What makes the Public Bank RCB Gold Debit Card special?

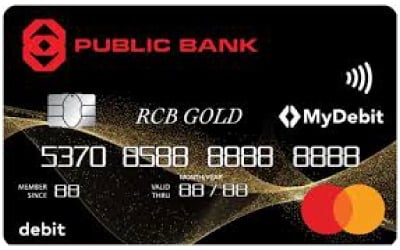

The Public Bank RCB Gold Debit Card is a premium financial tool for RCB Gold members. It serves a dual purpose: it acts as your everyday transaction card for global access and rewards, while simultaneously functioning as your membership card for priority banking services.

What special perks do I get to enjoy?

- Accelerated Rewards: Earn 3x VIP Points on overseas transactions (RM5 = 3 Points) and standard points on local spends (RM5 = 1 Point).

- Priority Banking: Flash this card at RCB Centres to access dedicated counters and personalised assistance.

- Cost Savings: No annual fee is charged for this card, ever.

- Shopping Security: Includes complimentary e-Commerce Purchase Protection covering up to USD200/annum for online shopping mishaps.

- Interest-bearing: Your money works for you in your savings account until you tap to pay.

Any other features that I should know?

- Wave and Pay: Utilises Mastercard Contactless for fast, PIN-less checkout on smaller amounts.

- Online Ready: Fully enabled for internet transactions, bill payments, and e-wallet top-ups.

- Fraud Management: Set your own transaction limits and SMS alerts via PBe for total peace of mind.

What are the fees or charges for this card?

- Annual Fee: Waived (Free for Life).

- Replacement Fee: RM12.00 (incurred only if the physical card is lost/stolen).

- Currency Conversion: 1.25% fee plus the daily wholesale exchange rate for non-MYR transactions.

- Non-Public Bank ATM Fee: RM10.00 per transaction locally or abroad.

Are there any transaction limits?

- Purchase Limit: Default limits apply, but can be increased to suit your lifestyle needs via online banking.

- Contactless Cap: Transactions above RM250 require a PIN; the cumulative daily limit is set at RM500 by default.

- Cash Withdrawal: Subject to your specific account type's daily withdrawal limit.

Am I eligible to apply?

This premier debit card is open to individuals with a valid and active Current or Savings Account, with a total deposit ranging from RM300,000 to under RM1 million with Public Bank.

If you are interested in applying, please prepare the following documents to make an application.

- A valid MyKad or Passport.

- Documentation showing your total deposits meet the RM300k minimum threshold.

- A debit card application form (usually handled during the RCB sign-up process).