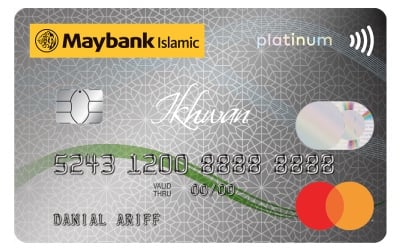

Don’t pay any credit card fees or GST, and give to charity instead with a platinum MasterCard from Maybank Islamic.

And true to the principles of giving, you’ll also get a chance to win a free Umrah package trip every week with the MasterCard Ikhwan Platinum Card.

Umrah trip or holiday package from Maybank

Stand a chance to win an Umrah package for the pilgrimage of your life or a holiday package (for non-muslims) with the Maybank Islamic MasterCard Ikhwan Platinum.

Each week, one winner will get a 2 pax package to Mecca, while non-Muslims will get a 2 pax holiday package instead. All you have to do is spend RM200 or above in a single receipt which will count as a single entry.

Every 3 months, Maybank Islamic will draw a weekly winner from these entries. Do contact Maybank if you wish to find out more details about this giveaway.

5% cash rebates to collect

Save more on the daily essentials when you spend on Friday and Saturday with your Maybank Islamic credit card.

You’ll be rewarded with 5% cash back on groceries and petrol at outlets across Malaysia, capped at RM50 each month.

Max out the rewards of this cashback offer when you spend RM1,000 each month. A total of up to RM600 in savings is yours each year.

Remember that you cannot carry over the spending from a single month for cashback in the next.

Collect TreatsPoints with Maybank Islamic MasterCard Ikhwan Platinum Card-i

Other than cashback, swipe your Maybank Islamic MasterCard Ikhwan Platinum credit card to earn reward points anywhere and everywhere you go, including overseas.

Each RM1 charged to your Mastercard will earn you 1X TreatsPoint, which you can use to collect cool prizes and redeem air miles (20,000 TreatsPoints = 1,000 Enrich/KrisFlyer/Asia Miles) from Maybank!

Other eligible local transactions to earn TreatsPoints include utilities, education, insurance, and EzyPay/-i, excluding government-related transactions and e-wallet reloads.

Charity Donations

Give towards a good cause each time you use your MasterCard Ikhwan credit card. Maybank will donate 0.1% of all your spending to Islamic Relief Malaysia and MERCY Malaysia.

That’s a little bit of charity on your part every day because every little amount counts.

Maybank Islamic MasterCard Ikhwan Platinum Card-i Finance Charge

What is the interest rate imposed on repayments?

| Conditions of Repayments | Tiered Interest Rate (per annum) |

| Prompt Repayment every month | 15% |

| Prompt Repayment 10 out of 12 months | 17% |

| Prompt Repayment of less than 10 out of 12 months AND New Cardmembers | 18% |

Previously, the finance charge was only imposed on the below that were not paid after the payment due date:

- Retail transaction - finance charge is calculated from the posting date till full payment is made

- cash advances/withdrawal transaction - finance charge is calculated from the transaction date

The finance charge is now based on the prevailing tiered interest rate (above) that will be imposed on any of your outstanding balances including all fees and charges (except late payment charges).

These are carried forward from the previous statement until the outstanding balances are fully settled.

All fees and charges include:

- Annual Fee

- Cash Advance Fee

- Card Replacement Fee

- Statement Copy Fee

- Sales Draft Retrieval Copy Fee

- Any other form of service of the miscellaneous fee (if any) EXCEPT Late Payment Charges

A late payment charge of 1% will be imposed if the minimum payment is not made by the payment due date. This is subject to a minimum of RM10, whichever is higher up to a maximum of RM100.

The changes made on this finance charge will not have any impact if you do not have any unpaid outstanding balance.

You will continue to enjoy a 20-day interest-free period, provided that the outstanding balances of your Maybank Islamic MasterCard Ikhwan Platinum are carried forward from the previous month's statement cycle and are paid in full.

What are the required documents to make an application?

To apply as a principal cardholder, please prepare the following documents accordingly.

For salaried employees:

- Copy of IC (both sides) or Passport

- Latest BE form with an official tax receipt

- Latest 3 months salary slips

- Latest 6 months savings account activity/current account statement

For self-employed:

- Copy of IC (both sides) or Passport

- Copies of the Business Registration Certificates

- Latest 6 months bank statement

For expatriates:

- Letter from employer confirming duration of employment contract in Malaysia

No Annual Fee

No Annual Fee