What is a Medical Insurance Deductible?

In a medical card context, deductible is the upfront amount you pay before your insurance plan starts covering the rest of the bill.

Once you meet the deductible amount, only then your insurance company will step in to pay.

What about my company’s medical insurance plan?

As an employee, there is a common misconception about your existing company’s medical plan that its coverage is sufficient. However, that’s not the case.

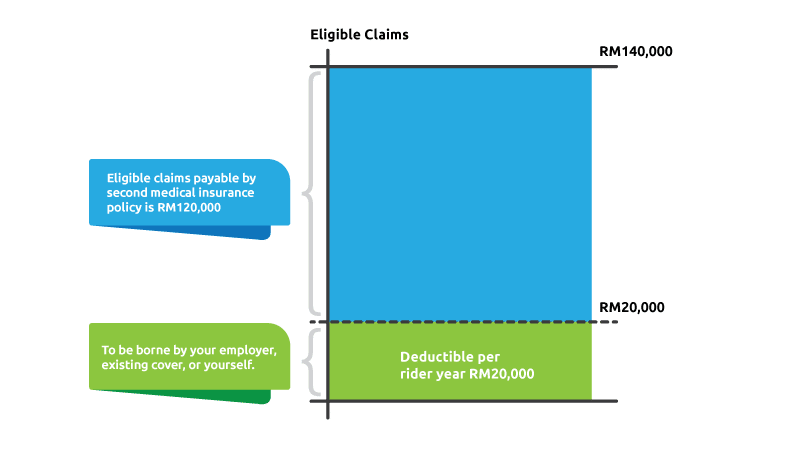

Let’s say your company provides you with a Group Term Company coverage that has an annual Hospitalization and Surgical limit of RM20,000.

This means that any insurance claims beyond RM20,000 will not be covered by the company and it has to be out of your pocket.

Getting a second medical insurance policy for yourself

A common option is to buy yourself a second or supplementary medical insurance policy to pay for the sum above RM20,000.

As insurance companies are on reimbursement-basis, you will have to pay first and then be reimbursed later on.

Since you’re covering the remaining amount of above RM20,000 on your own, your second card do not have to cover medical expenses from zero to RM20,000 (already covered by your company).

This is the most economical way to top up your medical insurance coverage!

Choosing a medical insurance plan: Deductible or zero deductible?

If you’re looking to buy a medical card, there is more to consider in choosing plans with deductible or zero deductible.

Plans with deductible were designed with the logic that you share a greater risk via paying for medical bills upfront, consequently lowering monthly or annual premium costs.

This would motivate consumers to buy medical insurance plans. Inversely, zero deductible plans come with higher monthly or annual premium costs.

Here’s a simple example comparing having deductibles or zero deductible:

|

AXA eMedic

Plan 100

Age: 30 years old |

||

| Plan |

Zero Deductible (RM) |

With Deductible (RM) |

| Annual Premium | 627.00 | 456.00 |

| Coverage | 100% of the eligible medical bill paid by AXA Affin. |

First RM1,000 of the eligible medical bill paid by you per hospital admission.

Balance will be paid by AXA AFFIN, with an annual limit of RM100,000, renewable up to age 80. |

As mentioned, zero deductible plan comes with a higher premium.

Having said that, this plan can save you money in the future when you make a medical insurance claim and have a lower threshold to activate coverage benefits.

Budgeting for healthcare expenses are more predictable as well due to the consistency of regular monthly premiums.

Zero deductible plan is the right one for you if:

- You have a chronic medical condition which requires on-going treatment or expensive prescription medication

- You are pregnant or plan to be pregnant (maternity medical expenses can be expensive)

- You have young children (high medical expenses when children gets sick)

- You like to participate in risky outdoor activities which meant that there is a higher risk of you getting injured

- You are considering a reparative surgery (knee or hip replacement)

While medical plans with deductible saves you on monthly or yearly premiums, the downside is that you need to foot a costly medical bill at your own expense before your medical card coverage kicks in.

However, what are the chances that you will be forking out money if you are young, healthy and rarely gets sick?

In addition, if you can afford to pay the upfront deductible amount for the rare occasion you needed to, why not opt for a plan with a deductible feature?

Deductible plan is the right one for you if:

- You are young, healthy and rarely get sick or injured

- You can afford to pay your deductible upfront if an unexpected medical expenses pops up

Next steps

Simply put:

- If you are young, healthy and have some money to spare, you can opt for a deductible plan.

- If you are older and living with a pre-existing or chronic health condition, then a zero deductible plan is the one you should choose.

Remember that when choosing medical plans, it is important to assess your healthcare needs and your financial capability.

If you are expecting to have a lot of medical expenses, then it will make more sense to opt for zero deductible.

Whether it’s buying your first medical insurance plan or to top up your medical coverage, compare and apply the right deductible plans for you.