What Is A Government/GLC Personal Loan?

A Government/GLC loan is a personal loan for civil servants and employees of government-linked companies. These loans are designed just for them. You can get great features like competitive interest rates and flexible repayment option. The types of government loans available are very diverse. You can find them from various sources, including banks and cooperatives. When choosing a loan, you can also pick between conventional and Islamic financing, as well as secured and unsecured loans.

What makes government personal loan attractive?

These loans often come with some great advantages that make them stand out, including:

- Lower interest rates compared to standard personal loans

- Flexible repayment terms that suit your financial situation

- Higher borrowing limits to meet larger expenses

- Convenient salary deductions via systems like Biro Angkasa, so repayments are automatically deducted from your monthly salary, making budgeting hassle-free and reliable

Overall, government and GLC personal loans provide a convenient and cost-effective way for eligible employees to access financing with less stress.

What is Biro Angkasa and how is it related to government personal loan?

Biro Angkasa, officially known as Angkatan Koperasi Kebangsaan Malaysia Berhad (ANGKASA), operates the Angkasa Salary Deduction System (SPGA). It is a vital system that facilitates the repayment of loans for government and Government-Linked Company (GLC) employees in Malaysia. This system provides a unique advantage for civil servants, offering a convenient and secure way to manage their financial commitments.

How the Biro Angkasa System Works

Biro Angkasa acts as a centralized 'collection agent' for a network of financial institutions, including banks, cooperative societies, and licensed money lenders. Instead of the borrower making monthly payments directly to the lender, the loan instalment is automatically deducted from their salary by the employer's payroll department.

Here's the step-by-step process:

1. Loan Application: A government or GLC employee applies for a personal loan from a bank or cooperative that is a member of the Biro Angkasa system.

2. Lender's Approval: The lender assesses the application and, upon approval, submits the details of the loan and the monthly deduction amount to Biro Angkasa.

3. Salary Deduction: Biro Angkasa sends a request to the borrower's employer (e.g., a specific ministry or government agency) to deduct the agreed-upon monthly instalment directly from the employee's salary.

4. Fund Disbursement: The employer’s payroll department executes the deduction and transfers the funds to Biro Angkasa.

5. Payment to Lender: Biro Angkasa then distributes the collected funds to the respective banks and cooperatives.

This system guarantees that loan payments are made consistently and on time, which is a key reason why lenders are willing to offer more favorable terms to civil servants.

Who can apply for a government personal loan in Malaysia?

Government personal loans in Malaysia are specifically designed for individuals working in the government sector. This means that only eligible applicants who are employed by the federal or state government, government agencies, or certain government-linked companies (GLCs) can apply for these loans.

Eligible applicants include:

- Civil servants: Employees working in various government ministries, departments, and agencies across Malaysia.

- Government-linked company (GLC) employees: Workers employed by selected GLCs that qualify under the government personal loan schemes.

- Government statutory bodies: Staff of government-funded organizations that fall under government loan eligibility criteria.

These loans are not available to the general public or private-sector employees; they are a special financial benefit extended exclusively to government employees.

What are the features and benefits of personal loan for government employees?

While personal loans for government employees in Malaysia share some similarities with general market loans, they truly stand out because of a highly beneficial features! These unique aspects are specifically designed to offer more accessible and favorable borrowing conditions.

Benefit 1: A lower income requirement

One of the most significant advantages for government employees is the remarkably lower income requirement to qualify for these specialized personal loans. Many of these programs welcome applicants with monthly incomes starting from as low as RM800, which is a real game-changer! While the exact minimum might vary slightly between different banks or cooperatives (koperasi), this feature opens doors to financial assistance for a much wider range of civil servants across Malaysia.

Benefit 2: Fixed and low-interest rate

Another fantastic benefit of these government loans is their fixed and low interest rate, which remains consistent throughout your entire loan period. This stability is a huge plus, making budgeting your monthly expenses incredibly straightforward and predictable, removing any worries about fluctuating costs. This is because government employees are required to repay the monthly instalments through salary deductions via Biro Perkhidmatan Angkasa (BPA), giving banks greater certainty.

What are the documents to apply for a government loan in Malaysia?

In any government personal loan application, you will need to prepare documents such as a copy of your IC, salary slips, bank statements and other supporting documents for the bank to process and approve your government loan so that you can receive your money quickly.

Here are the common documents required by banks for government loan applications for your easy reference:

- Copy of your IC (front and back)

- Latest salary slips (depending on the bank)

- Confirmation letter from employer (depending on the bank)

- Latest bank statement from your salary crediting account (depending on the bank)

- Latest EA Form (depending on the bank)

- Latest B/BE Form with validated receipt (depending on the bank)

- Other supporting documents may be required (depending on the bank)

Which banks offer the best personal loan for government employees in Malaysia?

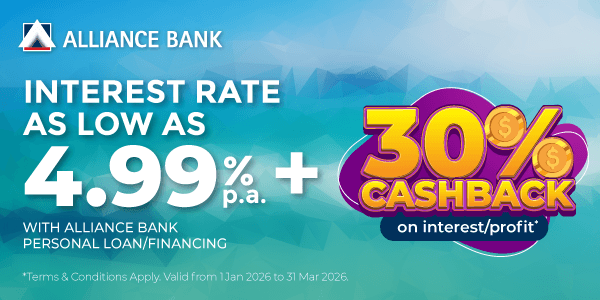

Some of the best loans for government employees include loans from Public Bank, Affin Islamic Bank, MBSB Bank and several others.

