Who can apply for Bank Islam Personal Financing-i For Professional Program?

Bank Islam Personal Financing-i for Professional Program is open to all fixed-income earners of medical practitioners and selected professionals.

To qualify for this unsecured Islamic personal loan facility, you must meet the following minimum requirements:

- Must be a Malaysian citizen

- Must be aged between 25 to 60 years and not exceeding the retirement age or the end of financing tenure

- Minimum monthly income of RM4,000 for Non-Package (without Takaful coverage)

- Minimum monthly income of RM5,000 for Engineers and Accountants

- Minimum monthly income of RM15,000 for financing above RM300,000

How much money can I borrow from this Islamic personal loan?

The profit rates will vary depending on the type of financing package, either with or without Takaful coverage and the profit rate types, whether flat or floating rate.

For options with a Takaful coverage, you can refer to the profit rate table above.

For options without a Takaful coverage, you will get a financing rate of 7.45% p.a. throughout the tenure of up to 3 years, and 9.35% for up to 10 years when you borrow any amount between RM10,000 and RM400,000.

Are there fees and charges I should know?

There is no fee for the processing of this Islamic financing, except for a Wakalah (Agency) Fee of RM50.

Bank Islam also requests you to make an Advance Payment of the equivalent of 2-month instalments upon approval.

Besides that, the Islamic financing facility is also subject to the Government Stamp Duty, which is calculated as 0.50% of the total amount borrowed.

How do I pay the money back?

You will start repaying your Islamic personal loan the month after you have received the money into the bank account of your choice.

You must make a prompt payment every month to avoid being charged with a 1% late penalty fee.

If you feel like settling the personal financing off ahead of the maturity date, you can do so and will be entitled to an ibra' (rebate), which is equivalent to the remaining profits at the time of settlement.

Bank Islam requires you to arrange either Salary Deduction, Salary Transfer with Auto Fund Transfer or Standing Instruction for the monthly instalment payments.

What documents are required to apply for Bank Islam Personal Financing-i For Professional Program?

Before making your way to the nearest Bank Islam branch to submit your application, you will be asked to provide supporting documents, such as:

- Copy of IC (front and back)

- Latest 3-months salary slips

- Latest 3-months bank statements of your salary crediting account

- Copy of confirmation letter from your employer

- Latest EPF statement

Additional Documents For Respective Professional

- Doctor

- Certificate of registration with MMC/MMA; OR

For LOCUM, additional letter/payment voucher from respective clinic or hospital

- Dentist

- Certificate of registration with MDC

- Accountant

- Degree in accountant AND;

- Professional Certificate from MICPA/ACCA/CIMA/CFA

- Engineer

- Degree in Engineering AND;

- Professional Certificate from BEM i.e IR

- Lecturer

- Minimum Degree/Master/PhD

- Staff of the 20 listed IPTA and 20 listed IPTS by Bank Islam

- Architect

- Degree in Architecture AND;

- Registered membership with LAM/PAM/ILAM

- Safety Officer

- OSH officer credential certificate issued by Chief Director of Department of Occupational Safety and Health (DOSH)

- Pharmacist

- Degree in Pharmacy AND;

- Registered membership with Pharmacy Board of Malaysia OR;

- Annual Practicing Certificate (APC) from PBM OR;

- Credential certificate from PBM

- Veterinary

- Degree in Veterinary Science or related field AND;

- Registered membership with Malaysian Veterinary Council (MVC) OR;

- Annual Practicing Certificate (APC) from MVC

- Optometrist & Optician

- Degree in Optometry (For optometrist) or at least Diploma in relevant field (Optician) AND;

- Registered membership with The Malaysian Optical Council (MOC) OR;

- Annual Practicing Certificate (APC) from MOC OR;

- Optical Lenses Permit (For Optician)

- Quantity Surveyor

- Degree in Quantity Surveyor or any related course AND;

- Registered membership with The Board of Quantity Surveyor (BQSM) OR;

- Certificate of registration – Form D (Registered QS)

- Actuary

- Degree in Actuarial Science or any related course AND;

- Registered membership with Actuarial Society of Malaysia OR;

- Certificate from one of institution below:

- Society of Actuaries (SOA) – United States

- Casualty Actuarial Society (CAS) – United States

- Institute and Faculty of Actuaries (I&FA) – United Kingdom

- Actuaries Institute – Australia

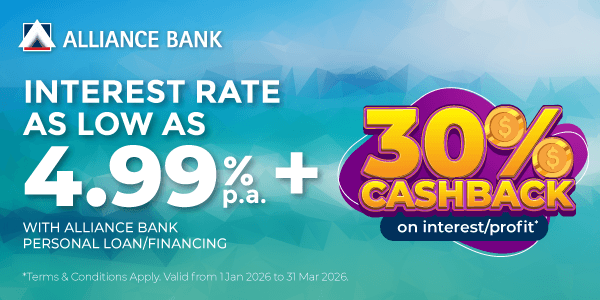

Low profit rates!

Low profit rates!