RinggitPlus Credit Card Promotions 2026

To maximise credit card benefits in Malaysia, it's essential to understand how to leverage sign-up bonuses, rewards programs, and cashback offers. For first-time applicants, RinggitPlus can guide you through selecting the best cards that match your spending habits and financial goals.

From the latest gadgets to cash vouchers to free luggage, these are just some of the credit card gifts that could be yours when you sign up for a credit card with RinggitPlus.

At RinggitPlus, we compare the latest sign-up offers so you can get the most cashback, air miles, shopping rewards, or exclusive freebies when you apply. Our RinggitPlus credit card promotion runs every week, so go ahead and bookmark this page so that you don't miss out on all the great credit card deals.

Without further ado, we bring you this week's lineups for our credit card promotion below.

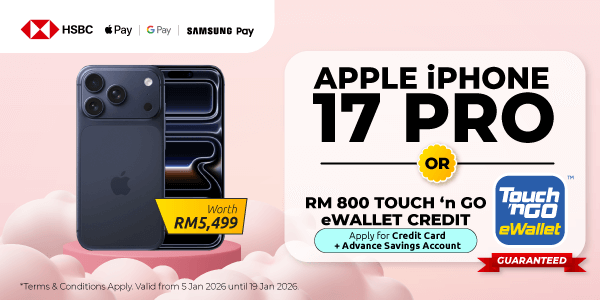

HSBC Credit Cards Promotion

| Sign Up Gift | Apple iPhone 17 Pro (For every 38th qualified applicant who has applied for the HSBC Visa Signature Credit Card, HSBC TravelOne Credit Card, or HSBC Live+ Credit Card, capped at 2 units) RM800 Touch 'n Go E-Wallet Credit (Guaranteed to qualified applicants who applied for HSBC Advance Account and deposited a minimum of RM5,000 in a single transaction within 60 days upon account activation, and also applied for either the HSBC Visa Signature, HSBC TravelOne Credit Card, or HSBC Live+ Credit Card) RM600 Touch 'n Go E-Wallet Credit (Guaranteed to qualified applicants who are not selected for the premium gifts above and have applied for the HSBC Visa Signature) RM200 Touch 'n Go E-Wallet Credit (Guaranteed to qualified applicants who have applied for HSBC TravelOne Credit Card or HSBC Live+ Credit Card) RM300 Touch 'n Go E-Wallet Credit (Guaranteed to qualified applicants who have applied for HSBC Amanah MPower Platinum Credit Card-i and a new HSBC Advance Account) |

| Sign Up Period | 5 January 2026 - 19 January 2026 |

| Requirement |

Apply, get approved by HSBC, activate the new card, and subsequently spend a minimum of RM3,000 in retail transactions within 60 days of the card approval date.

For gifts that require a new HSBC Advance Account, open your account within 10 days of card approval, activate the account with a minimum deposit of RM20, and deposit a minimum of RM5,000 in a single transaction within 60 days of account registration. |

| Eligible Card |

HSBC Visa Signature Credit Card

HSBC TravelOne Credit Card HSBC Live+ Credit Card HSBC Amanah MPower Platinum Credit Card-i |

| Eligible Applicant |

New customers only.

Existing primary cardholders, those who have had their HSBC credit card(s) application approved or denied within 6 months, and those who have cancelled their HSBC credit card(s) within 6 months before the date of the flash deal application, are not eligible. For gifts that require a new HSBC Advance account, applicants with any current and savings accounts with HSBC within the 12 months before the campaign’s start date are not eligible. Terms and conditions apply for HSBC Visa Signature, TravelOne, and Live+ Credit Cards Terms and conditions apply for HSBC Amanah MPower Platinum Credit Card-i |

UOB Credit Cards Promotion

| Sign Up Gift | RM200 Touch 'n Go E-Wallet Credit (Guaranteed to qualified applicants who have applied for UOB Zenith Card, UOB Visa Infinite Card, UOB PRVI Miles Elite Card, UOB PRVI Miles Card, UOB World Card, UOB Lady’s Solitaire Card, and UOB Platinum Business Card)

