Personal Accident Insurance Explained

Let us get some things straight. Life is always unpredictable and sometimes beyond our control. One of these things that we can't control is accidents.

Accidents are unpredictable, unexpected, life-changing and financially draining for anyone, especially breadwinners. While we may do all we can to avoid accidents, it is always better to prepare you and your family (financially) for these situations.

In this article, we will be going through a brief guide on Personal Accident insurance and its attribute.

Personal Accident Insurance: What Is It?

A personal accident (PA) insurance is an annual policy which provides compensation in the event of injuries, disability or death caused solely by an accident.

The plan is designed to pay out if you are severely injured or die in an accident, where policyholders receive a tax-free lump sum in the unfortunate events that are included in the policy.

Some insurers would include the following statements in their definition of a personal accident insurance:

1) Any untoward events that are unintentional and unexpected,

2) Violent, accidental, external and visible events

3) Sudden and unforeseen events.

Like any insurance policy, you will need to make a payment known as premiums.

Where Have I Heard About This Coverage?

If you are asking yourself this question, chances are you have heard about it in other insurance products. Some medical insurance policies and travel insurance policies do offer some form of accidental death/ injuries coverages.

You might also be familiar with your monthly SOCSO contribution of 0.5% of your salary. SOCSO provides coverage for any work-related injuries and accidents. However, it is important to note that these coverages are limited to certain parts like medical expenses and ambulance fees or to specific accidents like SOCSO.

What Are The Differences Between PA Insurances And Other Products?

You might be thinking why you should get a PA insurance policy since other insurance products or schemes provide similar coverages like medical insurance and SOCSO.

This is one of several misconceptions surrounding PA insurance. As such, it is important to note the differences between PA insurance and other products with similar coverage.

Firstly, the name itself is a good indicator of any differences. PA insurance focuses coverages on anything related to accidents or accidental means. Other products have a specific scope or have a limited coverage on accidents.

Most medical insurance and travel insurance provides specific coverage in regards to accidents (medical expenses) and in specific contexts (while you are travelling). Even SOCSO only cover work-related accidents, injuries and death.

Besides that, PA insurance differs from other insurance in that the premium and policy is based on the policyholder/ insured's occupation, the risk related to the occupation and hobbies.

Here is a table to illustrate the differences between PA insurance and other insurance and contribution.

| Insurance/ Products | PA Insurance | Travel Insurance | Medical Insurance | SOCSO |

|---|---|---|---|---|

| Coverage | Injuries, disability or death caused solely by an accident | Medical expenses and inconveniences caused by accidents or disruptions during travel | Medical expense caused by accidents and illness | Medical expenses caused by work-related accidents |

| Premium/ Contribution | Based on the classification of occupations and hobbies | Based on destinations/ travel habits | Based on health, age and lifestyle | Based on salary/ remuneration |

| Things that affect application | Certain occupations and hobbies | Age and lifestyle | Age and medical history | Salary |

| Insurance payout type | Sum Assured (Lump Sum) | Based on charges of medical expenses and coverage limit | Based on charges of medical expenses and coverage limit | Based on charges of medical expenses and daily rate |

| Access to Protection | 24-hours, worldwide | 24 hours, worldwide | Limited to Malaysia | 24 hours, local |

| Minimum Age | At least 30 days old | Age 3 and above | At least 30 days old | Once you are employed |

| Tax Relief | No | No | Yes | Yes |

As such, it is important to not only distinguish the differences but also the function of each product to reap the maximum benefit of each product.

Why Should You Apply For PA Insurance?

No-one wants to think about their own death or disability, let alone plan for it. However, we have to acknowledge that accidents can happen anytime and anywhere.

Road accidents, work-related accidents, accidents at home, whilst doing sports or other hobbies etc. can happen. When it happens, it will potentially drain your wallet and alter your life. Worst still, accidents do not cost you personally, it can also push your family into a difficult situation.

Perhaps you can consider these scenarios/ categories:

- I am the sole breadwinner of my family

- I am the only child of my elderly parents

- I am providing for my family

- My work/ workplace does raise some concerns for my safety

- My main concern is unexpected medical expenses

- I am scared about being handicapped

- I am concerned about my work or possibility of getting back to work after an accident.

