Wealth Management Explained

Did you know that around 70% of respondents save less than RM500 a month, 43% of the respondents spend exactly or more than what they earn each month, and about 52% of Malaysians above the age of 18 years have not yet started investing? In reference to the RinggitPlus Malaysian Financial Literacy Survey 2022, these numbers are the bitter truth on the financial state of most Malaysians from all walks of life.

Almost every day, if not often, we can find all kinds of financial tips or money management tips on the internet nowadays. However, getting on that first step to managing one’s personal finances better can be difficult.

What is wealth management?

Doesn’t matter if you already belong to the ‘mass affluent’ group or you’re just an ordinary everyday Malaysian, everyone needs good wealth management. But what is wealth management exactly? Put simply, it is a combination of investment management and financial planning.

Investment management is the handling of financial assets such as stocks, bonds, unit trusts and so forth that one has accumulated over a period of time. This wealth management type is about devising short- or long-term strategies for buying and selling your investment portfolio holdings.

Financial planning, on the other hand, involves organising personal financial matters and can be tied to multiple financial commitment categories in order to plan, manage and preserve one’s wealth. These categories include but are not limited to estate planning, credit and lending, tax efficiency, retirement planning, education savings and insurance.

In short, both investment management and financial planning work towards the same goal which is to achieve your personal or financial goals.

Who needs wealth management?

For a long time, wealth management has been targeted at people with a high net worth, where wealth managers are appointed to manage their clients’ financial assets with a dedicated fee. Among the usual tasks that these wealth managers do are to balance their clients’ investment risk appetite, liabilities, personal assets, etc. by coming up with strategies to grow or preserve their clients’ wealth.

Contrary to popular belief, wealth management isn’t just for high-net-worth individuals anymore. With strides made in finance technology, there are better cash and investment management options for many of us with an average income.

That said, regardless of making millions or thousands monthly, you can still reap the benefits of wealth management, where it is essential to make plans to build and preserve the wealth you accumulate.

Wealth management for low-to-mid-income individuals

While wealth management has been targeted at the rich for decades, it doesn’t mean individuals with a yearly income below RM300,000 should be left out.

More often than not, less-than-wealthy customers may have never obtained advice from traditional wealth management companies. However, the times are changing through the introduction of cash management platforms, robo-advisors, and online investment accounts.

Unlike traditional human-to-human financial advice, online cash and wealth management platforms provide personalised, automated financial advice based on algorithms. More and more individuals are leveraging these platforms for their convenience, ease of use, affordability, and transparency.

Wealth management for high net-worth individuals

In Malaysia, a high-net-worth individual has “a gross annual income exceeding RM300,000 or its equivalent in foreign currencies per annum” according to the Capital Markets and Services Act (CMSA). Wealth management services for these individuals are usually made available via premier banking but it doesn’t stop there – it’s also offered by renowned boutique firms like Whitman, Bill Morrisons, and so forth.

The advisory services are typically human-to-human, where wealth managers offer financial/investment advice, accounting/tax services, retirement planning, and legal/estate planning for a fee.

Why is wealth management important?

Generally, wealth management is a crucial part of making your personal and financial dreams come true, for instance, buying a home or saving for retirement. It requires a holistic approach to investments and concrete financial plans that allows you to target a broader set of opportunities and risks in building your wealth.

RinggitPlus has recently conducted a survey to find out how Malaysians manage their money. We found out that 44% of Malaysians spend exactly or more than what they earn, and 63% of respondents can only survive 3 months or less with their savings.

To cite an article from Business Today, about 40% of SEA households’ wealth is left uninvested, as Bank Negara statistics show that Malaysians hold RM 845 billion in cash. With today’s inflation rate, money left uninvested depreciates over time. This means saving without investing would only do more harm than good.

It just goes to show that wealth management is essential in our lives, especially in today’s tough economy.

What are the benefits of wealth management?

To ensure a comfortable retirement

From RinggitPlus’ Financial Literacy Survey in 2022, 85% of Malaysians expressed that their EPF savings are not enough for retirement. A comfortable retirement will depend on smart investment decisions to create a stable portfolio that generates passive income, this is where wealth management can help.

