Overview of ICBC Credit Cards in Malaysia

Your ultimate travel companion to China and the rest of the world, an ICBC credit card will give you instant acceptance and access to payment convenience, travel benefits, worldwide recognition and local benefits.

Compare ICBC Credit Cards 2024

All ICBC cards are reward credit cards — cards that allow you to collect reward points for your expenditure.

The ICBC Bonus Points are evergreen, which means that they have no expiry date. You can redeem your Bonus Points at a conversion of 150BP to RM1.

To illustrate, 1BP is earned for every RM1 spent on an ICBC Visa card and for every RMB2 spent on an ICBC UnionPay Dual Currency credit card.

All ICBC credit cards also charge among the lowest interest rates on retail, between 13.5% p.a. to 17.5%.

That’s not all, the cards are free for the first year. This annual fee waiver will also be given from the second year onward when you meet the minimum spending requirement.

However, only the ICBC UnionPay Dual Currency Platinum credit card has the advantage of Premier Airport Lounge Service at selected airport lounges in China.

You will have the privileges to access flight and boarding information, internet and TV, newspapers and magazines, and enjoy complimentary food and beverages.

ICBC UnionPay Dual Currency Credit Cards

Not only does ICBC have the largest service coverage and network in mainland China, but UnionPay does too!

Now you can travel to the land of the dragon (cashless) with an ICBC UnionPay Dual Currency credit card.

You have 3 options to choose from: the Classic, Gold or Platinum.

The ICBC UnionPay Dual Currency credit card provides you with the convenience of dual currency card payment, which includes Renminbi (RMB/CNY) and Ringgit Malaysia (MYR); shared credit limit; and ease of mind in exchange charge.

So, whenever you are in China, rest assured that all your payments will be settled in CNY. Any spending with ICBC Union Pay credit card Malaysia made outside of China will be settled in MYR.

ICBC Visa - Other Types of ICBC Credit Card

Besides ICBC UnionPay Dual Currency, there is another type of ICBC credit card - Visa cards.

The ICBC Visa cards have an international presence with local benefits.

You can use ICBC Visa Classic, ICBC Visa Gold and ICBC Visa Platinum in Malaysia, China and everywhere around the world.

ICBC Credit Card Repayment Method

Visa or UnionPay, you have multiple channels to make your credit card repayment such as:

- Standing Instruction via your ICBC Current or Savings Account

- ICBC Internet Banking

- Cheque payment in Ringgit Malaysia only

- Cash payment in Ringgit Malaysia only

- Interbank GIRO (IBG) at participating banks

ICBC credit card contact centre

Worrying over a lost or stolen credit card? Quickly dial ICBC 24-hour Customer Service Hotline at 1800 18 5588 (Domestic) or +603 2788 1600 (Overseas) to report and block your credit card activity.

These same hotline numbers are also available for you to enquire and complain about your experience with ICBC credit cards.

How can I apply for an ICBC credit card in Malaysia?

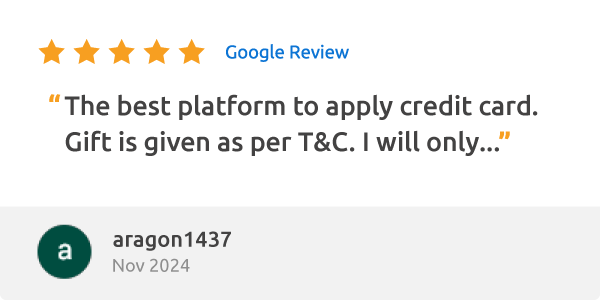

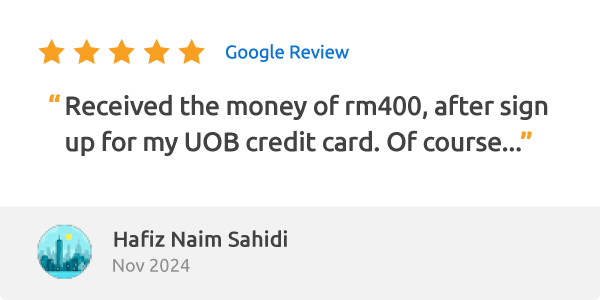

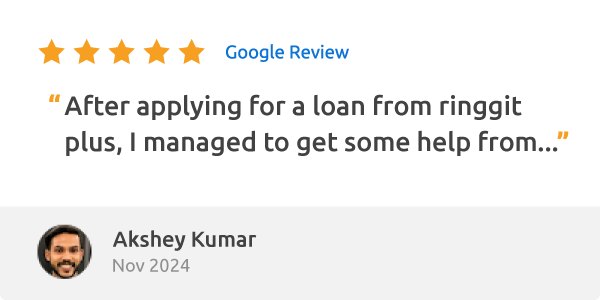

Applying for an ICBC credit card online is easy and you can do it here on Ringgitplus. Make sure you have reached the minimum age and income required.

In general, you must be at least 21 years old and earn a minimum income of RM24,000 annually.

For supplementary cardholders, as long as you are 18 years old, you can get an ICBC supplementary credit card.

| APPLY FOR ICBC CREDIT CARD - ELIGIBILITY | |

|---|---|

| Age of Principal Cardholder | Minimum 21 years old |

| Age of Supplementary Cardholder | Minimum 18 years old |

| Nationality | Malaysian & Chinese |

| Income Requirement (monthly) |

|

Documents for an ICBC credit card application

Now, you need to prepare some general documents to support your credit card application like the following:

| DOCUMENTS TO SUBMIT FOR ICBC CREDIT CARD APPLICATION | |

|---|---|

| Salaried Employees | Self-employed |

|

✔ Copy of MyKad (front and back) or Passport

✔ A copy of Chinese Citizen ID (front and back), if any ✔ A copy of the working permit ✔ Latest 3-month salary slips / EA form / EPF statement |

✔ Copy of MyKad (front and back) or Passport

✔ A copy of Chinese Citizen ID (front and back), if any ✔ A copy of the Business Registration Certificate ✔ Form BE or B, with tax payment receipt ✔ Latest 6-month company bank statement |