What is the product about?

RHB Smart Account is a current account that rewards accountholders with attractive bonus rates based on the banking transactions you perform. To begin, you only need to deposit a minimum of RM1,000 into this checking account to enjoy up to 6.60% p.a. return on your savings!

What benefits can I get from RHB Smart Account?

First, you get to experience RHB’s seamless banking services such as internet and mobile banking via RHBNow where you can perform online fund transfers, manage bill payments and what-have-you.

Besides, a debit card will be issued to you upon opening of RHB Smart Account. If you have already own one, just link it to the checking account. You can also request for a cheque book if you like to go old-school.

Interestingly, the more you save and transact with this current account, you will receive Bonus Interest Rates!

Tell me how to earn Bonus Interest Rate.

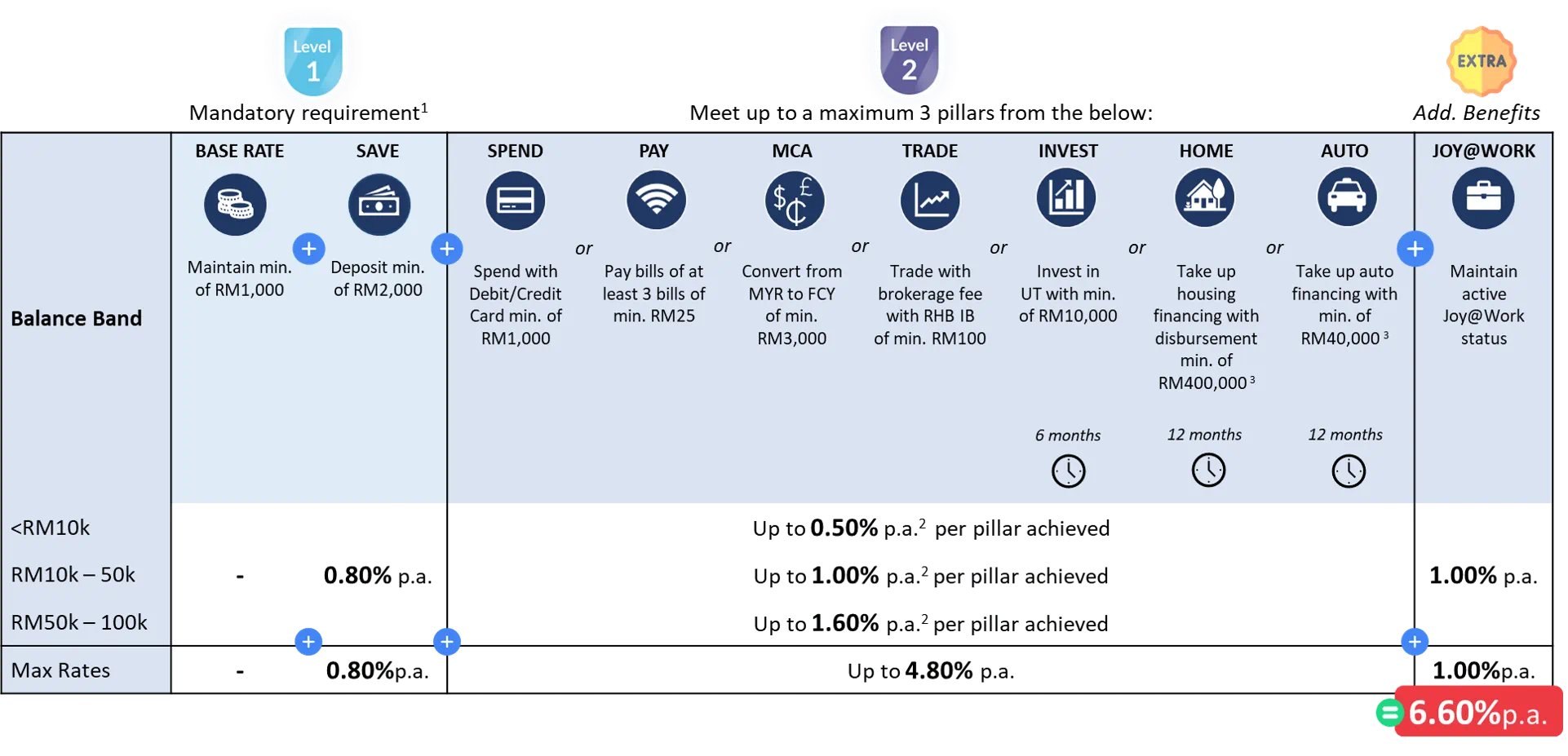

There are ways you can go about to earn 6.60% p.a. with RHB Smart Account:

Is overdraft facility available for this current account?

Sadly, overdraft facility does not come with this product.

Is it safe to place money in this current account?

Absolutely, 100% no doubt about it. Your hard-earned savings placed in this current account is protected under Perbadanan Insurans Deposit Malaysia up to RM250,000.