- I am concerned that SOCSO does not provide enough coverage.

If any of these scenarios apply to you, then you should get a PA insurance. In fact, some employers have made active steps to get their employees insured.

Who Is Eligible To Apply?

Everyone can apply for personal accident insurance. Only if you work in some high-risk jobs, like professional divers or pilots, or if you practise some high-risk hobbies, like parachuting or base-jumping, you might get rejected or the particular hobby might get excluded.

The Different Classes

If you read any brochures on PA insurance, you might come across these words: Class 1, Class 2, Class 3 etc.

These classes are categories of the policyholders/ insureds' occupations and their related risk. It should be noted that each insurance company have its own way of classifying the occupations and related risks.

Here is a general classification of the occupation.

| Classes | Definition |

|---|---|

| Class 1 | Occupation involving non-manual, administrative or clerical work – solely in offices or similar non-hazardous places or full-time student. |

| Class 2 | Occupation involving work of supervisory nature or travelling outside an office for business purposes but not engaging in manual labour. |

| Class 3 | Occupation involving occasional or regular manual work not particularly hazardous in nature but involving the use of tools or machinery (not using woodworking machinery). |

Why Do These Classes Matter?

These classes serve a few purposes for both the insurer and the potential customer.

For the potential customer, these classes help him/ her to determine the type of plan that he/ she is eligible for. For the insurer, these classes help them to determine the risks associated with the occupation of the potential customers, which help them to recommend the suitable plan.

Example: Desmond, a bank officer, is looking for a personal accident insurance when he started work in a bank. As Desmond's work is mainly an administration work in an office, Desmond’s occupation is considered as a Class 1 occupation: Occupation involving non-manual, administrative or clerical work.

This classification would lead to an insurer recommending a plan that fits his classification as a Class 1 policyholder.

It should be noted that some industries like the construction industry insure their employees with a similar insurance plan. This may be due to the number of risks related to the construction industry (Crane operation, transportation of building materials etc.).

Furthermore, some occupations like soldiers and heavy machinery operators are ineligible for insurance coverage as the risk of getting injured or disabled is greater. As such, it is in your best interest to contact your insurer and your company on the coverage or insurance that you can be qualified for.

When Should You Apply?

There are a few factors to take into consideration when you decide to apply for a PA insurance besides occupation. One of these factors is the life stage of the applicant.

Example: Desmond the newly employed bank officer is supporting his recently retired father. This additional information means he is a breadwinner, alongside his mother. As such, he is encouraged to apply for a PA insurance to provide compensation to his family in the event of an accident.

Other factors include

- The lifestyle of the applicant,

- Workplace,

- Age of the applicant etc.

How Does It Work?

As mentioned earlier, the plan is designed to provide the policyholders with a lump sum payment for the expenses related to the unfortunate events included in the plan.

What this means for the policyholders is they will receive a huge sum of money for all the respective coverages and benefits that are in their policies when they are in an accident.

In your application, brochure or other PA insurance documents, you might notice a table which depicts payment for the loss of limbs or injuries sustained in an accident.

This table is the scale of benefits, a scale on how much the insurer will pay for certain types of claims like the loss of a limb due to an accident.

Each insurer has its scale of benefit based on the policyholder's plan and occupation. That said, we can make a general table on the level of payment.

| Condition | Compensation % of limit of liability |

|---|---|

| Permanent Total Loss of use of one limb | 100% |

| Permanent Total Loss of sight of one eye | 100% |

| Permanent Total Loss of use of four fingers and thumb of either hand | 80% |

| Permanent Total Loss of use of fingers of either hand | - |

| - Three Joints | 15% |

| - Two Joints | 10% |

| - One Joint | 5% |

| Permanent Total Loss of use of four fingers of either hand | 50% |

| Permanent Total Loss of use of one thumb of either hand | - |

| - Both joints | 30% |

| - One Joint | 15% |

Type of Personal Accident Insurance

Personal accident insurance is often divided into five types:

| Plans | |

|---|---|

| Individual Plan | PA insurance plan that covers the policyholder. |

| Couple/Partner Plan | PA insurance plan that covers married couple. (More of that later) |

| Children Plan | PA insurance plan that insured the children of the policyholder. |

| Family Plan | PA insurance plan that provides coverage for the family of the policyholder. |

| Takaful | A co-operative policy where funds are contributed by donations from participants. You can read more about it our blog post. |

It should be noted that each insurer has their own special plans that cater to specific groups of people. Some insurers provide a special PA insurance plan that targets full-time students. So, check with your insurer which plan is the best match for your current situation.

