Key Features of Alliance Bank CashVantage Personal Financing-i

This Shariah-compliant personal financing comes with several key features that are worth highlighting:

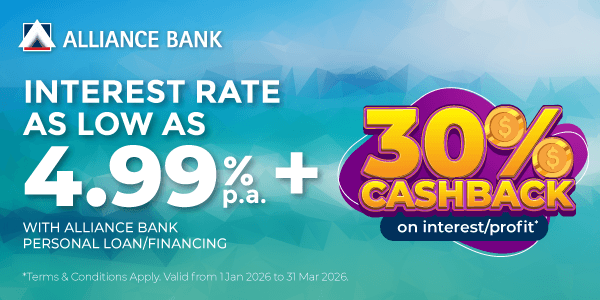

- Profit rate as low as 4.99% p.a.

- High financing amount of up to RM200,000

- Seamless online application (no guarantor or collateral required!)

- Fast approval and disbursement

- 30% cashback on profit paid (limited-time offer!)

With all of these great features, you can apply for this Alliance Islamic personal loan to fulfil your personal needs, such as for home improvement, purchasing a new vehicle, getting married, or starting a new business, as long as it is reasonable enough for the bank to consider.

Alliance Bank Personal Financing 30% Cash Back Campaign

For a limited time, approved applicants of Alliance Personal Loan or Personal Financing-i may stand a chance to get 30% Cash Back exclusively from Alliance Bank and Alliance Islamic Bank.

This promotion runs from 1 January 2026 to 31 March 2026 (“Campaign Period”), subject to the campaign's terms and conditions.

Who is qualified for this promotion?

This campaign is open to new individual customers who apply for a new Alliance Personal Loan or Alliance Personal Financing-i through Alliance Bank’s website or Sales channel.

To be eligible, you must earn a gross monthly income of RM3,000 as a salaried employee or RM5,000 if you are self-employed. Additionally, the financing facility you are applying for must be approved and disbursed during the Campaign Period to be eligible as a “Qualified Customer”.

Those who are not eligible for this promotion include the following:

- Customers who have participated in other promotional offers on preferential rates for the Facility during the Campaign Period

- Customers whose account(s) with the Bank are conducted unsatisfactorily; and

- Any other persons whom the Bank may exclude according to its internal policies

Which personal loan(s) can I apply for?

You can apply for:

- Alliance Bank CashFirst Personal Loan

- Alliance Bank CashVantage Personal Financing-i

How to be eligible for the 30% Cash Back?

The 30% Cash Back is up for grabs on the total interest or profit payable on the approved and already disbursed Financing Facility during the Campaign Period.

That said, to be entitled to the Cash Back, you, as the Eligible Customer, must pay the monthly instalment amount of the Financing Facility before the due date during the entire tenure of the said Facility (“Qualified Customers”) before being eligible for the 30% Cash Back.

When will the 30% Cash Back be credited to my account?

Based on the T&C, the first Cash Back will be paid one (1) day after the fourth (4th) instalment due date. The last Cash Back, on the other hand, will be paid one (1) day after the instalment of T-8 months, which refers to the eight (8) months before the end of the contractual tenure of the Financing Facility. These are known as the “Cash Back Period”.

For a better understanding, there is an illustration in the terms and conditions that you can refer to.

Can you show me the calculation of the Cash Back?

For more details about the calculation, you can find the illustration in the Campaign terms and conditions.

Are there any other important details I should know?

Yes, there are. Please note to give a call to Alliance Bank’s Customer Service Centre to notify the Bank if you have yet to receive the Cash Back for any month when due, no later than one (1) month during the Cash Back Period.

If you fail to notify the Bank within the time frame given, the Cash Back you supposedly earned will be considered forfeited.

Where can I reach out for more information?

For any questions, please feel free to give the Bank a call, or you can visit their website to find out more details about the campaign/promotion.

How much money can I borrow from this Islamic personal loan?

You can borrow from RM5,000 up to RM200,000 as the maximum financing amount, with Alliance Bank CashVantage Personal Financing-i.

These financing amounts come with flat profit rates from as low as 4.99% per annum, up to 16.68% per annum, depending on the loan tenure.

However, please note that the maximum borrowing amount and loan tenure may be subject to Alliance Islamic Bank's due diligence and approval.

How fast can I get my money?

Alliance Bank takes between two and three working days to process your loan application once you have submitted the completed documents to the branch.

Depending on which branches you have selected, you could potentially get your Alliance personal loan application approved and disbursed within 24 hours, too, subject to Alliance Bank's approval criteria.

Under its Same Day Cash feature, you need to bring your application form and supporting documents to perform a biometric scan and print out your EPF statement at Alliance Bank's designated branches:

- Midvalley

- Bandar Puteri Puchong

- Subang Jaya (SS15)

- Jalan Ipoh

- Taman Connaught

- Permas Jaya

- Batu Pahat

- Holiday Plaza

- Air Itam

- Butterworth

- Sinsuran

- Jalan Gaya

- Laksamana

- Taman Eng An

- Puchong Jaya

If you wish to disburse the approved money into another bank account of your choice, it will be subject to IBG transfer time and charges.

Are there fees I need to pay?

The advantage of this Islamic personal loan is that there is no processing fee or early exit fee. As for the latter, you only need to give the bank 3 months' written notice or profit rates.

The only fee you are required to pay is the Stamp Duty of 0.50%, which will be deducted from your total borrowed amount.

Who can apply for Alliance Bank CashVantage Personal Financing-i?

All Malaysians working and residing in Malaysia aged between 21 and 60 years can apply for this Islamic personal loan.

For example, if you are 58 years old at the time of the personal loan application, you can only borrow for a maximum of 2 years, as your loan tenure will cease upon reaching the maximum age.

To make an application, you must provide supporting documents.

Salaried employee and Government servant:

- A copy of your IC (both sides)

- Latest 3-month payslips

- Latest 3-month bank statement reflecting salary crediting

Commission earner:

- A copy of your IC (both sides)

- Latest 6-month payslips

- Latest 6-month bank statement reflecting the commission

Self-employed:

- A copy of your IC (both sides)

- A copy of the Business Registration Certificate/SSM

- Latest income tax (Form B) with an official tax receipt

- Latest 3-month company bank statement

Am I qualified to apply for an Alliance Bank personal loan if I'm blacklisted?

Depending on your credit history with other financial institutions, all this information (outstanding credit card, personal loan, home loan, or car loan debts) will be captured in CCRIS/ CTOS (a system that collects credit information on borrowers, not blacklisting them).

Assuming you have a poor credit standing due to irregular payments, the best course of action would be to break the habit and start making your payments on time to avoid future hurdles.

Alliance Bank is more likely to approve your loan application if you can show that you are managing your finances, rather than accumulating more debt.

What are the steps to apply for this personal financing?

Please proceed with the steps below to apply for the Alliance Bank CashVantage Personal Financing-i online with us.

- Click on the Apply Now button

- You will then be directed to our WhatsApp chatbot

- At the end of the chatbot flow, you will receive a link to Alliance Bank's website to further complete your loan application

- Once you're on the website, fill in your details and upload the required documents for the bank to process

- Within three (3) working days, Alliance Bank will contact you and help you with your loan application

Fast Approval & Low Profit Rate

Fast Approval & Low Profit Rate