Everything You Need To Know About Term Life Insurance

UPDATE : As announced by the Finance Ministry on 16 May 2018, Term Life Insurance will be zero-rated from 1st June onwards. This implementation applies to riders which are not related to life insurance, such as critical illness, medical cards and personal accident as well.

It’s never too early nor too late when it comes to insurance-planning, especially when it concerns your future.

Of course, when talking about term life insurance , there’s a lot of things you need to consider before committing to a policy.

How much coverage should you get? How long should the tenure be? Which add-on coverage should you consider to supplement your term life insurance policy?

If you’re still not sure on which term life insurance to get, we’re here to help you decide.

Here’s a complete guide to everything you need to know about term life insurance:

What is Term Life Insurance?

Term Life insurance is a very common form of life insurance and provides a lump sum payout if you die in the course of the policy duration or if you suffer from a Total Permanent Disability.

Known also as pure life insurance, it is priced affordably so that anyone can apply for it at any life stage and with this policy in hand, you can stay assured that you and your family will be protected in the occasion that something unfortunate happens to you.

For instance, let’s say that you’re a term life insurance policyholder, you will make payments called premiums to an insurance company or bank. In return, you will receive a fixed amount of money (lump sum) amount of coverage as the key benefit.

The benefit will be paid out to you or the beneficiaries of the policy as a lump sum in the event of death. In addition, you can extend the coverage to also include terminal illness, critical illness or total permanent disability.

Example :

A policyholder by the name of Maisarah has a term life policy which covers death and total or permanent disability (TPD) with a sum assured of RM120,000. She has nominated her son as the beneficiary of her policy. If she passes away during the coverage period, her son will receive the sum assured. But if she became totally or permanently disabled due to an accident or sickness, the benefits of RM120,000 will be paid out to her instead.

Why Should I Get Term Life Insurance?

No one wants to think about their own death, let alone plan for it. However, if you have a Term Life insurance policy, should the worst happen, your family can be provided for financially. Here are a few scenarios how this can be relevant for you :

If something unexpected happens to me…

- I want my child to further their studies without worrying about the cost.

- I want my wife/husband to stay in the home that we have lived in without letting our mortgage burden him/her.

- I want my parents to be cared for just like they have cared for me.

- My car loan should be the least of my family members’ concerns.

- I hope that my family can live comfortably without worrying about the future.

- I don’t want to burden my parents with my debt and student loan if something happens to me.

If you find yourself in any of the above, you have some good reasons to get Term Life insurance.

Read on to find out what a term life insurance policy can help you with in case something happens to you as a term life insurance policyholder.

What Are the Benefits of Having a Term Life Insurance Policy?

Accidents can happen when you drive out to get some take-out food, or when you’re walking down the stairs to get a drink of water at night – anytime and anywhere.

The basic benefit is the provision of sufficient life coverage at the lowest rates.

Probably the biggest benefit, other than those listed below, is your own peace of mind – the plan promises the payment of a substantial lump sum if you die during the tenure of the plan. The benefit provided can be huge and provides a financial cushion for the family.

Thus, by buying a term insurance plan on your own life with a sufficient Sum Assured, you can ensure the financial stability of your dependents even when you are not around anymore. This assurance provides every individual with peace of mind free from financial worries.

Benefits of Being Insured Under Term Life Insurance

How Much Term Life Insurance Coverage Should I Get?

An ideal term plan is a relative subject and depends on your requirements.

A fact-finding exercise is required to assess your financial and future requirements based on which an ideal plan can be bought. However, some facets which should be remembered when buying a term plan so as to make it an ideal one is as follows:

- Sum Assured – since a term plan provides the cheapest coverage, you should always aim for the maximum coverage based on your financial worth.

- Term– the plan tenure should also be kept long. Choose a plan which offers the highest tenure of coverage because buying a plan later in life would be expensive and also restrictive in terms of coverage.

