Why do I need an Early Stage Critical Illness Insurance Plan?

In Malaysia, cancer is the 4th leading cause of death where almost 60% of patients only discovered their plight at a later stage.

Fortunately, technology advancements have made early detection of dreaded diseases easier, which in turns, increases the survival rate.

Generally, all basic critical illness insurance plans only pay you out when the illness has reached advanced stage. To compensate this problem, the insurance industry has introduced an early stage critical illness plan.

What is an early stage critical illness plan?

An early stage plan is usually packaged as a complementary to your basic critical illness insurance plan. This plan is designed to provide financial protection in light of an early detection.

When you make a claim upon an early stage diagnosis, your policy will remain in force, but the basic sum assured will be reduced after deducting a portion of payout under this event.

If you bought a basic critical illness plan that does not offer an early stage payout, you will have to wait for the illness to develop to advanced stage to receive your total payout.

Is it important to buy a plan with early stage payout?

When an insured person is down with an illness, he or she has to consider other indirect costs that occurred during the course of illness.

A loss of income, for example, can happen as the insured person is unfit for work and must undergo intensive treatment.

A survey conducted by The Debt Management and Counselling Agency (AKPK) shows that many Malaysians do not set aside money for medical emergencies.

Along with an inflation on medical costs at 12% every year, almost 45% of cancer patients face financial problems within 12 months after diagnosis (Source: The Star).

This is where early stage critical illness plan comes to the rescue: a financial relief to get back on your feet without having to peek into your savings.

Plus, there is always a good chance of full recovery when a dreaded disease is detected at an early stage.

What is covered under this early stage plan?

The diseases covered under an early stage critical illness plan is the same as the basic plan (36 critical illness), but with payout benefit that is tiered to a low level of severity.

Common illnesses such as heart disease, cancer, stroke and many more have different level of severity or event. See table below for example:

| Category | Early Stage | End Stage |

| Coronary Artery Disease | Early Coronary Artery Disease | Coronary Artery By-Pass Surgery |

| Cancer | Carcinoma In Situ | Cancer |

| Heart Attack | Insertion of Cardiac Pacemaker | Heart Attack |

| Stroke | Brain Aneurysm | Stroke |

So, a small percentage of sum assured will be allocated to cover for an early stage diagnosis. This portion of payout will effectively reduce the total sum assured of your basic critical illness plan.

How does the early stage payout work?

The payout of a an early stage claim will be deducted from your basic sum assured. If the basic sum assured is RM100,000, it means that you are covered for up to that amount.

When you make a first claim of 30% under an early stage event, you will receive a benefit of RM30,000, which then will reduce your basic sum assured to RM70,000.

The balance of sum assured can be used for other critical illness claim, and the policy will terminate once the balance is fully claimed.

Depending on the severity of the illness, a single claim can deplete the basic sum assured, thus rendered the policy to lapse effectively.

Early stage critical illness payout structure

A critical illness plan with an early stage payout has 2 tiers of benefit: Early Stage Benefit and End Stage Benefit (reduced amount).

It is important to note that insurance providers don't pay out 100% of sum assured on your early stage claim. See table below for an example:

| Zurich Early Care Critical Illness | AXA AFFIN 110 CI Care | |

| Basic Sum Assured | RM100,000 | RM100,000 |

| Early Stage payout |

50% of sum assured upon diagnosis

= RM50,000 |

30% of sum assured upon diagnosis

= RM30,000 |

| End Stage payout |

100% upon diagnosis

= RM50,000 (reduced amount) |

100% upon diagnosis

= RM70,000 (reduced amount) |

| Type of CI | Rider | Rider |

In the event an early stage claim is being made under AXA Affin 110 CI Care Early Stage, a one-time benefit of 30% will be payable to the insured person, reducing the basic sum assured to RM70,000.

When a subsequent claim is made, the insured person will receive 100% of the end stage payout, which is the reduced amount of basic sum assured after deducting early stage claim.

