Everything You Need To Know about Critical Illness Insurance

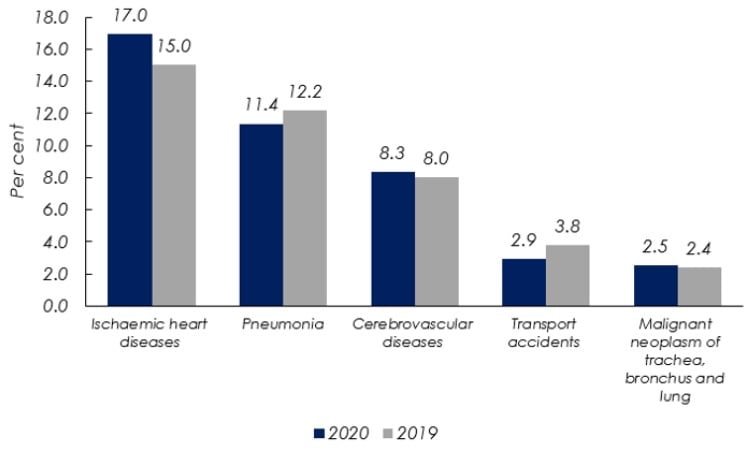

According to the Department of Statistics Malaysia, the top 3 principal causes of death for Malaysians in 2021 are Ischaemic Heart Diseases (17%), Pneumonia (11.4%), Cerebrovascular Diseases (8.3%), and Malignant Neoplasm of Trachea, Bronchus and Lung (2.5%).

If you look at it very closely, these 3 causes of death are illness-related, and the numbers keep going up year on year.

If that does not concern you yet, Heart Diseases don’t cherry pick its victims, it preys on EVERYONE. Here’s another scary fact: Indian ethnicity recorded the highest death due to this disease at 22.8%, followed by Bumiputera (16.6%) and Chinese (16%).

This article intends to spread awareness on the importance of critical planning. Keep on reading to learn more about the coverage, benefits, features, and all the terms and conditions you must know about critical illness insurance.

You can also compare and apply for the best critical illness insurance plan here on RinggitPlus.

What is a critical illness?

Critical illness can be defined as a condition, medical or natural, that is life-threatening to a person. In general, the insurance industry usually provides coverage for 36 critical illnesses, but there are a total of 42 critical illnesses aggregated such as follows:

1) Alzheimer's disease / severe dementia

2) Angioplasty and other invasive treatments for coronary artery disease

3) Apallic syndrome

4) Bacterial meningitis

5) Benign brain tumour

6) Blindness

7) Brain surgery

8) Cancer

9) Cardiomyopathy

10) Chronic aplastic anaemia

11) Coma

12) Coronary artery by-pass surgery

13) Deafness

14) Encephalitis

15) End-stage liver failure

16) End-stage lung disease

17) Full blown AIDS

18) Fulminant viral hepatitis

19) Heart attack

20) Heart-valve surgery

21) HIV infection due to blood transfusion

22) Kidney failure

23) Loss of independent existence

24) Loss of limbs

25) Loss of speech

26) Major head trauma

27) Major organ / bone marrow transplant

28) Medullary cystic disease

29) Motor neuron disease

30) Multiple sclerosis

31) Muscular dystrophy

32) Occupationally acquired HIV infection

33) Paralysis of limbs

34) Parkinson’s disease

35) Poliomyelitis

36) Primary pulmonary arterial hypertension

37) Serious coronary artery disease

38) Stroke

39) Surgery to aorta

40) Systemic lupus erythematosus with severe kidney complications

41) Terminal illness

42) Third degree burns

Notice that these critical illnesses are of medium to high severity because this insurance plan is meant to provide financial backup for the treatments after you are diagnosed with any of these illnesses.

The cost of critical illness treatment in Malaysia

It is a natural instinct to seek affordable medical treatment as we don’t want to burden our family members with debts.

While government hospitals offer cheaper medical treatment, private hospitals give you higher quality services with no waiting time.

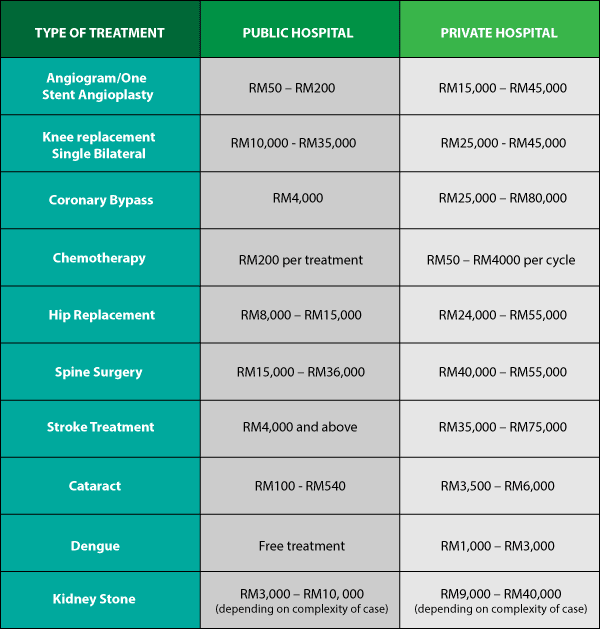

You have to factor in all treatment costs and expenses incurred for the critical illness you are diagnosed with because the price tag is different between public and private healthcare providers.

