What Is A Government/GLC Personal Loan?

Like any other loans, government loans share similar features such as competitive rates, flexible repayment and high borrowing amounts.

There are a variety of government personal loans Malaysia has to offer, from banks to cooperatives, conventional loans to Islamic loans, and secured loans to unsecured loans.

Who can apply for government loans?

Government loans are meant for those working in the government sector only. If you are employed by the Federal and State governments, your chances of being approved are likely.

Some banks do offer government loans to the employees of Statutory Bodies, Police, the Army and, in some cases, a government-linked company (GLC) as well.

It is best to check with the bank on the eligibility requirements when applying for personal loans for government employees.

What are the features and benefits of personal loans for government employees?

Although loans for government employees are quite similar to other types of personal loans in the market, two distinct features make government loans different from the rest.

A lower income requirement

Government employees have several advantages when applying for a government personal loan. One of them is the advantage of low-income requirement, which usually starts from as low as RM800 per month, although it may vary from bank to bank.

Fixed and low-interest rate

Government loans often offer a fixed and low interest rate on the total loan amount throughout your loan period. That's because government employees are required to repay the monthly instalments through salary deductions via Biro Perkhidmatan Angkasa (BPA).

What are the documents to apply for a government personal loan?

In any government personal loan application, you will need to prepare documents such as a copy of your IC, salary slips, bank statements and other supporting documents for the bank to process and approve your government loan so that you can receive your money quickly.

Here are the common documents required by banks for government loan applications for your easy reference:

- Copy of your IC (front and back)

- Latest salary slips (depending on the bank)

- Confirmation letter from employer (depending on the bank)

- Bank statement from your salary crediting account

- Other supporting documents may be required (depending on the bank)

Best personal loans for government employees in Malaysia

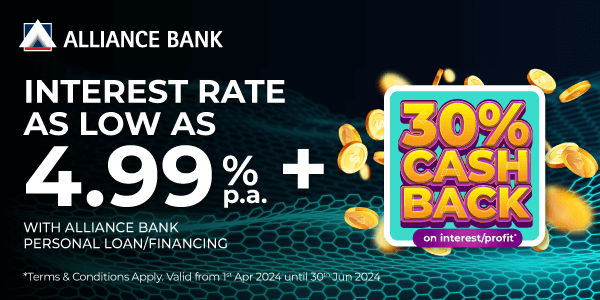

Some of the best loans for government employees include loans from Public Bank, Affin Islamic Bank, MBSB Bank and several others.

Here's a quick browse of some of the best personal loans for government employees.

| Bank/Financing Company | Interest/Profit Rate | Minimum Monthly Income | Loan/Financing Amount | Loan Tenure |

| MBSB Bank | 2.93% - 5.65% p.a. | RM3,000 | RM50,000 - RM250,000 | 3 - 10 years |

| Public Bank | 3.99% - 4.45% p.a. | RM1,500 | RM5,000 - RM150,000 | 2 - 10 years |

| Bank Islam | 4.20% - 5.99% p.a. | RM2,000 | RM10,000 - RM300,000 | 1 - 10 years |

| AmBank | 3.88% - 7.90% p.a. | RM1,500 | RM5,000 - RM200,000 | 2 - 10 years |

| UKHWAH | 4.35% - 4.99% p.a. | RM1,500 | RM2,000 - RM250,000 | 2 - 10 years |

| Bank Rakyat | 4.64% - 6.31% p.a. | RM1,000 | RM5,000 - RM200,000 | 1 - 10 years |

| RHB | 5.65% p.a. | RM2,000 | RM2,000 - RM300,000 | 2 - 10 years |

| BSN | 4.60% - 5.30% p.a. | RM1,500 | RM5,000 - RM200,000 | 1- 10 years |

| Affin Islamic Bank | 3.50% - 6.30% p.a. | RM1,500 | RM2,500 - RM250,000 | 2 - 10 years |

| Agrobank | 6.80% - 7.62% p.a. | RM1,000 | RM1,000 - RM200,000 | 1 - 10 years |

| Yayasan Ihsan Rakyat | 6.65% - 9.99% p.a. | RM1,500 | RM2,500 - RM250,000 | 1 - 10 years |

| Yayasan Dewan Perniagaan Melayu Perlis | 6.65% - 9.99% p.a. | RM1,500 | RM2,500 - RM250,000 | 1 - 10 years |

Before you get on with the loan application, make sure you compare all government loan rates, income requirements and benefits to get the best value out of your commitment.

Where to apply for government personal loans online?

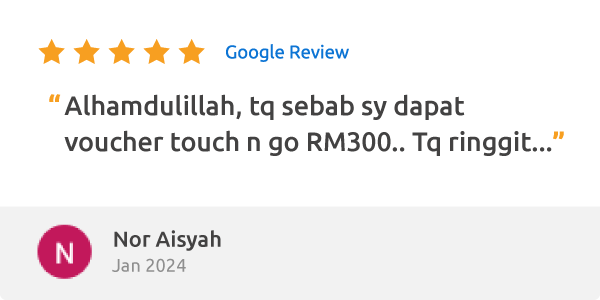

Nowadays, you can compare and apply for government loans online easily on RinggitPlus. And even better, you can also get loan recommendations with us as well!

With just one click away, our WhatsApp chatbot will help assess your financial profile and recommend loans that fit you. Click on the Apply For Loan button above to proceed.