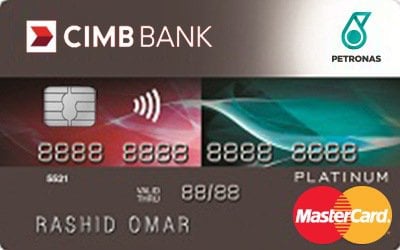

CIMB Petronas Platinum MasterCard - 5% Cash Rebates

More rewards, higher rebates and happier returns with every swipe of the CIMB PETRONAS Platinum Credit Card at any petrol station nationwide. If you spend more time on the road than in the office, you'll definitely consider signing up for this PETRONAS MasterCard.

You'd be surprised to learn that you can get 5% cash rebates on your petrol transactions, including grocery, cinema, mobile and utility bill payments via standing instruction, subject to a statement balance of RM1,500 and above.

Important note: Per a recent announcement by CIMB, the CIMB Petronas Platinum MasterCard will be discontinued effective 30 June 2025 onwards. Click here to read more details on the next steps for existing cardholders.

Annual Fee Waiver

Owning a Platinum credit card usually requires a higher income level and comes with a steep annual fee, which can be offset with a few swipes per year.

CIMB understands what you're going through every day for 365 days, thus waiving the annual fee for its PETRONAS MasterCard.

There is absolutely no condition requiring you to swipe the petrol cash rebate credit card in order to waive your annual fee.

CIMB Retail and Dining Privileges

Waiting for a year-end sale can take your youth away. But signing up for the CIMB Petronas Platinum Credit Card allows you to enjoy all year-round promotions, offers, deals, discounts and gifts at selected CIMB retail and dining establishments.

There are a host of partners providing a myriad of products and services ranging from health and beauty, department stores, golf clubs, travel and education under Retail Privileges.

For Dining Privileges, you can explore Halal epicurean cuisine, desserts and fine dining experiences at selected renowned hotels regionally such as Hard Rock Hotels, Hilton Hotels and Eastin Hotels, among others.

CIMB Petronas Platinum MasterCard Line of Credits

CIMB Petronas Platinum Credit Card does not only ensure that you'll receive extra mileage and greater fuel savings but can also serve as your credit lifeline in times of need via three unique lines of credit such as:

- CIMB Balance Transfer Plan

- CIMB 0% Easy Pay

- CIMB CashLite

5% cashback for petrol

5% cashback for petrol