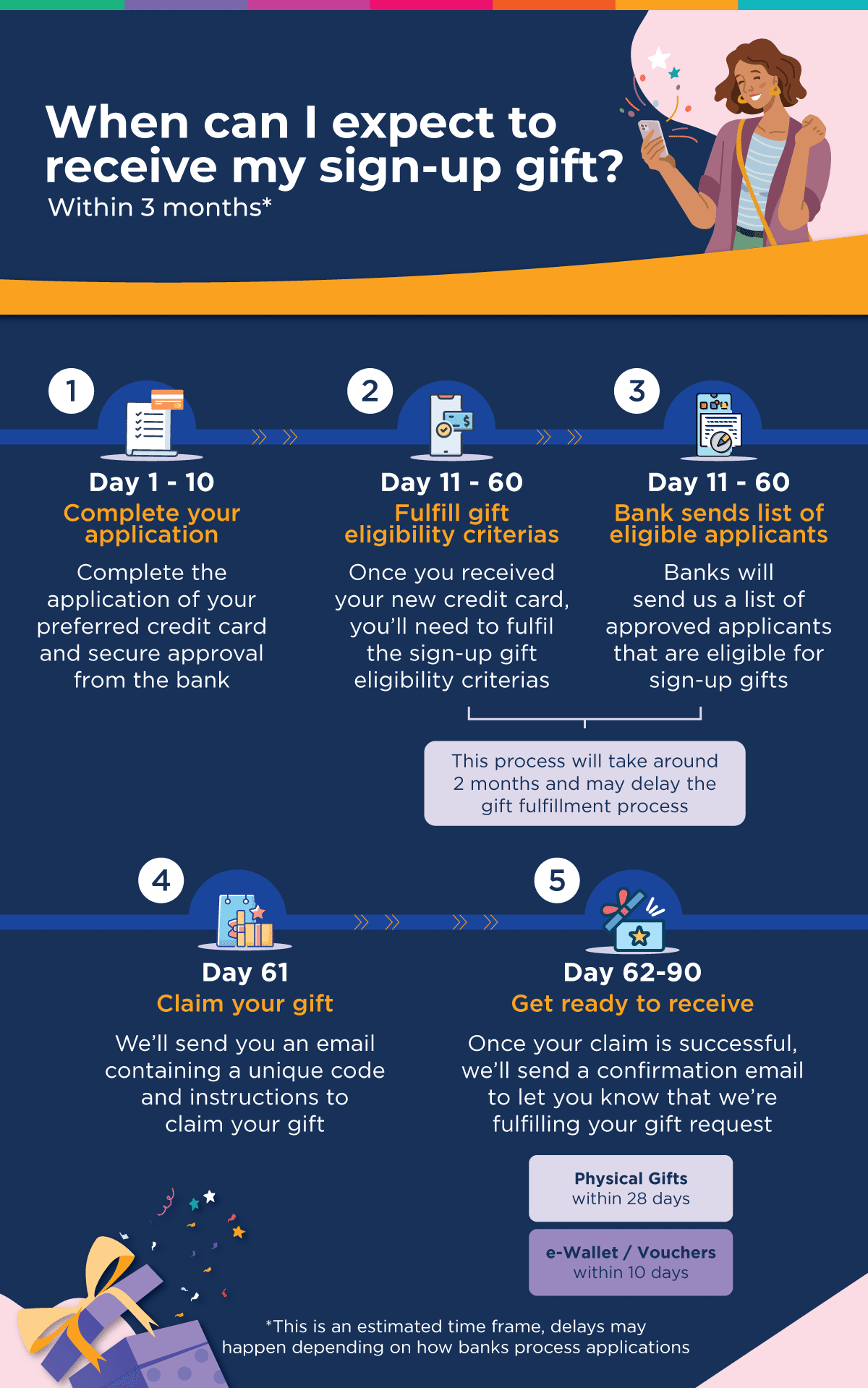

The RinggitPlus Gift Redemption Process

So you’ve applied for a credit card with sign-up gifts, what’s next? Once your application is approved by the bank, you’ll need to fulfil the gift criteria stated in our terms and conditions. From there, the banks will send us a list of approved applications that are eligible for the sign-up gifts. This process will take around 2 months.