When it comes to term life insurance coverage planning, there is no perfect formula to decide the actual amount of insurance coverage that you need. It all boils down to:

- How much are you willing and can you afford to pay

- What are your long-term financial needs?

Having said that, you can take into consideration the factors that will influence your need for term life insurance and use it as a guide for an estimate on the amount of coverage that you or your dependents need.

Here are some of the things that we suggest for you to ask yourself:

- Are you the sole breadwinner of the family? And if anything happens to you, will your spouse need to work again to support the family?

- If you sustain a total permanent disability, can your husband/wife support you?

- How many kids do you have and how old are they? What type of support do they need in the situation that you are not around?

Once you have answered those questions, you have a rough indication, but let’s give you a more concrete example:

For instance, if your household has monthly commitments of about RM2,000 , give or take, you will need about RM24,000 per year to cover the running cost. At the age of 30, you plan to be insured for the next 10 years. The amount you would want to cover with Term Life is approximately RM240,000

Table of Calculation

RM2,000 – monthly commitment

RM24,000 – annual commitment

RM24,000 X 10 years = RM288,000 - money required for the next 10 years

- Future financial obligations – If you have plans for your kid to study in a university, do not forget to include tuition bills and fees in your future plan. Get an estimated figure and outline it against your current cash flow for an overall view of the amount required for tertiary education.

For instance, in University Malaya, the average course fees per year is about RM7,000. The duration for a diploma programme ranges from 24 months to 36 months. From here, you know that at least RM14,000 will need to be set aside for your child’s education.

- Assets and savings in hand – When deciding the amount of term life insurance coverage needed, factor in your current savings, assets and long-term investments.

For instance, you may have invested a large portion of money into a fixed deposit account that serves to cover your family’s future expenses as a part of your financial planning. In this situation, term life insurance comes in as a secondary form of protection for you and your dependents.

Example :

Salim is a 45 years old crane operator with a monthly wage of RM4,000. His work requires him to work with heavy machinery at a construction site. His wife stays at home and takes care of their teenage daughter. Salim can opt to take up a term takaful policy. Priced as low as RM25 monthly, he can choose to be covered for RM50,000 which will help shoulder future financial commitments (house mortgage and child’s tertiary education) should anything happen to him.

What are The Things I Should Watch Out For?

Take note that the premium rates for a term life policy increase with age. The later you sign up for a Term Life policy, the higher the premium is likely to be for the same sum insured.

The reason for this is simple: As you age, the chances for (critical) illnesses increase. Therefore, the likelihood of a claim happening is also higher.

Not only is age affecting your state of health. In addition to that, here are a few other things you should watch out for:

- Only applicable events/circumstances are covered under the policy (usually accidental death and accidents)

- Payments due to natural death will be subjected to a sliding scale. For instance, if you died from natural causes within the first 6 months of your term life insurance policy, your beneficiaries may only receive a payment that consists of the premiums you have paid to date.

- The Term Life policy has no monetary value – it cannot be converted to investment plans.

- Term insurance is a risk management tool, so it cannot provide a hedge against inflation as Term Life comes with profit-free features

- Premium rates are only guaranteed until the end of the term

- As you grow older, you will be susceptible to several age-related health conditions. This might lead to an increase in your premium rates, or even a rejection to cover you

What Do Insurers Look at Before Approving My Term Life Insurance Policy?

Although it is easy to apply for a term life insurance policy, there are a few things that the insurers will take into consideration when it comes to approving or rejecting your insurance application or deciding the amount that is set as your premium.

- Your medical history (pre-existing conditions, surgery, and prescription medication)

- Your immediate family’s medical history

- Your occupation

- Lifestyle habits – (exercise, smoking, drinking, recreational drug use, frequent travel or high-risk hobbies)

On the other hand, AVOID doing the things listed below, as not only will it affect your insurance application but in some cases, you may even be convicted and subjected to heavy fines if found guilty. You may also risk having your insurance policy void and this will defeat the purpose of you getting insured.

