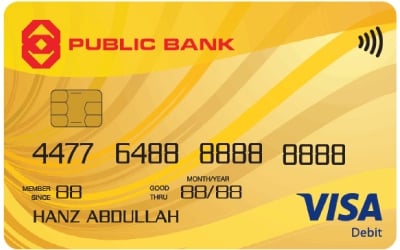

What Is A Public Bank Visa Debit Card?

The PB Visa Debit Card is an essential, secure two-in-one card that combines ATM functionality with Visa's worldwide acceptance. It links directly to your Public Bank Savings or Current Account. It’s designed for everyday use, letting you access cash and make purchases globally with ease and security.

What Are the Benefits?

- Global Purchasing Power: Use it at merchant outlets worldwide wherever the Visa logo is displayed.

- Earn Money While You Spend: Earn monthly interest on your credit balance, adding passive value to your funds.

- Auto Funds Assurance (Automatic Sweep): This optional service ensures funds are automatically transferred from your main account to the card account when needed, eliminating shopping inconvenience due to low balance.

- Safety First: You can opt for a separate Card Account, limiting your financial exposure should your card be compromised.

- Free ATM Access: Enjoy waived withdrawal fees when accessing cash at local Public Bank ATMs.

Who Can Apply For This Debit Card?

- Principal Cardmembers must be at least 12 years of age.

- Supplementary Cardmembers must be at least 12 years of age.

- For applicants aged 12 to 18 years old, the form must be completed and signed by a parent/guardian.

What Are the Required Documents to Apply for This Debit Card?

- A valid Personal Deposit Account (Savings Account or Current Account) with Public Bank.

- Completed application form (including parent/guardian signature for minors).

- Identification Document (e.g., NRIC or Passport) is typically required.

What Are the Fees That I Need to Pay?

- Annual Fee: RM8.00 per annum.

- Card Replacement Penalty (Lost/Stolen/Damaged): RM12.00.

- Cash Withdrawal at PB ATM/Over-the-Counter: Waived.

- Cash Withdrawal at Non-PB ATM (Local or Overseas): RM10.00 for each successful transaction.

- Overseas Conversion Fee: Visa exchange rate + 1.25% foreign exchange spread charged by the Bank.

- Cash-Out Fee (via POS): RM1.50 for each successful transaction (when a purchase is made).