What are secured personal loans?

Secured personal loans are backed by collateral or a guarantor. The loan is tied to something valuable that protects the lender. If you can't repay, the lender can claim this asset. Common examples include car loans where your vehicle secures the debt. Mortgages use your home as collateral for the loan amount.

Besides physical assets, financial products can serve as collateral too. Fixed deposits held at banks often back these loans. Structured investment products can guarantee your borrowing capacity. Unit trusts and other investment portfolios also qualify as security. This collateral system reduces the lender's risk significantly. It allows borrowers to access better rates and terms.

What are the advantages of secured personal loans in Malaysia?

Secured personal loans use collateral instead of just credit scores for approval. This collateral gives banks confidence to lend larger amounts safely. The repayment period can stretch up to twenty years long. Banks feel secure because they have valuable assets backing the loan.

The collateral's value directly affects your loan terms and conditions. Interest rates are generally lower compared to unsecured personal loans. Banks charge less because collateral reduces their financial risk significantly. Higher-value collateral often means even better rates and terms. This makes secured loans attractive for major purchases or expenses. However, longer repayment periods mean more total interest paid overall.

What are the disadvantages of secured personal loans in Malaysia?

While repayment tenure can extend for many years, interest rates may double. Most Malaysian banks require borrowers to own property before approving secured loans. House ownership demonstrates financial stability and provides additional security for lenders. The collateral acts as a safety net if borrowers default.

When borrowers fail to make payments, banks have legal rights. They can seize the pledged collateral to recover their money. Alternatively, banks may shift repayment responsibility to the guarantor instead. This guarantor becomes liable for the remaining debt amount completely. These enforcement options protect banks from significant financial losses. Borrowers should understand these serious consequences before taking secured loans.

What should I know about role of guarantor?

A loan guarantor plays a critical role in a secured loan, serving as a co-signatory who agrees to be responsible for the loan repayment if the primary borrower defaults.

- Equal Liability: The common misconception is that a bank must first exhaust all means of collecting the debt from the primary borrower before approaching the guarantor. However, under Malaysian law, a guarantor's liability is often identical to that of the principal debtor, and the bank can pursue both parties simultaneously.

- Payment on Demand: The guarantee contract typically includes a "payment on demand" clause, which gives the bank the right to demand the full outstanding loan amount from you immediately upon the borrower's default.

How to choose the best personal loans with collateral in Malaysia?

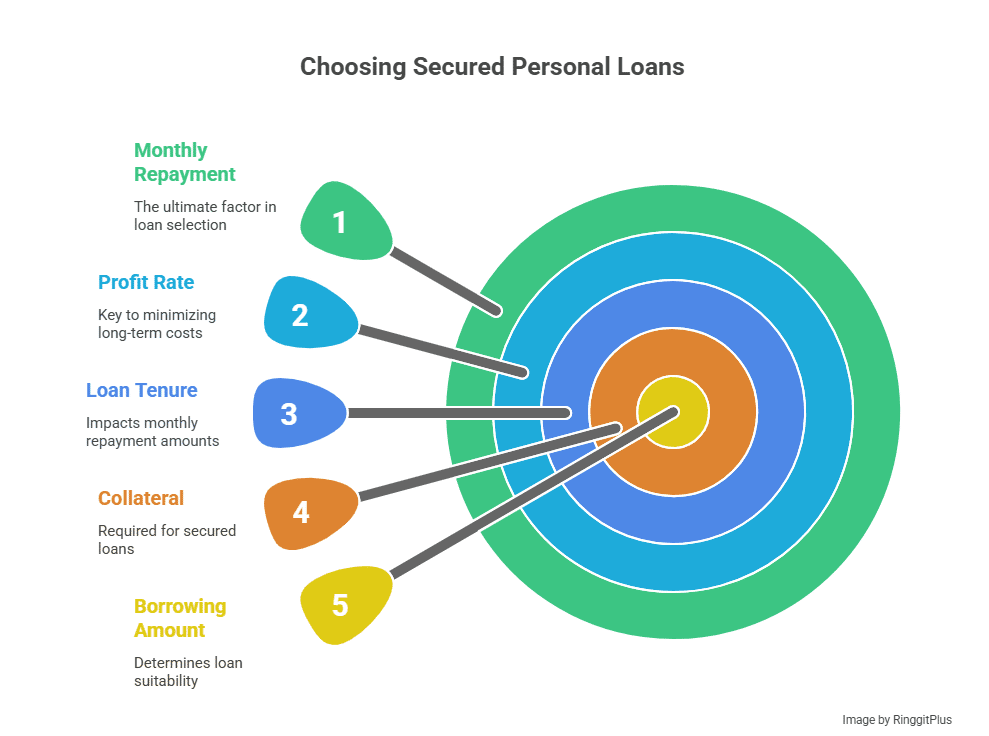

Choosing the right secured personal loan comes down to a few important considerations—especially if you’re committing to a loan that could last for decades. Start by asking yourself:

- Do I have a valuable asset to pledge as collateral?

