Overview of Standard Chartered Credit Cards in Malaysia

Catering to reward seekers, cashback lovers and avid travellers, get the best of both worlds: an international credit card brand with global and local benefits.

Standard Chartered Credit Card Application Journey

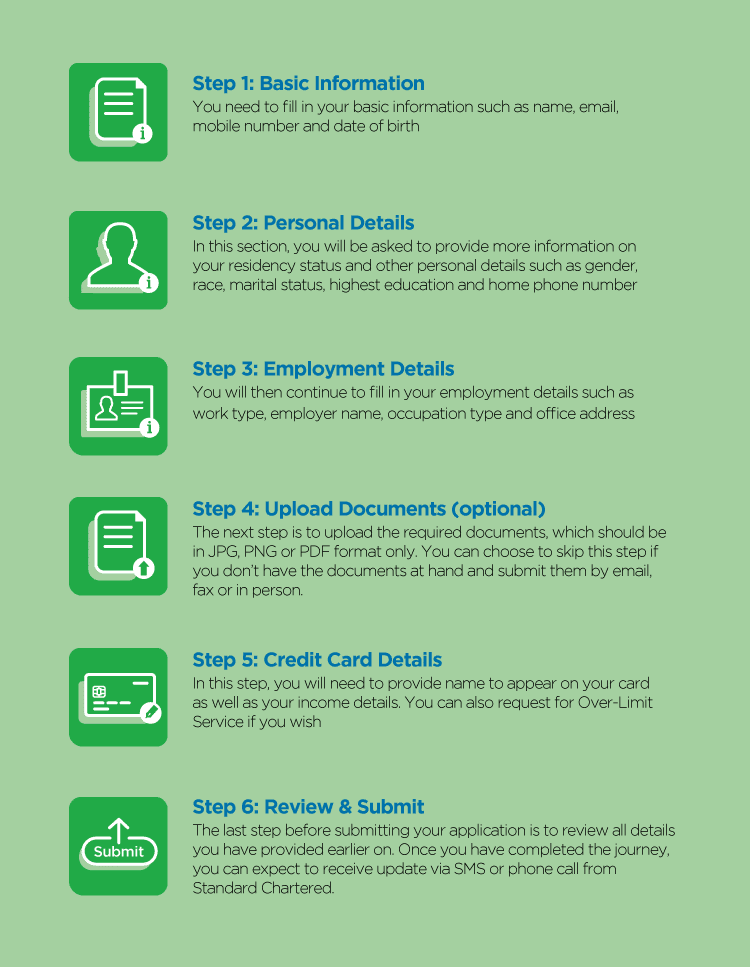

You can apply for a Standard Chartered credit card online through 2 simple steps: (1) RinggitPlus WhatsApp Chatbot, then (2) Standard Chartered Digital Form.

On the RinggitPlus WhatsApp Chatbot, you are required to provide your IC (front and back) to proceed with a credit check and card selection.

Next, you will be redirected to the Standard Chartered Digital Form to complete the application via these six steps:

Features and Benefits of Standard Chartered Bank Credit Cards

There are various features and benefits for the Standard Chartered Bank as listed below:

Standard Chartered Credit Card Malaysia: Rewards and Travel

Earn 360° Rewards Points with Standard Chartered Visa Platinum and Standard Chartered Platinum MasterCard Basic credit cards.

Check your card point balance on your monthly statement or by logging into SC Online Banking.

You will be spoilt for choice with the rewards program as you can redeem your points with a wide variety of gifts.

You can control the flexibility of your credit card point redemption by combining points with a cash payment if you want to save your points for another big-ticket item purchase.

That’s not all, you can also redeem your points with air miles from your favourite airlines that are partnered with Standard Chartered credit cards in Malaysia.

Better yet, get yourself a travel credit card like the Standard Chartered Journey Credit Card to collect and redeem Miles directly.

Get Cashback with a Standard Chartered Bank Credit Card

Maximise your monthly spending on petrol or any retail transactions with Standard Chartered cashback credit cards.

The Standard Chartered Simply Cash Credit Card will let you enjoy up to 15% cashback which will bring you even more value and savings.

You can choose to redeem your cashback with gifts or have the cash credited back to your Standard Chartered Bank credit card account.

Standard Chartered Credit Card Promotion

Enjoy a variety of Standard Chartered credit card promotions all year long with The Good Life Privileges!

Each Standard Chartered credit card also comes with its promotional features and benefits.

Security Features of Standard Chartered Malaysia Credit Card

Like all secured credit cards, your Standard Chartered card is built in with a secure payment method, known as a Personal Identification Number (PIN) to protect you against fraudulent activity.

Your online payment is also protected via Verified by Visa or Mastercard SecureCode.

Standard Chartered Virtual Credit Card

The Standard Chartered Virtual Credit Card is a secure, digital-only card designed for safe online transactions without needing a physical card.

It offers instant access upon approval, controlled spending, and fraud protection with one-time-use card details.

