Do I need a Whole Life Insurance policy?

According to the Life Insurance Association of Malaysia (LIAM), only 54% of Malaysians have life insurance protection, while approximately half of the Malaysian population is not insured for unpredictable life events.

In an unfortunate event of death or disability of the breadwinner, LIAM stated that the 2018

sum assured per capita of RM46,610 is too low to support the livelihood of one family member.

(A sum assured is the minimum payout that the policyholder will receive should he/she passes away).

The amount that is actually needed to sustain your loved ones is more than two folds. Based on the 2012/2013 Underinsurance Study in Malaysia conducted by LIAM with University Kebangsaan Malaysia, it is noted that the average

mortality gap for each family member is at about RM100,000 to RM150,000.

(The mortality gap is the difference between the sum assured amount and the actual amount needed to sustain surviving loved ones).

The financial burden is greater on your family members when there are pending housing loan, car loan and credit card commitments upon your demise or when you are disabled without an income.

Clearly, financially protecting your loved ones in your absence or in the absence of main income with life insurance plan is absolutely necessary.

How does whole life insurance work?

Whole life plan essentially offers a life-long protection where a lump sum amount will be paid to your beneficiaries when you pass away or if you suffer a total permanent disability (TPD).

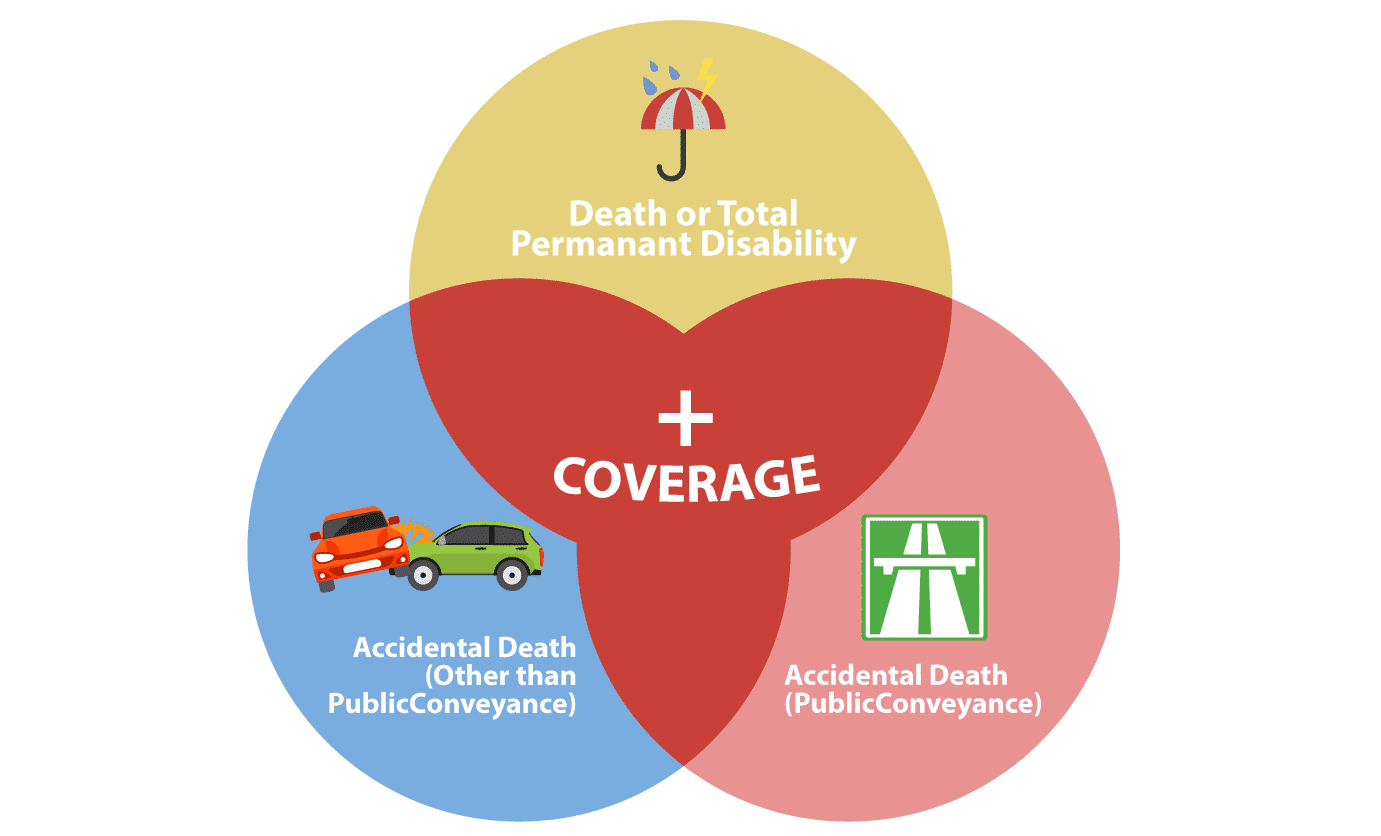

Lifetime Protection: Death & Total Permanent Disability

Types of Death and Total Permanent Disability coverage (Only either one below will be payable):

- Death or Total Permanent Disability

- Accidental Death by Public Conveyance (Public Transportation such as taxi, bus and train)

- Accidental Death due to injury from accident other than by public conveyance

- Whole life policies as a category is pretty tricky due to the inclusion of the investment element. This is why it is important to understand what you’re really paying into. So put on your seat belts and let’s set out into the world of whole life insurance.

It’s all about accumulating Cash Value

Cash value is a savings portion of a whole life plan generated from an overpayment of premiums.

Premiums are paid regularly in a fixed amount to keep your policy active. A portion of the premium will also be used to partly fund the cost of insurance .

