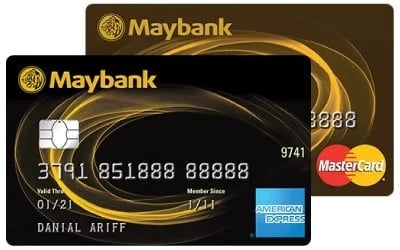

Maybank 2 Gold Cards: No-Fee Credit Card for Maximum Rewards

Looking for a credit card that offers cashback, rewards, and zero annual fees? The Maybank 2 Gold Cards are an excellent option. This unique dual-card setup includes both the Maybank 2 Gold Mastercard and the Maybank 2 Gold American Express, allowing you to earn more with every purchase and maximize savings.

Whether you're a frequent shopper, foodie, or traveler, these cards offer unbeatable benefits.

Why the Maybank 2 Gold Cards Stand Out

If you want to earn high rewards without high costs, here’s why the Maybank 2 Gold Cards stand out:

- 5% Weekend Cashback on dining, shopping, and entertainment when you use the Maybank 2 Gold American Express on weekends, capped at RM50 per month.

- 5x TreatsPoints on weekday transactions using the American Express card, allowing you to accumulate rewards faster.

- 1x TreatsPoints on Mastercard transactions, making every ringgit spent valuable. No TreatsPoints for Mycdd, Government Bodies, JomPay, FPX, and E-Wallet reloads.

- Flexible Reward Redemptions – Convert TreatsPoints into cashback, shopping vouchers, gifts, or air miles with airlines.

- Pro Tip: Use the American Express for weekend dining and shopping to maximize cashback, while the Mastercard is ideal for international transactions and at non-AMEX merchants.

No Annual Fees & Flexible Payment Options

One of the best features of the Maybank 2 Gold Cards is that they come with no annual fees for life. Here are the additional benefits:

- No Annual Fees for Life – Never worry about annual card renewal fees. You only need to pay the RM25 government service tax annually.

- Maybank EzyPay & EzyPay Plus – Convert large purchases into 0% interest installment plans for up to 36 months.

- Balance Transfer Plans – Transfer existing credit card balances and enjoy lower interest rates.

- Cash Treats Feature – If you need quick cash, you can easily access funds with Maybank’s cash advance option.

Maybank 2 Gold Cards Finance Charge

Maybank offers competitive interest rates based on your repayment record:

| Conditions of Repayments | Tiered Interest Rate (Per Annum) |

| Prompt Repayment every month | 15% |

| Prompt Repayment 10 out of 12 months | 17% |

| Prompt Repayment of less than 10 out of 12 months AND New Cardmembers | 18% |

Enjoy a 20-day interest-free period if you pay off your balance in full each month. A late payment fee of 1% of the outstanding balance (minimum RM10, maximum RM100) applies if you miss the payment deadline.

Am I eligible to apply, and what are the required documents?

If you're a Malaysian who owns a Maybank account and is earning a minimum annual income of RM30,000, you are eligible to apply for this credit card. If you're an expatriate, you need to have a minimum annual income of RM60,000 and own a Maybank account to be eligible.

To apply as the principal cardholder, please prepare the following documents accordingly.

For salaried employees:

- Copy of IC (both sides) or Passport

- Latest 3 months' salary slips

- Latest 6 months savings account activity/current account statement

For self-employed:

- Copy of your IC (both sides) or Passport

- Copies of Business Registration Certificates/Trading License/Form 9, Form 24, Form 49

- Form B/Latest EA form

- Latest 6 months personal/company bank statement

For expatriates:

- Letter from employer confirming duration of employment contract in Malaysia

To apply for a supplementary card, please prepare a copy of the cardholder's IC (both sides) or Passport.

5% Weekend Cashback!

5% Weekend Cashback!