- Mispresentation – making a false statement or providing misleading information

- Fraud – (i.e; faking death )

- Concealment of material facts – withholding information of material fact

Can I Boost My Term Life Insurance Coverage?

If you ever feel that your existing term life insurance coverage is not sufficient, do note that you cannot increase your sum assured, once you sign the contract as per the agreed conditions.

You may be thinking, why would I want to switch the sum assured for my policy? Well, what is going on in your life may play a part in influencing your coverage needs - such as marriage, home purchases, children and more.

In the situation that your life situation changes and you need a higher sum assured, you should consider purchasing a separate, additional term life policy.

Term Insurance Plans quote a premium taking into consideration all the relevant factors. Once set, the premiums do not change over the entire tenure of the plan. However, some plans offer an optional premium increase to mitigate inflation and increasing living cost.

Having said that, you may include add-on coverage (also known as ‘riders’) to further enhance your existing term life insurance policy. A rider serves as a cost-effective way for you to get protection and security so that you will have peace of mind in the situation that something unfortunate happens.

Here are the riders which you can opt to include in your term life insurance policy:

- Critical illness rider – policyholder will receive a lump sum if they are diagnosed with a critical illness specified in the insurance policy such as cancer, heart attack, stroke, kidney failure and others

- Waiver of premium rider – pays all the premiums due in the situation that the policyholder becomes disabled

- Accelerated Death Benefit rider – allows policyholder to receive cash advances against the death benefit in the situation that the policyholder is diagnosed with a terminal illness

- Accidental Death and Dismemberment rider – pays nominee an amount equal to the rider sum assured in case of an accidental death. It will also pay a percentage of the rider sum assured in the situation of dismemberment

- Guaranteed insurability rider – allows you to purchase insurance coverage at a later date without the need of a pre-requisite medical exam

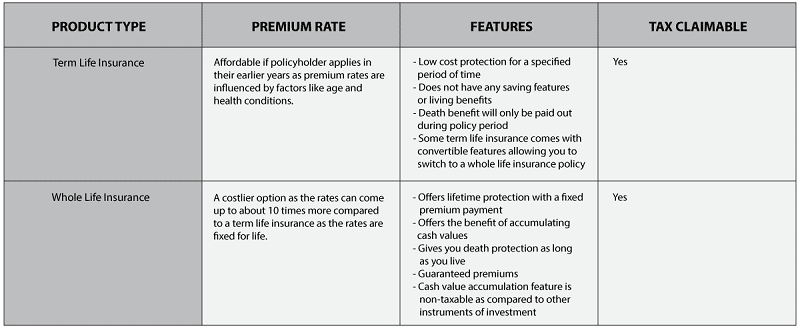

How is Term Life Different Compared to Whole Life Insurance?

In a nutshell, whole life insurance can be defined as a permanent life insurance product, that offers lifetime coverage (maximum coverage age of 80 - 100 years old, depending on the policy provider), meaning the policy is guaranteed for as long as you can pay the premiums.

Some whole life insurance plans come with additional riders, which normally result in a higher premium.

For a clearer understanding of the differences between term life insurance and whole life insurance, here are some of the things that you can use for comparison:

Example :

Adam has a whole life policy with a sum assured of RM100,000. He has paid his premiums regularly for the last 15 years, so his policy has accumulated a cash value of RM40,000. The cash value reflects an accumulation of Adam’s premiums after allowances for company expenses and claims.

At this point, he can choose to surrender his policy and get a lump sum payment which is to the cash value of the policy.

If Adam does not surrender his policy and suddenly passes away, his beneficiaries will receive the sum assured of RM100,000.