RM100 Touch 'n Go E-Wallet Credit (Guaranteed to qualified applicants who have applied for UOB Preferred Card, UOB Lady’s Card, UOB ONE Card, UOB EVOL Card, Lazada UOB Card, and UOB Simple Card) |

| Sign Up Period | 5 January 2026 - 3 February 2026 |

| Requirement | For UOB Zenith Card, UOB Visa Infinite Card, UOB PRVI Miles Elite Card, UOB PRVI Miles Card, UOB World Card, UOB Lady’s Solitaire Card, and UOB Platinum Business Card Apply with RinggitPlus, get approved by the bank, activate the card, and make a minimum amount of RM400 in retail transactions (“Retail Spend”) within sixty (60) calendar days from the Credit Card approval date to be eligible. For UOB Preferred Card, UOB Lady’s Card, UOB ONE Card, UOB EVOL Card, Lazada UOB Card, and UOB Simple Card Apply with RinggitPlus, get approved by the bank, activate the card, and make a minimum amount of RM200 in retail transactions (“Retail Spend”) within sixty (60) calendar days from the Credit Card approval date to be eligible. |

| Eligible Card | UOB Zenith Card UOB Visa Infinite Card UOB PRVI Miles Elite Card UOB PRVI Miles Card UOB World Card UOB Lady’s Solitaire Card UOB Platinum Business Card UOB Preferred Card UOB Lady’s Card UOB ONE Card UOB EVOL Card Lazada UOB Card UOB Simple Card |

| Eligible Applicant |

New customers only.

Existing primary cardholders and those who have cancelled their UOB credit card(s) within 12 months before the date of the flash deal application are not eligible. Terms and conditions apply. |

Maybank Credit Cards Promotion

| Sign Up Gift | RM2,500 Cash Via DuitNow (For every 40th qualified applicant who has completed their online application within the Promotion Period, and has met the eligibility criteria, capped at 5 units) |

| Sign Up Period | 29 December 2025 - 26 January 2026 |

| Requirement |

Apply, get approved by Maybank, activate the new card, and subsequently make a minimum of one (1) retail transaction (no minimum amount is required) within 30 calendar days from the date of the card's approval date to be eligible.

|

| Eligible Card |

Maybank World Elite MasterCard

Maybank Islamic MasterCard Ikhwan Platinum Card-i Maybank Islamic MasterCard Ikhwan Gold Card-i Maybank Islamic World Elite Mastercard Ikhwan Maybank Islamic myimpact Ikhwan Mastercard Platinum Credit Card-i Maybank 2 Gold Cards Maybank 2 Platinum Cards Maybank Grab Mastercard Platinum |

| Eligible Applicant |

New customers only.

Existing principal cardholders who hold any Maybank credit cards or those who have cancelled their Maybank credit card within 6 months before the date of the flash deal application are not eligible. Terms and conditions apply. |

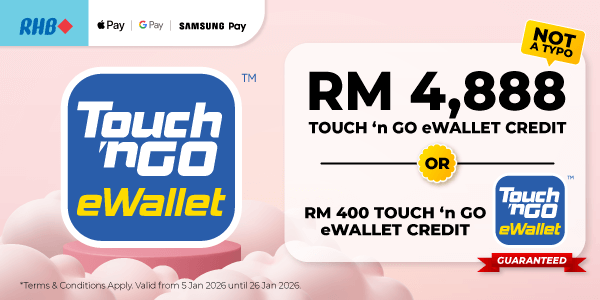

RHB Credit Cards Promotion

| Sign Up Gift |

RM4,888 Touch 'n Go E-Wallet Credit (For one (1) Random Winner per week based on the Approval List from the Bank, capped at 3 units)

RM400 Touch 'n Go E-Wallet Credit (Guaranteed to qualified applicants who have two (2) approved RHB credit card applications) RM250 Touch 'n Go E-Wallet Credit (Guaranteed to qualified applicants who are not selected to receive the gifts mentioned above) |

| Sign Up Period | 5 January 2026 - 26 January 2026 |

| Requirement |

For applicants who apply for one (1) RHB Credit Card Get approved, activate your new RHB credit card, and subsequently make one (1) retail transaction with no minimum purchase amount as a Principal cardholder, within 60 days of the card's approval date. For applicants who apply for two (2) RHB Credit Cards Get approved, activate your new RHB credit cards, and subsequently make one (1) retail transaction on BOTH the cards with no minimum purchase amount as a Principal cardholder, within 60 days of the card's approval date. |

| Eligible Card |

RHB Visa Infinite

RHB Visa Signature MyEG-RHB Credit Card RHB World MasterCard Credit Card RHB World MasterCard Credit Card-i RHB Cash Back Visa Credit Card RHB Cash Back MasterCard Credit Card RHB Islamic Cash Back Credit Card-i RHB Rewards Visa Credit Card RHB Rewards MasterCard Credit Card RHB Rewards Visa Credit Card-i RHB Shell Visa Credit Card RHB Shell Visa Credit Card-i |

| Eligible Applicant |

New customers only.