- Do I need a large sum of money, and am I comfortable with a longer repayment plan?

If yes, then secured loans might suit your needs perfectly. But, don't focus only on the lowest monthly payment amount. Look closely at the profit rate or effective interest rate. This rate determines your total payment over the loan's lifetime. Also consider the total loan tenure when making your decision.

Longer repayment periods mean more interest accumulates despite low rates. Compare offers from multiple banks before making your final choice. Some banks offer flexible terms and early repayment options available. Others provide promotional rates based on your collateral type specifically. Your financial profile may also qualify you for better terms. So take time to evaluate all these factors before committing completely.

How can a personal loan calculator help me choose the best secured loan?

Make use of the personal loan online calculator. To start using the loan calculator, all you have to do is to select the secured personal loan you prefer and then specify your monthly income, borrowing amount and period of repayment. The loan calculator then indicates the monthly repayment which is the best-determining factor when looking for the best secured personal loan.

How do I repay my secured loan every month?

Secured loans in Malaysia follow regular monthly payment schedules. These loans use collateral like property or deposits as backing. The collateral helps lower your risk and may offer better rates. However, making monthly payments is crucial to avoid losing your asset.

Malaysian banks offer three main repayment options for your convenience. These methods suit different lifestyles and income patterns effectively. Choose the option that works best for your financial situation. Consistent payments protect your credit standing and valuable collateral from seizure.

1. Salary Deduction

This option is often preferred by government employees or individuals working in selected government-linked companies (GLCs). Through salary deduction, your monthly loan instalment is automatically deducted from your paycheck before it’s credited to your bank account. It’s typically done via systems like Biro Angkasa or Potongan Gaji Berjadual (PGB).

This method offers several benefits:

- Automatic and timely: Reduces the risk of missed payments.

- Easier budgeting: You always know your loan payment is already covered.

- Preferred by some lenders: Especially for loans via cooperatives or government channels.

However, not all private sector employees may have access to this method. If you're not eligible for salary deduction, don’t worry—other options are available.

2. Auto-Debit from Salary Crediting Account

For private-sector employees or anyone whose salary is paid into a designated bank account, auto-debit is one of the easiest and most reliable repayment options. Here’s how it works:

- You authorize the bank to automatically deduct your monthly instalment from your salary crediting account.

- On your agreed payment date, the bank will pull the required amount from your account, as long as there's sufficient balance.

Why many borrowers prefer this method:

- Convenient: Once set up, it runs automatically.

- Worry-free: No need to remember due dates.

- Supports your credit score: Keeps your payment history clean and consistent.

Tip: Make sure your salary is credited a day or two before the auto-debit date to avoid insufficient fund issues that may cause failed payments or bank fees.

3. Standing Instruction (SI)

If you prefer to manage payments on your own terms—or want to pay from a different account—you can set up a Standing Instruction (SI) with your bank. This method allows you to schedule a fixed recurring payment every month on a date you choose.

Key features:

- Customisable: You decide the payment amount and date.

- Ideal for flexible income earners: Freelancers or gig workers often use this to match their cash flow.

- Can be linked to different banks: Useful if your loan and income accounts are with separate banks.

However, with SI, you need to be a bit more hands-on. It's your responsibility to ensure there's enough money in your account before the deduction date, or the instruction might fail.

Who can apply for a secured personal loans in Malaysia?

Similar to applying for a conventional personal loan, the requirements of applicants are the same:

- Malaysian Citizens - both Muslims and non-Muslims can apply for Islamic banking products.

- The minimum age ranges from 18 - 21 years old.

- The maximum age ranges from 60 - 65 years old.

- The minimum monthly income typically ranges from RM1,500 and above.

- A guarantor or collateral is required.

What personal documents do I need to apply for a secured personal loans in Malaysia?

Generally, you will need some of the documents below to start your loan application.

Supporting documents for Collateral:

- Original Land Grant

- Original Certificate of Fixed Deposit or Structured Investment or Unit Trusts

- Copy of Passbook or Statement

Salaried Employee:

- Copy of IC (both sides)

- Latest 3 months’ validated salary slips

- Latest 3 months’ bank statements of the salary crediting account

- Confirmation Letter from Employer

Self-Employed:

- Copy of IC (both sides)

- Business Registration Certificate or Operating License

- Last 6 months’ bank statements

- Latest annual income statement (BE/B Form), with valid tax payment receipt

- Last 2 years business financial statement

Still not sure? Check out our other personal loan recommendations.