What Is An Interest Rate?

An interest rate is calculated in percentage and charged to your principal loan amount.

Almost every loan — car loan, home loan, business loan or personal loan charges an interest rate (or ‘profit rate’ if it is an Islamic loan).

Also known as annual percentage rate or APR, these interests can be calculated on a fixed-rate or floating-rate basis.

Some prefer the former as it will help them budget their monthly expenses, whereas the latter is usually favourable for those earning variable incomes.

Which bank offer the best personal loan with a lowest interest rate in Malaysia?

Alliance Bank offers a low-interest loan starting from 4.99% p.a. with up to RM200,000 financing over loan tenures of up to 7 years.

| Bank | Interest/Profit Rate (p.a.) |

Minimum Income

|

Loan Amount | Loan Tenure |

|---|---|---|---|---|

| RinggitPlus.com | ||||

| Alliance Bank | From 4.99% p.a. | RM3,000 | RM5,000 – RM200,000 | 1 - 7 years |

Why do banks charge personal loan with interest rate?

The interest serves as a “fee” for doing business with you and assuming the risk of default.

Money lending is risky because there is no guarantee you can get the money back on time and in full.

A personal loan interest rate can be high or low depending on the risk profile of a borrower.

If you have a poor credit history, you may be charged a higher interest rate than those with a good credit rating because you are considered a high-risk borrower.

Why should I apply for a personal loan with lowest interest rate?

Most people will go after personal loans with low-interest rates because it is manageable. In truth, nobody likes to pay interest. So anything close to zero interest is exciting for borrowers.

A low-interest personal loan gives you room to plan your budget and expenses.

You could be looking into consolidating all debts with a low-interest loan, financing funeral expenses, footing large medical bills, or paying for wedding expenses or school fees.

How to get a low interest personal loan in Malaysia?

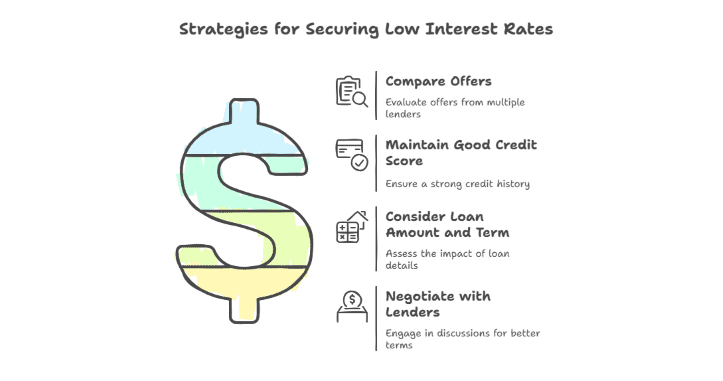

As you know, there are a variety of low-interest loans in the market, and you must shop around for the benefits and features that you want.

You must also watch out for the product's fine print before agreeing on anything.

Another way to secure loans with low interest is by pledging an asset to your loan.

This collateral will be used to cover the remaining loan outstanding in case you are no longer able to meet your repayment.

If you don’t have collateral, you can get a guarantor to co-sign your loan agreement, who will then be responsible for the repayment.

Unfortunately, personal loans with low interest will not be given to borrowers with poor credit ratings. Therefore, take your time to improve your credit score by building a solid financial standing.

Which bank offers low interest rate on personal loans in 2025?

Here's a quick loan comparison in Malaysia offering low interest rates.

| Bank | Interest/Profit Rate | Minimum Monthly Income | Loan Amount | Loan Period | Who Can Apply? |

| Bank Islam | 4.50% - 7.50% p.a. | RM4,000 | RM10,000 - RM300,000 | 1 - 10 years | Public sector employees |

| HSBC Amanah | 4.88% - 10.50% p.a. | RM3,000 | RM6,000 - RM250,000 | 2 - 7 years | All salaried employees |

|

Alliance Bank |

4.99% - 16.68% p.a. | RM3,000 | RM5,000 - RM200,000 | 1 - 7 years | All salaried employees |

| CIMB | 4.38% - 19.88% p.a. | RM2,000 | RM2,000 - RM100,000 | 2 - 5 years | All salaried employees |

| Al Rajhi Bank | 5.27% - 14.83% p.a. | RM3,000 | RM10,000 - RM250,000 |

1 - 8 years

|

All salaried employees |

How to apply for low interest personal loan with RinggitPlus?

Compare personal loan rates and find one that suits your preference and financial background. Afterwards, you can apply online for low-interest rate loans via our RinggitPlus WhatsApp chatbot.

You can even get loan recommendations with us if you need a head start. Just click on the Apply For Loan button above!