Lower interest rates on finance charges

Yes, you read that right. Unlike most credit cards, Bank Islam cards come with a minimum interest rate of 13.50% per annum rather than 15.00%.

The highest annual interest rate is 17.50% p.a. On top of that, there is no joining fee for this Islamic credit card.

Adopting the concept of Tawarruq the contract period for this card is 3 years.

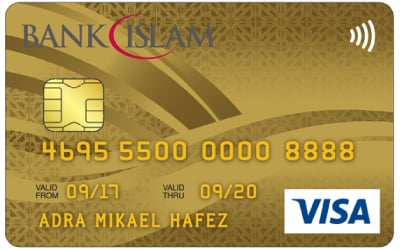

Bank Islam Visa Gold Credit Card-i - Worldwide Recognition

Not only that the Bank Islam Visa Gold Credit Card-i is recognised worldwide but it also lets you perform emergency cash withdrawals while you're travelling overseas.

The card is also embedded with the latest SMART Chip Technology which would now mean that your payment is made swiftly and contactless.

Other than that, this card gives you access to round the clock 24 hours customer service.

Benefit from the Gold card features

Well since this is a Shariah-compliant credit card, it can only be used for transactions at Halal merchants.

So, before you go shopping please make sure to double-check if the merchant meets the card requirements.

Also, when applying for this card be sure to set a profit margin that works best for you.

The reason is that the profit margin will be permanent for the 3-year contract period.

Flexi payment benefit

Now then, like most people there comes an occasion when we want to make purchases over our savings budget.

Whether it’s getting a new refrigerator, TV set, computer or just putting some new wheels on your car.

These expenses are sometimes inevitable, so why not use a really good instalment plan to pay for it?

The Bank Islam Installment Payment Plan allows you to convert any purchase amount of RM150 or more into smaller instalments with 0% interest, with tenures of up to 36 months.

Of course, this plan applies to only a selected number of merchants.

However, there is also Bank Islam GoFlexi Program that allows you to convert any purchase with minimum amount of RM1,000 into smaller instalments with 0% interest and one-time handling fees of 4.5% of the transaction amount, with tenures of up to 12 months.

Better benefits with Bank Islam Visa Gold Credit Card-i

There is much that Bank Islam Gold Visa Card-i has to offer.

Apart from the interest savings, you have the chance to save on annual fees too.

Simply swipe your card 12 times a year and voila! No annual fees for that year!

Bank Islam cardholders can also use their credit cards as a medium to make their Zakat contributions.

Up to 3% cashback

Up to 3% cashback