 1500 points in your account.

A protected journey while travelling

Accidents could happen to anyone, anywhere and anytime. More so when you're at a place that you are not familiar with.

Get financially protected with comprehensive travel insurance when you charge your flight tickets to your AmBank Visa Platinum in full. Should you suffer from accidental permanent disability or worst of all – death *touch wood*, you or your beneficiary will be compensated up to RM500,000.

Find out more details about this privilege in the Automatic Travel Insurance Policy.

Free-For-Life credit card

This AmBank credit card comes with a completely free annual fee, with no conditions attached to the fee waiver.

You can enjoy this benefit as long as you're 21 years old and above besides have a minimum annual income of RM24,000.

Additionally, you can extend this privilege to your loved ones aged 18 and above by providing them with supplementary cards.

The first three supplementary cards are free for life, but from the fourth supplementary card onward, an annual fee of RM188 will apply.

Bonus reward points and air miles

Bonus reward points and air miles