What Should I Look Out For?

Aside from the aforementioned classification of the occupations and your lifestyle, there are other things you need to be aware of. Like any insurance plan, age can play a role in your premium payment and renewal of your insurance plan. Also, these other factors apply:

- Personal health

- Amount of coverage

- Coverage options

- Documents for application and claim

- Your nominee in the event of accidental death

What Does Personal Accident Insurance Cover?

Every insurer has its scope of what a personal accident insurance covers. However, there is a list of things that are generally covered by all insurers.

- Accidental Death: The coverage amount paid to your closest family members if you die in an accident.

- Permanent Total/ Partial Disability: Cash pay-out following an accident if you can't work any longer or perform day to day tasks.

- Temporarily Total Disablement: Cash compensation if you are unable to work temporarily because of total disability.

- Medical Expense: Expenses for medical treatment and service for the injuries and disabilities from an accident.

- Funeral Expense: What your insurer will cover for your funeral if you pass away in an accident.

- Hospitalisation Benefits: Cash benefit if you're admitted to the hospital due to an accident.

If you find these basic coverages insufficient, you can opt for additional coverages option to increase your coverages.

- Double Indemnity: Coverage for death that occurs using public transportation, usually double the amount of the accidental death coverage.

- Maternity Risk: Compensation for death directly caused by a pregnancy disorder or complications arising from childbirth or miscarriage.

- Personal Liability: Coverage if you're required to pay for damages to another person's property and their injuries.

As noted before, every insurer has their own riders and each according to their discretions.

What Happened If You Change Your Job?

Here is what we need to get out of the way: We are changing jobs more often nowadays. However, it is unlikely that it will affect your premium as most likely you stay in a similar field of work and so, jobs fall within the same classification.

Example: Desmond recently changed his job from a bank officer to a product manager. As his new job fell within the same class 1 categories, this means that there are no changes in the premium or policy. All he needs to do is to update the information on his occupation.

However, if Desmond makes a significant change from one job to the next, then it is likely he needs to change plans.

Example: William, a factory supervisor, was promoted to the position of product manager. Previously, William applied for PA insurance while he was a factory supervisor (Class 2). William's PA insurance plan may have some changes since his new position falls within the Class 1 category.

As such, you need to contact your insurer to inquire if you need to make changes to your insurance policy or premium.

Your Duty

With that, we need to get this thing straight: it is your duty to disclose any information that the insurer request. Every insurance brochure will have this wording "Importance/ Duty of disclosure", which means the policyholder's duty to provide relevant and accurate information to the insurer.

If you do not provide them, your claims or application may be rejected by the insurer.

How Much Coverage Should I Get?

This part is very much dependent on two things:

- Your personal situation (financial commitment)

- Your employer and

- SOCSO

If you are the sole breadwinner of a family of five and you have some debts to settle, you should consider getting a PA insurance plan that provides more coverage to provide financial relief for your family in the event of your death in an accident.

Your employer's coverage of your medical expenses is also a good indicator of how much coverage you need. Most employers provide coverage of the employee's medical expenses for a limited time. This means any expenses after the cover period will be paid by the affected employee. As such, you want to consider a PA insurance that provides sufficient coverage for your medical expenses and supplement SOCSO.

What Do Insurers Look at Before Approving Personal Accident Insurance Policy?

Although it is easy to apply for a personal accident insurance policy, there are a few things that the insurers will take into consideration when it comes to approving or rejecting your insurance application or deciding the amount that is set as your premium.

