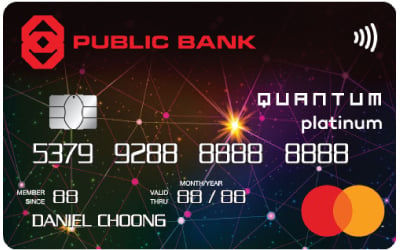

Shopping is the most celebrated activity in life. You can do it while taking advantage of cashback and rewards with a Public Bank Quantum MasterCard credit card.

Zero annual fees for life!

You must be thinking that there is a catch, right? But no! There is no hidden motive behind it.

Both principal and supplementary cardholders of Public Bank Quantum MasterCard can equally enjoy free-for-a-lifetime card usage without any conditions.

Say bye-bye to credit cards that charge you a steep annual fee and turn to Public Bank Quantum MasterCard to get more for your money.

Double the cards with Public Bank Quantum

More good news for those wishing to sign up for Public Bank Quantum MasterCard today as you will get a complimentary Public Bank Quantum Visa credit card upon approval. Isn't two better than one?

Not to mention, you can also enjoy a 2% cashback on contactless spending with the said Quantum Visa card! Combine the cashback you get with Quantum MasterCard, it's a cashback galore.

2% cash back on overseas transactions

Do you like the idea of getting back your money after spending it?

Well, the Public Bank Quantum MasterCard credit card gives you 2% cashback when you shop at least RM100 per transaction on overseas purchases.

Do you know that you can enjoy significant savings on your spending through a cash rebate, which is sort of a refund in a small percentage credited back into your credit card? All you need to do is spend, spend and spend!

For every Ringgit spent on the category, you earn 2% cashback, capped at RM20 per month.

| Highlights for Public Bank Quantum MasterCard | |

|

Highest cashback rate |

2% cashback with a minimum spend of RM100 |

|

Highest cashback amount |

RM20 per month |

|

Eligible spend to earn the highest cashback rate |

Overseas Transactions |

|

Eligible Cardholder(s) |

Principal and Supplementary |

Public Bank Quantum MasterCard VIP Points

Cashback alone is not enough to deem a credit card's uniqueness.

That's why Quantum MasterCard steps up its game with cashback and reward points features so that you can reap the benefits of this plastic card.

It's easy to collect VIP Points because, for every Ringgit spent on a local retail transaction, you earn 1 VIP Point!

Put simply, RM3,000 worth of spending gets you 3,000 VIP Points. Do note that your VIP Points will expire in three (3) years, so don't forget to redeem special gifts for yourself with the accumulated VIP Points!

Special 0% Flexi-Pay for 12 months

Free up your monthly expenses with a flexible instalment plan that charges you zero interest on your conversion amount.

Exclusively for Public Bank Quantum MasterCard credit cardholders, you get to enjoy a 1% one-time upfront interest for a 12-month flexi payment plan.

To convert the amount to the Public Bank Flexipay Plan, just make a minimum transaction of RM1,200, then call Customer Service at +603 2176 8000.

You can also write to [email protected] within three days after the purchase or five days before the settlement date to enrol.

Public Bank Quantum MasterCard contactless function

Your Public Bank Quantum card is equipped with contactless functionality, where you simply need to tap or wave your card on the contactless terminal reader when making a payment at the checkout.

- No signature or pin is required for the retail purchase of RM250 and below in Malaysia.

- The cumulative contactless transaction limit defaults to RM500.

- The cumulative contactless transaction limit will be reset automatically after performing a transaction with a PIN entry.

- To change the cumulative contactless transaction limit, or to turn off the contactless functionality, you may perform it via ATM / CRM or call the Public Bank Card Services Help Desk at 03-2176 8000.

24/7 Help Desk

If your credit card is stolen, tampered with or broken, there is a dedicated, round-the-clock Help Desk that is ready to assist you with any credit card-related emergencies.

Just dial +603 2176 8333 and the representative will assist you accordingly.

What documents are required to apply for PB Quantum MasterCard?

For Salaried Employee:

- Copy of your IC (front and back)/Passport

- Latest month's salary slip; and/or

- Latest EA statement; and/or

- Latest EPF statement; and/or

- Copy of Employment Letter/Employer Confirmation

For Self-Employed:

- Copy of your IC (front and back)/Passport

- Latest 1-year tax returns/tax receipts

- Latest Income Tax Return (Form B)

- Copies of Business Registration

- Latest 3 months' bank statement

- Latest 6 months' company CASA statement (for company directors)

- Copy of latest card statement

*Applicants who are self-employed but do not register for companies are required to fill up their names as the company name and indicate the nature of the business.

For Variable Income:

- Copy of your IC (front and back)/Passport

- The latest 6 months of the following:

- Overtime as reflected on the salary slips

- Commissions Statements/Vouchers

- Fee Statements/Vouchers

- The latest 3 years of the following:

- Dividend Statements/Vouchers

- Interest Statements/Vouchers

Other Income Sources:

- Tenancy Agreements and/or

- Pension Statements/Vouchers and/or

- Annuities Statements

Overseas Income:

- Latest 3 months' salary slips

- Latest 2 years Notice of Assessment/Form IR8A/Form IR8E (for Singapore only)

- Salary Deposits Account (reflecting the latest minimum 3 months of salary crediting - for Brunei only)

- Employment Letter

Any additional income documents may be required at the absolute discretion of the Public Bank.

Public Bank Quantum credit card limit and credit line

If you earn RM36,000 per annum or less, the maximum Public Bank Quantum MasterCard credit limit will be two times (2x) your monthly income.

If you have two or more cards with Public Bank, a total combined credit line will be offered to cover the use of all cards held by you (the principal) and your supplementary cardholders.

You can choose to have your supplementary cardholders nominated for a separate credit line from a minimum of RM1,000.

2% cashback for overseas transactions

2% cashback for overseas transactions