The RinggitPlus Gift Redemption Process

So you’ve applied for a credit card with sign-up gifts, what’s next? Once your application is approved by the bank, you’ll need to fulfil the gift criteria stated in our terms and conditions. From there, the banks will send us a list of approved applications that are eligible for the sign-up gifts. This process will take around 2 months.

From then on, you will receive a gift redemption email if you are eligible for a sign-up gift. The email contains a designated code from us and instructions on how to claim your gift. Please refer to our comprehensive FAQs to find out more. For a clearer picture, below is our sign-up gift redemption process.

When Can I Expect To Receive My RinggitPlus Sign-Up Gift?

Generally, you'll be enjoying your gift within about 3 months from when you first applied.

Here’s a clear, friendly guide to the steps involved:

1. Day 1-10: Get Your Application In.

First things first, you'll complete your credit card application and get that all-important approval from the bank. That's step one towards your awesome gift!

2. Day 11-60: Meet the Gift Criteria.

Once your shiny new credit card arrives, you'll just need to fulfill the specific criteria to become eligible for your sign-up bonus. Think of it as activating your reward!

3. Day 11-60: Banks Share Eligible Lists.

During this same period, the banks will be sending us the official lists of approved applicants who qualify for our exclusive sign-up offers.

Just a heads-up: this part of the process, handled by the banks, can sometimes take up to two months, and might slightly extend the overall time it takes for your gift to reach you.

4. Day 61: Time to Claim Your Gift!

Around this mark, keep an eye on your inbox! Ringgitplus will send you an email containing a unique code and simple instructions on how to claim your well-deserved gift. It’s an exciting email to receive!

5. Day 62-90: Your Gift Is On Its Way!

Once your claim is successfully processed, we’ll send you a quick confirmation email to let you know that your gift request is officially being fulfilled.

- If you're getting a Physical Gift, you can typically expect it to arrive within 28 days from that confirmation.

- For e-Wallet or Vouchers, these digital goodies usually land much quicker, within 10 days.

Just a friendly note: while we provide these estimated timelines to give you a clear picture, sometimes slight delays can occur. This usually depends on how quickly the banks process individual applications. We appreciate your patience!

Full List of RinggitPlus Sign-Up Gift Winners

19 March 2025 - 24 March 2025| Date | Campaign Name | Winners |

| 29 April 2025 - 20 May 2025 | RHB Samsung Galaxy S25 Flash Deal | See full list |

| 28 April 2025 - 5 May 2025 | UOB Apple iPhone 16 Flash Deal | See full list |

| 14 April 2025 - 21 April 2025 | UOB Apple MacBook Air M4 Flash Deal | See full list |

| 14 April 2025 - 21 April 2025 | HSBC Apple iPhone 16 Pro Max Flash Deal | See full list |

| 8 April 2025 - 29 April 2025 | RHB RM5,000 Touch ‘n Go E-Wallet Credit Flash Deal | See full list |

| 3 April 2025 - 7 April 2025 | HSBC Apple MacBook Air M4 Flash Deal | See full list |

| 24 March 2025 - 7 April 2025 | MAYBANK RM5500 Cash Via DuitNow Flash Deal | See full list |

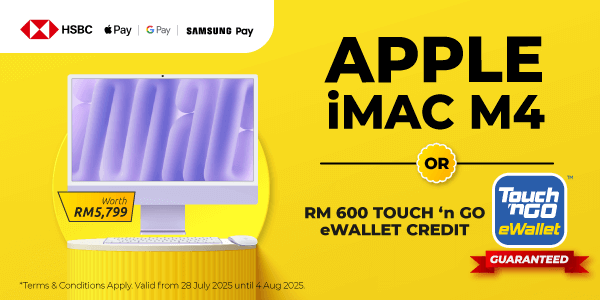

| 24 March 2025 - 3 April 2025 | UOB Apple iMac M4 Flash Deal | See full list |

| 24 March 2025 - 3 April 2025 | HSBC RM7500 Touch & Go e-Wallet Flash Deal | See full list |

| 19 March 2025 - 24 March 2025 | HSBC Apple iMac M4 Flash Deal | See full list |

| 17 March 2025 - 8 April 2025 | RHB Apple iPad 11th Gen + Apple Magic Keyboard Folio Flash Deal | See full list |

| 10 March 2025 - 24 March 2025 | MAYBANK Apple iPhone 16 Pro Flash Deal | See full list |

| 10 March 2025 - 17 March 2025 | HSBC Apple MacBook Air M3 Flash Deal | See full list |

