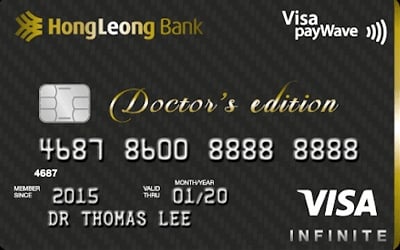

Hong Leong Visa Infinite Doctor's Edition, every doctor's and dentist's best friend

Your best friend would want only the best things to happen to you, and so would Hong Leong Visa Infinite Doctor's Edition.

This Hong Leong credit card is specially designed to reward registered medical doctors and dentists, so they can enjoy their lives as they have saved many people's lives.

From superb Enrich Point conversion, free travel insurance, and zero annual fees to Premium Concierge Services - it's time for doctors to enjoy the best life can offer!

Automatic MAS Enrich Point conversion

If you happen to be an avid traveller or wish to save money on flight tickets, the Hong Leong Infinite Doctor's Edition credit card can help you.

Your retail spending will be converted into Malaysian Airlines Enrich Points at attractive rates automatically.

Talking about saving time and cutting costs!

| Spending Category | Enrich Points |

| Local and Overseas Dining Spend | RM1 = 1x Enrich Point |

| Local and Overseas Travel and Retail Spend | RM4 = 1x Enrich Point |

| Other Local and Overseas Spend | RM6 = 1x Enrich Point |

Travel benefits

With this Hong Leong credit card, doctors can enjoy travel benefits such as:

- 4x complimentary access to participating Plaza Premium Lounges in Malaysia and Singapore airports. Terms and conditions apply.

- Automatic travel insurance coverage up to RM2 million for personal accidents and travel inconveniences. Find more details.

- 24-hour card-related assistance

Who can apply for the Hong Leong Visa Infinite Doctor's Edition?

Anyone within the age range of 21 to 70 years old, and either registered as a medical doctor with the Malaysian Medical Council (MMC) or as a dentist with the Malaysian Dental Council (MDC), with a minimum annual income of RM48,000 (RM4,000/per month), is eligible to apply.

The minimum age for the supplementary cardholders is 18 years old.

Enrich Points Conversion

Enrich Points Conversion