From then on, you will receive a gift redemption email if you are eligible for a sign-up gift. The email contains a designated code from us and instructions on how to claim your gift. Please refer to our comprehensive FAQs here to find out more. For a clearer picture, below is our sign-up gift redemption process.

Full List of Winners

19 March 2025 - 24 March 2025| Date | Campaign Name | Winners |

| 24 March 2025 - 7 April 2025 | MAYB RM5500 Cash Via DuitNow Flash Deal | See full list |

| 24 March 2025 - 3 April 2025 | HSBC RM7500 Touch & Go e-Wallet Flash Deal | See full list |

| 19 March 2025 - 24 March 2025 | HSBC Apple iMac M4 Flash Deal | See full list |

| 17 March 2025 - 8 April 2025 | RHB Apple iPad 11th Gen + Apple Magic Keyboard Folio Flash Deal | See full list |

| 10 March 2025 - 24 March 2025 | MAYB Apple iPhone 16 Pro Flash Deal | See full list |

| 3 March 2025 - 10 March 2025 | HSBC Apple iPhone 16 Pro Flash Deal | See full list |

| 24 February - 17 March 2025 | RHB RM5,000 Touch ‘n Go E-Wallet Credit Flash Deal | See full list |

| 24 February - 3 March 2025 | UOB Apple iPad Pro M4 Flash Deal | See full list |

| 18 February - 24 February 2025 | UOB Apple MacBook Air M3 Flash Deal | See full list |

| 17 February 2025 - 24 February 2025 | HSBC Apple iPhone 16 Pro Flash Deal | See full list |

| 10 February 2025 - 17 February 2025 | UOB RM3500 Touch & Go e-Wallet e-Voucher Flash Deal | See full list |

| 4 February 2025 - 10 February 2025 | UOB Apple iPhone 16 Pro Flash Deal | See full list |

| 3 February 2025 - 24 February 2025 | RHB Apple iPad Pro M4 Flash Deal | See full list |

| 3 February 2025 - 17 February 2025 | ALLI RM4,500 Touch ‘n Go E-Wallet Credit Flash Deal | See full list |

| 3 February 2025 - 10 February 2025 | HSBC Apple MacBook Air M3 Flash Deal | See full list |

| 13 January 2025 - 3 February 2025 | RHB Apple iPhone 16 Pro Flash Deal | See full list |

| 13 January 2025 - 20 January 2025 | HSBC RM5,678 Touch 'n Go E-Wallet Credit Flash Deal | See full list |

| 13 January 2025 - 20 January 2025 | UOB Apple MacBook Pro M4 Flash Deal | See full list |

| 6 January 2025 - 13 January 2025 | HSBC Apple iMac M4 Flash Deal | See full list |

| 30 December 2024 - 6 January 2025 | UOB Apple iPhone 16 Pro Flash Deal | See full list |

| 23 December 2024 - 13 January 2025 | RHB RM5,000 Touch 'n Go E-Wallet Credit Flash Deal | See full list |

| 23 December 2024- 30 December 2024 | UOB Apple iPad Pro M4 Flash Deal | See full list |

| 17 December 2024 - 23 December 2024 | UOB Apple iMac M4 Flash Deal | See full list |

| 16 December 2024 - 23 December 2024 | HSBC Apple iPhone 16 Pro Max Flash Deal | See full list |

| 9 December 2024 - 30 December 2024 | AEON Apple iPad Air M2 and Apple AirPods Pro 2 Flash Deal | See full list |

| 9 December 2024 - 16 December 2024 | UOB Apple iPhone 16 Pro Max Flash Deal | See full list |

| 9 December 2024 - 16 December 2024 | HSBC Apple MacBook Pro M4 Flash Deal | See full list |

| 2 December 2024 - 23 December 2024 | RHB Apple iPhone 16 Pro Flash Deal | See full list |

| 2 December 2024 - 9 December 2024 | HSBC RM4,800 Touch 'n Go E-Wallet Credit Flash Deal | See full list |

| 2 December 2024 - 9 December 2024 | UOB RM3,456 Touch 'n Go E-Wallet Credit Flash Deal | See full list |

| 2 December 2024 - 9 December 2024 | AEON Apple iPhone 16 Pro Max and RM1,000 Cash Via DuitNow Flash Deal | See full list |