| 4 March 2025 - 10 March 2025 | UOB Apple iPhone 16 Pro Max Flash Deal | See full list |

| 3 March 2025 - 10 March 2025 | HSBC Apple iPhone 16 Pro Flash Deal | See full list |

| 24 February - 17 March 2025 | RHB RM5,000 Touch ‘n Go E-Wallet Credit Flash Deal | See full list |

| 24 February - 3 March 2025 | HSBC RM8888 Touch & Go e-Wallet e-Voucher Flash Deal | See full list |

| 24 February - 3 March 2025 | UOB Apple iPad Pro M4 Flash Deal | See full list |

| 18 February - 24 February 2025 | UOB Apple MacBook Air M3 Flash Deal | See full list |

| 17 February 2025 - 24 February 2025 | HSBC Apple iPhone 16 Pro Flash Deal | See full list |

| 10 February 2025 - 17 February 2025 | UOB RM3500 Touch & Go e-Wallet e-Voucher Flash Deal | See full list |

| 4 February 2025 - 10 February 2025 | UOB Apple iPhone 16 Pro Flash Deal | See full list |

| 3 February 2025 - 24 February 2025 | RHB Apple iPad Pro M4 Flash Deal | See full list |

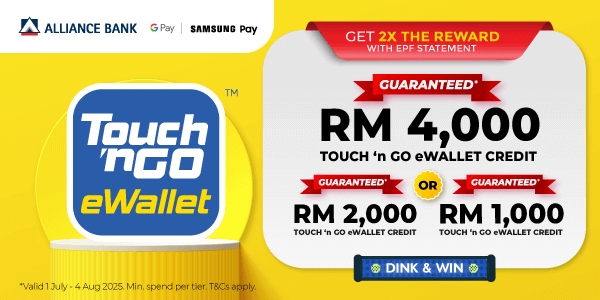

| 3 February 2025 - 17 February 2025 | ALLI RM4,500 Touch ‘n Go E-Wallet Credit Flash Deal | See full list |

| 3 February 2025 - 10 February 2025 | HSBC Apple MacBook Air M3 Flash Deal | See full list |

| 21 January 2025 - 27 January 2025 | UOB Apple iPad Pro M4 Flash Deal | See full list |

| 20 January 2025 - 27 January 2025 | HSBC Apple iPhone 16 Pro Max Flash Deal | See full list |

| 13 January 2025 - 3 February 2025 | RHB Apple iPhone 16 Pro Flash Deal | See full list |

| 13 January 2025 - 20 January 2025 | HSBC RM5,678 Touch 'n Go E-Wallet Credit Flash Deal | See full list |

| 13 January 2025 - 20 January 2025 | UOB Apple MacBook Pro M4 Flash Deal | See full list |

| 7 January 2025 - 13 January 2025 | UOB RM4,800 Touch ‘n Go E-Wallet Credit Flash Deal | See full list |

| 6 January 2025 - 20 January 2025 | Standard Chartered Apple MacBook Air M3 Flash Deal | See full list |

| 6 January 2025 - 13 January 2025 | HSBC Apple iMac M4 Flash Deal | See full list |

| 30 December 2024 - 6 January 2025 | UOB Apple iPhone 16 Pro Flash Deal | See full list |

| 23 December 2024 - 13 January 2025 | RHB RM5,000 Touch 'n Go E-Wallet Credit Flash Deal | See full list |

| 23 December 2024- 30 December 2024 | UOB Apple iPad Pro M4 Flash Deal | See full list |

| 17 December 2024 - 23 December 2024 | UOB Apple iMac M4 Flash Deal | See full list |

| 16 December 2024 - 23 December 2024 | HSBC Apple iPhone 16 Pro Max Flash Deal | See full list |

| 9 December 2024 - 30 December 2024 | AEON Apple iPad Air M2 and Apple AirPods Pro 2 Flash Deal | See full list |

| 9 December 2024 - 16 December 2024 | UOB Apple iPhone 16 Pro Max Flash Deal | See full list |

| 9 December 2024 - 16 December 2024 | HSBC Apple MacBook Pro M4 Flash Deal | See full list |

| 2 December 2024 - 23 December 2024 | RHB Apple iPhone 16 Pro Flash Deal | See full list |

| 2 December 2024 - 9 December 2024 | HSBC RM4,800 Touch 'n Go E-Wallet Credit Flash Deal | See full list |

| 2 December 2024 - 9 December 2024 | UOB RM3,456 Touch 'n Go E-Wallet Credit Flash Deal | See full list |

