Standalone Medical Card: A cheaper option for super savers

We often read and hear about the importance of having a health insurance coverage, backed by the fact that the cost of a medical treatment has been on the rise over the years.

Quoting Antony Lee, the Chairman of The General Association of Insurance Malaysia (PIAM), as saying: “Medical inflation has been on an upward trend with double-digit increases in recent years and is projected to reach 14% in 2019.”

What does this supposed to mean? It means that getting a fever diagnosis with medicines and medical certificate at a private clinic can easily cost you more than RM100 per visit.

Unless you are settled on relying heavily to the public healthcare system, having a health insurance coverage is a necessity nowadays.

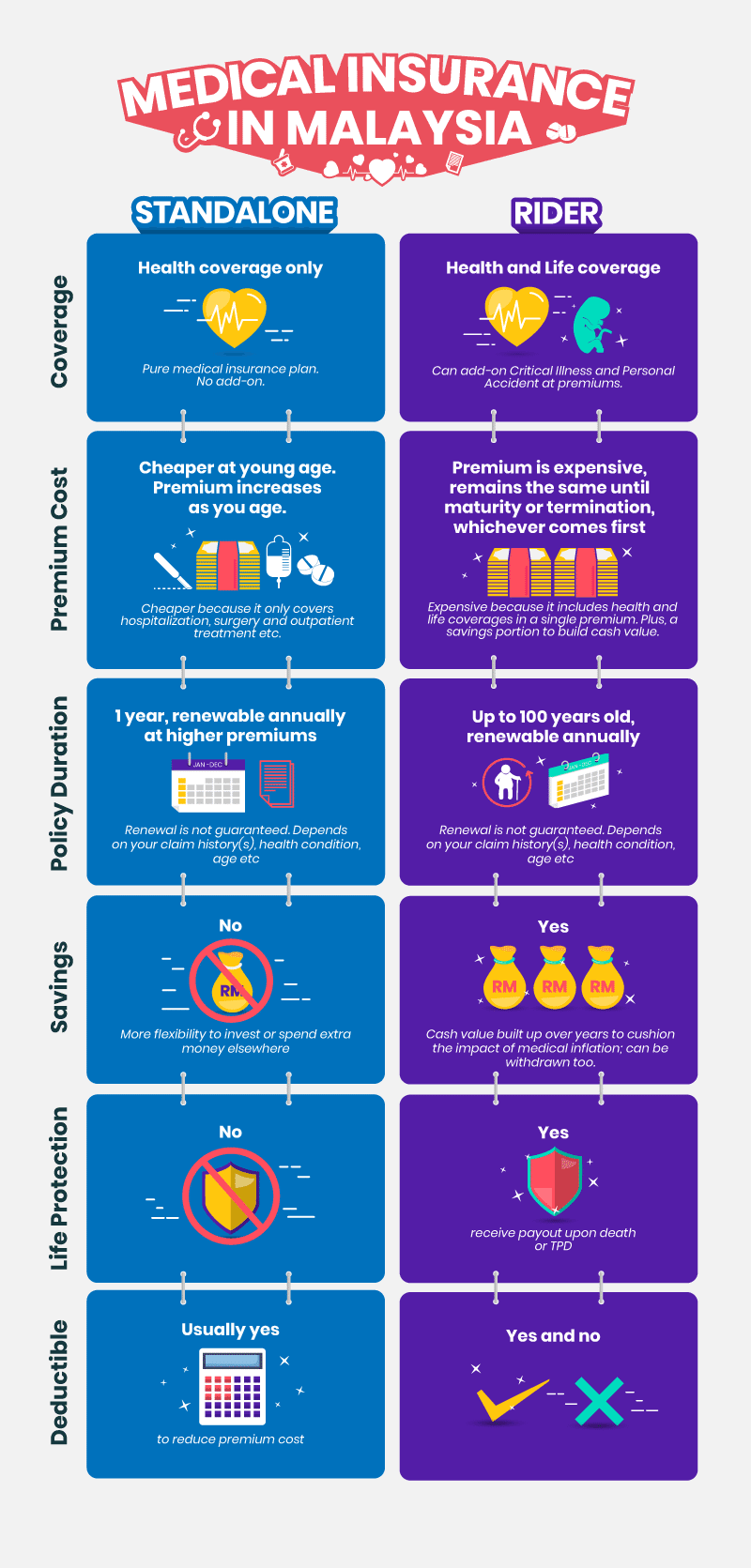

Medical insurance comes in 2 options: (1) standalone with no frills medical policy, (2) medical rider attached to a life insurance plan such as an investment-linked policy.