Existing principal cardholders and those who have cancelled their RHB credit card within 12 months from the date of the current application are not eligible. Terms and conditions apply. |

AmBank Credit Cards Promotion

| Sign Up Gift |

Apple iPad Air M3 11-inch (For every 38th qualified applicant who meets the requirements, and based on the Bank's approval list, capped at 4 units)

RM200 Touch 'n Go E-Wallet Credit (Guaranteed to qualified applicant who applied for the Visa Signature Card and meets the requirements, based on the Bank's approval list) RM100 Touch 'n Go E-Wallet Credit (Guaranteed to qualified applicant who applied for the Visa/ UnionPay Platinum Card and meets the requirements, based on the Bank's approval list) |

| Sign Up Period | 5 January 2026 - 3 February 2026 |

| Requirement |

For AmBank Visa Infinite Card, AmBank Islamic Visa Infinite Card-i, AmBank Visa Signature Card, AmBank Islamic Visa Signature Card-i, AmBank BonusLink Visa Signature Card Apply, get approved by the Bank and activate the card before 5 March 2026 (11:59 PM), then spend a minimum of RM400 in retail transactions within sixty (60) calendar days upon the approval date to be eligible. For AmBank Cash Rebate Visa Platinum Card, AmBank BonusLink Visa Platinum Card, AmBank Islamic Visa Platinum CARz Card-i, AmBank Visa Platinum Card, AmBank Islamic Visa Platinum Card-i, AmBank UnionPay Platinum Card Apply, get approved by the Bank and activate the card before 5 March 2026 (11:59 PM), then spend a minimum of RM200 in retail transactions within sixty (60) calendar days upon the approval date to be eligible. |

| Eligible Card |

AmBank Visa Infinite Card

AmBank Islamic Visa Infinite Card-i AmBank Visa Signature Card AmBank Islamic Visa Signature Card-i AmBank BonusLink Visa Signature Card AmBank Cash Rebate Visa Platinum Card AmBank BonusLink Visa Platinum Card AmBank Islamic Visa Platinum CARz Card-i AmBank Visa Platinum Card AmBank Islamic Visa Platinum Card-i AmBank UnionPay Platinum Card |

| Eligible Applicant |

New customers only.

Existing primary cardholders of an AmBank Credit Card and those who have cancelled any of their credit cards issued by the Bank in the last 12 months from the date of application are not eligible. Terms and conditions apply. |

Alliance Bank Credit Cards Promotion

| Sign Up Gift | Up to RM888 Blind Box Cashback (Meet the qualifying requirement to earn campaign entries to qualify) |

| Sign Up Period | 9 January 2026 - 19 January 2026 |

| Requirement |

Apply, get approved by Alliance Bank by 15 April 2026, activate the card, and spend a minimum of RM300 in retail transactions within sixty (60) calendar days upon the approval date to be eligible. |

| Eligible Card |

Alliance Bank Visa Platinum Credit Card

Alliance Bank Visa Signature Credit Card Alliance Bank Visa Infinite Credit Card Alliance Bank Visa Virtual Credit Card |

| Eligible Applicant |

New customers only.

This promotion is excluded for business accounts, non-Alliance Bank Visa cards, and individuals or entities deemed ineligible due to legal, financial, or internal bank criteria. Terms and conditions apply. |

Frequently Asked Questions

These FAQs explain how credit card approvals and sign-up gift redemptions work on RinggitPlus. If your question is related to bank approval status or gift delivery timelines, you will likely find the answer below.

1. How can I check my application status?

Credit card approvals are handled entirely by the bank. RinggitPlus is not involved in the approval decision or processing timeline, so we are unable to check your application status or speed up the bank’s decision. Most banks have a dedicated hotline for credit card applications. You can find the contact number on the bank’s official website or in the confirmation or welcome email sent after you applied.

If your card has already been approved and activated but you are waiting for your sign-up gift, contact us at [email protected]. We can check whether the bank has shared your approval details and confirm whether you are eligible for gift redemption.

2. I’ve received my credit card, but I’m still waiting for my reward. What should I do?

Please wait up to 60 days from your card approval date, or from the date you completed the RinggitPlus Rewards Redemption Form (whichever is later), to receive your gift redemption email or reward.