| 2 December 2024 - 9 December 2024 | AEON Apple iPhone 16 Pro Max and RM1,000 Cash Via DuitNow Flash Deal | See full list |

| 25 November 2024 - 2 December 2024 | AEON Apple iPhone 16 and RM1,000 Cash Via DuitNow Flash Deal | See full list |

| 25 November 2024 - 2 December 2024 | UOB Apple MacBook Pro M4 Flash Deal | See full list |

| 25 November 2024 - 2 December 2024 | HSBC Apple iPhone 16 Pro Max Flash Deal | See full list |

| 18 November 2024 - 25 November 2024 | AEON Apple AirPods Pro (2nd Gen) Flash Deal | See full list |

| 18 November 2024 - 25 November 2024 | HSBC RM4,567 Touch 'n Go eWallet Credit | See full list |

| 18 November 2024 - 25 November 2024 | UOB Apple iPad Pro M4 Flash Deal | See full list |

| 12 November 2024 - 18 November 2024 | UOB RM4,800 Touch 'n Go E-Wallet Credit Flash Deal | See full list |

| 11 November 2024 - 2 December 2024 | RHB RM5,000 Touch 'n Go E-Wallet Credit Flash Deal | See full list |

| 11 November 2024 - 18 November 2024 | AEON Apple iPhone 16 Pro Max and RM1,000 Cash Via DuitNow Flash Deal | See full list |

| 11 November 2024 - 18 November 2024 | HSBC Apple iMac M4 | See full list |

| 4 November 2024 - 11 November 2024 | AEON Samsung Galaxy Z Fold6 and Samsung Galaxy Buds 3 Pro Flash Deal | See full list |

| 4 November 2024 - 11 November 2024 | HSBC RM5,678 Touch 'n Go E-Wallet Credit Flash Deal | See full list |

| 4 November 2024 - 11 November 2024 | UOB Apple iPhone 16 Pro Max Flash Deal | See full list |

| 28 October 2024 - 4 November 2024 | AEON Apple MacBook Air M3 and Apple AirPods Pro (2nd Gen) Flash Deal | See full list |

| 28 October 2024 - 4 November 2024 | HSBC Apple iPhone 15 Pro Max Flash Deal | See full list |

| 28 October 2024 - 4 November 2024 | UOB RM3,500 Touch 'n Go E-Wallet Credit Flash Deal | See full list |

| 21 October 2024 - 28 October 2024 | AEON RM5,000 and RM1,000 Cash Via DuitNow Flash Deal | See full list |

| 21 October 2024 - 28 October 2024 | HSBC RM8,888 Touch 'n Go E-Wallet Credit Flash Deal | See full list |

| 21 October 2024 - 28 October 2024 | UOB Apple iMac Flash Deal | See full list |

| 21 October 2024 - 11 November 2024 | RHB Apple iPhone 15 Pro Max Flash Deal | See full list |

| 15 October 2024 - 21 October 2024 | UOB RM5,000 Touch ‘n Go E-Wallet Credit Flash Deal | See full list |

| 14 October 2024 - 21 October 2024 | AEON Apple iPhone 15 Pro Max and RM1,000 Cash Via DuitNow Flash Deal | See full list |

| 14 October 2024 - 21 October 2024 | HSBC Apple MacBook Air M3 Flash Deal | See full list |

| 9 October 2024 - 14 October 2024 | HSBC RM5,000 Touch 'n Go E-Wallet Credit Flash Deal | See full list |

| 7 October 2024 - 14 October 2024 | AEON Apple iPad Pro M4 and Apple AirPods Pro (2nd Gen) Flash Deal | See full list |

| 7 October 2024 - 14 October 2024 | Standard Chartered Apple iPhone 15 Pro Max | See full list |

| 7 October 2024 - 14 October 2024 | UOB Apple MacBook Pro M3 Flash Deal | See full list |

| 30 September 2024 - 7 October 2024 | AEON Apple MacBook Air M3 and RM1,000 Cash Via DuitNow Flash Deal | See full list |

| 30 September 2024 - 7 October 2024 | Standard Chartered RM11,888 Touch 'n Go eWallet Credit | See full list |

| 30 September 2024 - 7 October 2024 | HSBC Apple iMac Flash Deal | See full list |

| 18 September 2024 - 25 September 2024 | Standard Chartered Apple MacBook Pro M3 | See full list |

| 9 September 2024 - 18 September 2024 | SCBK Sony PlayStation 5 | See full list |