What Is Shariah-Compliant Banking?

Shariah-compliant banking is strictly regulated and governed by the highest Islamic financing Shariah Advisory Council (SAC) of Bank Negara Malaysia.

This is a Shariah committee that essentially ensures all Islamic personal loans in Malaysia adhere to the Shariah principles, which excludes all of the following practices:

- Haram: Businesses that include gambling, alcohol, tobacco, pornography and more

- Riba: Practice of lending with high-interest rates

- Gharar: Speculative or risky sales where the value is dubious or uncertain

- Zulm: Activities and practices that are exploitative, oppressive or cruel

How does an Islamic personal loan work?

Islamic banks will "purchase" approved assets or commodities for the borrower and sell them at a higher price for financing thus differing from their conventional counterpart which is based on the concept of lender and borrower with money as a commodity.

The Islamic loan is structured in a way where real purchase-and-resale of real assets and commodities is being made so that it is Shariah-compliant as this type of loan is prohibited from making money out of money by charging interest (Riba).

Are Islamic loans free from interest rates?

Islamic loans are where the bank buys an asset on behalf of you as the borrower and then sells it to you at a profit. Think of the profit rate as business earnings from the fee and profit for assets purchase and resale.

A conventional personal loan, on the other hand, is where the bank lends borrowers money with an interest charged on the amount borrowed — this is how banks make money on loans.

The borrower’s monthly loan repayment by instalment includes the specified rate based on a margin above the bank’s base lending rate (BLR) along with the interest rate over a set of tenures.

What are the benefits of an Islamic personal loan?

Although the benefits of a Shariah-compliant personal loan are quite similar to the conventional loans in the market, there are a few benefits that you only get to enjoy with the former option.

The below list is just some of them. You can get more details by checking in with your choice of Islamic bank/lender.

Lower late payment fees

If there’s any late settlement on loan repayments, the fees may be lower than a conventional loan charge — as compounding interest is prohibited by the Shariah principles.

Based on the Ta’widh concept, Islamic banks are subjected to charge late payment fees at a maximum rate of 1% per annum.

No early settlement fees

Any early loan settlement before the expiry of loan tenure will get a rebate.

Known as Ibra’ (rebate), Islamic personal loans pay an incentive to customers who pay off their loans ahead of time.

Do note that not all Islamic banks provide this benefit.

Fixed repayment amount

The repayment amount is a fixed one for the entire tenure as compared to conventional loans whereby it varies.

What is the maximum Islamic loan I can borrow?

Depending on the borrower’s credit rating assessed by the bank during the application, Islamic banks in Malaysia offer loans from RM1,000 to RM250,000.

How can I choose the best Islamic loan in Malaysia?

Looking at the profit rate is the key to choosing the best Islamic personal loan.

First, list down a few Islamic personal loans with a low profit rate as a start. Next, compare them with the Islamic loan’s tenure which will directly impact monthly repayment.

Finally, use a personal loan calculator to help you estimate your monthly repayment.

How do I repay my monthly instalment?

Typically, you will have three options to choose from such as salary deduction, auto debit for monthly instalments (for salary crediting account) or via Standing Instruction.

Regardless, it all depends on the loan you're applying for. Double-check with your bank!

Which Islamic loans offer the best profit rates in Malaysia?

Currently, you can expect the profit rates of Islamic loans in Malaysia to range from 3.01% p.a. to 20.00% p.a. depending on the lenders.

Before you hit that Apply For Loan button above, here's a brief look at the Islamic personal financing profit rates in the current market for the year 2024, so far.

| Bank/Financial Lenders | Profit Rate | Minimum Monthly Income | Financing Amount | Financing Tenure |

| Al Rajhi Bank | 5.42% - 14.19% p.a. | RM5,000 | RM10,000 - RM250,000 | 1 - 8 years |

| Bank Islam | 4.20% - 5.99% p.a. | RM2,000 | RM10,000 - RM300,000 | 1 - 10 years |

| JCL | 18.00% - 20.00% p.a. | RM1,000 | RM500 - RM50,000 | 6 months - 5 years |

| Public Bank | 3.99% - 4.45% p.a. | RM1,500 | RM5,000 - RM150,000 | 2 - 10 years |

| Bank Rakyat | 4.64% - 6.31% p.a. | RM1,000 | RM5,000 - RM200,000 | 1 - 10 years |