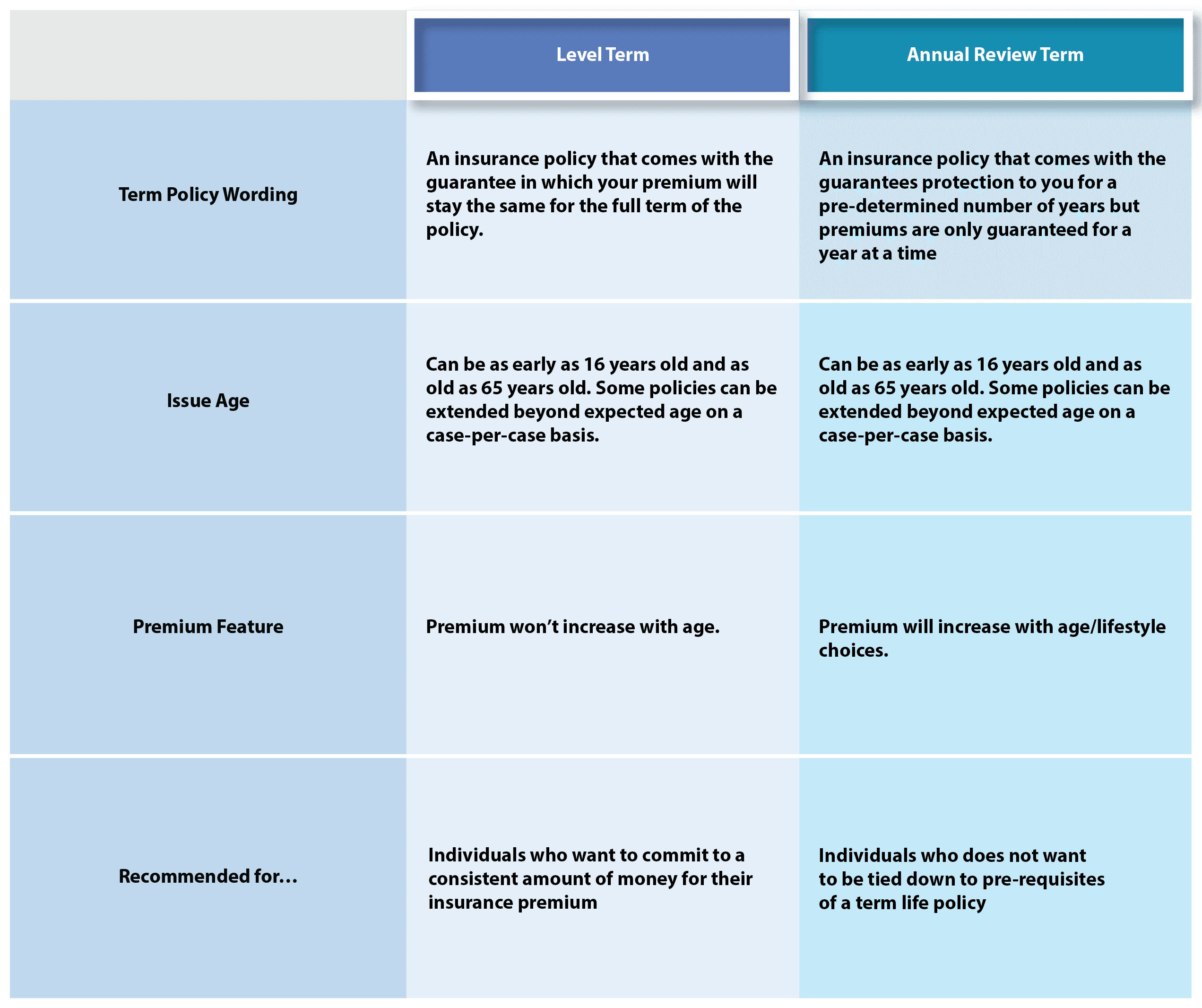

What is The Difference Between Level Term Insurance and Annual Renewable Insurance?

Thinking about choosing term life policy to safeguard your family needs but unsure as to whether you should opt for a ‘level term policy’ or ‘annual renewable term policy’? Well, here’s what you need to know about the types of term life insurance available. Here's a table to help you under

Example

John is looking for a term life insurance policy to protect his family. He would like to be covered for at least the next 20 years. After comparing between different term life products, he opts for a level term life insurance. In this situation, his premium is fixed at RM80 per month for a 10 year policy with no increase in rates on an annual basis.

