What are secured personal loans?

Just as its name suggests, secured personal loans are secured against a guarantor or the value of the collateral the borrower owns. This means that the loan is attached to something of value which typically would be car loans and mortgages.

Other types of collaterals are in the form of fixed deposits, structured investments or unit trusts.

What are the advantages of personal loan with collateral?

With collateral being pledged to the secured personal loan (instead of credit scores for unsecured loans), this creates confidence for the bank to allow borrowing larger amounts for a longer tenure.

The repayment period of secured personal loans can be stretched up to 20 years! Based on the value of the collateral attached to the secured loan, interest rates are generally lower as compared to unsecured loans.

What are the disadvantages of collateral loan?

While the repayment tenure can be for a long time, interest rates can be doubled. Also, most banks in Malaysia would require that borrowers own a house before the secured personal loans can be approved. The collaterals function as a safety net should the borrower fail to make repayments.

In such circumstances, the bank has the right to seize the collateral pledged or shift the responsibility of repayment to the guarantor.

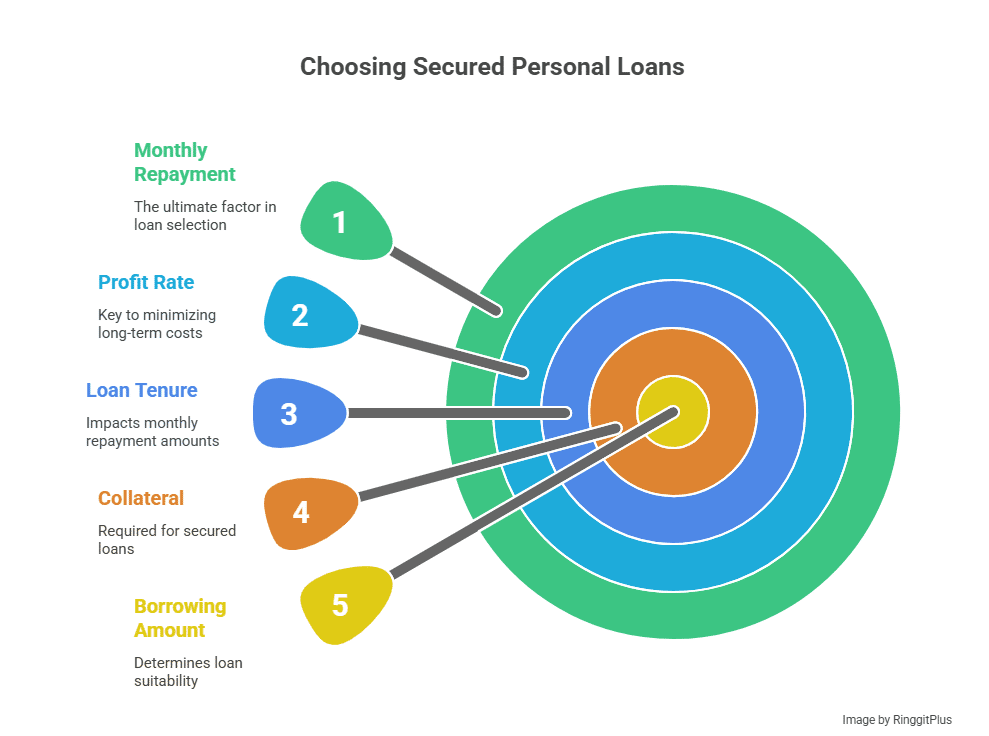

How to choose the best secured personal loan in Malaysia?

Secured loans are best for long-term borrowers who need a huge sum of cash and have a suitable property to be pledged as collateral. However, with the long-term repayment period, low-interest rates would accumulate over the years.

Hence, looking at the profit rate is key to choosing the best secured personal loan. Next, compare them to the loan’s tenure which will directly impact monthly repayment.

How can a personal loan calculator help me choose the best secured loan?

Make use of the personal loan online calculator.

To start using the loan calculator, all you have to do is to select the secured personal loan you prefer and then specify your monthly income, borrowing amount and period of repayment.

The loan calculator then indicates the monthly repayment which is the best-determining factor when looking for the best secured personal loan.

How do I repay my secured loan every month?

Typically, you will have three options to choose from such as:

- Salary deduction

- Auto-debit for monthly instalments (for salary crediting account)

- Via Standing Instruction

Who can apply for a personal loan with guarantor in Malaysia?

Similar to applying for a conventional personal loan, the requirements of applicants are the same:

- Malaysian Citizens - both Muslims and non-Muslims can apply for Islamic banking products.

- The minimum age ranges from 18 - 21 years old.

- The maximum age ranges from 60 - 65 years old.

- The minimum monthly income typically ranges from RM1,500 and above.

- A guarantor or collateral is required.

What personal documents do I need to apply for a bank loan with collateral in Malaysia?

Generally, you will need some of the documents below to start your loan application.

Supporting documents for Collateral:

- Original Land Grant

- Original Certificate of Fixed Deposit or Structured Investment or Unit Trusts

- Copy of Passbook or Statement

Salaried Employee:

- Copy of IC (both sides)

- Latest 3 months’ validated salary slips

- Latest 3 months’ bank statements of the salary crediting account

- Confirmation Letter from Employer

Self-Employed:

- Copy of IC (both sides)

- Business Registration Certificate or Operating License

- Last 6 months’ bank statements

- Latest annual income statement (BE/B Form), with valid tax payment receipt

- Last 2 years business financial statement

Still not sure? Check out our other personal loan recommendations.