| MBSB Bank | 3.01% - 5.80% p.a. | RM3,000 | RM50,000 - RM400,000 | 3 - 10 years |

| RHB | 5.65% p.a. | RM2,000 | RM2,000 - RM300,000 | 2 - 10 years |

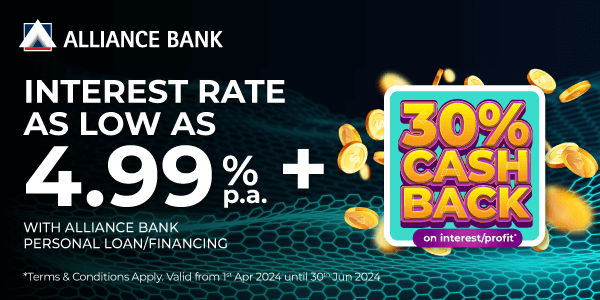

| Alliance Bank | 4.99% - 16.68% p.a. | RM3,000 | RM5,000 - RM300,000 | 1 - 7 years |

| HSBC Amanah | 4.88% - 10.50% p.a. | RM5,000 | RM6,000 - RM250,000 | 2 - 7 years |

| Yayasan Ihsan Rakyat | 6.65% - 9.99% p.a. | RM1,500 | RM3,000 - RM300,000 | 1 - 10 years |

| AEON | 7.92% - 18.00% p.a. | RM1,500 | RM1,000 - RM100,000 | 6 months - 7 years |

| AmBank Islamic | 8.00% - 11.99% p.a. | RM3,000 | RM2,000 - RM150,000 | 1 - 5 years |

| Yayasan Dewan Perniagaan Melayu Perlis Berhad | 6.65% - 9.99% p.a. | RM1,500 | RM3,000 - RM300,000 | 1 - 10 years |

Who can apply for Islamic personal loans?

Similar to applying for a conventional personal loan, the requirements of applicants include Malaysian citizens with fixed incomes with the minimum age being 18 years old and up to 65 years old. Other requirements include:

- Malaysian citizens - both Muslims and non-Muslims can apply for Islamic banking products.

- The minimum age ranges from 18 to 25 years old.

- The maximum age ranges from 58 to 65 years old.

- Minimum monthly income typically ranges from RM1,500 to RM5,000. For pensioners, the minimum monthly income is RM800.

- A guarantor or collateral may or may not be required, depending on the bank. If a guarantor is not required, a security deposit in the form of a 1-month advanced instalment amount. Once approved, your advanced amount will be deducted from your loan amount.

What documents should I prepare to apply for an Islamic personal loan?

Common documents such as a copy of your IC, salary slips, bank statements and EPF statements are usually required to make an application. However, some lenders may also request additional documents.

Below are some of the documents that you can prepare beforehand.

For salaried employees:

- Copy of your IC (both sides) AND

Submit ANY one of the following:

- Latest 3 months’ validated salary slips

- Latest 3 months’ bank statements of the salary crediting account

- Copy of the latest EPF, EA or BE form with the official tax payment receipt

- Copy of the Letter of Appointment (if employed less than 3 months)

- Copy of the Yearly Commission Statement from the employer

For self-employed individuals:

- Copy of IC (both sides) AND

Submit ANY one of the following:

- Copy of the latest B Form with the official tax payment receipt or CPO2 attached

- Copy of the latest EPF statement

- Copy of the audited financial statement or profit and loss account

- Copy of the Business Registration Form

The top 6 best Islamic personal loans in Malaysia

We recommend Islamic personal loans from Alliance Bank, Al Rajhi Bank, HSBC Amanah, MBSB Bank, AEON and JCL.

For easy comparison and consideration, here are the mentioned six Shariah-compliant personal financing:

- Alliance Bank CashVantage Personal Financing-i

- Al-Rajhi Personal Financing-i

- JCL i-Fund Personal Financing

- HSBC Amanah Personal Financing-i

- AEON i-Cash Personal Financing-i

- MBSB Afdhal-i

Compare and apply for Islamic personal loans with RinggitPlus

Already have one Islamic personal financing you would like to apply for? Go ahead and apply for loans online with RinggitPlus. Just click on the Apply For Loan green button above and we will assist you all the way.

If you need suggestions for Islamic loans that fit your financial background, simply use our loan recommendation service. It's completely free!