If you have not completed the Rewards Redemption Form yet, check your inbox and spam folder for the redemption email from RinggitPlus. Completing the form promptly helps avoid delays in the gift delivery process. If it has been more than 60 days, or you are facing issues completing the form, email us at [email protected], and we will assist you.

3. What is a unique ID, and why is it important?

Your unique ID is a reference code that links your credit card application to your sign-up gift, similar to a tracking number. You will find this unique ID in the gift redemption email sent by RinggitPlus. RinggitPlus uses this code to verify your eligibility and match your application with the bank’s approval list. When completing the Rewards Redemption Form, you must enter the correct unique ID.

Providing an incorrect or incomplete ID may delay gift processing, as we will not be able to match your details with the bank’s records. If you cannot locate your unique ID or did not receive the redemption email, contact us at [email protected], and we will assist you.

4. I can’t remember if I’ve completed my Rewards Redemption Form. What should I do?

Click the redemption link in the RinggitPlus email you received. If you have already submitted the form, you will see a message that says “You have already submitted the Rewards Redemption form.”

To locate the email, check both your main inbox and spam folder. The subject line usually mentions “reward redemption” or “gift redemption.” If the form opens blank, it means you have not submitted it yet.

If you need confirmation that we have received your submission, contact us at [email protected] with your name and unique ID, and we will verify it for you.

5. I’ve completed my Rewards Redemption Form. When will I receive my reward?

Physical gifts are typically delivered within 21 to 28 working days, depending on stock availability. E-vouchers and DuitNow cash transfers may take up to 60 days after the bank verifies that all campaign criteria have been met.

For physical items such as phones, tablets, or home appliances, delivery usually takes around 21 working days but may extend to 28 working days. If it has been longer than 28 working days, contact us at [email protected] with your unique ID for assistance.

6. How do I modify my delivery address after completing the Rewards Redemption Form?

Contact us at [email protected] immediately with your unique ID and updated address. Address changes are only possible if your gift has not yet been shipped.

If the gift has already been dispatched, we will not be able to redirect it. In such cases, you may need to coordinate directly with the courier or arrange collection from the original delivery address.

7. What is considered retail spending?

Retail spending generally includes local and overseas purchases, online transactions, e-wallet reloads (such as Touch ‘n Go, BigPay, and Boost), standing instructions, auto-billing, and insurance or takaful payments.

Transactions that do not qualify include cash advances, balance transfers, instalment payments, quasi-cash transactions, refunds, disputed transactions, charity payments, utility bills, government payments, and fees such as interest charges or annual fees. Definitions may vary by bank. Always refer to the promotion’s terms and conditions.

8. Can I change my gift?

No. Gifts cannot be changed or exchanged. The gift offered is fixed based on the campaign period during which you applied.

If your promotion offered a specific item or reward, such as an iPhone model or Touch ’n Go credit amount, only those options are available and cannot be swapped. For premium promotions, such as “every 38th applicant” deals, selected applicants will receive the premium gift. All other eligible applicants will receive the guaranteed secondary gift from the same campaign.

9. Why was I not selected as a winner for a flash deal?

Flash deals are limited promotions with strict eligibility criteria. Even a small mismatch may affect eligibility. Common reasons include not meeting the minimum spending requirement, having your application approved outside the campaign period, not being a new customer to the bank, or not being selected in a lucky draw.

All sign-up promotions are strictly for new customers. If you currently hold, or recently cancelled, a credit card from the same bank (usually within the past 6 to 12 months), you may not be eligible. If you were not selected as a lucky draw winner, you will not receive the premium gift, but you may still qualify for the guaranteed secondary gift if all other conditions are met. You can check the winners' list to confirm your status.

10. Does RinggitPlus collect any of my data during the application process?

Yes, but only limited information. This includes your name, email address, the credit card product you applied for, your application reference number, and application date. This information is used solely to verify your gift eligibility against the bank’s approval list.

RinggitPlus does not collect sensitive information such as your IC number, income details, bank statements, or employment information. These details are submitted directly to the bank and are protected under their security and privacy policies.

All data collected by RinggitPlus is protected under Malaysia’s Personal Data Protection Act (PDPA) and is used strictly for gift redemption purposes. We do not share this information with third parties.

Still have questions?

If your question is not covered here, you may refer to our detailed FAQ article, which covers topics such as DuitNow transfers, warranty information, redemption timelines, and additional troubleshooting steps.

You can also contact us directly:

Email:

[email protected]