Standalone Medical Card versus Rider Medical Card

The most important highlight that differentiates a Standalone from Medical Rider is the premium cost; Standalone medical card is way cheaper compared to a rider for several reasons:

Choosing the right medical card for yourself and/or family members requires a strategic financial planning.

If your purpose is to get covered for health only and want to save money on premiums, a standalone medical card is the right way to go.

Standalone Medical Card is cheaper

Standalone medical card is a term insurance plan that provides coverage such as hospital, surgical, outpatient and other medical benefits.

The best part about this cash-over-cover insurance plan is it is much more affordable than a rider medical card because it is a pure medical insurance plan.

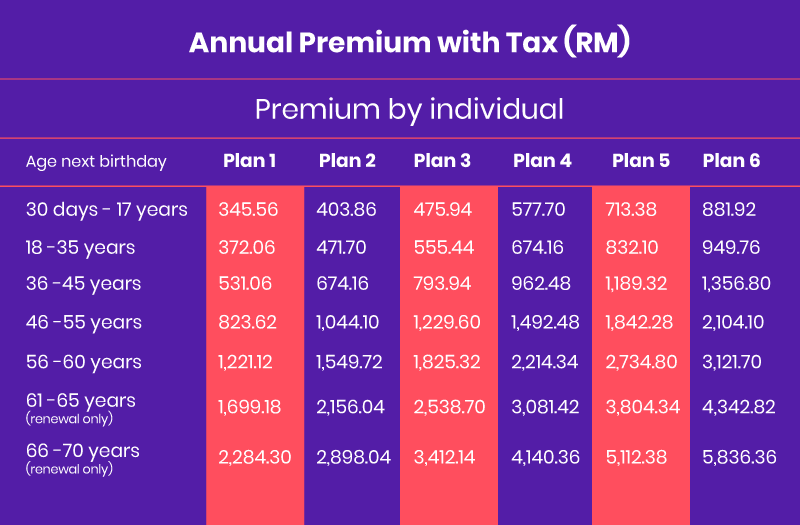

Let us take a look at the table of annual premium of a Standalone Medical Card X below. There are 6 plans you can choose from, with each showing an annual premium according to the age band.

If, at the point of buying this medical card, you are an individual aged between 18 to 35 years, your annual premium starts from as low as RM372.06 (Plan 1). When divided by 12 months, you are actually paying RM31 every month.

A medical rider works the same way as a standalone medical card, except that it comes in the forms of investment-linked policy (ILP).

ILP has a base plan, which is life insurance, and a savings plan. To increase the policy coverage in health insurance, a medical card is added on as a rider.

Let’s say you have an ILP with medical card rider of RM3,000 per year, this means that for every month, your premium payment is RM250.

In comparison, medical rider is more expensive because it is part of a comprehensive insurance plan, whereas standalone medical card is cheaper because it is a pure medical insurance plan.

Standalone Medical Card is not guaranteed

In terms of premium renewal, both standalone and rider medical cards are not guaranteed.

What it means by “non-guaranteed” is because of medical inflation and other lifestyle and health factors, an insurance company may or may not renew your health insurance plan.

Referring to the table of annual premium above, it is evident that the premium cost goes up as the age band increases.

If at 25 years old you signed up for a medical card at RM372.06, it could be RM400, for example, when you turn 26 years.

The insurance company will look at many factors, including but not limited to your:

- Claim history(s) – how much claims have you made and how frequent that happened?

- Past health issues – what pre-existing condition(s) you had and how serious was it?

- Age – the older you are, the more expensive it gets to insure you.

Let’s say you have made multiple claims in a year due to same illness until your annual limit is exhausted, the insurance company will increase your annual premium for the next policy year for the risks you have transferred to them.

If you think a medical rider works differently in terms of renewal, think again. Although medical rider is attached to an ILP, your medical card policy renewal is subject to insurance company discretion too, based on the factors mentioned above.

Even when you have not made any claim in your previous policy years, your standalone medical card premium will still increase due to age increment. This is because the insurance company is covering the actual cost of insuring you.

