HR Ministry Allocates RM5 Million To Improve Graduate Employability

The Human Resources Ministry has allocated RM5 million to roll out nationwide initiatives aimed at improving the employability […]

Duit the easy way.

The Human Resources Ministry has allocated RM5 million to roll out nationwide initiatives aimed at improving the employability […]

Malaysia recorded stronger labour productivity in the fourth quarter of 2025, as value added per hour worked increased […]

Buying a home is one of the biggest financial decisions most Malaysians will ever make, yet recent disputes […]

AmBank Group has introduced a new campaign offering a 2% per annum bonus rate on its Foreign Currency […]

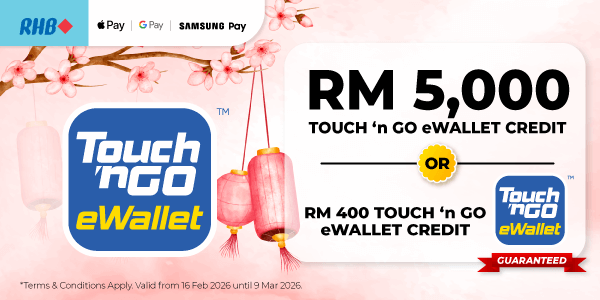

RHB Premier is running a Wealth Savvy Campaign from 13 February to 30 June 2026, rewarding customers who […]

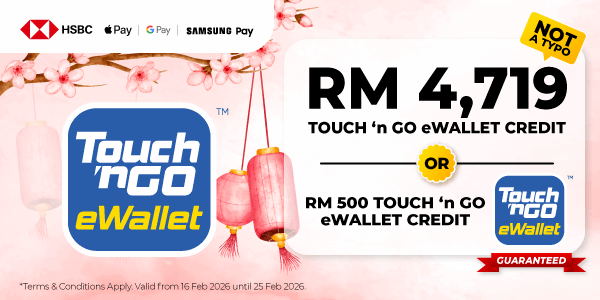

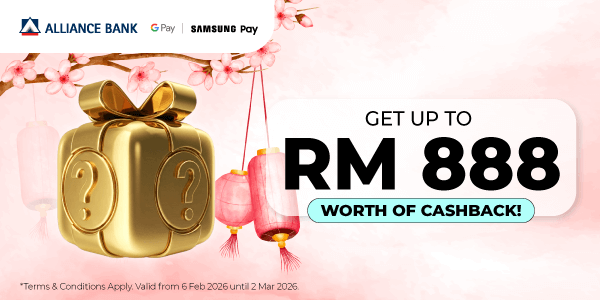

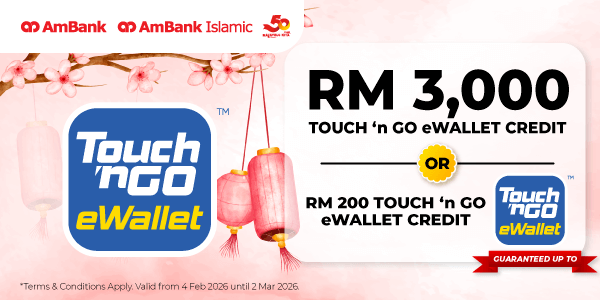

Keep the prosperity flowing this Chinese New Year with Unbox This Week. Apply for a credit card through […]