Cancer-specific critical illness payout structure

For critical illness plans that are designated for Cancer, the payout structure will also consist of Early Stage and End Stage benefits, but are categorized further by types of cancer: Generic Cancer and Gender Specific Cancer.

| AXA AFFIN SmartCancer Cash | Citibank CancerCare | |

|

Early Stage payout: Generic Cancer Gender Specific Cancer |

30% of sum assured, one-off 30% of sum assured, one-off |

30% of sum assured, one-off Nil |

|

End Stage payout: Generic Cancer Gender Specific Cancer |

(reduced amount)

100% upon diagnosis up to 200% upon diagnosis |

(reduced amount)

100% upon diagnosis up to 200% upon diagnosis |

|

Power Reset

|

No | Yes |

The table above highlights two types of cancer covered and the benefits that can be claimed from this critical illness plan.

While Citibank CancerCare does not cover Gender Specific Cancer at early stage, it does pay up to 200% of sum assured for advanced stage cancer of the same category.

This critical illness plan is also equipped with a Power Reset function, which resets the balance sum assured back to 100% after 12 months from the diagnosis date of early stage Generic Cancer.

What is Gender Specific Cancer?

It is a cancer that affects one group of gender's specific organ. This type of cancer is specific to that Insured Person's gender only.

| Female Specific Cancer | Male Specific Cancer |

|

Breast Cancer

Fallopian Tubes Cancer Ovarian Cancer Cervical Cancer Uterus Cancer Vagina / Vulva Cancer |

Testicular Cancer

Penile Cancer Prostate Cancer |

What if a critical illness recurs?

Chances for a critical illness to recur after an early detection and treatment is very likely. With that in mind, insurance providers are now introducing plans with multiple claims for the same critical illness of different stages.

Here's an illustration on how Same Critical Illness Category claim would look like:

Sum Assured: RM100,000

- Early Stage: 30% of Sum Assured

- Intermediate Stage: 60% of Sum Assured

| Claim |

Critical Illness Category

|

Critical Illness Event |

Critical Illness Stage

|

Benefit Payable | Balance Sum Assured |

| 1st Claim | Coronary Artery Disease | Early Coronary Artery Disease | Early |

RM30,000

(RM100,000 * 30%) |

RM70,000 |

| 2nd Claim | Coronary Artery Disease | Minimally Invasive Direct Coronary Artery Bypass Grafting | Intermediate |

RM30,000

(RM100,000 * 60% - RM30,000) |

RM40,000 |

| 3rd Claim | Coronary Artery Disease | Other Coronary Artery Disease | Intermediate | Not Payable^ | RM40,000 |

| 4th Claim | Heart Attack | Insertion of Cardiac Defibrillator | Intermediate |

RM40,000

|

Policy Terminates |

^Subsequent claim that is under the same critical illness category with same or lower critical illness stage as previous claim will not qualify for payable benefit.

In other words, same critical illness category claim can be done only when it's at a higher level of severity or critical illness stage.

Are there any other additional benefits under Early Stage plan?

Some insurance providers go extra miles to provide the best critical illness insurance plans by offering additional benefits that will be paid on top of the basic sum assured.

It is also worth noting that these additional benefits do not reduce the basic sum assured. See table below for some examples:

| Additional benefit / Product | Zurich Early Care CI | AXA Affin 110 CI Care | Allianz Prime Care (Plus) |

| Angioplasty & Other Invasive Treatments for Coronary Artery Disease | up to 10% or max RM25,000 | Additional 10% of sum assured | up to 15% or RM30,000 (whichever is lower) |

| Diabetes Benefit | nil | Additional 10% of sum assured | Additional 20% of sum assured |

| Cancer Benefit | nil | Double payout |

Early stage: Additional 30% of 35%

End stage: remaining 35% |

| Catastrophic Benefit | nil | nil | 20% of sum assured |

| Rehabilitation Benefit | 12% per year (monthly repayment) | nil | nil |

| Second Medical Opinion | RM2,000 lump sum one-off payment | RM200 per visit up to max 10 visits per lifetime | nil |