Cash value grows at the beginning of your policy years because the cost of insurance is lower when you are younger. As a result, you are overpaying your premium right from the start to build your cash value.

The cost of insurance, however, increases over time because it costs more to insure you as you age. Hence, the cost of insurance will eventually become higher than your premiums.

This leads to a part where your cash value which you’ve built up in the early years is paying the difference without having to adjust premium amount.

The best part of a whole life insurance policy is that the premium amount is guaranteed throughout the policy term. Even if you fall gravely ill later in life, premium stays the same as long as your policy is still in force (by paying your premiums).

It’s wise to get a life insurance at a younger age to start building your cash value.

Participating, Non-Participating and Investment Linked Policies

There are 3 types of policies you will find in the life insurance market:

1. Whole Life Participating

Participating policy is an insurance plan with investment feature.

This plan usually comes with the highest premium payable, which resulting to the highest overpayment that leads to high guaranteed Cash Value.

The accumulated Cash Value can be borrowed against or withdrawn at any time throughout the policy term.

You must be wondering where is the investment part of it?

Well, the Cash Value will be invested in a fund where policyholders (you) participate in earning bonuses or dividends every year, on top of your current cash value. This is also known as “participating funds”.

In terms of investment risks, it is solely borne by the insurer as funds are managed by the insurance company.

|

TOTAL Cash Value = Current Cash Value + Bonuses + Dividends |

2. Whole Life Non-Participating

Also known as endowment or savings plan, premiums are payable until maturity of the plan or upon policy termination, whichever occurs first.

Any increase in coverage would increase premium amount, however premium rates are guaranteed and remained the same throughout.

Non-participating whole life policies also accumulates guaranteed

Cash Value from overpayment of premiums in the beginning of policy years.

What sets non-participating policy apart is the absence of bonuses or dividends from the cash value invested by the insurance company.

|

TOTAL Cash Value = Current Cash Value |

Without bonuses or dividends, cash value will increase at a slower rate as compared to participating whole life insurance.