| 25 November 2024 - 2 December 2024 | AEON Apple iPhone 16 and RM1,000 Cash Via DuitNow Flash Deal | See full list |

| 25 November 2024 - 2 December 2024 | UOB Apple MacBook Pro M4 Flash Deal | See full list |

| 25 November 2024 - 2 December 2024 | HSBC Apple iPhone 16 Pro Max Flash Deal | See full list |

| 18 November 2024 - 25 November 2024 | AEON Apple AirPods Pro (2nd Gen) Flash Deal | See full list |

| 18 November 2024 - 25 November 2024 | HSBC RM4,567 Touch 'n Go eWallet Credit | See full list |

| 18 November 2024 - 25 November 2024 | UOB Apple iPad Pro M4 Flash Deal | See full list |

| 12 November 2024 - 18 November 2024 | UOB RM4,800 Touch 'n Go E-Wallet Credit Flash Deal | See full list |

| 11 November 2024 - 2 December 2024 | RHB RM5,000 Touch 'n Go E-Wallet Credit Flash Deal | See full list |

| 11 November 2024 - 18 November 2024 | AEON Apple iPhone 16 Pro Max and RM1,000 Cash Via DuitNow Flash Deal | See full list |

| 11 November 2024 - 18 November 2024 | HSBC Apple iMac M4 | See full list |

| 4 November 2024 - 11 November 2024 | AEON Samsung Galaxy Z Fold6 and Samsung Galaxy Buds 3 Pro Flash Deal | See full list |

| 4 November 2024 - 11 November 2024 | HSBC RM5,678 Touch 'n Go E-Wallet Credit Flash Deal | See full list |

| 4 November 2024 - 11 November 2024 | UOB Apple iPhone 16 Pro Max Flash Deal | See full list |

| 28 October 2024 - 4 November 2024 | AEON Apple MacBook Air M3 and Apple AirPods Pro (2nd Gen) Flash Deal | See full list |

| 28 October 2024 - 4 November 2024 | HSBC Apple iPhone 15 Pro Max Flash Deal | See full list |

| 28 October 2024 - 4 November 2024 | UOB RM3,500 Touch 'n Go E-Wallet Credit Flash Deal | See full list |

| 21 October 2024 - 28 October 2024 | AEON RM5,000 and RM1,000 Cash Via DuitNow Flash Deal | See full list |

| 21 October 2024 - 28 October 2024 | HSBC RM8,888 Touch 'n Go E-Wallet Credit Flash Deal | See full list |

| 21 October 2024 - 28 October 2024 | UOB Apple iMac Flash Deal | See full list |

| 21 October 2024 - 11 November 2024 | RHB Apple iPhone 15 Pro Max Flash Deal | See full list |

| 15 October 2024 - 21 October 2024 | UOB RM5,000 Touch ‘n Go E-Wallet Credit Flash Deal | See full list |

| 14 October 2024 - 21 October 2024 | AEON Apple iPhone 15 Pro Max and RM1,000 Cash Via DuitNow Flash Deal | See full list |

| 14 October 2024 - 21 October 2024 | HSBC Apple MacBook Air M3 Flash Deal | See full list |

| 9 October 2024 - 14 October 2024 | HSBC RM5,000 Touch 'n Go E-Wallet Credit Flash Deal | See full list |

| 7 October 2024 - 14 October 2024 | AEON Apple iPad Pro M4 and Apple AirPods Pro (2nd Gen) Flash Deal | See full list |

| 7 October 2024 - 14 October 2024 | SCBK Apple iPhone 15 Pro Max | See full list |

| 7 October 2024 - 14 October 2024 | UOB Apple MacBook Pro M3 Flash Deal | See full list |

| 30 September 2024 - 7 October 2024 | AEON Apple MacBook Air M3 and RM1,000 Cash Via DuitNow Flash Deal | See full list |

| 30 September 2024 - 7 October 2024 | SCBK RM11,888 Touch 'n Go eWallet Credit | See full list |

| 30 September 2024 - 7 October 2024 | HSBC Apple iMac Flash Deal | See full list |

| 18 September 2024 - 25 September 2024 | SCBK Apple MacBook Pro M3 | See full list |

| 9 September 2024 - 18 September 2024 | SCBK Sony PlayStation 5 | See full list |