Everything You Need to Know about Medical Card Insurance

Private hospital treatment in Malaysia comes with substantial costs. A standard appendectomy runs RM8,000-RM12,500 at Klang Valley hospitals. Caesarean sections cost RM8,000-RM15,000. Dengue fever treatment? RM5,000-RM10,000. A three-day stay for a minor procedure can easily hit RM10,000-RM15,000 when you factor in room charges, consultation fees, diagnostic tests, and medication. Without medical insurance, these bills come directly from your savings.

Government hospitals charge far less, often just RM1 to RM5 for registration, with subsidised treatment costs. But waiting times regularly exceed four hours for non-emergency cases, and specialist appointments can take weeks or months. Many Malaysians turn to private hospitals for faster care and shorter queues, but most private facilities require proof of insurance coverage before admission for planned procedures.

That's where medical card insurance becomes essential. A good medical card covers your hospital bills directly through cashless admission, eliminating the need to pay thousands upfront. You get admitted, receive treatment, and walk out without settling the bill yourself - the insurer handles it with the hospital.

How Medical Cards Protect Your Savings

Medical card insurance shifts the financial risk of hospitalisation from you to the insurer. When you need treatment, your medical card covers the direct costs (ward charges, surgeon fees, medication, diagnostic tests) up to your policy limits.

Consider what a single hospitalisation costs in Klang Valley: A three-day stay in a standard single room at Gleneagles Kuala Lumpur runs RM263 per night for the room alone (current official rate), plus consultation fees (RM200 to RM500), diagnostic tests (RM500 to RM2,000), and medication (RM300 to RM1,000). Without insurance, you're looking at RM5,000 to RM10,000 out of pocket for a relatively minor admission.

Your medical card also matters because private hospitals typically require insurance confirmation before admitting you for planned procedures. Emergency cases get admitted regardless, but you'll need to settle the bill yourself if you lack coverage, which can mean paying RM20,000 to RM50,000 before discharge for major procedures.

This guide explains how medical cards work in Malaysia, what the key terms mean, how to make claims successfully, and how to choose coverage that actually protects your finances without overpaying on premiums.

What Medical Cards Actually Cover

Medical cards pay for hospitalisation costs directly to the hospital, so you don't need to come up with RM10,000-RM50,000 upfront when you need treatment. Malaysian medical cards typically provide comprehensive hospitalisation and surgical coverage, including:

Room and board - Daily room charges at your policy's limit (RM150 to RM500 per night, depending on room type and hospital)

ICU and critical care - Intensive care unit charges, which can cost thousands per day

Surgeon and anaesthetist fees - Professional fees for surgical procedures and anaesthesia

Operating theatre charges - Use of surgical facilities and medical equipment

Pre-hospitalisation expenses - Medical consultations and diagnostic tests (X-rays, blood tests) within a specified period before admission

Post-hospitalisation expenses - Follow-up consultations and medication for a specified period after discharge

Daycare and outpatient procedures - Procedures that don't require overnight stays, such as cataract surgery, dialysis, or chemotherapy

Most Malaysian medical cards work on a cashless admission basis with panel hospitals. The insurer settles the bill directly with the hospital through a guarantee letter, and you walk out without paying anything upfront, as long as your treatment falls within your policy coverage and limits.

For non-panel hospitals, you'll pay first and claim reimbursement later by submitting your medical reports and bills to the insurer within 30 days after discharge.

Without a medical card, you're paying everything out of pocket. A caesarean section now costs RM12,000 to RM20,000 at private hospitals. Appendix surgery costs RM15,000. Cancer treatment can cost RM75,000 to RM400,000. That money comes from your savings, EPF withdrawals, or emergency loans if you lack coverage.

Medical Card Insurance Terms

A medical card usually comes with some stipulations that intend to protect the interests of both parties: the insurer and the insured.

Annual Limit

This is the claimable amount that a policyholder is entitled to in a year and it will be refreshed every policy year upon your policy anniversary date.

For instance, if your medical card has an annual limit of RM100,000, you can only claim up to this amount in that policy year. Any amount above the annual limit will not be covered by your medical card.

The annual limit has a range from as low as RM10,000 to as high as RM2 million in a year. There are also medical cards without annual limit, giving you the flexibility to claim any amount up to the lifetime limit.

Depending on your financial capacity at the time of buying an insurance plan, a 'right' annual limit amount should fully cover for the cost of treatment for a health condition that may arise.

This can save you from digging deep into your pocket to pay for the difference between your annual limit and the actual cost of treatment.