On the other hand, if he opts for an annual renewable term insurance, his policy may be subjected to changes in premium, depending on his age upon the maturity of the policy that he holds.

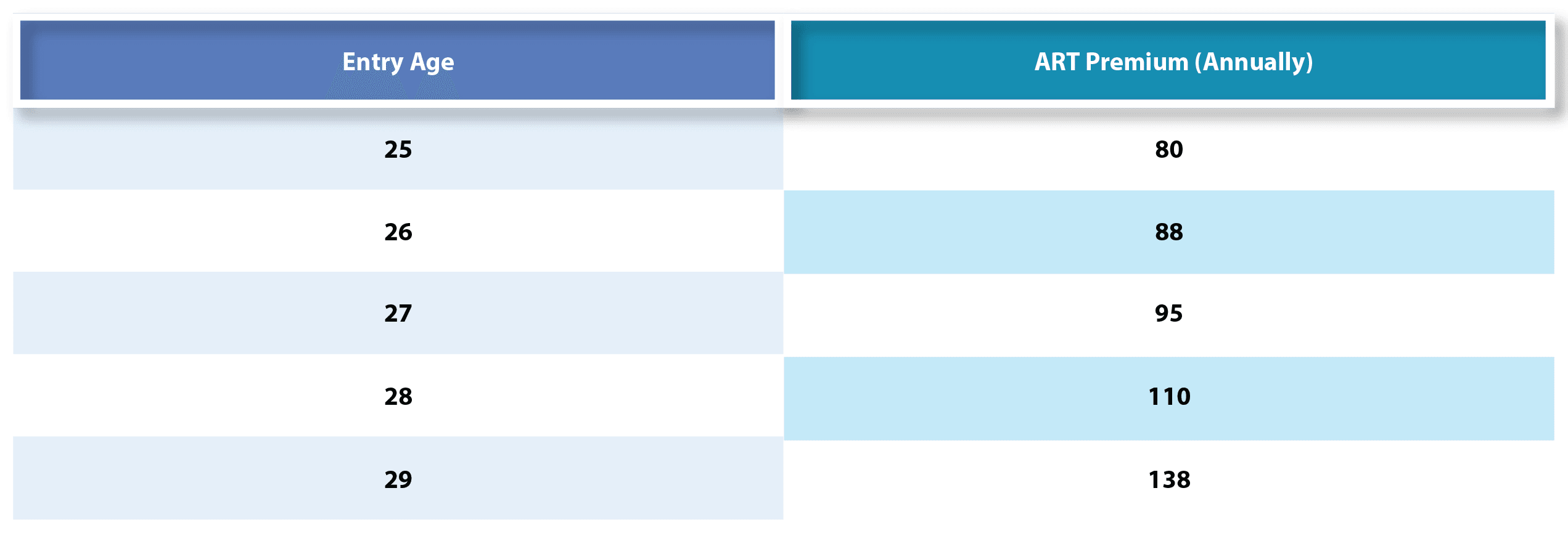

Here's a table to understand how annual renewable term insurance works :

For illustration purposes

In the situation that John chooses to take up annual renewable term insurance, his premium will be determined differently by his insurers. Depending on the coverage and policy type, he might end up paying more after the maturity of his policy. However, he can choose to let the policy lapse should he feel that he does not require insurance coverage anymore.

What about Annuities? How is it Different from Term Life Insurance?

Having done your research on insurance coverage, you may have come across another plan called annuity, which is another form of long-term investment offered by insurers. Perhaps you may have thought, hang on, is it okay for me to go for an annuity instead?

On the surface, there is not much difference between both plans – a monthly premium payment is expected, guaranteed payment to the beneficiary after the policy holder’s death ensures that your family’s financial expenses are taken care of plus it’s tax-deductible too.