To fight against inflation with investments

Wealth managers can help you diversify your investments across several asset classes and geographic areas to increase your risk protection and increase your ability to withstand market ups and downs. A wealth manager will limit the amount invested while also building up sizable quantities over time, protecting your hard-earned cash in the event of an emergency.

To manage your financial goals

Needless to say, all of us have goals, whether it's long-term or short-term. Long-term goals can include saving up for your child’s education, paying off hefty loans, and even earning your first million. While short-term goals include saving up the down payment for a new home, buying a car, or going on a lavish vacation. Wealth management advisors will be able to devise strategies depending on your goals and timelines. Some examples include government bonds, unit trusts, capital financing, and real estate for long-term goals; money market or fixed deposits for short-term goals.

How can I get into wealth management?

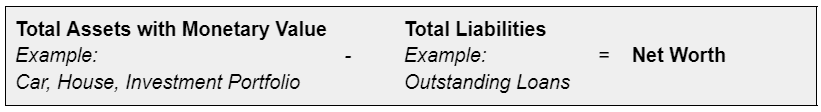

There are various ways to start your wealth management journey. Before you start, it’s best to know your net worth. You can determine your net worth with the formula below:

Once you’ve determined your net worth, you can explore various options to manage your wealth. Below are some of the options you can opt for, depending on your preference.

Types of wealth management products

Investment Accounts with Banks

There are several types of investments with banks. Today, banks are making investing more accessible via in-house mobile apps. To start, you'll have to choose from a range of investment products and sign up for an account. Here are a few investment account options to consider if you’re a beginner.

Unit Trusts and Shariah-Compliant Unit Trusts

For investors wishing to easily diversify their portfolios, they are one of the most well-liked investment solutions. These funds contain assets with gains that you may keep for yourself rather than reinvest! Unit trusts are thus appropriate for people who want to retain stability while making long-term investments.

Fixed Deposits

A fixed deposit or sometimes referred to as an FD in Malaysia is one of the most secure choices for new investors whereby you will be guaranteed valuable returns if your money remains invested in a longer term. The downside though, is there's a chance that the interest rates might fluctuate from time to time – depending on the OPR set by BNM – and any penalties might be levied too if you withdraw your funds before the agreed term matures.

Gold Investment Accounts

Investing in gold is a profitable method to diversify your portfolio without owning any physical assets. Gold has benefited investors who seek stability and diversification in their assets and it's even more rewarding through diversification with other asset classes like stocks or bonds. For people who like minimal risk and who have a reasonable amount of long-term stability in their financial reserves, gold is a great investment.

Cash Management Platforms

Cash management helps users to manage their cash and assets. Cash management apps are designed as an investment alternative to fixed deposits. Compared to robo-advisors, these platforms provide a lower risk while offering saving rates that are of the same standard as fixed deposits, without lock-in periods.