Lifetime Limit

|

Table 1: Medical Card Lifetime Limit Comparison |

||

|

Feature |

Medical Card A with AL |

Medical Card B without AL |

|

Max Cover Age |

80 years old |

80 years old |

|

Annual Limit (AL) |

RM100,000 |

Unlimited |

|

Lifetime Limit (LL) |

RM1,000,000 |

RM1,000,000 |

|

Claim Frequency (projected) |

1 full claim every year up to 10 years |

Could be more or less than 10 years, depending on the claim amount per year |

A lifetime limit is the maximum amount you are entitled to claim from your medical card over the tenure of your contract with the insurance plan.

Let us take a look Table 1: Medical Card Annual Limit Comparison for an example. Both medical cards have a lifetime limit of RM1 million, with the difference of Medical Card A comes with an Annual Limit, whereas Medical Card B does not.

If you own Medical Card A, you will benefit from having a 10 years’ worth of coverage with a lifetime limit of RM1 million (if you make a yearly claim of RM100,000).

If you own Medical Card B, you have the flexibility to claim any amount in a year. Your lifetime limit will be deducted accordingly and gradually decreasing over years.

There is no right or wrong way to place an importance on the limits when considering a medical card insurance. Most importantly is how much are you willing to commit in a month or year when you have decided it.

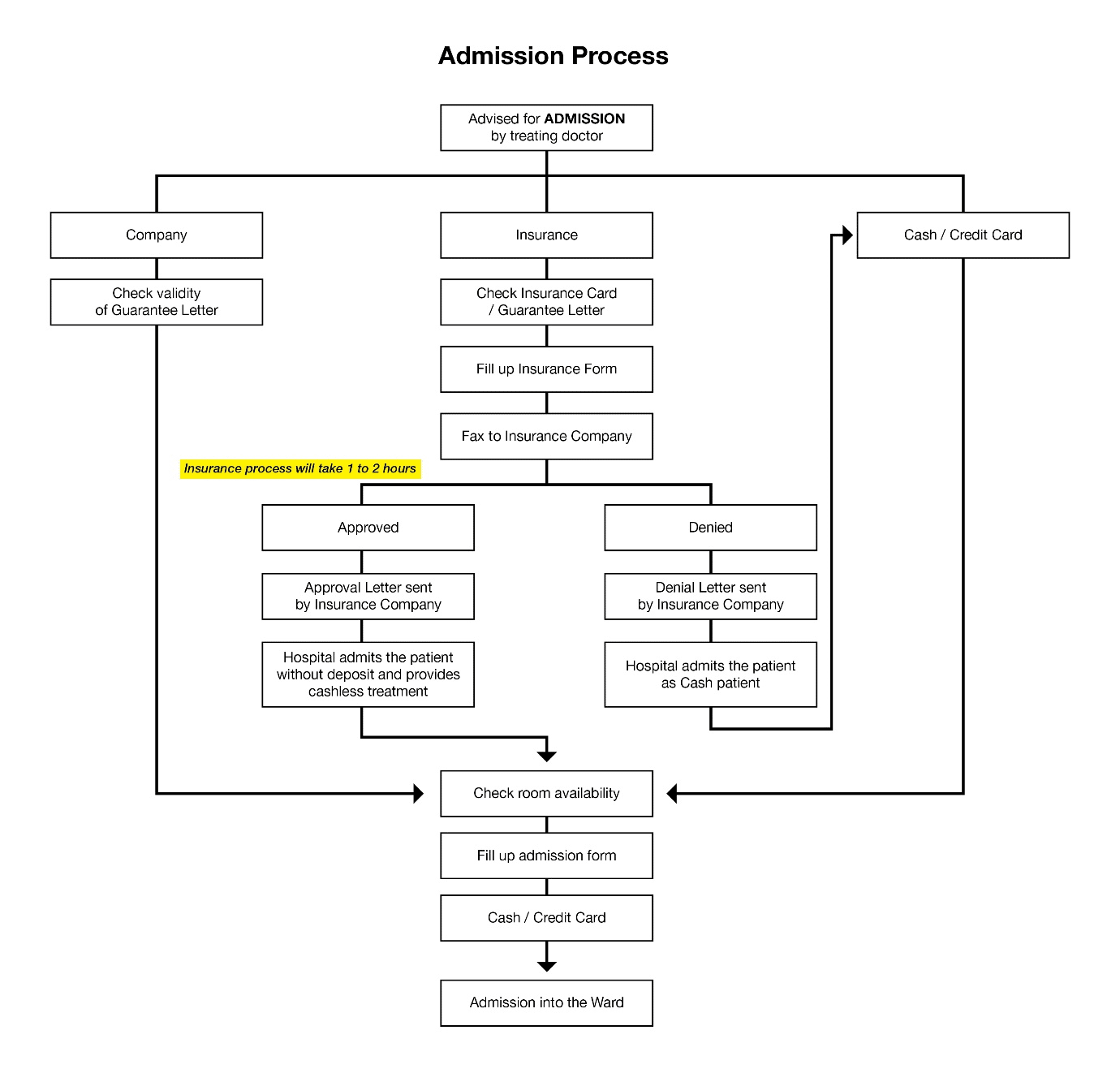

Guarantee Letter

Source: Manipal Hospital

Many of us are under an impression that a medical card can guarantee our hospital admission on its own. The truth is, the real procedures take time as it requires cross-checking by the hospital and insurer.