But that’s where the similarities end. To put it simply:

Annuity – A financial investment product offered by the insurer to you (i.e; annuitant) that is designed to provide you a stream of income in your golden years. Generally, annuities act as a form of savings which you can withdraw during your retirement. Compared to term life insurance, it serves to protect the economic well-being of your loved ones in case anything happens to you as the policyholder.

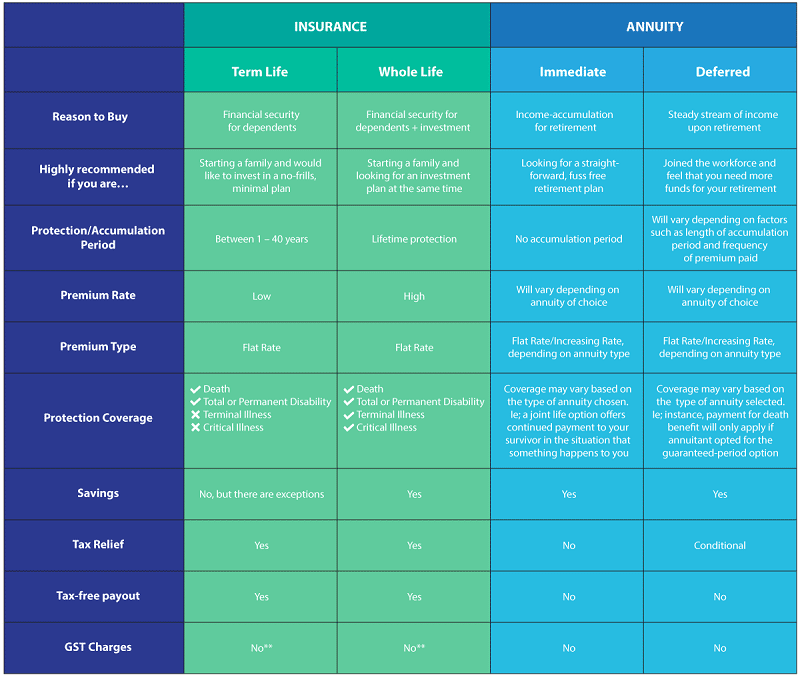

For a more comprehensive look at how annuities work as opposed to life insurance, here’s a comparison table that highlights the differences between all 4 products.

*** Non-life riders, as well as fees and charges imposed on the policy, will be subjected to GST.

** Protection coverage may vary between whole life policies

What is the Minimum Contract Duration of Term Life?

Usually, the minimum contract duration is five years. However, it is advisable to go for more than five years only, as the premium after those five years will become much more expensive, as you get older.

So it's better to go for a ten or even twenty years plan right away.

Is the Premium for Terms Plan Same For Everyone?

Of course not!

Premiums for an insurance plan primarily depend on the age of an individual. Even individuals of the same age might be charged a different premium because the premium is calculated on various parameters.

Some of those parameters include the following:

• The coverage and term – the level of coverage and the plan tenure chosen, affect the premium. The higher the sum insured, the higher the premium.

• The insured’s medical and family history – prevalence of a medical ailment increases the risk and increases the premium

• Lifestyle habits – participation in hazardous activities, smoking and drinking increase risk and hence the premiums are higher

What Happens If I Discontinue Paying the Premiums?

You should ideally pay all the premiums due in your term plan on time. If premiums are due beyond the due date, a grace period is normally allowed for paying the premiums.

If the premium is not paid even in the grace period, the policy would lapse. A lapsed policy has reduced benefits called the paid-up Value.

In a lapsed policy, the Sum Assured would be reduced in proportion to the premiums you actually paid against the total premiums payable.

This reduced cover would defeat the whole purpose of a term plan and so, paying the premium is always advised.

How Can I File A Claim on Term-Life Insurance?

Losing a loved one is one of the most difficult life events we ever have to face.