Here's a general idea of how much it costs for critical illness treatment between a public hospital and a private hospital:

For example, a Coronary Bypass surgery at a private hospital can cost you up to RM80,000, whereas a public hospital charges RM4,000.

A critical illness plan with a commensurate amount of sum assured can help you to focus on receiving the best medical treatment provided by our healthcare providers.

Why is critical illness planning necessary?

There are a number of direct and indirect causes of critical illness, ranging from personal lifestyle to social and environmental issues.

Late detection of a dreaded disease is a common phenomenon in Malaysia, with over 60% of patients discovered that they have been struck with the big C at Stage 3 or 4.

As the saying goes: prevention is better than cure. Despite being diagnosed with a critical illness, people who are at terminal stage do have a chance of survival between 6 to 12 months.

Overview of Critical Illness Insurance

This is an insurance plan that provides financial coverage for all medical costs and expenses to incur after you are diagnosed with a critical illness.

Unlike life insurance and medical card, critical illness insurance pays you out in lump sum upon claim so that you can focus on your treatment and recovery.

Anatomy of a critical illness insurance

It is impossible to understand the nature of this product when skimming marketing materials per se because the information is usually abridged and concise.

Albeit, these are the things that you should pay attention to in a critical illness plan:

Coverage

All critical illness insurance plans cover end-stage level of illness (see list of 42 critical illnesses above). The basic coverage can be as low as 5 to as high as 150 critical illnesses, depending on the underwriter's discretion.

There are products offering additional coverage such as personal accident, maternity covers, cosmetic surgery and many more.

Some additional coverage are packaged as options, which require a top-up on your basic premium.