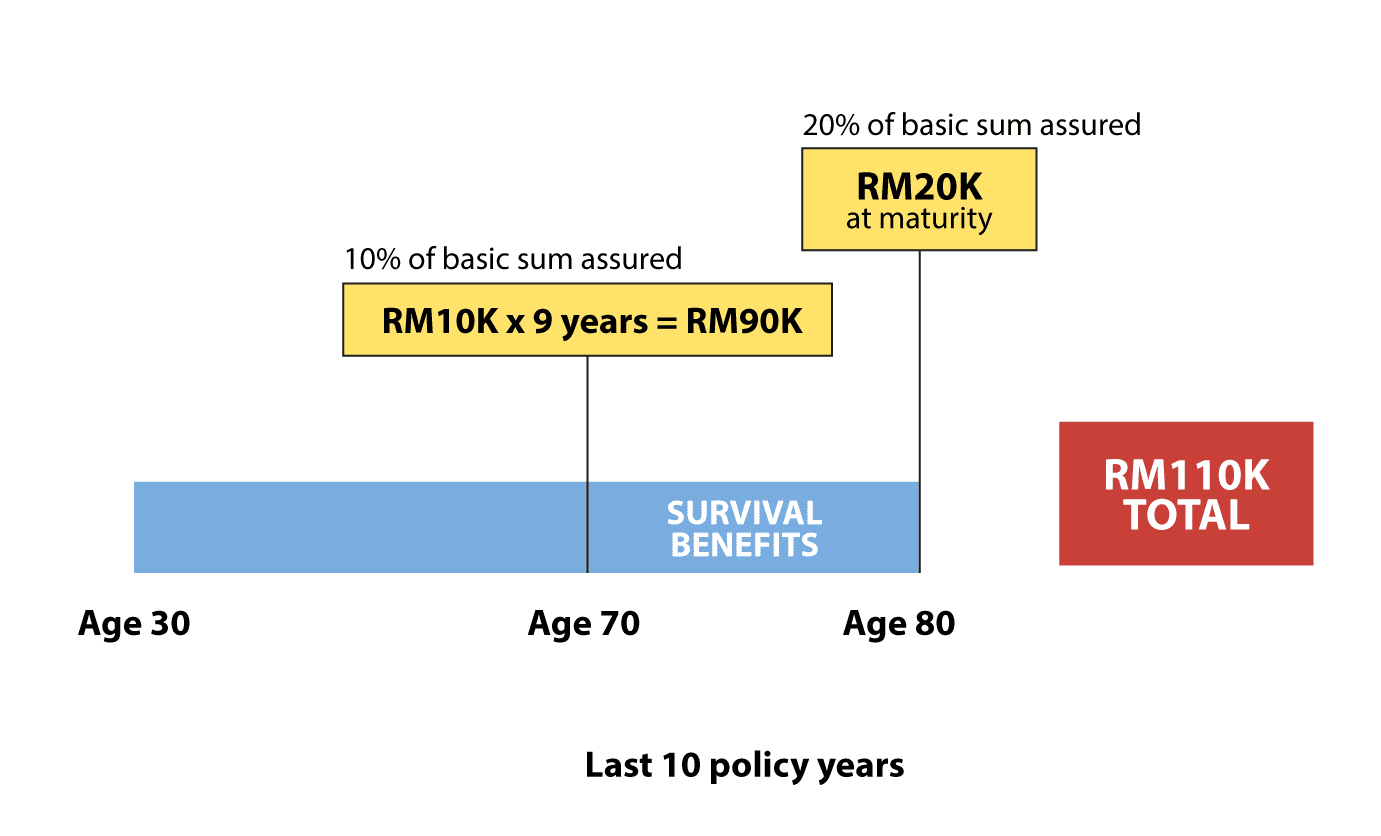

However, insurance providers would package the policy with maturity benefits for greater savings.

Great Eastern Great 110 Legacy for example, gives you the option to withdraw the Survival Benefits of 10% every year for the last 10 policy years (until death or surrender) or you can choose to accumulate them for greater savings of 20% at maturity.

3. Investment Linked Policy

Not to be confused with a whole life participating policy, Investment Linked Policy is where your premium is invested into investment funds.

This means that the total Cash Value is entirely dependent on the Net Asset Value (value price of unit fund at policy termination or surrender) of your funds.

