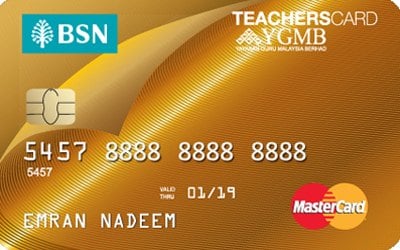

BSN 1 TeachersCard MasterCard, rewards for teachers

Get rewarded for your service to Malaysian education with BSN 1 TeachersCard MasterCard!

You’ll earn reward points whenever you make purchases using this BSN credit card.

What should you do with these Rewards Points?

Collect and redeem exciting gifts from the BSN Happy Rewards Programme – vouchers, gadgets, home appliances, kitchenware and more!

You’ll earn 1x Happy Points for every Ringgit that you spend on local retail purchases, while overseas purchases will give you double the Happy Points!

Just remember to check the exchange rates for overseas transactions before you swipe.

Great Savings with a BSN Credit Card

BSN 1 TeachersCard MasterCard also gives you more ways to save.

You won’t have to pay any annual credit card fees because these charges are waived for life!

The same applies to supplementary cards if you’re looking to get one for a family member.

If you’ve raked up some debt on other credit cards that you own, you can get some relief through Bank Simpanan Nasional’s balance transfer programme.

Pay 0% interest for your monthly repayments for a 6-month tenure!

Zero Interest Instalment-Pay Plan

Planning to make a purchase you can’t afford? Monthly instalment plans are seldom worth your while.

BSN Instalment-Pay on the other hand offers a 0% management fee with a one-time upfront fee on purchases of at least RM500 from selected BSN merchants.

Pay back what you owe in monthly instalments over 6, 12 or 24 months!

Low-Interest Fees

Just in case you have the habit of overspending on your credit card each month, BSN gives you the lowest credit card interest rate of 8.88%.

Pay your credit card bills on time to enjoy this special rate – for teachers only!

What are the eligibility criteria and the required documents to make an online application?

Any Malaysians aged a minimum of 21 years with the below job titles are eligible to apply. You also must be earning at least RM24,000 annually to make an application.

For a smoother application journey, please prepare the following documents.

Teachers, Staff of MOE & Lecturers from Public Institutions of Higher Learning:

- A copy of your IC (both sides)

- Latest 1 month's salary slip

Lecturers from Private Institutions of Higher Learning:

- A copy of your IC (both sides)

- Latest 2-month salary slip OR

- Latest EPF statement OR

- Form EA/Form B with an official tax payment receipt

Tailored for educators

Tailored for educators