Here's a quick browse of some of the best personal loans for government employees.

| Bank/Financing Company | Interest/Profit Rate | Minimum Monthly Income | Loan/Financing Amount | Loan Tenure |

| Bank Muamalat | 6.99% - 10.99% p.a. | RM2,000 | RM10,000 - RM250,000 | 2 - 7 years |

| MBSB Bank | 3.06% - 5.80% p.a. | RM3,000 | RM10,000 - RM250,000 | 2 - 10 years |

| Public Bank | 3.99% - 4.45% p.a. | RM1,500 | RM5,000 - RM350,000 | 2 - 10 years |

| Bank Islam | 7.15% - 9.05% p.a. | RM2,000 | RM10,000 - RM400,000 | 1 - 10 years |

| AmBank | 3.35% - 8.50% p.a. | RM1,500 | RM5,000 - RM200,000 | 2 - 10 years |

| UKHWAH | 4.35% - 4.99% p.a. | RM1,500 | RM2,000 - RM250,000 | 2 - 10 years |

| Bank Rakyat | 4.92% - 6.72% p.a. | RM1,600 | RM10,000 - RM400,000 | 1 - 10 years |

| RHB | 3.05% - 3.17% p.a. | RM2,000 | RM2,000 - RM300,000 | 2 - 10 years |

| BSN | 4.60% - 8.50% p.a. | RM1,500 | RM5,000 - RM400,000 | 1- 10 years |

| Affin Islamic Bank | 3.50% - 5.30% p.a. | RM1,500 | RM2,500 - RM250,000 | 2 - 10 years |

| Agrobank | 6.45% - 7.85% p.a. | RM1,000 | RM5,000 - RM250,000 | 1 - 10 years |

| Yayasan Ihsan Rakyat | 6.65% - 9.99% p.a. | RM1,500 | RM3,000 - RM300,000 | 1 - 10 years |

| Yayasan Dewan Perniagaan Melayu Perlis | 6.65% - 9.99% p.a. | RM1,500 | RM3,000 - RM300,000 | 1 - 10 years |

Before you get on with the loan application, make sure you compare all government loan rates, income requirements and benefits to get the best value out of your commitment.

Frequently Asked Questions (FAQ) About Government Personal Loans in Malaysia

What's the lowest government personal loan rate in Malaysia?

The lowest government personal loan rate starts from 2.95% p.a. from Direct Lending for civil servants, followed by RHB Personal Financing-i at 3.05% p.a. and MBSB Mumtaz-i at 3.06% p.a. These rates are much lower than regular personal loans (8% to 16% p.a.) because repayment is guaranteed through Biro Angkasa salary deduction.

Can contract government employees get government personal loans?

Contract government employees can apply, but eligibility varies by bank. Most banks require at least 6 to 12 months of continuous service, and your contract must extend beyond the loan repayment period.

How much can I borrow with a government personal loan?

Government personal loans range from RM2,000 to RM400,000 depending on the bank and your income. Banks typically limit loans to 10 to 12 times your monthly salary, and your total debt commitments cannot exceed 60% to 70% of your gross income.

Do government personal loans require a guarantor?

Most government personal loans don't require a guarantor because repayment is secured through Biro Angkasa salary deduction. Banks may ask for guarantors if you're borrowing above RM150,000, have existing debts, or are a contract employee.

Can I pay off my government personal loan early?

Yes, but most banks charge early settlement penalties of 3% to 5% of your outstanding balance. Some banks waive penalties after 2 to 3 years, so check your loan agreement before settling early.

What's the maximum tenure for government personal loans?

The maximum tenure is 10 years, though repayment must complete before retirement age (typically 60). Shorter tenures mean higher monthly payments but lower total interest, while longer tenures reduce monthly payments but increase total interest cost.

Are government personal loans Shariah-compliant?

Yes, many banks like MBSB, Bank Islam, Bank Rakyat, RHB Islamic, and Public Bank Islamic offer Shariah-compliant government personal loans using Tawarruq or commodity Murabahah principles. Rates are competitive with conventional loans, starting from 3% p.a.

Can I refinance my government personal loan?

Yes, you can refinance by taking a new loan to settle your existing one if you find a lower rate. You need to calculate whether you'll save money after accounting for early settlement penalties on your current loan.

What documents do I need for a government personal loan application?

You need your IC copy, 3 to 6 months of salary slips, and bank statements from your salary account. Some banks may also request an employment confirmation letter, EA form, EPF statement, or staff ID card.

What happens if I miss a government personal loan payment?

Missing a payment is rare since Biro Angkasa automatically deducts from your salary. If deduction fails due to insufficient salary, you'll face late fees of RM50 to RM100 plus daily interest, and after 30 days, it gets reported to CCRIS.

Can I transfer my government personal loan if I change departments?

Yes, you can keep your loan when transferring between government departments since Biro Angkasa operates across all agencies. Just inform your bank about the transfer, and your new payroll department will continue deducting payments.

How to apply for a government personal loan with RinggitPlus?

Nowadays, you can compare and apply for government loans online easily on RinggitPlus. And even better, you can also get loan recommendations with us as well! With just one click away, our WhatsApp chatbot will help assess your financial profile and recommend loans that fit you. Click on the Apply For Loan button above to proceed.