Fast Approval Personal Loans In Malaysia

Urgency and excitement are the reasons why people are looking for fast loans. Sometimes in your life, unexpected events could catch you by surprise and when money is in question, waiting for your next salary can be stressful.

Emergency cases such as paying for a medical bill (when a medical card does not cover you), upcoming education fees, car or home maintenance, and outstanding utility payments, require immediate financial attention.

Needing fast cash also applies in situations when you are funding for your next vacation, wedding, deposit on your new car or home and many other excitements.

Are there any banks in Malaysia that offer personal loan with fast approval?

Mainstream lenders i.e. banks usually follow the financial regulator's guidelines to approve loan applications which will take several working days.

Alternatively, individuals seeking urgent financial help could consider non-bank options such as licensed money lenders, cooperatives and peer-to-peer platforms.

While you might stand a high chance of approval by these non-banks, it is best to practise caution when approaching these institutions. You may find out the legality of a finance company by checking the company registration number via MyData SSM.

How long does is take for a personal loan to be approved?

The standard turnaround time is between 2 to 5 working days with complete application and document submission to the bank.

Nowadays, you can even get a personal loan approved and disbursed to your account within 24 hours when you complete an online loan application.

Bank personal loans with fast approval in Malaysia

| Bank | Approval Time | Interest Rate | Minimum Monthly Income | Loan Amount | Loan Period | Debt Consolidation | Cashback |

| Hong Leong Bank | 2 days* | 5.00% - 7.50% p.a. | RM2,000 | RM5,000 - RM250,000 | 2 - 5 years | No | Yes |

| CIMB | 1 day upon complete submission* | 4.38% - 19.88% p.a. | RM2,000 | RM2,000 - RM100,000 | 2 - 5 years | No | No |

| Maybank | 2 day upon complete submission* | 6.50% - 8.00% p.a. | RM3,500 | RM5,000 - RM100,000 | 2 - 6 years | No | No |

| RHB | 1 day approval and disbursement* | 13.47% - 22.48% p.a. | RM3,000 | RM2,000 - RM150,000 | 1 - 7 years | Yes | Yes, under Joy@Work Salary Deduction Scheme |

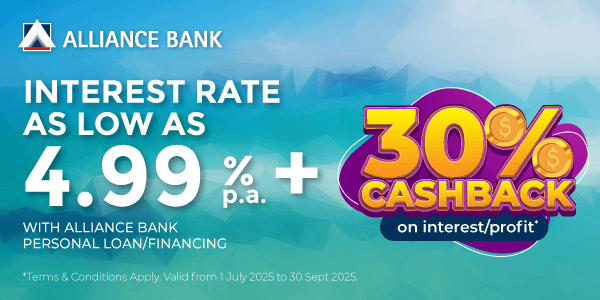

| Alliance Bank | 1 day under "Same Day Cash"* | 4.99% - 16.68% p.a. | RM3,000 | RM5,000 - RM200,000 | 1 - 7 years | Yes | Yes |

While processing your loan application, the banks will take into account many factors to determine your loan amounts and interest rates, such as your credit history (record of your repayments), credit score or credit rating, current financial commitments, income, employment type, debt service ratio, savings and other assets.

If the bank rejects your personal loan application due to falling short of the requirements, don’t let that discourage you from exploring other options because they might have different approval criteria.

Is that possible for me to get an instant loan without documents in Malaysia?

If you're searching for instant loans without any documents in Malaysia, most likely you won't find any. However, some of the lenders below do offer less documentation such as instaDuit.

Below are some personal loans from non-banks that you can consider applying. For now, these financial lenders have their criteria and set of required documents, despite the fast approval.

Non-bank personal loans with fast approval in Malaysia

| Licensed Financial Lender | Approval Time | Interest Rate | Minimum Monthly Income | Loan Amount | Loan Period | Debt Consolidation | Cashback |

| Adacash | 1 day* | 18% p.a. | RM1,000 | RM500 - RM1,000 | 1 month - 3 months | No | No |

|

Icon Venture Capital |

1 day* | 18% p.a. | RM3,000 | RM5,000 - RM100,000 | 1 - 5 years | No | No |

|

Emicro |

1 day* | 18% p.a. | RM1,500 | RM500 - RM10,000 | 1 month - 2 years | No | No |

|

Yayasan Ihsan Rakyat |

1 day* | 6.65% - 9.99% p.a. | RM1,500 | RM2,500 - RM250,000 | 1 - 10 years | No | No |

|

Yayasan Dewan Perniagaan Melayu Perlis Berhad |

1 day* | 6.65% - 9.99% p.a. | RM1,500 | RM3,000 - RM300,000 | 1 - 10 years | No | No |

| instaDuit |

1 day* | 18% p.a. | RM1,500 | RM1,000 - RM10,000 | 1 - 4 years | No | No |

| Tambadana | 1 day* | 18% p.a. | RM1,500 | RM1,000 - RM10,000 | 1 - 12 months | No | No |

All in all, knowing how much you can afford and committing to it every month is the main question to answer yourself when applying for a personal loan with fast approval.

How to calculate my monthly instalment?

Let us do some simple math to increase your chances of getting your desired loan amount to be approved. See below for an illustration:

You are looking to borrow RM50,000 from Bank A for 5 years to finance your home renovation.