In other words, your Cash Value is not guaranteed and tied to the underlying performance of the funds.

|

TOTAL Cash Value = Net Asset Value |

Simply put, your monthly premiums are used to buy units in a fund which you will be holding on until you choose to redeem them (sell units off in return for cash, also known as Net Asset Value).

Now depending on the fund performance at the time you choose to redeem your units, you potentially earn higher returns as compared to non-participating life insurance or savings plan held for the same time period.

As you are dealing directly with the market via an agent, you have full control over your choice of investment funds to suit your investment goals and financial needs.

You have the flexibility to switch between sub-funds according to their performances. Therefore, investment risk is borne by you.

Whole Life Participating vs Investment Linked Policy

| Criteria | Whole Life Participating [Insurance with Investment] |

Investment Linked Policy [Investment with Insurance] |

| Cash Value | Guaranteed. Cash Value accumulated can be borrowed against or withdraw before death or total permanent disability. | Not guaranteed. Dependent on the Net Asset Value (the value of unit funds at the time of policy termination). |

| Premiums Payable | Fixed premiums but are higher as it lets you participate in the earnings of the insurer, in the form of dividends or bonus. Hence, premiums go into the insurer’s participating funds and managed by the insurer. | Flexibility in premiums to be invested in one or more sub-funds, each with its own investment goal. You also have the flexibility and control to switch between funds to suit your investment goals. |

| Earnings / Returns |

Dividends or bonus paid out from the performance of the insurer’s investment. Usually annually. Cash Value + Earnings |

Potentially higher returns as it is dependent on the performance of the sub-funds (higher Net Asset Value). Returns = Net Asset Value |

| Investment Risk | Insurers will bear the risk. | You will bear the investment risk. |

| Coverage | Guaranteed. High guaranteed Cash Value would ensure sufficient insurance coverage, even if the cost of insurance increases. | Insurance Coverage may reduce. Due to rising cost of insurance, unit funds may not be sufficient to pay for both coverage and investments. Top up of premium is required. |

Here’s an illustration to help you compare Whole Life Participating & Investment Linked Policies in Malaysia:

Jennifer is a 30-year-old businesswoman. She plans to purchase a life insurance plan that can give her long term savings but also grant her the flexibility to access cash in times of need.

| Criteria |

Allianz PrimeSaver |

|

| Type of Whole Life Insurance | Whole Life Participating | Investment Linked Policy |

| Premium Payment Terms |

Annual Premium

6, 10, 15 and 20 years |

Annual Premium, with the flexibility to top up whenever to maximise investment value. |

| Coverage Terms |

20 years

30 years |

20 years and maximum coverage up to the age of 100. |

| Coverage Type |

Non-accidental &

Accidental Death |

Total and Permanent Disability

Option to add rider |

| Allocated premium for Investment | Managed by insurer. |

Policy Year 1-3: 60%

Policy Year 4-6: 80% Policy Year 7-10: 95% Policy Year 11 & above: 100% |

|

Cash Payment (Earnings / Returns) |

Guaranteed, annually.

Payment percentage is set in a schedule, ranging from 10% - 60%. |

Not guaranteed.

Dependent on fund’s performance. |

| Maturity payout |

Guaranteed.

Inclusive of current cash value and additional bonus. |

Receive the remaining balance in account, inclusive of net asset value of funds. |

Which is the better whole life insurance plan?

Different policies serve different needs which essentially means understanding what your needs are and then comparing with the plans’ unique propositions.

Your financial portfolio should have a variety of financial instruments for an all rounded coverage.

Whether it is choosing a whole life participating plan, a non-participating plan or investment linked policy, it is imperative to decipher them in details.

Compare some of the best whole life insurance policies in Malaysia and apply now on RinggitPlus.

Top whole life insurance providers in Malaysia

- Great Eastern Life Insurance

- AIA Life Insurance

- Prudential Life Insurance

- Zurich Life Insurance

- Allianz Life Insurance

- Hong Leong Assurance Life Insurance

- Tokio Marine Life Insurance

- Gibraltar BSN Life Insurance