A guarantee letter is part of the cashless admission policy, whereby the insurer will take care of your hospital bills on your behalf via your medical card, provided you have satisfied the policy’s terms and conditions.

Without a guarantee letter, you are most likely to bear all costs at your own expense. If you happened to come across a scenario like this one, you should read on our >>Guides to Claim Your Medical Insurance.

Panel Hospital

An insurance company will have a list of hospitals who they have partnered with and agreed to accept their medical cards. They are called the panel hospitals.

When you get admitted into one of the panel hospitals, the process of admission and claiming will be much easier compared to that of non-panel hospitals as your medical card is guaranteed by the panel hospital.

If you chose or happened to be hospitalized in a non-panel hospital, worry not. All you need is your medical report and bills attached when you make an insurance claim to the insurance provider.

You must submit your claim request within 30 days after you have been discharged.

Cashless vs Reimbursement Policy

The rule of thumb for getting the best medical card is knowing the difference between cashless and reimbursement policy.

A cashless policy is where the insurer will pay for the bills directly to the hospital on behalf of the Insured Person. With that said, you need a guarantee letter from the insurer.

Under the reimbursement policy, you will pay for the total hospitalization costs first, and then the insurer will reimburse all expenses when you have made a claim after you have been discharged.

Room & Board

All medical cards cover for room charges for up to a maximum number of stays. Some quarters put an emphasis on this benefit as recovery process can be personal and requires a comfortable space.

That's why you can choose to be fully or partially covered by your medical card under Room & Board.

When you choose a plan with RM300 room and board for 150 days, it means that the medical card is covering you for up to that amount and time.

If you wish to upgrade your room, this action will trigger a clause in your medical card policy contract whereby you need to co-pay for the difference.

For example, if your chose to stay in a Single Deluxe room at Tung Shin Hospital with RM300 room and board coverage, the amount that you need to cover on your own is RM150 per day.

|

Table 2: Hospital Room Rates in Klang Valley |

|||||

|

Hospital |

Suite |

Single Deluxe |

Single Standard |

Double Bedded |

Four Bedded |

|

KPJ Ampang Puteri Hospital |

RM680 |

- |

RM230 |

RM160 |

RM90 |

|

Sunway Medical Centre |

RM700 - RM1,288 |

RM338 |

RM268 |

RM150 |

RM95 |

|

Pantai Hospital Bangsar |

RM630 - RM1,138 |

RM388 |

RM238 - RM288 |

RM138 - RM168 |

RM98 - RM118 |

|

Hospital Pusrawi |

- |

RM280 |

RM200 |

RM140 |

RM95 |

|

Tung Shin Hospital |

RM280 - RM450 |

RM220 |

RM200 |

RM140 |

RM90 |

|

Gleneagles Kuala Lumpur |

RM980 - RM3,800 |

RM380 |

RM250 |

RM160 |

RM100 |

|

Manipal Hospital |

- |

RM300 |

RM200 |

RM120 |

RM80 |

|

Assunta Hospital |

RM350 - RM550 |

RM320 |

RM220 |

RM150 |

RM95 |

|

AVISENA Specialist Hospital |

RM650 - RM1,500 |

RM500 - RM580 |

RM230 |

RM175 |

- |

|

Hospital Kuala Lumpur |

RM225 |

RM180 |

RM120 |

RM90 |

RM60 |

All prices are for per day**

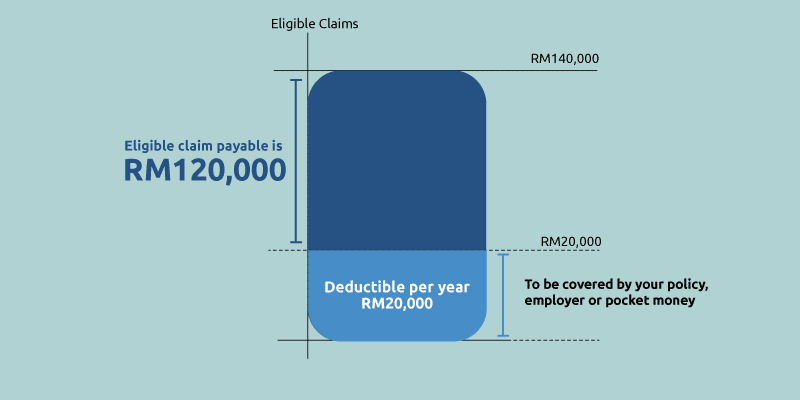

Deductible

A deductible is the amount of risk you are willing to cover when you suffer a loss. In the medical card context, deductible is payable by the Insured Person before an insurance starts covering the rest of the bills.

