Who Can Apply For Low Income Personal Loans?

When it comes to approving personal loan applications, most banks favour people with high credit scores and a certain range of income.

However, there are still several banks offering personal loans for earners with low salaries. Let's find out!

Which personal loan matches my income level?

The minimum wage in Malaysia is currently standing at RM1,500 per month, which is still considered low, especially for those living in the city.

While every sector of the economy is working hard to improve our living quality, banks are also lending their credits to the needy.

If you are strapping for some cash but are not sure whether you are eligible to apply for a personal loan, don't lose heart just yet.

RinggitPlus has a wide range of low-income personal loans and financing that can meet your income level.

Personal loan for private company employees with low salaries:

| Monthly Income | Bank/Finance Company | Personal Loan/Financing |

| RM800 | CIMB | CIMB Xpress Cash Financing-i |

| RM1,000 |

JCL

Adacash |

JCL i-Fund Personal Financing Adacash Personal Loan |

| RM1,500 | Tambadana AEON Emicro instaDuit |

Tambadana Short Term Loan AEON i-CASH Personal Financing Emicro Personal Loan instaDuit Personal Loan |

| RM2,000 | RHB Hong Leong Bank |

RHB Personal Financing Hong Leong Personal Financing-i |

Personal loan for government and/or GLC employees with low salaries:

| Monthly Income | Bank/Finance Company | Personal Loan/Financing |

| RM800 | Bank Rakyat | Bank Rakyat Personal Financing-i for Pensioners |

| RM1,000 | Bank Rakyat |

Bank Rakyat Personal Financing-i Public |

| RM1,500 |

AmBank

Affin Islamic Bank Yayasan Ihsan Rakyat Yayasan Dewan Perniagaan Melayu Perlis Berhad |

AmBank Islamic Personal Financing-i Affin Islamic Personal Financing-i Yayasan Ihsan Rakyat Personal Financing-i Yayasan Dewan Perniagaan Melayu Perlis Berhad Personal Financing-i |

| RM2,000 | Bank Islam |

Bank Islam Flat Rate Personal Financing-i Package |

Tips: If you need a head start, you can get loan recommendations from us. Just click the Apply For Loan button above to proceed and it shouldn't take you more than 10 minutes!

What is the maximum amount of personal loan I can borrow?

Each bank offers a different range of personal loans for low-income earners and the maximum loan could reach up to RM300,000.

However, the amount of personal loan you’ll get is dependent on your monthly salary and credit report. Thereafter, the bank will decide on the maximum loan amount for you.

How to choose the right personal loan for low-income earners in Malaysia?

Taking a personal loan when you’re earning a low salary may be scary because what if you’re unable to repay the loan? Don’t worry, there are ways to choose the perfect personal loan according to your circumstances.

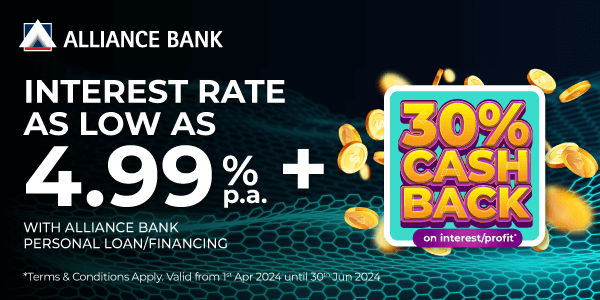

The first thing you need to look at when comparing personal loans for low-salary earners is the interest rate. List down a few loans that offer low interest rates.

Secondly, compare the loan tenure. A personal loan for low-income earners with the lowest interest rate may have short tenure, making it unsuitable for some people.

Lastly, use the personal loan calculator on our website to determine if you can afford the loan.

What are the documents to apply for low-income personal loans?

In general, below are some of the documents that you need to prepare to apply for low-income personal loans:

Salaried Employee:

- Copy of your IC (front and back)

- Latest 3-months or 6-months salary slip (depending on the bank)

- Latest 3-months or 6-months EPF statement (depending on the bank)

- Latest BE Form, with an official tax payment receipt

- Latest EA Form

Self-Employed:

- Copy of IC (front and back)

- Business Registration Certificate

- Latest 3-months or 6-months company bank statement (depending on the bank)

- Latest BE Form, with an official tax payment receipt

- Latest 6-months commission statements and bank statement (for commission earners and depending on the bank)

How to increase the approval rate of low-income personal loans?

Show the banks that you’re trustworthy by providing original documents, especially your address and monthly commitments such as your electricity and water bills, or telco bills.

Please note that some personal financing may require you to take out a Takaful plan in case you get into unfortunate events, resulting in you being unable to repay the financing.

To top it off, your credit or financial background also plays an important role as it could influence the chances of approval of your loan. Hence, we suggest that you have a credit background check as the first step and you can do so online via Experian, for example.

Overall, please consult with the bank of your choice before you decide to take up a loan.