Compared to medical rider, the cash value (from your savings and investment) is covering the difference between cost of insurance and actual premium as you age. That’s why it is more expensive.

Standalone Medical Card with Deductible

Here’s another strategy to keeping your standalone medical card annual premium lower: deductible.

A deductible is the upfront cash payment borne by you before your insurance money comes in. Deductible amount ranges from as low as RM1,000 to few hundred thousand, and is common in standalone medical card policies.

If you want to pay lower premiums, you should go for a higher deductible medical card. However, you must always prepare a sum of money upfront to receive the benefit of your medical card.

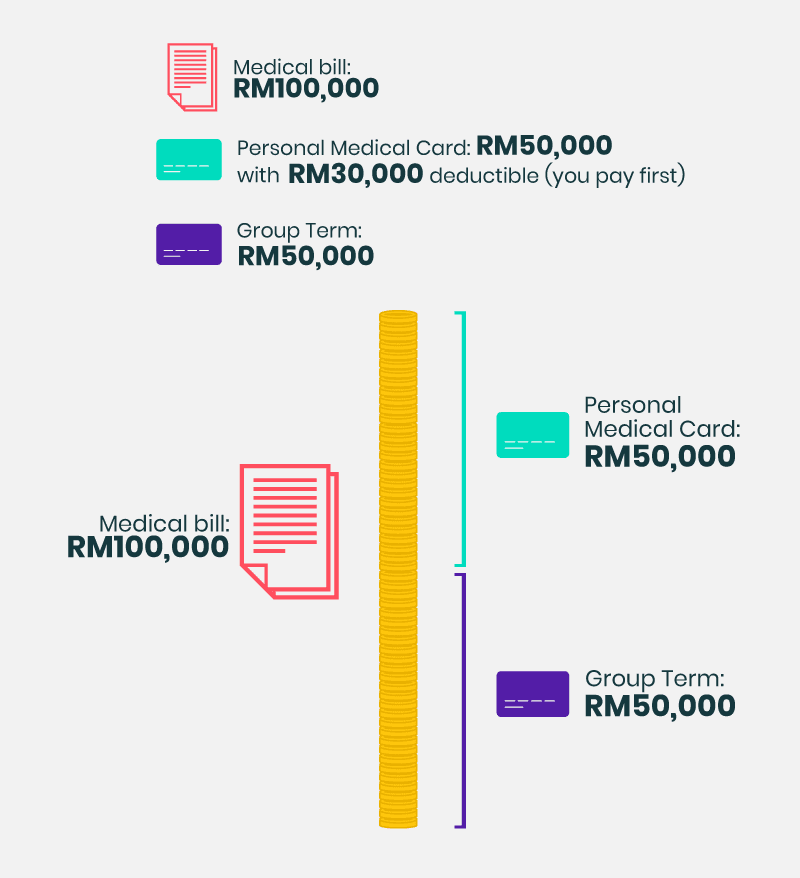

Policyholders are usually advised to get a medical card with higher deductible, IF you are already covered with a medical insurance plan, whether personal (zero deductible) or company group term.

Standalone Medical Card and Group Term

What if you don’t even have a personal medical card with zero deductible? You can turn to your employment benefits.

Although group insurance coverage is a voluntary benefit by employer, having a Group Term as part of your employment benefits is a good start. This way, you can afford an inexpensive standalone medical card with high deductible as your first personal medical insurance plan.

See below example on how a personal medical card might do you a favour, even though you are covered by company Group Term:

In the diagram above, the deductible amount of RM30,000 is covered by your Group Term first, instead of your own money, whereas the remaining balance is covered by your personal medical card.

Not only you have saved yourself from digging deeper into your own savings, but also applying for a personal loan with high interest rate.

Standalone Medical Card to Comprehensive Insurance Plan

In conclusion, owning a personal medical insurance is necessary to better manage your financial risks when you fall sick and are unable to work.

A basic health insurance plan such as standalone medical card is enough to cover your hospitalisation and other medical expenses, at a fraction of your monthly income.

When you have moved up a ladder in your career and life, always review your insurance plan(s) by increasing coverage limit, adding on critical illness insurance or personal accident insurance.

You can also buy an ILP such as whole life insurance to get a comprehensive insurance coverage in a single premium, with a medical rider add-on.