The bank is offering an interest rate of 5.99% p.a. flat and instant approval on an online loan application.

|

What do I get from this product? |

|

Loan amount = RM50,000 Loan tenure = 5 years (60 months) Loan interest rate = 5.99% p.a. flat |

|

How much interest am I paying for 5 years? |

|

RM50,000 x 5.99% p.a. = RM2,995 per year x 5 years = RM14,975 |

|

What is my total borrowing amount? |

|

RM50,000 + RM14,975 = RM64,975 |

|

What is my monthly instalment amount for 5 years? |

|

RM64,975 ÷ 60 months (5 years) = RM1,082.90 per month |

Now, before the bank can approve this loan amount, they will look into your debt-service ratio (DSR) first.

But what is a DSR? In layman's terms, it is a calculation by the bank to determine whether you can repay this amount every month. And here's how to count your DSR:

Total monthly commitments ÷ Total monthly income x 100% = DSR

Now, let's give you an example for further clarification.

Let’s say that you are earning RM5,000 a month and have a credit card balance transfer of RM500 and a car loan of RM1,200 every month. Together with this new loan amount you’re applying for, your DSR will be calculated as follows:

|

What is your monthly income? |

|

RM5,000 |

|

What is your monthly commitment? |

|

RM500 + RM1,200 + RM1082.90 = RM2,782.90 |

|

What is your DSR? |

|

RM2,782.90 ÷ RM5,000 x 100% = 55.65% |

From this calculation, your total monthly commitment makes up half of your monthly income, which is considerably high.

This means you need to reassess your loan amount to ensure that your financial health is in check and you will have enough disposable income to live by.

A general rule of thumb to get your loan approved faster and at the best interest rate is you need to maintain a DSR level between 30% to 40%.

You also need to make sure that you can repay your monthly instalment on time and in full, otherwise, the bank will penalise you for being late and impartial in payment.

What are the documents to prepare to the money lender for my fast loan approval?

In general, you should prepare documents like your IC, salary slips, bank statements and EPF statements for fast loan approval. Other types of documents may also be required depending on the bank.

A personal loan is offered to a salaried employee of a private or public company, and self-employed individuals and these employment types play a major role in deciding your loan approval. This is because lending money to an individual without a permanent job is seen as having a higher credit risk to the bank.

Hence for those that are working on a commission and contract basis, you may need to provide more income proof to convince the bank that you are indeed capable of meeting the monthly repayments.

For your easy reference, here are the documents that are mostly required in a fast approval loan application:

Salaried Employee:

- Copy of your IC (front and back)

- Latest 3 or 6-months salary slip (depending on the bank)

- Latest 3 to 6 months bank statements (depending on the bank)

- Latest 3 or 6-months EPF statement (depending on the bank)

- Latest BE or BE e-Form, with an official tax payment receipt

- Latest EA Form

Self-Employed:

- Copy of your IC (front and back)

- Business Registration Certificate

- Latest 3-months or 6-months company bank statement (depending on the bank)

- Latest BE or BE e-Form, with an official tax payment receipt

- Latest 6-months commission statements and bank statement (for commission earners and depending on the bank)

Is it possible to get a fast approval loan for foreigners in Malaysia?

Unfortunately, almost all banks don’t allow foreigners to apply for personal loans. However, foreigners are welcome to apply for home loans and car loans in Malaysia but are still subject to the terms set by the bank.

Is this fast approval loan can be apply for foreigners in malaysia?

How can I get an instant approval loan for my application?

Depending on your credit background and the underlying terms of each financial lender, your loan can take up to seven working days to get approved.

Before you make an application, below are some tips to get a fast approval loan.

Always pay on time and in the full amount

Discipline, discipline, discipline. Do you know that banks have access to your financial history?

Yes, they do go through your credit report with CCRIS and CTOS.

Banks use these resources to verify your creditworthiness when applying for a loan with them.

Since personal loans are mostly unsecured, you are your guarantor.

If you have a habit of delaying your repayments, it will be reflected in your credit report for up to 12 months.

If you have a bad credit score, improve it

Now that you know that banks can tell if you are a good paymaster or not, this is your chance to rectify the issue in the first place.

Banks will most likely reject your loan applications when you have a history of late payments or, worse, defaulted (non-payment).

To make matters worse, late payment on your loan can lower your credit score, hence, lowering the chances of approval.

The best case scenario is that you must commit to settling all your unpaid debts and wait a little while before applying for a new loan until your history of payment in arrears is off the CCRIS database.

Reduce your loan commitments, if can, consolidate them

Let’s journey back to the DSR level. If the bank finds that you are over-committed with loans and credit card debts, you are not going to make a good impression on them.

Always keep in mind that your monthly commitment should not be more than what you can afford.

Create a credit history, for beginners only

For those who have just started earning an income, a credit card is a good start to building your credit history.

Look for a credit card without an annual fee with a low credit limit for starters and spend a small amount to see if you can repay.

How to apply for a fast loan online in Malaysia?

Now that you are equipped with the necessary information about loans with fast approvals, you can go ahead and apply easily online through our website in RinggitPlus! Just hit the Apply Now button above and we'll assist you accordingly.

Don't forget that you can also get loan recommendations with RinggitPlus too!