Because deductible amount is absorbed into your premiums, you must assess your budget and needs before buying a medical card.

A high-deductible plan saves you on monthly or yearly premiums. The downside is, you need to foot a costly medical bill at your own expense before your medical card coverage kicks in.

A low to zero-deductible plan, on the other hand, comes with a higher premium. The bright side is, this plan can save your out-of-pocket money when you make a medical insurance claim in the future.

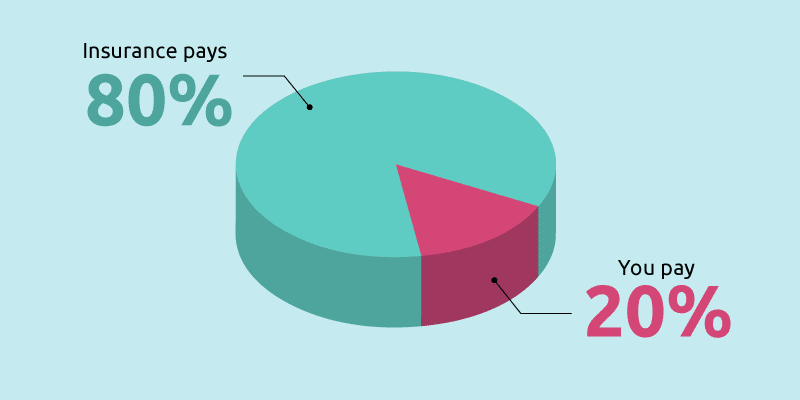

Co-Insurance

This is also a cost-sharing feature between the insurer and the Insured Person. The amount is based on a percentage and is charged after you have paid your plan’s deductible.

Usually, you will only need to pay a small percentage, with the insurer covering the large portion of the bill.

For example, if your medical card has a 20% coinsurance, you are responsible for the 20% of the total healthcare services, while the 80% will be covered by your insurer.

Guides to Claim Your Medical Insurance

Owning a cashless policy is convenient as you don’t need to claim once you have been discharged. However, there are situations which require you to pay upfront at the hospital admission counter, such as:

- Your medical card is a reimbursement policy

- Your insurer did not issue Guarantee Letter

- You are admitted into a non-panel hospital

- You seek medical treatment overseas

If you caught yourself in any one of these situations, you can claim back your expenses by following these 3 simple steps:

Step 1: Prepare documents

Typically, these are the documents required for your claiming process:

- A copy of your MyKad

- Medical report by treating doctor

- Original medical bill(s) and receipt(s)

- Investigation or diagnostic report (if any)

- For overseas treatment: original itemised bill(s), flight ticket, passport

Always remember to keep the original copy of bills and receipts when you are receiving medical treatment because they may be entitled for reimbursement.

Most importantly, a medical report is a prerequisite document for a claim.

Step 2: Complete Claim Form

You need to complete a claim form, which can be downloaded from your insurance provider’s website or app. Without this claim form, your claim request is invalid.

Take this time to also review thoroughly your claim form and other documents before proceeding to submit them.

Step 3: Submit Claim

There are many ways you can choose to submit your claim. You can rely on your agent or do it yourself via mailing or stopping by at branch office.

Some insurance companies offer online submission platform too. Regardless of the means, you must complete the claim submission within 30 days after hospital discharge to qualify for reimbursement.

Now, what if the insurance provider rejects your claim? It is important that you call up your agent and review the policy, together with your claim request form and documents before appealing for a second time.

Besides, you can also seek helps from PIAM Information Centre and Ombudsman for Financial Services (OFS) if your claim has been unfairly denied again.

Summary:

Best Medical Cards in Malaysia:

-

Allianz MediSafe Infinite+ Medical Card

-

AIA A-Plus Health Medical Card

-

Etiqa Elite Takaful Medical Plus Medical Card

-

ManuLife ManuHealth Elite Medical Card

-

Prudential PRUValue Med Medical Card

-

Takaful myClick MediCare Medical Card

-

Great Eastern Smart Medic Medical Card