At this emotional time of grief and remembrance, financial and legal issues must also be addressed.

Below is a list of documents which are usually required by the insurer to file for a term life insurance claim, such as:

Original Insurance Agreement

Death Claim Form from insurer

Statement by Physician

Certified copy of Death Certificate

Certified copy of Policyholder’s NRIC

Certified copy of Claimant’s NRIC

Certified copy of Marriage or Birth Certificate for proof of relationship

Certified copy of Police Report for accident and suicide cases

Certified copy of Post Mortem Report if applicable

Consent Letter for Medical Report Release if applicable

Newspaper Cutting of Obituary or news report (if any

Burial Permit (if any)

Other supporting documents (if any)

Documents for Total and Permanent Disability (TPD)

Original Insurance Agreement

TPD Claim Forms to be filled by Claimant

TPD Claim Forms to be completed by physician

Certified copy of Policyholder’s NRIC

Certified copy of Claimant’s NRIC

Termination letter / Medical Board Out letter

Photograph of Dismemberment if applicable

Newspaper Cutting of Obituary or news report (if any)

Other supporting documents (if any)

Does the Payout Stay the Same No matter When I Die?

It is dependent on the life insurance policy you buy. If you buy level term insurance, then the payout is the same whether you die in year one or the 25th year.

A cheaper alternative is ‘decreasing term insurance’, where the payout gradually becomes smaller over the years. If for example, you choose a decreasing level policy, then it is often linked to a repayment mortgage because the amount you owe the lender also decreases over time.

Another option is ‘family income benefit’, which pays an income much like a monthly salary rather than a lump sum, from the time of the claim until the end of the term. This is even cheaper than a level or decreasing term insurance because the amount being paid out by the insurer is expected to be less overall.

Can I Buy Term Life for Someone Else?

Many couples take out joint life insurance, due to convenience and the fact it is normally cheaper.

It is worth noting though, that joint life insurance only pays out once (at the first death), and leaves the surviving partner without insurance.

It is then more than likely that when the survivor wishes to take out new insurance, the premiums will be expensive because the person will be older and/or in a worse state of health.

Why Do I Need to Declare if I Smoke?

All insurance proposal forms ask you whether you are a smoker. This is true for both life as well as medical insurance.

Based on the information you provide, the insurer decides the type of risk your account has, and they do underwriting math accordingly. Meaning, it's likely that you pay 10-15% more as a smoker.

Most importantly, you don't want to lie about it.

If the insurer finds out later that you have lied about your smoking habit and you die due to lung cancer or any related disease, there is a good possibility that the claim would be rejected.

Since the sum insured normally is very large, you should be double sure that you don't provide misleading information on the form. It will only backfire on your family you leave behind, as they might not see any money.

What Happens If I Provide Wrong Information?

That depends on the kind of information, that you got wrong. If it's something like address details, never mind. Those can easily be changed at any time.

What you really want to avoid, is to provide wrong information during the application process.

Any facts that are relevant to determine your premium, such as your medical history or whether you are a smoker. Worst case, you won't be covered and the insurer will reject your claim. So it's really not worth lying.

Term life Insurance Glossary

Not all of us are insurance underwriters. There’s a lot of fine print that goes into your insurance policy; the worst time to ask questions is after you’ve signed the paperwork!

Educate yourself on life insurance terminology with our glossary below:

Riders

Most term life insurance policies will only provide protection benefits for death and total permanent disability (TPD). If you’re looking for additional coverage, do check if your insurer has the option of add-on riders.

Riders allow you to customize your policy’s coverage to fit your needs. For example, if you’re looking for coverage benefits for hospitalisation and critical illness, do opt for a term life plan which offers the option for a medical card rider.

Sum assured

When an event which triggers the payment of benefits occurs, the insurer will usually make a lump sum payment to the beneficiaries of the policy or the next of kin. This payment is called the sum assured.

The amount may vary depending on the coverage of the policy and the attached riders. Some policies offer higher benefits for death and TPD due to accidents or travel using public conveyance.

