Why do people go overseas for medical treatment?

Crowdfunding for medical expenses has become a trend in Malaysia. It reflects the empathy and generosity of our rakyat to the plights of other fellow Malaysians who are seeking medical treatment that is not available in their home country.

A recent case in point is an eight-month-old toddler from Malacca, Ainul Mardhiah Ahmad Safiuddin, who had a rare “Germ Cell Tumour” in her mouth.

With financial assistance and donations from the Malacca government and fellow Malaysians, she was able to receive treatment in the UK, and her family travel and accommodation are fully covered as well.

Imagine not having access to crowdfunding. How do we go about receiving financial aid when facing an urgent medical condition? This heartwarming story also begs the question of the necessity of having overseas medical insurance for oneself, and how can we benefit from it.

What is the most common medical treatment you can get overseas?

Every year, many people leave their home countries in search of better medical treatment and healthcare.

According to Patients Beyond Borders, the most common overseas medical treatment or procedures are:

- Cosmetic surgery (for example, breast augmentation, facelifts and liposuction)

- Dentistry (for example, dental implants, dentures crowns and whitening)

- Cardiology/heart surgery (for example, bypass and valve replacement)

- Orthopaedic surgery (for example, joint and spine surgery, hip or knee replacement)

- Oncology (for example, cancer treatments)

- Health screenings along with scans, diagnosis and other treatments

Based on the 2020 International Living Annual Global Retirement Index, the top six (6) countries with the best ratings in the “Best Healthcare in the World” category are:

| 2020 Medical Specialisation Ranking by Country | ||

| #1. | Costa Rica | Knee and hip replacements, cosmetic surgery and dental care |

| #2. | Columbia (tie) | General and specialised medical services |

| #3. | Spain (tie) | Health screenings, dental care, etc. |

| #4. | Portugal | Dental care |

| #5. | Malaysia (tie) | Burn treatment, IVF, cancer treatments, blood tests, health screenings, dental, vision, hearing, X-Ray and MRI scans |

| #6. | Mexico (tie) | Health screenings, dental care, X-Ray and MRI scans |

However, the costs incurred when you travel overseas for medical purposes can poke a big hole in your pocket and savings.

The costs that we are talking about are not only hospitalisation, but also transportation (flight, taxi, car rental), accommodation (hotel, homestay), daily meals, childcare (if any), and miscellaneous expenses.

Unless you are financially capable of managing those expenses, a health insurance policy is necessarily required so that you can receive your overseas medical treatment in peace.

Can I use my health insurance overseas?

For the purposes explained above, you do need an overseas medical card, which is designed to cover all expenses incurred when receiving medical treatment outside of Malaysia.

Structurally speaking, an overseas medical card shares similar benefits and features as a standard medical card. However, for the latter, the policy’s coverage is valid in Malaysia only.

One of the biggest assumptions that policyholders may have is that a standard medical card can also be used for medical treatment overseas.

The truth is, all standard medical cards don’t cover expenses for overseas treatment, however, they sometimes provide a value-added service such as a second opinion benefit.

This benefit allows you to seek opinions from different doctors or specialists, locally or overseas, before getting into the treatment you are diagnosed with.

In a case where your doctor has referred you (or you choose) to treatment outside of Malaysia, it must take place at your insurance provider’s panel hospitals in Singapore and Brunei only.

That’s not all, the treatment will also be subject to a clause:

“...Reasonable and Customary and Medically Necessary charges for equivalent local treatment in Malaysia,”

What does that mean in layman's terms?

Reasonable and Customary Charges

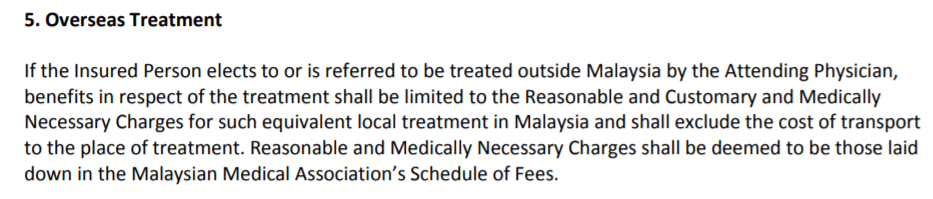

In your health insurance policy document, you will come across the term “Reasonable and Customary Charges” in the footnote or clause (see extracted example below).