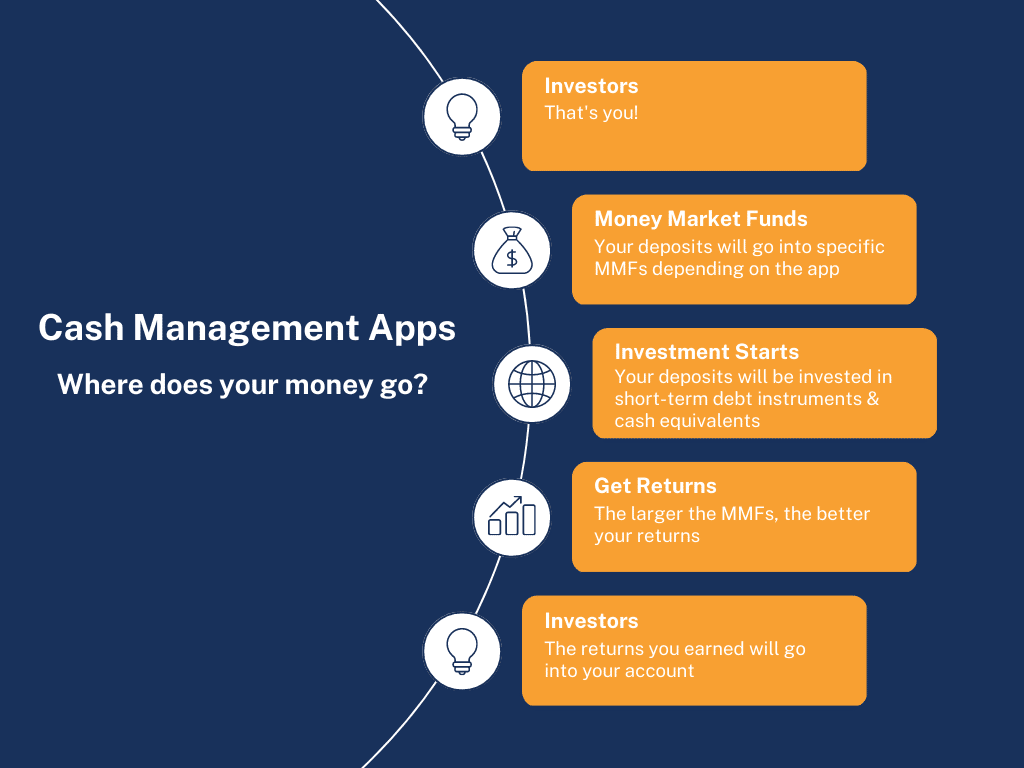

Where does your money go when you use cash management apps?

Your deposits will go into Money Market Funds (MMFs). Depending on different cash management providers, your deposits will go into specific MMFs. For example, the money market fund in Versa Cash is the Affin Hwang Enhanced Deposit Fund, and Stashaway Simple’s underlying fund is the AmIncome Fund.

Money Market Funds (MMFs) can be loosely described as mutual fund that invests in highly liquid, short-term instruments. For example, banks issue instruments like commercial papers, as a method to reinforce short-term cash to balance their deposit shortfall reserves. Essentially, MMFs are lending money to banks, so as the fund increases, so will its negotiation power to get you better returns. Apart from investing in money market instruments, the MMF also holds fixed deposits from banks as an alternative way to gain returns.

How to start saving with cash management platforms?

Anyone can start by downloading cash management apps. Once you’ve downloaded the app, sign up for an account, and deposit any amount you like. Usually, the minimum deposit starts at RM1, with no annual fee charges or withdrawal charges. While return rates per annum are from 3.5% to 4%. Check out a list of cash management app options below.

- KDI Save

- Versa Cash

- Stashaway Simple

- GO+ by Touch 'n Go (Shariah-compliant)

Robo-Advisors

Robo-advisors are designed to provide automated, algorithm-driven investing services depending on an investor’s goals and risk tolerance. In essence, a robo-advisor provides services comparable to those of a human financial advisor, but often with lower entry requirements and administrative costs.

Where does your money go when you use robo-advisors?

Depending on the financial information that you provide a robo-advisor (age, income, goals, risk level), you may be recommended with a variety of assets for investment such as the following.

- Shares (in different markets/regions/industries)

- Exchange Traded Funds (ETFs)

- Bonds/Sukuk

- Property/Real Estate/REITs

- Cash/Currencies

- Gold

How to start investing with robo-advisors?

Registering for a robo-advisor account usually starts with completing a risk-profiling questionnaire, and evaluating your financial situation and goals. The investment risk profiles usually range from conservative to aggressive.

Conservative - investors that fit into this group take a very little risk. They look forward to simply taking safe bets with their money and are aware of the minimal returns.

Moderate - a point between conservative and aggressive investors. These investors often maintain a broad and well-balanced portfolio and they prioritise both reducing risks and raising rewards equally.

Aggressive - this consists of investors with the highest risk-bearing capacity. Their objective is to attain exponential returns from the market in the shortest time possible, and for that, they are ready to confront price volatility and endure losses.

In terms of initial deposits, the standard baseline for deposits is RM100. As for annual fees, most robo-advisors charge annual flat fees of less than 0.5% per specific amount managed. Below are some of the well-established robo-advisors in Malaysia.

- KDI Invest

- Versa

- Stashaway

- MyTheo

- Akru

- Wahed (Shariah-compliant)

- BEST Invest (Shariah-compliant)

All in all, anyone can get into wealth management regardless of income and net worth. Start managing your wealth with one of our partnered providers. If you’d like more advice on wealth management or financial planning, feel free to read our RinggitPlus blog on how to keep your finances in check.