Benefits

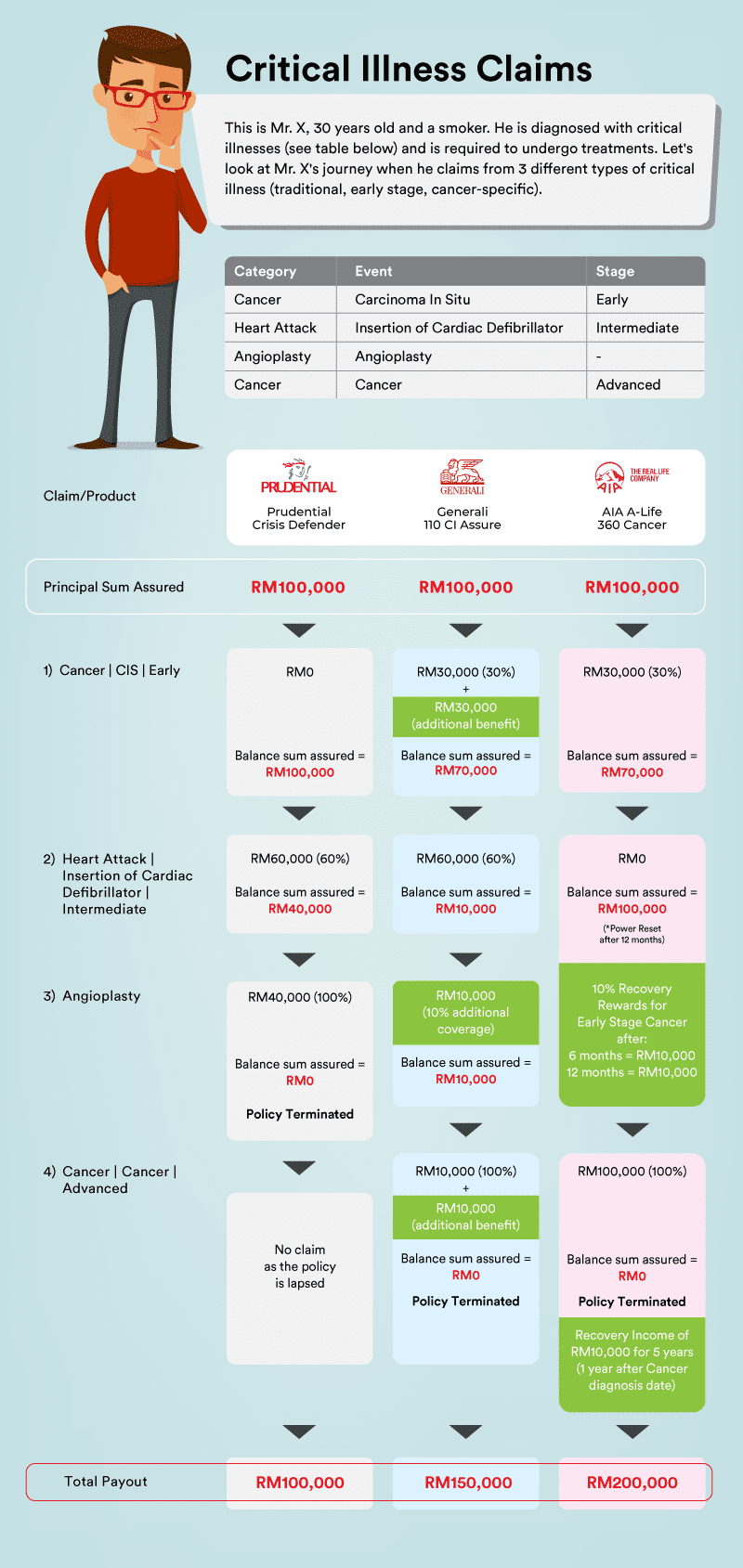

This section outlines the unique selling points of a critical illness insurance plan. Since you are aware of the type of critical illnesses covered, now you want to know how much you get paid back when you claim for any one of these events.

You will notice, in the table of benefits in every product brochure, of this information:

1) The number of plans with its increasing values of Sum Assured

This is the amount you are covered for in a critical illness insurance plan. The higher the basic sum assured, the higher will be the premium.

2) The percentage of payout per coverage

This is a portion of payout you will get from this insurance plan once you are diagnosed with a critical illness.

3) Additional payout

This is a portion of payout on top of your basic sum assured you will get from this insurance plan once you are diagnosed with a specific critical illness as per outlined by the insurer.

4) Other benefits

This is additional benefits you will get from this insurance plan, e.g. No Claim Bonus of 10% up to 5 years, or Second Medical Opinion etc.

Features

Features are the provisions of a critical illness plan. These are the crucial provisions that you must pay attention to when buying a critical illness insurance plan:

1) Waiting period

This is a period you must observe after commencement of the policy. You are not allowed to make a claim in this period, which will be rejected by the insurer.

A standard market practice suggests a 30-day waiting period for 36 critical illnesses, whereas up to 90 days for special critical illness. The best part is, there are products offering zero waiting period after policy commencement and in between claims.

2) Survival period

This is a period you must survive before making a claim for a critical illness which you have been diagnosed with.

Subject to product terms and conditions, the beneficiary may or may not get back the sum assured if the life assured did not survive this period.

3) Premium rate

Depending on your critical illness insurance plan, the premium rate is either guaranteed or non-guaranteed.

For a term plan, the premium is guaranteed at policy entry age and will increase according to the relevant age band.

The insurer has the right to revise your premium rate as they deem fit and must notify you within 90 days of revision.

Types of critical illness insurance plan

People have unique preferences when it comes to financial planning. By understanding the type of critical illness plan, you can make the right purchase.

Essentially, there are 2 variants of critical illness insurance:

1) Term policy

This is the most traditional insurance plan that is claimable upon diagnosis of any one of the critical illnesses. The coverage term is usually shorter and will terminate once claim is made.

2) Investment-linked policy

This is a rider plan that is attached to your investment-linked policy. Upon diagnosis of any one of the critical illnesses, you will be paid a lump sum under this rider, while the main policy remains in force.

Over time, the value of the policy will grow as it is used for investments and to cover insurance costs.

How many times can I claim under critical illness insurance plan?

You have reached the trickiest part of this insurance plan. The claiming process of a critical illness is very straightforward, but the conditions are not. Let’s take a look at the details:

1) Single claim

This type of claim is prevalent in most traditional critical illness plans. You are entitled to make a single critical illness claim upon diagnosis, which then will render the policy to terminate.

2) Multiple claims

a. Normally 2 to 3 times per occurrence

b. Must not be a recurrence of the same illness or severity

3) Multiple claims of same illness

You can make multiple claims of the same illness, provided that the plan covers for that critical illness you are diagnosed with, and you have a medical history of that illness.

You can have more than one critical illness plans that meet your budget and needs. If you need a more comprehensive coverage, compare and apply for the best early stage critical illness plans.

If you are a woman and have concerns for your female health, head over to our best female critical illness plans.

The total payout from your critical illness plan can be used for not only covering your treatment cost, but also other charges incurred during your hospital stay.

If you want to have extra financial backup to cover for your hospitalization expenses, you can check out our best medical card insurance plans. Compare and apply now on RinggitPlus!