Extracted example:

Two things you need to look at here: (1) the fee charged by your physician or doctor, and (2) the amount of money that your insurance provider will approve.

The fees charged by your physician or doctor is regulated by the Ministry of Health. Medical practitioners nationwide will refer to the Malaysian Medical Association’s (MMA) Schedule of Fees for the amount they are allowed to charge you for a particular service.

The insurance company will use this information to determine the amount they are willing to pay for a particular service in a particular area.

In Malaysia, for example, the cost to undergo an Angioplasty procedure at a private hospital is around RM40,000, whereas the cost for the same procedure done in the US is between US$28,000 to US$30,000.

If you submit a claim to your insurance provider for the Angioplasty procedure done in the US (US$1=RM4.13, at the time of writing), the insurance provider will not reimburse you in full amount because the cost for the treatment is above reasonable and customary for the same treatment in Malaysia.

In this case, your insurance provider will pay up to a certain percentage with you covering the differences. Worst, if your standard medical card does not have a panel hospital in countries outside of Malaysia, they may not approve your claim request at all.

When do I need an overseas medical card?

If you have a serious medical condition which requires attention from experts in the field which the local healthcare providers are not equipped with, the next course of action is to look abroad for the right doctors, best treatment plans and world-class facilities.

With an overseas medical card in your pocket, you are well prepared for the costs involved from the moment you landed the country of choice, right until the medical bill is printed out.

Overseas medical card has very high annual and/or lifetime limit to absorb not only the cost of insurance but also ancillary costs, currency exchange rates and taxes. Therefore, this medical card generally has higher premiums than a standard medical card.

Similar to a standard medical card, overseas medical card observes the same benefits, features, terms and conditions. The difference is that overseas medical card has a higher coverage amount and its benefits are applicable on a global scale.

Pre-existing conditions

Medical conditions that require ongoing treatment such as heart disease, chronic obstructive pulmonary disease and cancer are covered under overseas medical card.

Allianz MediAdvantage, for example, will provide second medical opinion service, concierge service and overseas hospitalisation and surgical coverage upon confirmation of any one of the Covered Diseases.

Depending on the insurance providers, the covered diseases or illnesses may vary.

Duration of cover

Overseas health insurance policy is yearly renewable and will remain effective as long as premiums are paid. A standard medical card, on the other hand, only cover overseas medical expenses incurred only in Singapore and Brunei within 90 consecutive days of residence.

How to choose overseas medical insurance?

Here are some tips to help you choose the best overseas medical insurance:

Deductibles

To lower annual premium cost, you will have an option to select a deductible. A deductible is the upfront amount you are willing to pay before your insurance covers you.

AXA SmartCare Optimum for example, gives you an option to pay the first RM7,500 up to RM20,000 of your hospital bills. Thereon, they will reimburse the remaining amount up to your overall annual limit.

Level and Area of coverage

The level of coverage (plan) you choose can determine the amount of premium you pay. Choosing between a private room and shared room or accepting a lower limit on your maximum claim can make a difference in cost.

In terms of geographical area, you usually do not require coverage in every part of the world. You have the option to choose only territories you need healthcare to keep your premiums low.

Additional coverage

Overseas medical coverage allows you to tailor the level of care to your needs. There may be additional coverage you need such as maternity, newborn, extended outpatient, repatriation or even dental cover.

By tailoring coverage to your needs, you can potentially keep your premiums low while still getting the healthcare you really need.

Before traveling abroad for medical treatment, it is imperative to understand your needs and options so that you have sufficient health insurance in place.

Having the right coverage will give you peace of mind and that goes a long way!