Linked to your Standard Chartered account, it allows easy tracking via online banking or the Standard Chartered Mobile app. Ideal for online shopping, subscriptions, and business payments, this card provides convenience and security.

Standard Chartered Balance Transfer Plan for Lower Interest Rate

Are you anxious looking at your monthly statement every month with your outstanding balance incurring more interest even after you have partially paid it?

Worry no more as your SCB credit cards offer a balance transfer plan at a one-time low-interest rate and flexible repayment tenure.

Now, when you sign up for Standard Chartered Balance Transfer Plus, you will save on interest charges and reduce your monthly instalment amount.

Therefore, no minimum payment is allowed. Otherwise, you will go back to paying high finance charges of up to 18% per annum.

Standard Chartered FlexiPay Plan for Installment

Standard Chartered's easy payment plan gets you the product or service that you have been craving for a long time by just converting the purchase amount made via your credit card into smaller monthly installments at a flexible repayment period.

The minimum amount to be converted is RM500 and you need to apply for Standard Chartered FlexiPay Plus within 30 days from the date of your transaction to enjoy a flat and low-interest rate.

What travel benefits can I get with a Standard Chartered credit card?

For Malaysians who travel frequently, Standard Chartered credit cards offer a range of premium travel-related benefits that add comfort, convenience, and value to your journeys.

One of the standout perks is Plaza Premium Lounges free access at both Kuala Lumpur International Airport (KLIA and KLIA2) — perfect for relaxing before your international flights. On top of that, some cards like the Standard Chartered Journey Credit Card offer fast air miles conversion, allowing you to earn and redeem points for flight rewards more efficiently.

You can also enjoy monthly Grab ride rebates on airport transfers when you meet the minimum spend on travel-related expenses, making your trips to and from the airport more convenient and affordable.

Plus, you’ll be covered with travel insurance of up to USD100,000, including COVID-19 protection, giving you added peace of mind.

How to Apply for a Standard Chartered Credit Card?

Anyone can apply for a Standard Chartered card online in Malaysia here on RinggitPlus, provided that you meet the minimum requirements of holding a valid IC or Passport, and earning a minimum annual income of RM96,000 or RM8,000 monthly.

| APPLY FOR STANDARD CHARTERED CREDIT CARD ONLINE - ELIGIBILITY | |

|---|---|

| DOCUMENTS FOR STANDARD CHARTERED CREDIT CARD APPLICATION | |

| Salaried Employee | Commission Earner/ Self-Employed |

|

Private sector:

✔ Copy of your IC (both sides) or passport ✔ Latest 2 years of EPF statements (PDF copy downloaded from the KWSP i-Akaun website/mobile app) Public sector: ✔ Copy of your IC (both sides) or passport ✔ Latest Form B/BE and the Acknowledgement Summary Page ( click here for the guidelines) |

Private sector:

✔ Copy of your IC (both sides) or passport ✔ Commission statement and bank statement Public sector: ✔ Copy of your IC (both sides) or passport ✔ Latest Form B/BE and the Acknowledgement Summary Page ( click here for the guidelines) |

Note:

1. Standard Chartered may request additional documents at its absolute discretion if your assessment does not meet the requirement.

2. Effective 13 May 2024, please ensure that "Account 3" is shown in the downloaded EPF statement.

Which Standard Chartered Credit Cards is the best in Malaysia 2025?

Standard Chartered Simply Cash Credit Card - best for cashback

Get rewarded with up to 15% cashback every month on Petrol and Groceries plus Dining (these two are under one category) spend.

Standard Chartered Visa Platinum - best for rewards points

Earn 8x reward points each time you spend overseas using foreign currency, 5x reward points on dining and grocery purchases and 1x reward points on all other local transactions. Spend a minimum of RM1,500 or more on online purchases in each monthly billing cycle to get an extra 5,000 bonus points!

Standard Chartered Journey Credit Card - best for travel credit card

Enjoy a faster way to earn AirMiles and great travel privileges such as unlimited airportPlaza Premium Lounge access, complimentary airport ride transfer, travel medical coverage and more with the Journey Credit Card.

Standard Chartered Platinum Mastercard Basic - best for credit card beginners

A credit card for beginners that waives the annual fees for life and gives reward points for every Ringgit spent. To manage your finances right, you need to begin right.

How Long Does It Take to Get Approved for a Standard Chartered Credit Card via RinggitPlus?

The approval time for a Standard Chartered credit card varies based on the bank’s processing time and the completeness of your application. Once you apply via RinggitPlus, you’ll receive a welcome email with instructions to complete your application with Standard Chartered.

To avoid delays, ensure you submit all required documents accurately. If your email doesn’t appear in your inbox, check your Promotions or Spam folder. After submission, the bank will review your application and contact you once it’s processed. For assistance, reach out to us at [email protected].

Applying via RinggitPlus gives you access to exclusive credit card sign-up gifts that you won’t get elsewhere. It’s a fast, easy and rewarding way to apply — especially for first-time users looking for convenience and perks in one go.