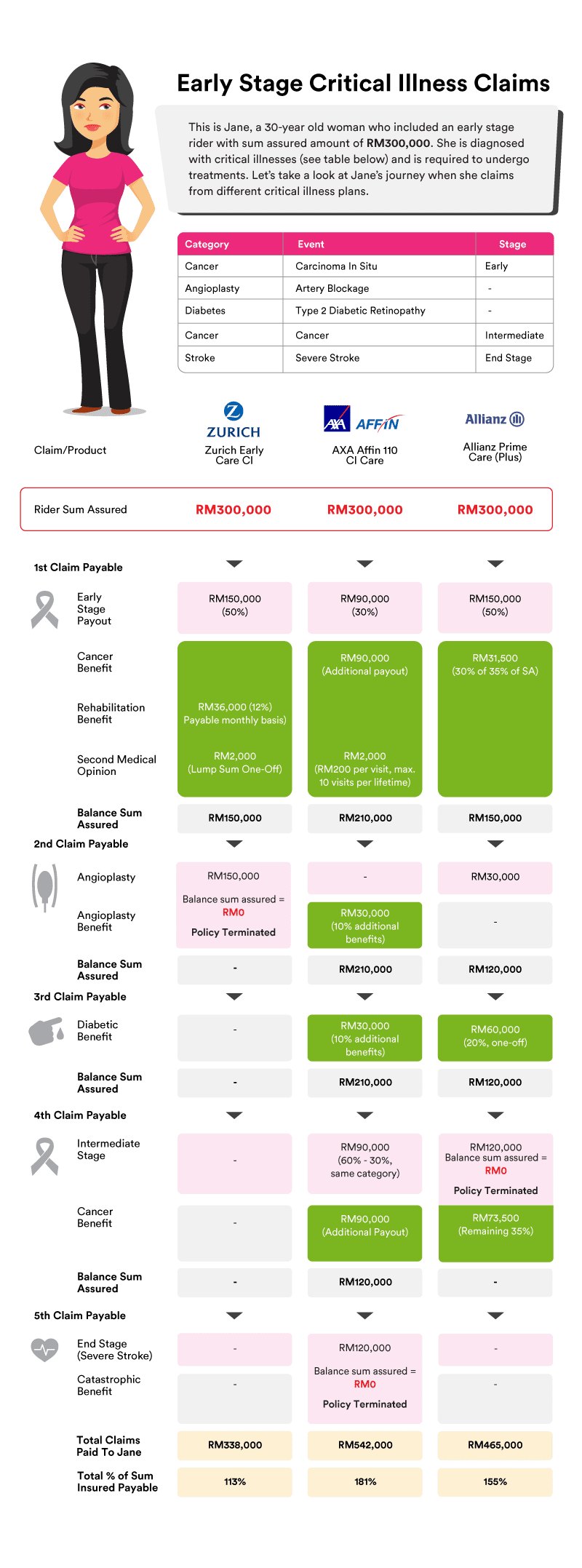

An Illustration: Early Stage Benefits & End Stage Critical Illness Claims

|

Summary of Benefits for Jane: |

||

|---|---|---|

| Zurich Early Care CI | AXA Affin 110 CI Care | Allianz Prime Care (Plus) |

|

A comprehensive Early Stage benefit which includes Rehabilitation and Second Medical Opinion benefit.

For a basic early stage rider, this is sufficient on top of a Medical or Life plan. |

Highest claim % of Sum Insured Payable due to Additional Payout for Cancer benefit.

If Cancer runs in Jane's family and it worries her, then this would be best for her. |

Competitive claim % of Sum Insured Payable due to various CI benefits offered.

Get this plan for a well-rounded coverage. |

Compare and Apply Early Stage Critical Illness Insurance Online

An Early Stage insurance plan should not be viewed as a substitute for a life insurance plan. It is ideal for those who identify the risk of Early Stage illnesses and the costs associated. If you do get an early stage plan, remember to get regular check-ups to utilize the use of Early Stage benefits attached.

The plan should be purchased in addition to a basic Medical Insurance or Term Life Insurance (if Early Stage is not included).

Compare and apply for the Best Early Stage Critical Illness Insurance now!