Premiums

Premiums are the payment, or one of the periodical payments, a policyholder agrees to make for an insurance policy. The premium rates for your term life policy will be determined based on various factors, such as your age, sex, health, occupation and your lifestyle habits such as smoking and drinking.

A major plus when getting a term life policy is flat rate premiums. Otherwise known as level premiums, your premium rates will stay the same throughout the duration of your policy, so you won’t have to worry about increases in costs.

Depending on your policy you may be given the option of monthly, quarterly, semi-annually, annual or lump sum payments.

Policy period

Term life insurance always comes in a variety of packages, with wide coverage period anywhere between 5 to 20 years.

Short-term policies such as 5-year plans can usually be renewed once they expire. But since age is a factor in calculating your premiums, don’t be surprised if the premiums increase when you try to renew your policy.

Not all term life policies are renewable. If so, you’ll want to check if the policy can be converted to a permanent plan if you’re planning to extend your coverage after your policy expires.

Cash value

The cash value reflects an accumulation of your premiums after allowances for company expenses and claims. When you choose to surrender your policy and get a lump sum payment, it will only be the cash value of the policy. Usually, it takes a few years before you start to see the cash value grow, as your policy will increase in cash value over time.

Beneficiaries

Beneficiaries are the individuals - such as family members - that you nominate to receive the benefits from your policy.____ No-claim bonuses, refunds & loyalty benefits

The popular conception of term life insurance is that unless something happens to you, there are little to no actual benefits to getting a policy. In our opinion, that’s good because it means you’re still alive.

However, some insurers have taken the extra step by offering a no claim bonus. It can take the form of a refund of your premiums, in full or partial; or it can be a discount on your premiums if you decide to renew your term life policy as a loyalty benefit.

You will have to pay higher premiums, compared to a term life policy which does not have this feature, but you might save a lot more cash in the long run.

Age restrictions

There are benefits of getting a term life policy early. Your premiums will be much lower compared to when you sign up for a policy when you’re older and with higher health risks.

You’ll want to take note of the age restrictions of your term life policy before you sign up. Most plans are catered to adults, which mean there is usually a minimum age entry at about 18 years of age.

All term life policies will have a maximum age and an expiry age. The maximum age is the age limit for new customers to sign up for a policy. The expiry age on the other hand is the age coverage limit for a policy, or simply when it’ll expire.

Late premium payments

Life insurance is a contract between the insurer and you. To qualify for the benefits guaranteed by the policy, you’ll need to fulfil your obligation by paying your premiums regularly and on time.

Insurers will issue a notice if you do not pay your premiums. Your policy and coverage will be terminated if you default on your payments for more than 30 days. For term life policies with a saving plan attached, the insurer will deduct the premium payments that you owe from its cash value.

Tax relief

For individuals in the tax bracket, you can claim tax relief of up to RM6,000 from life insurance premiums. Tax relief lowers your deductible annual income to reduce the amount of taxes which you’ll have to pay.

Your filings for tax relief from life insurance premiums will be subject to approval from the Inland Revenue Board of Malaysia (LHDN), so remember to keep the receipts of all your premium payments.

How do I Apply for Term Life Insurance?

Selecting the right term life insurance can be tough. The most common method in Malaysia is a face to face conversation between you and an insurance agent.

This approach is can be quite personal, in particular, if the agent is a friend or any other person you trust, but you will need to set aside time to make an appointment which is not exactly the most convenient method if you are always on the move.

Alternatively, you can go a purely digital path and apply online via RinggitPlus or some insurers websites.

In general, and online application is very straight-forward and fast. You need to answer a few key questions and the premium calculator will be able to let you know your individual offer details.

Upon agreeing to the quotation given, you will be asked to answer a few additional and more detailed questions about your medical history. And that’s it – your application is on its way.

For a comprehensive list of term life insurance products available in Malaysia, you may want to check our website to discover what we have to offer.