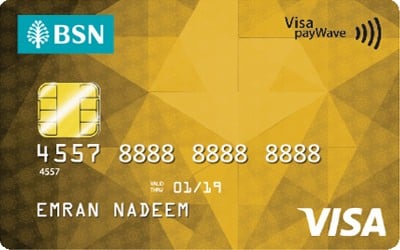

BSN Gold Visa — Rewards Galore!

Earn Happy Reward Points whenever you charge your expenses to your BSN Gold Visa.

For every Ringgit that you spend on local purchases, you’ll be rewarded with 1 point. Spend overseas, and you’ll get 2 points for every RM1. That’s double the rewards!

You can collect these points and redeem them for a wide array of exciting prizes listed on the myBSN Happy Rewards Points catalogue.

Low-Interest Balance Transfer

It doesn’t matter if you’re looking to manage your credit balance with another bank or consolidate your debts for better credit management.

Bank Simpanan Nasional offers 0% interest rates for a balance transfer tenure of 6 months.

For tenures between 12 to 24 months, you’ll get interest rates of 4.5% instead.

BSN Gold Instalment-Pay Plan

Maybe you got a little excited over a purchase that you can’t afford immediately, but you don’t want to pay the regular credit card interest rates if you swipe for it.

You can still get it with Instalment-Pay, a flexipay service offered by BSN.

With Instalment-Pay, you’ll be able to pay for your purchase in monthly instalments of either 6, 12 or 24 months.

If you choose the shortest tenure of 6 months, you’ll only be charged 3% interest on your purchase; interest rates of 4% and 5% apply for the 12 and 24-month tenures respectively.

Free Travel Insurance for BSN Gold Visa Cardholders

We mentioned free travel insurance! All you have to do is pay for your travel fare in full with your Gold Visa card, and you’ll be entitled to complimentary coverage of up to RM100,000.

You’ll also be reimbursed for lost and delayed luggage, as well as delayed and missed flight connections.

| BSN Travel Inconveniences Insurance | Coverage (up to) |

| Lost Luggage (more than 48 hours) | RM1,600 |

| Delayed Luggage (more than 6 hours) | RM1,600 |

| Flight Delay (more than 6 hours) | RM600 |

| Missed Connection (more than 4 hours) | RM600 |

BSN Gold Visa — ZERO Annual Fee

We planned all along to save the best for last. Your BSN Gold Visa also comes with ZERO annual fees.

That also means skipping the 6% GST attached to credit card annual fees - woohoo!

Am I eligible to apply? What are the required documents to make an application online?

Any Malaysians aged a minimum of 21 years and earning an annual income of RM36,000 and above are eligible to apply online for this credit card by BSN.

Additionally, please prepare the documents below for a smoother application journey.

Government Servant:

- A copy of your IC (both sides);

- Latest 1-month payslip; OR

- Employee Confirmation Letter (For Army and Police personnel, please attach a copy of the Authority Card)

Private Sector Employee:

- A copy of your IC (both sides); AND

- Latest 3 months payslip/latest EPF Statement/EA Form/BE Form

Self-Employed:

- A copy of your IC (both sides);

- Latest 6 months company's bank statement;

- Latest B Form with official tax receipt for the latest two years;

- Copy of Form 9, 24, & 49; OR

- Copy of Business Registration Certificate

Commission Earner:

- A copy of your IC (both sides);

- Latest 6 months commission statement/Annual commission statement; OR

- EA Form/BE Form with an official tax receipt

Low Finance Charge

Low Finance Charge