- Your medical history (pre-existing conditions, surgery, and prescription medication)

- Your immediate family’s medical history

- Your occupation

- Lifestyle habits – (exercise, smoking, drinking, recreational drug use, frequent travel or high-risk hobbies)

On the other hand, AVOID doing the things listed below, as not only will it affect your insurance application but in some cases, you may even be convicted and subjected to heavy fines if found guilty. You may also risk having your insurance policy void and this will defeat the purpose of you getting insured.

- Misrepresentation – making a false statement or providing misleading information

- Fraud – (i.e: faking death )

- Concealment of material facts – withholding information of material facts.

Excluded Occupation

Like any insurance, personal accident insurance has its own exclusion. In personal accident insurance, some occupations are ineligible for an insurance application. These occupations often have a high risk of getting injured, handicapped or killed in an accident. Most insurers categorise these occupations as "Hazardous Occupations".

i. Civil Defence/ law enforcement: soldiers, firemen, police officers, marines, jet fighters etc.

ii. Construction Industry: crane operators, demolition squad, miners, woodworking machinists, timber loggers, etc.

iii. Other professions: professional athletes, war correspondents, aircraft operators, pilots, oil riggers, seamen etc.

Again, every insurer has their own list of excluded professions or scope of excluded industries.

Common Exclusions

Aside from the excluded occupation, there are many general exclusions that are similar to other insurance policies. However, these exclusions differ according to policies and insurers.

- Hazardous sports

- War, rebellion, terrorism

- Acts of nature

- Pregnancy

- Self-inflicted injury, HIV

- Unlawful activities, etc.

How To Make A Claim?

If you are thinking that all you need is just a form from the insurance company, you will be surprised at this section. By now, you will be sick of me repeating this same sentence "Every insurer has its way of making claims". Yet, it is important as not every insurer has the same set of documents and forms required for the claims.

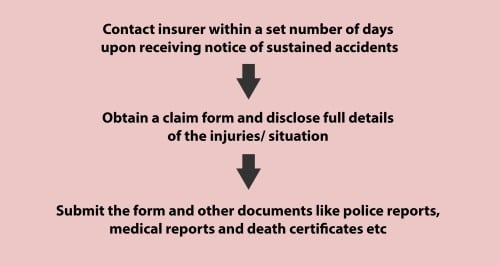

Secondly, there are different procedures for different situations like intensive care, permanent disablement and even death. However, most procedures have a few things in common.

How Do I Apply For PA Insurance?

Selecting the right personal accident insurance can be tough. The most common method in Malaysia is a face to face conversation between you and an insurance agent.

This approach is can be quite personal, in particular, if the agent is a friend or any other person you trust, but you will need to set aside time to make an appointment which is not exactly the most convenient method if you are always on the move.

Alternatively, you can go a purely digital path and apply online via Ringgitplus or some insurers websites. In general, and online application is very straight-forward and fast. You need to answer a few key questions and the premium calculator will be able to let you know your individual offer details. Upon agreeing to the quotation given, you will be asked to answer a few additional and more detailed questions about your medical history. And that’s it – your application is on its way.

For a comprehensive list of PA insurance products available in Malaysia, you may want to check our website to discover what we have to offer.

Terms I Should Know

When you read any insurance product disclosure sheet, you will encounter this segment "Key terms I should know". Now, most people are inclined to skip this segment.

However, we urge you to have a closer look at this segment as it details important information regarding payment and documentation.

Importance of Disclosure: The duty of the policyholder to disclose all the necessary information truthfully and accurately. This duty also extends to updating any new information (i.e. job changes).

Cash before Cover: The insurance will not be effective until the premium due has been paid.

Premium Warranty: The insurance policy is automatically cancelled unless the full premium is paid within 60 days from the commencement date of coverage.

Notice of Claim: A written notice to the insurer with full details within seven days upon receiving notice of or sustaining any accident, loss or damage.

Coverage Options: The add-ons to enhance the personal accident insurance policy coverage.

Couple: Couple with regards to insurance refers to married couples with marriage certification.

Scale of Benefits: The amount the insurer will pay for certain types of claims like the loss of a limb due to an accident.