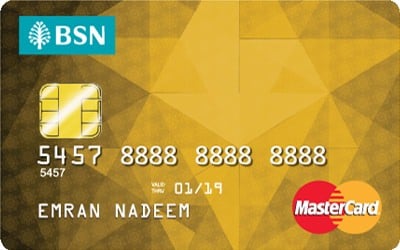

BSN Gold MasterCard — Zero Annual Fee

Unlike other gold credit cards which may waive your annual fee charges – with conditions such as a minimum number of swipes or minimum spending – the annual fee for your BSN Gold MasterCard is completely free!

This means you won’t have to justify your usage of your credit card, not when you don’t have to pay additional costs for owning one.

And no annual fee means no 6% GST charges every year either!

Rewards When You Spend

Owning a gold credit card with Bank Simpanan Nasional means that you are automatically enrolled in the BSN Reward Point programme.

For all your retail purchases both locally and overseas, you’ll earn points which you can later redeem for exciting gifts!

Spending overseas will double your Happy Points for every RM1 spent.

For local retail shopping, you will earn 1x Happy Point for every Ringgit instead.

Low-Interest Rates

Let’s talk savings. With your BSN Gold MasterCard, you’ll get special low-interest rates of 13.5% on your outstanding credit balances.

If you’re a government servant, you get an even lower rate of 11% interest p.a. To qualify, you’ll have to settle your minimum payments promptly.

If you’re looking to consolidate your outstanding credit debt with other banks, you can get a balance transfer with Bank Simpanan Nasional and pay low interest rates of 0%, instead of the regular tiered credit card rates.

Bank Simpanan Nasional offers tenures of 6 months to 4 years on balance transfers.

BSN Gold MasterCard Application Requirements

To get your very own BSN Gold MasterCard, you need to earn a minimum of RM36,000 a year.

This card is only available to Malaysians who are at least 21 years of age.

What are the documents needed to apply for the BSN Gold MasterCard?

Please prepare the following documents for a seamless online application journey.

Government Servant:

- A copy of your IC (both sides);

- Latest 1-month payslip; OR

- Employee Confirmation Letter (For Army and Police personnel, please attach a copy of the Authority Card)

Private Sector Employee:

- A copy of your IC (both sides); AND

- Latest 3 months payslip/latest EPF Statement/EA Form/BE Form

Self-Employed:

- A copy of your IC (both sides);

- Latest 6 months company's bank statement;

- Latest B Form with an official tax receipt for the latest two years;

- Copy of Form 9, 24, & 49; OR

- Copy of Business Registration Certificate

Commission Earner:

- A copy of your IC (both sides);

- Latest 6 months commission statement/Annual commission statement; OR

- EA Form/BE Form with an official tax receipt

Exclusive Rewards & Benefits

Exclusive Rewards & Benefits